Your debt settlement letter should include the following pieces of information:

- Your proposed settlement amount — Make sure you state this as a dollar amount, not a percentage of your debt.

- How you want the creditor to report the debt to the credit bureaus — Let them know that you want them to report the debt...

- Why they should accept your offe r — This can include a...

How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

What to include in a debt settlement letter?

There are some key details that all debt settlement offer letters should have:

- The full name used for the credit account

- Your full address

- Your account numbers or a reference number from the creditor

How do you write a letter of settlement?

Settlement Agreement Letter Writing Tips. The letter should specify the important details. The letter should also specify how the settlement can be tackled. The letter should specify the amount. The letter should be clear and simple. The letter should express the terms & conditions from the standpoint of both the parties.

Should I write a debt settlement offer letter?

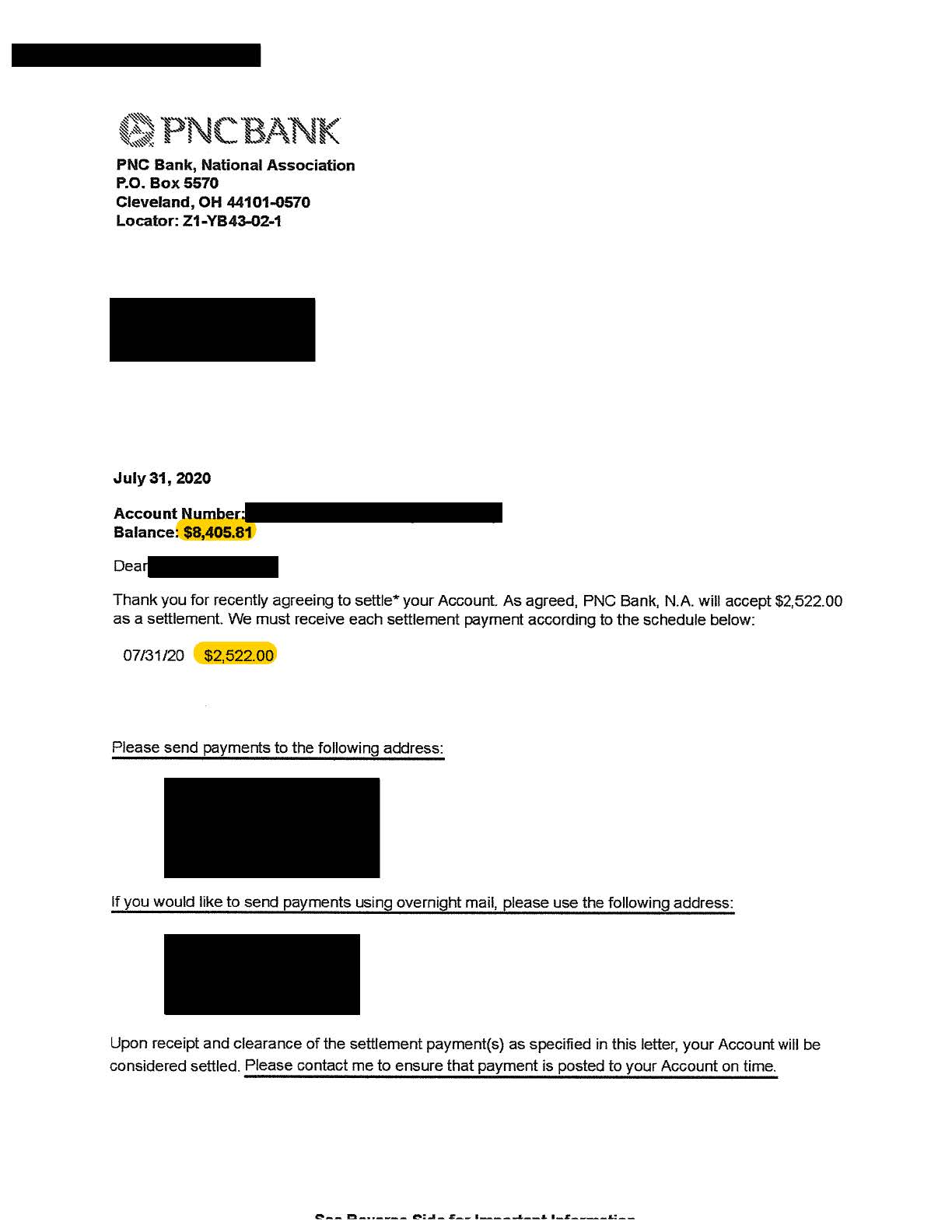

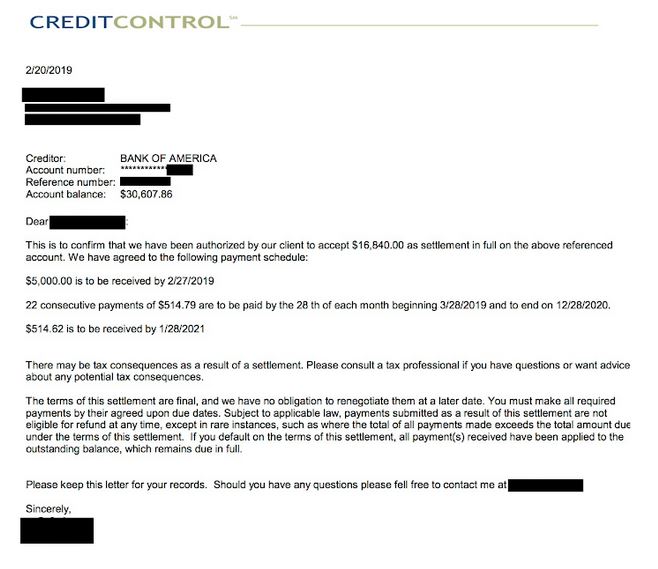

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

What are debt settlement documents?

A debt settlement agreement is a contract signed between a creditor and debtor to re-negotiate or compromise on a debt. This is usually in the case when an individual wants to make a final payment for a debt that is owed.

What happens when a debt is settled?

Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account. The account will be reported to the credit bureaus as "settled" or "account paid in full for less than the full balance."

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

What are the negative effects of debt settlement?

Debt settlement can cause your credit score to fall by more than 100 points, and it stays on your credit report for seven years. If your creditors close accounts as part of the settlement process, this can cause your credit utilization to increase, which also negatively affects your credit score.

Can I remove settled debts from credit report?

That's a common question. Yes, you can remove a settled account from your credit report. A settled account means you paid your outstanding balance in full or less than the amount owed. Otherwise, a settled account will appear on your credit report for up to 7.5 years from the date it was fully paid or closed.

Is it good to settle a debt?

Settling an Account Is Better Than Not Paying at All And, if you are planning on making a major purchase, such as buying a home, you may be required to either settle or pay in full any outstanding delinquent debts before you can qualify for a loan.

Is settled in full good on credit report?

A settled account is considered a negative entry on your credit report since it indicates the lender agreed to accept less than the full amount owed. A settled account on your credit report tends to lower your credit scores, but its effect will lessen over time.

How long does it take to improve credit score after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

What is Upsolve for bankruptcy?

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

What Is This Letter For?

Debt settlement letters help a debtor to engage in a constructive dialogue with a creditor. After you validate that you owe the debt, the process of a debt settlement begins. According to the Fair Debt Collection Practices Act (FDCPA), a debt settlement company has five days to send you a letter validating that the debt is yours after their call.

Is a Debt Settlement Itself the Right Option for Me?

Surely, debt settlement itself is not for every American debtor. You should have more than $7,500 in unsecured debt. If you are ready for your credit score to change (going down and then going up after the process), then it can be a solution for you. In other cases, you can try credit counseling. That may be a better option.

How to Write a Debt Settlement Proposal Letter?

So, that it’s easy to get the idea of the structure, it must contain an introduction of yourself and your account. Don’t forget to put the facts of your case with the details such as your credit card number, address, and phone number. In the letter, you should also offer an exact amount of money – a lump sum – that you are willing to pay.

What to Expect after the Process?

First, you send your detailed and precise letter, and then you wait to hear back from your creditor. Be sure to request that the creditor update your account status. It’s essential to have your credit report adequately updated to reflect that the debt is no longer due.

Why do creditors and collectors write letters?

The main advantage of having written correspondence is to save texting history of debt settlement letters from a debtor and also settle letters from a creditor back to the debtor.

What is debt settlement?

The primary aim of debt settlement is to partially free you from the weight of unpaid bills. It’s an agreement between a debtor and a creditor, in order to find the possibility of paying less than what you own now. One of the first milestones of the whole process is writing a debt settlement letter.

When was Debtquest USA founded?

Our company was founded in 2009 out of a desire to help Americans. Our service is proclaimed excellent based on more than 200 reviews. We know what we are doing. Join DebtQuest USA, and let’s start your new life together!

What is a counteroffer letter?

This template letter makes a counteroffer when an original creditor offers you an initial settlement amount. The goal is to offer a lower amount and negotiate for a removal of the negative information from your credit history.

How long does it take to settle a debt with a collection agency?

They have five days to do so under the Fair Debt Collection Practices Act (FDCPA).

How to settle a debt on your own?

When you’re working to settle a debt on your own, you want to do everything in writing. This is especially true if you’re making formal debt settlement agreements. Creditors and collectors will try to get you to agree to things over the phone. Don’t fall for it! Ask them to send you their proposal in writing. Avoid saying anything that acknowledges that you’re obligated to repay the debt. You can use these debt settlement letter templates to negotiate everything in writing.

Can you admit to a debt?

Never admit that you owe the debt or that you’re supposed to pay it. This can reset the statute of limitations on collecting the debt in some states!

What is a Settlement Letter for Debt?

If you’ve been struggling with debt for a while, you may have heard about debt settlement. But did you know that the settlement process often starts with writing a letter? In light of that, we’ve created a guide to writing a settlement letter for debt settlement.

What is a settlement letter for debt?

Before we can get into specifics about writing a debt settlement letter, it’s vital to understand the concept of debt settlement itself. At its core, debt settlement involves negotiating with your creditors and asking them to forgive a portion of your debt in exchange for a lump-sum payment.

Pros and cons of writing a debt settlement letter

While writing a settlement negotiation letter may seem like the obvious choice over paying the full amount you owe, like any other financial decision, this has its advantages and disadvantages. We’ve laid them out for your consideration below. Read them carefully to get a better idea of whether or not you want to go this route.

How to write a settlement negotiation letter

If you’ve weighed the pros and cons of settling your debt and decided that you do want to write a debt settlement offer letter, the next step is to learn how to put one together. To that end, we’ve listed the components of an effective settlement letter below. Use these points as a template when you’re ready to write your letter.

The bottom line on writing a debt settlement offer letter

When you’re genuinely struggling financially, writing a debt settlement letter can be one of the first steps toward finally becoming debt-free. That said, since settling your debt can have lasting implications on your overall financial health, it’s important to think this decision through before you put pen to paper.

What is debt settlement?

Debt Settlement Basics. A debt settlement is an agreement between a debtor and creditor. Generally, the terms of the debt settlement allow the debtor to pay less than he or she owns. Sometimes the payment will be made in a lump sum.

What to include in a letter to creditor?

It’s important to include the facts of your case. These include details such as the credit card number of the card tied to the debt. Once you’ve introduced yourself and the account in question, you can name your number.

What happens if a debt collector settles your case?

If a debt collector or other creditor is on your case, it’s likely that your creditor is after you for an amount equal to what you owe, plus any interest that has accrued. Your goal in the process of a debt settlement is to agree to pay less than what you owe.

Is it a good idea to send a debt settlement letter?

It’s also a good idea to approach the debt settlement process as a negotiation between you and your creditor.

Can a non profit write a debt settlement letter?

Non-profit credit counselors can also help write debt settlement letters if they deem it appropriate for an individual’s circumstances. You can also write your own debt settlement letter.

Is it a gamble to write a settlement?

Writing a debt settlement is a bit of a gamble. There's no guarantee that your creditors will accept the settlement you offer. But if the gamble pays off... Menu burger. Close thin.

Can a debt settlement letter be used as a negotiation?

You’re trying to pay a low amount and your creditor is trying to get as much out of you as possible. Ideally, a debt settlement letter would not be the start of your debt settlement negotiation. If you make the first move by sending a debt settlement letter, your creditor can easily come back and ask for more.