One way that interbank settlement may take place is through debits and credits to accounts they maintain with a common correspondent bank. This is essentially how the Reserve Banks effect settlement: they maintain settlement accounts, referred to as “master accounts,” for financial institutions that participate in their payments systems.

What is Interbank Clearing and settlement?

Interbank clearing and settlement networks allow banks to settle USD payments within a day and international payments within two days.

How do interbank transfers take place?

Interbank transaction through a central bank This kind of transaction takes place on the country's, normally State-owned central bank, which holds accounts that are owned by the country's associated banking institutions. In this model, transfers between banks are done through the central bank.

What is an interbank transaction?

Interbank transaction through correspondent bank accounts In simple words: banks maintain several bank accounts on each other and keep (lend) funds on them. These funds are usually sourced by mutual lending or paid through assets.

What is the clearing house interbank payments system?

The Clearing House Interbank Payments System (CHIPS) is the primary clearing house in the U.S. for large banking transactions.

What do banks use to settle between each other?

Banks and other institutions can hold accounts with us, which are used to settle money moved between them.

How do banks settle payments?

The settlement bank will typically deposit funds into the merchant's account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

What is interbank settlement system?

Interbank Settlement means the transfer of funds between the bank of the originator and the bank of the beneficiary in relation to a payment transaction.

How do banks settle wire transfers?

[i] The sending and receiving institutions' Federal Reserve accounts are used to settle each individual wire transfer payment. The Fed debits the sending institution's account and credits the receiving institution's account, while sending a message to the receiving institution containing all the transaction's details.

How are payments cleared and settled?

Settlement involves exchanging funds between the two banks, while clearing can end without any interbank money movement. In the clearing process, funds move between the recipient's or sender's bank account and their bank's reserves.

How does bank clearing system work?

Clearing Process: The clearing process begins with the deposit of a cheque in a bank. The cheque (along with other cheques) is delivered to the bank/branch where it is drawn. The cheque is passed for payment if the funds are available and the banker is satisfied about the genuineness of the instrument.

How are international payments settled?

The sending bank removes money from the sender's bank account, clearing the transaction. It's not until after the receiving bank puts forth the funds, both institutions settle the payment, and the banks exchange capital that the process ends.

How does ATM settlement work?

The processor then ACHs the cardholder's funds into the merchant's bank account, usually the next bank business day. In this way, the merchant is reimbursed for all funds dispensed by the ATM. So when you request cash, the money moves electronically from your account to the host's account to the merchant's account.

How does debit card settlement work?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank. The business will then receive the authorized funds in its merchant account.

Can you fake a wire transfer?

U.S. consumers lose millions of dollars each year to fraudsters using wire transfers as part of their scams. Western Union, Moneygram and similar businesses allow you to send money quickly. Their services are useful for transmitting funds to friends, relatives and others you know well.

How long does a bank transfer take between different banks?

Computerized transfers between two accounts of the same bank are made immediately. Computerized transfers between two accounts at different banks can take up to one business day.

How does settlement happen with SWIFT?

How does the payments process work? When a domestic payment is made, the initiating institution sends a message to the receiving institution, after which the transfer is settled electronically. As such, domestic payments can often be settled instantly or within 24 hours.

What is the process of settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What does it mean when payment is settled?

Settlement used to define the concluding step in getting the payment for some services, the receiver or the financial institution obtains the payment, after this procedure the money is available for the trader. This word describes the actual process of conducting a payment to someone.

How are the account settled?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.

What does it mean to settle a transaction?

Transaction settlement is the process of moving funds from the cardholder's account to the merchant's account following a credit or debit card purchase. The issuer will route funds to the acquirer via the card network.

What is interbank market?

As the name suggests, the interbank market is a market where foreign currency is traded between large privately held banks. The interbank market is what people refer to when talking about the currency market. It is built of large currency trades above $1 million, e.g., CAD/USD or USD/JPY. However, the transactions are often much larger, ...

How long does it take for an interbank transaction to settle?

The interbank market is the predominant influence on the exchange rates around the world in the short term. Most transactions take two business days to settle, with a few exceptions. As a result of the settlement delay, a credit between the companies/banks is established to help bring the trades to fruition.

What is SWIFT banking?

Some banks also participate in the SWIFT (Society for Worldwide Interbank Financial Telecommunications) market. SWIFT enables institutions to send and receive information regarding financial transactions in a safe, proven, and reliable way.

What is proprietary trading?

Some of the exchanges taking place are banks working on behalf of their clients. Many of the other transactions are proprietary, meaning the trades are for the banks’ own accounts.

How many components are there in the interbank market?

The interbank market consist of four main components:

What is floating rate?

The interbank market follows a floating rate system. Floating Exchange Rate A floating exchange rate is an exchange rate system where a country’s currency price is determined by the foreign exchange market, depending. , meaning the exchange rate “floats” or adjusts on its own time ...

What is market maker?

The market makers consist of the largest banks in the world. The banks constantly trade currency between each other for themselves or on behalf of their customers. The trades form the fundamental base for the currency exchange rates/market. As a result of the banks’ competitiveness, the market ensures a fair and close spread.

What is correspondent banking?

In fact, correspondent banking is how banks can give customers accounts in non-domestic currencies where they don’t have a banking licence. For example, a Singapore bank may not have a banking licence in the UK, and so it will maintain a GBP denominated nostro with a big bank in the UK, and it would use that as a mega-account for all its customers’ GBP currency.

What happens when both customers bank with the same bank?

If both customers bank with the same bank, then that bank clears the transaction. If there is a correspondent banking relationship, then the receiving bank clears the transaction. If there is a central bank system – a RTGS or DNS, then the central bank clears the transaction.

Why do we rely on correspondent banks rather than RTGS?

For international payments (of one currency – ie not foreign exchange!), we rely on correspondent banks rather than RTGS because it’s unlikely that both banks will be on the same RTGS.

Why does the central bank clear transactions?

You’d say that the central bank clears the transaction because there is no further action needed. (NB Just to confuse everyone, the word clearing in payments means something different to the word clearing in securities trading). If both customers bank with the same bank, then that bank clears the transaction.

What is clearing account?

The accounts that each bank holds with the central bank for this purpose is sometimes called their clearing account. (In reality banks hold multiple accounts at the central bank, for different purposes). This is much more efficient than maintaining lots of nostros.

How might Bank A fund its account at Bank C in the first place?

How might Bank A fund its account at Bank C in the first place? Perhaps the banks opened accounts with each other at the same time, funded with the same amounts: Bank A opens an account at Bank C, and Bank C opens an account at Bank A , and they both agree “Let’s start off by owing each other $100,000.”. Or Bank A could sell an asset to Bank C “Here’s a bond, please pay me by crediting my account”.

What happens if Bank A opens an account with Bank C?

If Bank A opened an account with Bank C, it could instruct Bank C to transfer the $10 from its account to Clarabel’s account:

What is settlement of interbank funds?

In general, the settlement of interbank funds transfers can be based on the transfer of balances on the books of a central bank (i.e. central bank money) or commercial banks (i.e. commercial bank money). In practice, settlement in the vast majority of largevalue funds transfer systems takes place in central bank funds.

How does systemic risk affect interbank settlement?

As analysed in the Lamfalussy Report, the size and duration of participants' credit and liquidity exposures in the interbank settlement process are basic factors affecting the potential for systemic risk. As these exposures last for longer and become larger, the likelihood that some participants may be unable to meet their obligations increases, and any participant's failure to settle its obligations is more likely to affect the financial condition of others in a more serious manner. Interbank funds transfer systems in which large intraday exposures tend to accumulate between participants therefore have a higher potential for systemic risk.

What is final settlement?

Settlement discharges the obligation of the payer bank to the payee bank in respect of the transfer. Settlement that is irrevocable and unconditional is described as final settlement. In general, the settlement of interbank funds transfers can be based on the transfer of balances on the books of a central bank (i.e. central bank money) or commercial banks (i.e. commercial bank money). In practice, settlement in the vast majority of largevalue funds transfer systems takes place in central bank funds. Although the rules and operating procedures of a system and the legal environment generally may allow for differing concepts of finality, it is typically understood that, where settlement is made by the transfer of central bank money, final settlement occurs when the final (i.e. irrevocable and unconditional) transfer of value has been recorded on the books of the central bank. The report focuses on the settlement finality of the central bank transfers in this sense.

Why is settlement delayed?

information is transmitted to receiving banks in real time), while settlement may be delayed (either because the system is a DNS system or because, in an RTGS system, liquidity constraints may delay settlement at least temporarily).

What are the risks associated with payment system?

Earlier CPSS reports identified the major types of payment system risk. Credit risk and liquidity risk are two basic risks to which participants in payment and settlement systems may be exposed. Credit risk , which is often associated with the default of a counterparty, is the risk that a counterparty will not meet an obligation for full value, either when due or at any time thereafter. It generally includes both the risk of loss of unrealised gains on unsettled contracts with the defaulting counterparty ( replacement cost risk) and, more importantly, the risk of loss of the whole value of the transaction ( principal risk ). Liquidity risk refers to the risk that a counterparty will not settle an obligation for full value when due but at some unspecified time thereafter. This could adversely affect the expected liquidity position of the payee. The delay may force the payee to cover its cashflow shortage by funding at short notice from other sources, which may result in a financial loss due to higher financing costs or to damage to its reputation. In more extreme cases it may be unable to cover its cashflow shortage at any price, in which case it may be unable to meet its obligations to others. Settlement risk may be used to refer to the risk that the completion or settlement of individual transactions or, more typically, settlement of the interbank funds transfer system as a whole, will not take place as expected. Settlement risk comprises both credit and liquidity risks.

What is interbank funds transfer?

Interbank funds transfer systems are arrangements through which funds transfers are made between banks for their own account or on behalf of their customers. Of such systems, largevalue funds transfer systems are usually distinguished from retail funds transfer systems that handle a large volume of payments of relatively low value in such forms as cheques, giro credit transfers, automated clearing house transactions and electronic funds transfers at the point of sale. The average size of transfers through largevalue funds transfer systems is substantial and the transfers are typically more timecritical, not least because many of the payments are in settlement of financial market transactions. The report focuses on these largevalue systems.

How are funds transferred?

A funds transfer is initiated by the transmission of a payment order or message requesting the transfer of funds to the payee. In principle, the payment messages may be credit transfers or debit transfers, although in practice virtually all modern largevalue funds transfer systems are credit transfer systems in which both payment messages and funds move from the bank of the payer (the sending bank) to the bank of the payee (the receiving bank). The payment messages are processed according to predefined rules and operating procedures. Processing may include procedures such as identification, reconciliation and confirmation of payment messages. The transmission and processing of payment messages in largevalue funds transfer systems is typically automated (i.e. electronic).

What is B anking transaction?

B anking transactions are part of people's routine. From your every morning's coffee cup to the billions movemented everyday inside intercontinental companies and governments, towns work everyday thanks to bank transactions. However, few people know what really means to transfer funds from your bank account to another.

What happens when you tell your bank you want US$ 5?

So now your bank owes you less US$ 5 and owes us more US$ 5. This is what we call a "bank transfer". Pretty simple, isn't it?

What does it mean when your bank statement says you owe 1,000?

When our bank statement tells us our bank balance is US$ 1,000, this means that the bank owe us US$ 1,000. At the same time, if our balance is negative, we owe that amount to the bank.

How do banks keep their accounts?

In simple words: banks maintain several bank accounts on each other and keep (lend) funds on them. These funds are usually sourced by mutual lending or paid through assets. Back to our scenery, your bank, say Y ourBank, has an account with our bank, say OurBank, whereas our bank also has an account with your bank.

What happens when you send money to a bank?

The first thing we have to understand is that once we send funds to our banking accounts, the institution will not simply store it somewhere until the day when you need it . What's actually happening is a loan: you are lending your money to the bank. Based on your contract, they may or may not reward you for doing so, but they're given the rights to use your money as they want to. This includes lending your money to someone else and getting the profits of this operation.

How much of the world's money is put into physical cash and coins?

It's estimated that only about 8.3% of the world's money is put into physical cash and coins (M0). Banks do know it and therefore are smart enough not to put your US$ 5 on an armored car and driving it until our bank.

Can bank administrators own accounts?

However this method brings issues and risks. First of all, it wouldn't be easy for bank administrators to own and control accounts on every bank that their clients might want to transfer to. Secondly, there is the risk of a bankruptcy.

What Is the Clearing House Interbank Payments System (CHIPS)?

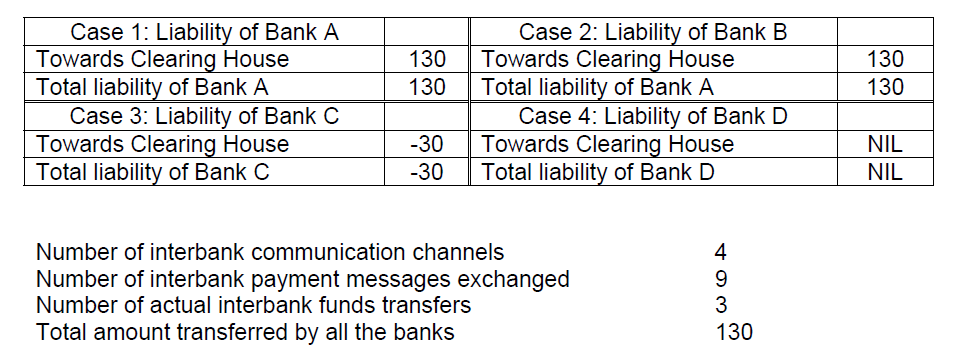

The Clearing House Interbank Payments System (CHIPS) is the primary clearing house in the U.S. for large banking transactions. As of 2015, CHIPS settles over 250,000 of trades per day, valued in excess of $1.5 trillion in both domestic and cross-border transactions. CHIPS and the Fedwire funds service used by the Federal Reserve Bank combine to constitute the primary network in the U.S. for both domestic and foreign large transactions denominated in U.S. dollars.

What is a chip?

The Clearing House Interbank Payments System ( CHIPS) allows large interbank transactions in the U.S. to clear. CHIPS is slower but less expensive than the other major interbank clearing house known as Fedwire, making it more amenable to larger transactions that can take longer to clear. CHIPS works by netting debits and credits across transactions, ...

What time does the chip system work?

CHIPS acts as a netting engine, where payments between parties are netted against each other instead of the full dollar value of both trades being sent. From 9 p.m. to 5 p.m. ET. banks send and receive payments. During that time, CHIPS nets and releases payments. From 5 p.m. until 5:15 p.m. the CHIPS system eliminates credit limits, and releases and nets unresolved payments. By 5:15 p.m., CHIPS releases any remaining payments and sends payment orders to banks via Fedwire.

What are the steps of a funds transfer?

There are two steps to processing funds transfers: clearing and settlement . Clearing is the transfer and confirmation of information between the payer (sending financial institution) and payee (receiving financial institution).

How does chip work?

CHIPS works by netting debits and credits across transactions, providing both clearing and settlement services to its customer banks.

What is a financial institution contracting with?

In some systems, financial institutions may contract with one or more third parties to help perform clearing and settlement activities. The legal framework for institutions offering payment services is complex. There are rules for large-value payments that are distinct from retail payments.

What is settlement in financial services?

Settlement is the actual transfer of funds between the payer's financial institution and the payee's financial institution. Settlement discharges the obligation of the payer financial institution to the payee financial institution with respect to the payment order. Final settlement is irrevocable and unconditional.

What is clearing?

Clearing starts with financial institutions sending payment messages through the payment network; the payment network routes these messages and other related information for the participating financial institutions to correctly process payment instructions. In faster payment systems, these messages flow on a transaction-by-transaction basis, and by agreement among the participants, the clearing process enables faster payments to be credited to payees’ accounts in near real time.

What is settlement?

The second key function is the interbank settlement process, which results in the discharge of the financial obligations that arise as a result of the clearing process between payers’ and payees’ financial institutions. One way that interbank settlement may take place is through debits and credits to accounts they maintain with a common correspondent bank. This is essentially how the Reserve Banks effect settlement: they maintain settlement accounts, referred to as “master accounts,” for financial institutions that participate in their payments systems.

What is unpacking clearing and settlement?

Unpacking clearing and settlement. To most people, all faster payment systems seem pretty similar since they all make it possible for payers and payees to see their transactions reflected in their accounts in near real time. 1 What’s more, they all enable payees to use the funds they receive immediately. For example, as a payer or payee, you might ...

What is interbank settlement?

Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule. Real-time gross settlement and deferred net settlement have tradeoffs with regard to settlement risks, particularly liquidity risk and credit risk.

Why do financial institutions use deferred net settlement?

A deferred net settlement structure helps to optimize liquidity (and reduce liquidity risk), as each financial institution’s total settlement obligation is reduced by the amount owed to it by the other participants in the network. In addition, by settling only at predesignated times that are typically within the operating hours of the intraday credit markets (Off-site) and/or the Federal Reserve’s Discount Window (Off-site), financial institutions can typically access additional liquidity (if needed).

What is a fast payment?

1 According to the Bank for International Settlements (BIS), a faster payment is "… a payment in which the transmission of the payment message and the availability of ‘final’ funds to the payee occur in real time or near-real time on or as near to a 24-hour and seven-day (24/7) basis as possible." (Committee on Payment and Settlement Systems (2016), Fast payments: Enhancing the speed and availability of retail payments, Bank for International Settlements, November).

How does deferred net settlement work?

While deferred net settlement can simplify some liquidity issues, it retains credit risk between participants up to the point of settlement. In this case, all other financial institutions owed funds by the defaulting financial institution bear a risk of loss because faster payment system rules require the receiving financial institutions to make final payments to their customers even if they never receive payment from the paying financial institution. Credit risk between participants is reduced in real-time settlement systems because payments are settled between participants on a transaction-by-transaction basis before or concurrent with the payee’s financial institution crediting the payee’s account.

Settlements and Trade Agreements

- Trades in the interbank market are often referred to as taking place in the spot marketor cash market. For the most part, the currency transactions settle in two business days; one of the major exceptions is the US dollar to Canadian dollar transactions that settle in one business day. As a result of the delay in settlement, financial institutions ...

Regulation of The Interbank Market

- As was previously stated, the interbank market is unregulated and decentralized. With that in mind, there is no specific location or exchange that the currency is traded on; instead, it is composed of thousands of interbank exchanges of currency at agreed-upon prices and quantities. The prices come from market makers, usually the largest banks in the world. Central banks in m…

Summary

- In summary, the interbank market is made up of large-scale currency transactions between banks around the world. The transactions can be proprietary, taking place on behalf of the bank’s accounts or on behalf of the bank’s customers. The interbank market is the predominant influence on the exchange rates around the world in the short term. Most transactions take two business …

Related Readings

- CFI offers the Capital Markets & Securities Analyst (CMSA)®certification program for those looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant resources below: 1. Foreign Exchange Risk 2. New York Mercantile Exchange (NYMEX) 3. Spot Exchange Rate 4. USD/CAD Currency Cross