If you are writing to request assistance regarding your Equifax credit report (i.e., dispute, fraud alert, security freeze, a copy of your credit report), please also include a copy of a document from each of the two categories below: One item to validate ID such as: Valid driver's license. Social Security card. Pay stub.

Full Answer

What is the settlement with Equifax?

The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach. The initial deadline to file a claim in the Equifax settlement was January 22, 2020.

How do I Check my Equifax breach settlement status?

For more details and to check your claim status, visit EquifaxBreachSettlement.com . If you were affected by the Equifax data breach, you can still claim financial reimbursement for costs you incurred, or time you spent dealing with fraud or identity theft, after January 22, 2022.

Can I get reimbursed for the Equifax data breach?

The Federal Trade Commission has officially opened a claim process for all those who wish to be reimbursed for time, losses, and out-of-pocket expenses tied to the 2017 Equifax security breach that exposed the personal data of more than 145 million U.S. consumers.

What expenses can I claim under cash payment under Equifax?

Step 6: Under Cash Payment, you can request reimbursement for up to $20,000 in losses, but you will need to document those expenses, except for any credit monitoring by Equifax that you paid for. Out-of-pocket expenses can include money you spent on credit freezes or credit monitoring, postage, faxes, mileage, and telephone charges.

See more

How do I claim my Equifax settlement?

For more details and to check your claim status, visit EquifaxBreachSettlement.com . If you were affected by the Equifax data breach, you can still claim financial reimbursement for costs you incurred, or time you spent dealing with fraud or identity theft, after January 22, 2022. Claims are due by January 22, 2024.

How much will Equifax settlement be?

$425 millionEquifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

Will I get $125 from Equifax?

If you asked for money If you requested compensation of up to $125 or reimbursement for time spent recovering from fraud or ID theft, a check or debit card will be mailed to the address you used when submitting your claim. Be prepared for compensation that is much less than you requested.

Who qualifies for Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

Has Equifax settlement been approved?

More Information About the Settlement In September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people. The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories.

Should I cash a class action settlement check?

People have mixed feelings about class-action suits, and whether you cash class-action refund checks is up to you. Generally, if you get one, you probably paid a lot more in wrongful fees than you're getting back in the settlement. If you don't cash the check, the money may go back to the company.

What happened to the Equifax lawsuit?

In 2017, hackers broke into Equifax in a breach that exposed the financial information of 147 million Americans. A federal court in 2020 approved a $380 million settlement of class actions lawsuits, with no finding or judgment of wrongdoing made.

How do I check my Equifax claim?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

What are the harms of Equifax?

In its complaint, the FTC alleges that Equifax failed to secure the massive amount of personal information stored on its network, leading to a breach that exposed millions of names and dates of birth, Social Security numbers, physical addresses, and other personal information that could lead to identity theft and fraud ...

How much did Equifax pay for data breach?

In fact, the credit reporting agency disclosed this week that it expects to pay out an additional $100 million for its role in the breach. Last year, the company set aside then agreed to pay out nearly $700 million to settle numerous federal and state investigations.

How long does a data breach claim take?

In reality, how long a data breach claim takes simply comes down to the circumstances of the case. Some cases could be resolved in a few months, whereas others may end up being pursued for several years.

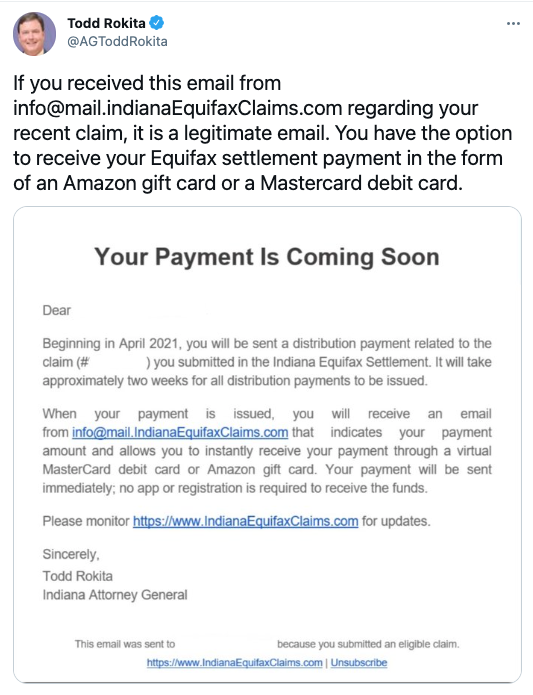

How Much Will Indiana residents get from the Equifax settlement?

approximately $79The Indiana Attorney General will start sending settlement payments on Wednesday to Hoosiers whose data was leaked in a 2017 Equifax breach. More than 236,000 past and current Indiana residents will get approximately $79 as part of a settlement that Indiana reached with the credit company.

How do I get my money from Equifax breach?

To get free credit monitoring or a cash payment (or both), you must submit a claim: online at EquifaxBreachSettlement.com, or. through the mail. (Send your claim to Equifax Data Breach Settlement Administrator, c/o JND Legal Administration, P.O. Box 91318, Seattle, WA 98111-9418).

What is the Indiana Equifax settlement?

As part of the settlement, Equifax agreed to pay $19.5 million to the State of Indiana. That money is being directed to consumer restitution payments and costs associated with the settlement. If your personal information was impacted in the data breach, you are eligible for a consumer restitution payment.

What is Indiana Equifax claims?

It involves a massive security breach at the Equifax credit bureau back in 2017. The breach compromised the social security numbers, birthdates, addresses, credit card information and driver's license numbers of 147 million Americans. States like Indiana sued and won class action settlements.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

How much time can you spend on a data breach?

You may be eligible for the following reimbursement cash payments for: Time Spent during the Extended Claims Period recovering from fraud, identity theft, or other misuse of your personal information caused by the data breach up to 20 total hours at $25 per hour.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Can you claim out of pocket time spent?

Submit a claim to receive reimbursement for Out-of-Pocket Losses and/or Time Spent. You may claim Out-of-Pocket Losses, Time Spent, and Credit Monitoring Services under the Settlement depending on whether you file claim(s) during the Initial or Extended Claims Period.

Are you eligible?

Hackers were able to get access to a multitude of consumers’ private information, including names, Social Security numbers, dates of birth, credit card numbers and driver’s license numbers.

What does the claim cover?

There are four types of relief you can claim from Equifax under the terms of the settlement:

What happens if you don’t file a claim?

Under the terms of the settlement, there are services that you are entitled to — even if you don’t file an official claim, the FTC says.

How long can you claim free credit monitoring?

Submitting a claim can be “overwhelming,” so take it slow, Lacey says. At the very least, you should claim the free credit monitoring for up to 10 years. “There should be no reason whatsoever not to file, especially the basic claim — the credit monitoring — or if you have credit monitoring, the claim for $125,” says Jack Gillis, executive director of the Consumer Federation of America. This is probably what most consumers will file for, Gillis adds.

How much can you get if your Equifax account was compromised?

If your information was compromised during the massive 2017 Equifax data breach, you could be entitled to up to $20,000.

How much can you claim for a credit breach?

Monetary loss: Consumers will be able to claim up to $20,000 for any losses or fraud that were the results of the breach or any out-of-pocket expenses they may have incurred, such as paying to freeze and unfreeze their credit reports. You’ll need to attach supporting documents, such as receipts, to show how much money you spent.

What happens if you don't have good records?

“If you don’t have good records, you may not be able to see the full benefit of what the settlement is providing ,” Lacey says.

How long does it take to get a free credit report from Equifax?

You can get six free credit reports from Equifax in a 12-month period, for seven years beginning January 2020. These are in addition to the free reports you’re already entitled to under the law.

What is the CFPB?

We're the Consumer Financial Protection Bureau (CFPB), a U.S. government agency that makes sure banks, lenders, and other financial companies treat you fairly.

When did Equifax breach?

In September 2017 , Equifax announced a breach that exposed the personal data of approximately 147 million people. If your data was impacted, under a legal settlement, you may claim free services and payments.

Can you request reimbursement for Equifax?

You can request reimbursement if you spent money, for example: For certain Equifax products before the breach. To freeze or unfreeze your credit. For credit monitoring services. Dealing with fraud or identity theft after the breach.

How much did Equifax pay for the data breach?

As part of its $700 million settlement with the commission, Equifax set aside more than $500 million to compensate the millions of victims of the data breach.

How long do you have to keep your maiden name on your credit report?

To get the cash, you must certify that you have credit monitoring and will keep it for six months.

How much money can you claim for identity theft?

If you were the victim of identity theft and it cost you a significant amount of money, it makes sense to gather the receipts and other supporting documents required for a claim that approaches the $20,000 individual limit.

How to find out if your Social Security number was exposed?

Step 1: Use this link to access the claim process . Then scroll down to "Find Out if Your Information Was Impacted" and click on that link. After entering your last name and the last six digits of your Social Security number, you'll instantly get an answer about whether your data was exposed and you're eligible to make a claim.

Can you report credit monitoring expenses?

In a Monday press conference, the FTC announced that consumers would be able to report some credit monitoring expenses and the time they spent resolving issues raised by the breach without having to submit receipts or other records.

Is Equifax doing credit monitoring?

For consumers skeptical about accepting the credit monitoring, Lacey explains, "it’s not Equifax doing the work; it’s their competitors doing it on their behalf."

Do retailers earn affiliate commissions?

When you shop through retailer links on our site, we may earn affiliate commissions. 100% of the fees we collect are used to support our nonprofit mission. Learn more.

What is cash payment on Equifax?

According to the form, cash payment is available “if you lost or spent money trying to prevent or recover from fraud or identity theft caused by the Equifax data breach and have not been reimbursed for that money…”

How to find out if your personal information was breached?

To find out if your personal information was affected by the security breach, you can go to the Equifax Data Breach Settlement “Check Your Eligibility” page.

How long can you sue Equifax for identity breach?

And you will still be eligible to access identity restoration services for a period of at least seven years once the settlement is final.

When did Equifax breach?

It’s practically been forgotten, but Equifax – one of the three major credit bureaus that assemble and maintain credit information on nearly every adult in America – was subject to a massive data breach back in September 2017.

How long is credit monitoring free?

If you were a minor in May 2017, you’re eligible for a total of 18 years of free credit monitoring.

What happens if you lose more than $20,000?

If your losses exceeded $20,000, and you intend to pursue full recovery through a separate lawsuit, you’ll need to opt out of the settlement.

What happens if your identity is not compromised?

Even if your identity has not been compromised, it could happen sometime in the future. The stolen information ends up on the Dark Web where it’s readily available to identity thieves and other fraudsters.