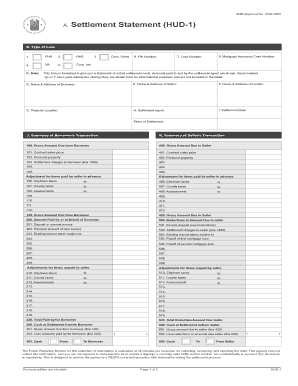

A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line. Source: (American Land and Title Association)

Full Answer

What is a settlement statement in home buying?

What Is a Settlement Statement in Home Buying? What Is Pending Escrow? Up until October 3, 2015, the Consumer Financial Protection Bureau required HUD-1 Settlement Statements to be provided to every buyer and seller when a real estate transaction was taking place, as well as to borrowers who were going through the refinancing process.

What goes on a settlement sheet?

The negotiated price or reimbursement of all these items are memorialized on a settlement sheet at the purchase date. When the transaction is complete, the buyer then needs to record the transition into their accounting system. The buyer may want to simply record the total cash spent and loans incurred as a building asset on their balance sheet.

What is on the second page of a settlement statement?

The second page of the settlement statement itemizes all settlement fees assessed to the buyer and seller. Note: any items labeled “P.O.C.” (Paid Outside Closing) have been prepaid.

How do you list purchase price on a settlement sheet?

Purchase price: This amount is usually listed as the “selling price” or “consideration” and represents the amount negotiated with the seller less any “seller assist” or price reduction (s) associated with the transaction. Each adjustment should be listed on the settlement sheet as separate lines.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is a settlement page?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How do you read a settlement statement?

0:217:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

What is the primary purpose of the settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Is a closing disclosure the same as a closing statement?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

Where do I find closing statements?

If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase. Other parties that may have copies of the settlement documents include your real estate agent, or the financial institution that holds the loan for the property.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

What is a final closing statement?

DEFINITION. A closing statement is a written record of the terms of a loan or other financial transaction, disclosing the final terms of an agreement.

What happens at settlement for the seller?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

Which of the following items are typically prorated at closing?

Mortgage interest, general real estate taxes, water taxes, insurance premiums, and similar expenses are usually prorated at closing.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What is settlement in real estate?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

What should be included in a settlement?

9 Things to Include in a Settlement AgreementA Legal Purpose.An Offer.Acceptance of the Terms.Valid Consideration on Both Sides.Mutual Assent.Waiver of Unknown Claims.Resignation.Confidentiality Clause.More items...•

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

What is a settlement letter?

A settlement letter is a letter that provides a quote for the amount you need to pay in order to settle your vehicle finance account in full.

What should be included in a settlement agreement?

A settlement agreement always includes monetary and/or non-monetary consideration provided to the claimant to settle known claims against the business....Waiver of Certain Claims.Earned wages.Business expense reimbursement.Unemployment insurance.COBRA.Workers' compensation insurance.

What is 902 mortgage insurance?

902 Mortgage Insurance Premium – Most lenders require mortgage insurance on conventional loans which exceed 80% of the purchase price or the appraised value, whichever is less. This insurance, paid by the buyer, protects the lender against loss if the buyer defaults on the loan. Lender’s requirements vary.

What is the 805 fee?

805. Lender’s Inspection Fee – This charge applies when a lender must re-inspect the property after repairs have been made, or when it is a new home. Some government loans require the seller to pay.

What is 807. assuming fee?

807. Assumption Fee – The lender’s charge for paperwork involved in processing records for a new buyer assuming an existing mortgage.

What is loan discount?

Loan Discount – These are the “points” charged by the lender to increase it’s yield on a loan with a below market interest rate. One point is equal to one percent of the loan amount. The number of points will vary according to market conditions.

What is a 903. insurance premium?

903. Hazard Insurance Premium – The hazard (homeowner’s) insurance premium, if not already paid, is collected at settlement. The buyer should contact the lender for specific requirements concerning policy coverage prior to settlement.

What is a deposit in real estate?

201. Deposit or Earnest Money – All monies deposited by the buyer in good faith, to be applied against the purchase price of the property.

What is VA 812?

812. VA Funding Fee – A premium of up to 1-7/8 percent (depending on the size of the down payment) paid on a fixed rate loan.

What is a HUD-1 settlement statement?

This five-page document combines the previous HUD-1 Settlement Statement, the Truth in Lending Act disclosures and the Good Faith Estimate. On its own, however, a settlement statement can be defined as a document which fully summarizes all fees that both a borrower and lender will be required to pay during the settlement of a loan.

What is page 2 of closing costs?

Page 2 is dedicated to all the details associated with your closing costs. It is here that you'll want to examine origination charges, like application and underwriting fees, and service fees, such as appraisals and credit reports. There's also a section for other costs that include things like taxes and government fees, initial escrow payments due at closing and real estate commissions.

What is page 4 on a loan?

Page 4 is exclusively for loan disclosures. It is here that you will learn how much a late payment will cost you, if the lender will accept a partial payment and whether or not you will have an escrow account. Should the lender not require an escrow account, page 4 will reveal if you are being charged an escrow waiver fee.

When is a closing disclosure required?

All lenders are required to provide a Closing Disclosure at least three business days prior to any settlements or refinance closing dates. This time gives you a chance to review the terms of the document and ensure they are close to or match the estimates that were given by the lender at the beginning of the process.

What is included in closing disclosure?

The first is for your loan calculations, which include the total number of payments you'll make over the life of the loan, your finance charges and your APR. Section two lists other disclosures, such as your appraisal and contract details. The third section contains contact details for the lender, the buyer's real estate agent, the seller's agent and the settlement agent. The final section is where you sign and date that you have received and reviewed the document.

Who is Alicia Bodine?

Alicia Bodine is a New Jersey-based writer specializing in finance. With more than 13 years of experience, her work has appeared in LendingTree, GoBankingRates, Sapling, Zacks and Pocket Sense.

How long does a petitioner stay in the homestead?

Petitioner / Respondent (circle one) will remain in the family home, located at _____________________, until at least such time as the youngest child of the parties is eighteen years old, graduates from high school, or becomes emancipated, whichever occurs first. The resident of the homestead agrees to pay all expenses associated with living in the home, including but not limited to the mortgage payments, taxes, insurance, utility bills, and maintenance costs.

What does the respondent agree to waive in a divorce?

Petitioner and Respondent agree to waive any rights that each may have in the pension of the other. All other retirement accounts now individually held and maintained will be and remain the separate property of the spouse in whose name the asset is now held.

Why do petitioners and respondent have to live separately?

Because certain irreconcilable problems have developed between Petitioner and Respondent, they have agreed to live separately and apart, have filed for divorce, and are attempting to resolve the property issues between them without going to trial. 2.

What happens when a couple divorces?

When a couple divorces they often go through the process of dividing up the assets (fur niture, cars, frequent flyer miles) and the debts (mortgages, credit cards, etc.). The form below is a sample of what a property settlement agreement between divorcing spouses may look like.

Is it easy to divide marital property?

Dividing up marital property is hardly an easy task, especially when there are emotional attachments involved, not to mention the fact that the question of who actually owns what isn't always clear. Before signing a property settlement agreement, it's important to understand your rights to marital property.

Do you need to consult an attorney before signing a property agreement?

It is always recommended that you consult with an attorney before signing any agreement related to your property interests, so that you have a full understanding of your rights, including any marital property rights that you may have acquired during marriage. Thank you for subscribing!

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is line 902 on a mortgage?

Line 902 shows mortgage insurance premiums that are due at settlement. Escrow reserves for mortgage insurance are recorded later. It should be noted here if your mortgage insurance is a lump sum payment that's good for the life of the loan.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is line 903 used for?

Line 903 is used to record hazard insurance premiums that must be paid at settlement to have immediate insurance coverage on the property. It's not used for insurance reserves that will go into escrow.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What happens if the appraisal comes in higher than the sales price?

If the appraisal comes in higher than the sales price, then the buyers can relax and be happy that they have purchased a home for less than its market value. Once the contract has been signed, you as the seller cannot renegotiate the price higher. However, if the appraisal comes in lower than the sales price, then the buyer’s lender will limit the loan amount to that lower value. The buyer may have to come up with additional cash to cover the financing gap or may ask you to renegotiate the contract. Your REALTOR® can advise you about the best way to handle this situation, but in any case you and the buyer are also bound by the contract terms.

What are adjustments at closing?

At a typical closing, adjustments are made to the final amounts owed by the buyer and you as the seller. For example, if you’ve been paying your property taxes through an escrow account, you may be credited extra for prepaid taxes or you may receive less money at settlement if the property taxes haven’t been paid properly.

How long can you rent back a house?

Generally, you’re restricted to a maximum rent-back of 60 days because lenders would require ...

What do you need to do before closing on a house?

Before closing on a house, you need to get to the settlement table. You’re near the end of the process of selling your home, but don’t breathe a sigh of relief just yet. While it’s certainly true that you can lighten up on the perfectionism required to show your home at any moment, as a seller you still need to cooperate with your buyer, ...

Who provides settlement services?

The decision about who provides settlement (also known as closing or escrow) services varies from one market to another. In many places, the buyer chooses the settlement company, but in others the seller chooses. When closing on a house, the buyer will provide funds to buy your home and the settlement agent will review the sales agreement to determine what payments you’ll receive. The title to the property is transferred to the buyers and arrangements are made to record that title transfer with the appropriate local records office.

Do you need to have a home inspection before closing?

Before closing on a house, most transactions include a home inspection, so you’ll need to make your home available to the inspector and then negotiate with the buyers about anything the inspection turns up according to the terms of your contract.

Can you negotiate a settlement date with a buyer?

Buyers and sellers typically negotiate a settlement date that is mutually agreeable. If you have sold your home and are not yet ready to move into your next residence, you can sometimes negotiate a “rent-back” with the buyer that allows you to stay in the home after the settlement by paying rent to the buyer.

When will you receive the seller’s net sheet in the home sale process?

Customarily, a real estate agent who uses seller’s net sheets will supply one to you at different points during the transaction. These stages include:

Who prepares the seller’s net sheet?

Typically, the listing agent prepares the seller’s net sheet, Black says.

Why does Grove ask for each seller to initial and date the seller's net sheet?

Grove asks each seller to initial and date the seller’s net sheet so that they grasp how much money they stand to pocket from the deal.

What does a net sheet do for a seller?

The projections in the seller’s net sheet can guide you, in collaboration with your agent, toward one key decision about your home—whether to raise or lower the sale price.

What are the costs of home insurance?

According to Allstate, one of the country’s largest home insurance companies, items that you could see on a buyer’s cost sheet include: 1 Appraisal fee 2 Credit report fee 3 Inspection fee 4 Legal fees 5 Title insurance cost 6 Title search fee 7 Document-recording fees 8 Escrow fees 9 Taxes

What is a top notch real estate agent?

However, a top-notch real estate agent is competent and familiar with every aspect of a transaction, including the seller’s net sheet should you request one.

What percentage of the final sale price is paid to sellers?

Sellers can expect to pay between 6-10% of the final sale price in commissions and closing costs, so it’s nice to see exactly where that money is going.