A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line. Source: (American Land and Title Association)

Full Answer

What is a loan settlement statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of all of a loan’s terms and conditions as well as all extraneous fees.

What Settlement Statement items are tax deductible?

What on the HUD-1 Statement Is Deductible on Federal Taxes?

- Prepaid Property Taxes. The HUD-1 settlement statement for taxes itemizes closing costs, including prepaid items such as real property taxes and mortgage interest.

- Mortgage Loan Points. When taking a look at a HUD statement example, you'll find mortgage loan discount points listed. ...

- Prepaid Mortgage Interest. ...

- Non-Deductible Settlement Charges. ...

How to settle a mortgage?

- The name of the creditor

- The amount owed

- That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How to create a mortgage interest statement?

You'll need to locate these boxes to fill out Schedule A:

- Box 1: Mortgage interest received from the borrower. This is the amount of interest you paid to your lender over the course of the year.

- Box 5: Mortgage insurance premiums. These are required when you purchased a home with less than 20% down.

- Box 6: Points paid on the purchase of the principal residence. ...

What is a settlement statement for a mortgage?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Is a settlement statement the same as a mortgage statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

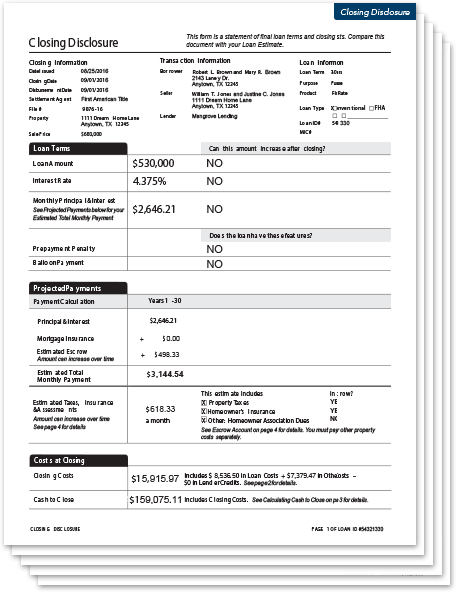

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What is a closing statement in a settlement?

What is the seller's closing/settlement statement? The Seller's Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. This is one of many closing documents for seller.

What form contains a settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is the difference between closing and settlement?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

Which two items will appear on a closing disclosure?

Credits and debits appear on the closing statement.

What a closing statement looks like?

A mortgage closing statement lists all of the costs and fees associated with the loan, as well as the total amount and payment schedule. A closing statement or credit agreement is provided with any type of loan, often with the application itself.

Who typically prepares the closing statement?

Typically, closing agents are real estate attorneys, title companies or escrow officers. Unlike the HUD-1, which closing agents generally provided to buyers and sellers on the day of a real estate closing, closing statements must be issued at least three business days before closing.

What is a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

Are HUD-1 settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

What can I expect to see on my settlement statement?

Several items are listed and organized within a settlement statement, including:

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, “it’s safe to say that you are at the tail end of the process,” Moreira says. It’s crucial to review this document carefully to ensure all costs are accurate.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

What is a monthly mortgage statement?

A monthly mortgage statement contains important information about your loan servicer, your payment schedule, your loan balance and much more. A monthly mortgage statement contains important information about your loan servicer, your payment schedule, your loan balance and much more. You are using an outdatedbrowser.

What does paying attention to your mortgage statement mean?

Paying attention to this portion of your mortgage statement gives you a chance to plan what to do when your mortgage payment goes up. For example, some borrowers may choose to refinance into a new loan.

What is a mortgage loan account number?

Your mortgage loan account number is what identifies the mortgage as yours. If you need to contact your loan servicer with a question or an issue, you’ll need to provide your account number.

How long does it take for an adjustable rate mortgage to change?

If you have an adjustable-rate mortgage (ARM), the interest rate may change over time. If your mortgage term is more than one year, your loan servicer will send you an estimate of the new payment seven to eight months before the first adjustment. If your ARM previously reset, then the servicer must notify you two to three months before the next adjustment.

What happens if you are behind on your mortgage payment?

If you fall behind on making your mortgage payments, your mortgage statement will include a delinquency notice. This usually happens after your loan is 45 days late. The delinquency notice will provide information on how to bring the loan current. Once your mortgage payment is 30 days late, your mortgage lender typically reports this to the credit bureaus. A late mortgage payment does more damage to your credit score than other types of late payments. It can also affect your eligibility for refinancingor a new home loan later on.

How long do you have to dispute a mortgage loan?

Generally, lenders must address your written dispute within 30 days. Many consumers question how long to keep mortgage loan statements.

How long do you have to pay your mortgage before it is late?

Generally speaking, most lenders offer a grace or courtesy period — usually two weeks — before your payment is marked late.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How long does a HELOC loan last?

This revolving product has a set draw period that usually ends after 10 years. After the draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is line 902 on a mortgage?

Line 902 shows mortgage insurance premiums that are due at settlement. Escrow reserves for mortgage insurance are recorded later. It should be noted here if your mortgage insurance is a lump sum payment that's good for the life of the loan.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What form do you use for a refinance loan?

In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.