Full Answer

What is a property settlement?

Property Settlement. Property settlements can arise through agreement of the parties, subject to approval by the court, or by court order. Once approved, the settlement functions like a contract for enforcement or modification purposes. Some states use alternate terms to describe a property settlement, such as property agreement,...

What do you need to know about a settlement statement?

(Solved) A settlement statement is a document given to borrowers at closing that itemizes services and fees charged to the borrower by the lender or broker. 1 What is the purpose of a settlement statement? 2 What is a seller’s settlement statement? 3 Who prepares the settlement statement? 4 What are closing costs on settlement statement?

How can you tell if a house is having settlement?

Evidence that a home may be having settlement include: Cracks in drywall or plaster; cracks in stucco, block or brick siding Should a home incur excessive settlement, then the home may suffer damage to the foundation. If the damage is significant it can cause damage to the rest of the home sitting on-top of the foundation.

Can a property settlement be upheld by the courts?

The settlement will usually be upheld by the courts unless it is found to be invalid. A court will rule that a property settlement is invalid if it is Unconscionable, which means that the agreement is so unfair to one party that it must be modified. Whether an agreement is unconscionable is determined by the facts in each case.

What is a property settlement agreement in Virginia?

A Property Settlement Agreement is a written contract between the parties that sets forth their rights, duties, and obligations that arise out of their separation and divorce and may include such things as the division of their property, spousal support, attorney's fees, custody of their children, and child support.

How long is property settlement UK?

You do not need to wait until you are divorced to commence your property settlement and any claim for maintenance. If you are in a de facto relationship the time limit is two years from the date of separation. The property settlement process can start any time after separation.

What is property settlement Australia?

All the property owned by you and your partner, either in your joint names or in your individual names, is known as the “matrimonial asset pool”. The term “property settlement” describes the division of property between a husband and wife, or de facto partners, when they separate.

What should you not forget in a divorce agreement?

5 Things To Make Sure Are Included In Your Divorce SettlementA detailed parenting-time schedule—including holidays! ... Specifics about support. ... Life insurance. ... Retirement accounts and how they will be divided. ... A plan for the sale of the house.

How long does it take to get money after house settlement?

The timeframe in which it takes for mortgage funds to be released does vary between lenders, however, it is common for funds to be released within between 3 and 7 days.

Can my ex wife claim my pension after divorce?

Your ex-spouse can absolutely claim your pension after your divorce if there is no legally binding financial agreement in place.

What happens at settlement of property?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

What should I look for in final inspection before settlement?

Things to check for during a pre-settlement inspection include:Lights and electronics. Test each room's light switch to ensure it's working. ... Plumbing. ... Water heaters. ... Air conditioners and heaters. ... Door handles and locks. ... Appliances. ... Curtains and blinds. ... Windows and glass.More items...•

What can go wrong on settlement day?

What could possibly go wrong?Funds not transferred in time.Documents not received in time.Other parties bank not having all documentation finalised.Bank cheques drawn for settlement are incorrect.Documents have been signed or witnessed incorrectly.Documents have been prepared incorrectly.More items...

What can a wife claim in a divorce?

Assets that you have built up or acquired during the period of marriage are known as matrimonial assets or marital assets. These typically include property, pensions, savings, personal belongings, and cash in the bank.

How do narcissists settle divorce?

5 Tips for Divorcing a NarcissistTry to Keep Their Words Against You Impersonal. ... Keep Your Family Law Attorney in the Loop. ... Beat Them at Their Own Game with the Truth. ... Have Your Finances in Order. ... Create a Divorce Team Beyond Family Law Attorneys. ... Deal with Any Divorce Hurdle Through the Nilsson Legal Group.

How do I protect myself financially in a divorce?

How to Financially Protect Yourself in a DivorceLegally establish the separation/divorce.Get a copy of your credit report and monitor activity.Separate debt to financially protect your assets.Move half of joint bank balances to a separate account.Comb through your assets.Conduct a cash flow analysis.More items...•

How long does it take to buy a house from offer to completion UK 2022?

On average you need from 6 to 12 weeks to search and find the right property, from 2 to 4 weeks to receive a mortgage offer, around 16 weeks for conveyancing including signing and exchanging contracts and then from 2 to 4 weeks to complete the sale, get the keys and move in to your lovely new home.

How long do searches take when buying a house 2022 UK?

Searches usually take around 2 weeks but can take much longer if the Local Authority is overloaded. Ask the solicitor to find out how long they are going to take. If it is more than a week ask the solicitor if they can carry out personal searches which may be significantly faster.

How long after signing contracts do you complete UK?

Your solicitor will discuss dates for completion with you once your contracts have been exchanged. Usually, there's a period of one to three weeks between exchange and completion, but this may be longer depending on the size of your chain.

How long does it take to buy a house with no chain 2022 UK?

If there is no chain involved in the buying process, you can normally expect to complete within approximately three months.

What is a settlement agreement for a divorcing party?

If the divorcing parties agree to how they decide to dive their assets, a formal property settlement agreement is prepared in this case to suffice the purpose. The settlement constitutes a list of details and all the individuals who will benefit from the same.

What is a marital property settlement agreement?

Marital Property Settlement Agreement. A Marital Property Settlement Agreement is a type of contract that often exists in uncontested divorces. The same agreement divide the assets, property and the debts of a marriage. Fortunately, it spells out the valid terms and all the rights for both the parties.

What is the same agreement for spousal alimony?

The same agreement divide the assets, property and the debts of a marriage. Fortunately, it spells out the valid terms and all the rights for both the parties. The same also settle any issue concerning spousal alimony and child custody.

What is a settlement agreement?

A property settlement agreement is that essential piece of document which fundamentally is a written agreement between two parties involved in the division of a property. For example, a married couple who looks forward in dividing their property into two legal entities has to abide by the policies mentioned there in a property settlement agreement.

Is a property settlement a prenuptial agreement?

Property settlement agreements typically come alive before marriage as a prenuptial document or even during a marriage as a post-nuptial agreement. Some other terms for Property Settlement include Property Agreement, Separation Agreement however all refer and surrounds around the same idea.

Can a married couple get custody of their children?

Many times married couples residing with their sons and daughters have to face an additional challenge of acquiring child custody if ever then plan to divorce or separate on mutual and legal terms. As a matter of reality, it gets outwardly challenging to let go of your most beloved ones so easily. We have tried to collect a property settlement agreement template that rightly justifies the purpose and also rightly explains the child custody settlement. You can go through the same to find out things to consider during one such agreement of settlement.

Is a property settlement agreement a real estate deal?

Property settlement agreement exists since the time trade in real estate started up . Today, Real Estate is one of the most prominent industry in a lot of countries where the same promote the overall economic growth of the country and opens newer employment possibilities. In that case, there has been a rise in individual investors looking to trade in real estate properties every now and then.

How is property divided in divorce?

First, each spouse's separate property is given to the appropriate spouse, then the rest of the property (the Community Property) is divided without consideration of "marital misconduct." The factors to consider when making a division of the community property include the "contribution of each spouse to the acquisition of the marital property, including contribution of a spouse as homemaker; value of the property set aside to each spouse; duration of the marriage; and economic circumstances of each spouse when the division of property is to become effective." This option retains the distinction between property bought before the marriage (separate property) and property bought during the marriage (community property). Many states have adopted some form of these tests for their courts to use when dividing property at divorce. Once an agreement is decided upon, the property settlement has the same enforceability as a contract.

What are the two types of property that must be distributed in a settlement?

Two types of property that must be distributed in the settlement are community or marital property and separate property. Community or marital property consists of property that is purchased by either or both of the spouses during the time they are married. Property bought during the time the couple is married is presumed to be marital property ...

How to determine if a property settlement is unconscionable?

Whether an agreement is unconscionable is determined by the facts in each case. An unconscionability finding can be based on several factors relating to property settlement. Lack of disclosure by one of the parties can be one reason to find an agreement unfair. For example, if, when the parties met to discuss and divide their assets, one spouse did not reveal the existence of a particular asset, the other spouse, who later locates or hears of the asset after the property settlement has been approved, may seek to have the settlement overturned on the basis that he or she did not know of the asset at the time of the settlement. The court may modify the settlement to avoid further injustice to one party.

What is property settlement?

A property settlement involves the property that the couple obtained either before marriage or during marriage. The agreement also may include such issues as maintenance (otherwise known as Alimony) payments to one spouse or even custody of the children. Two types of property that must be distributed in the settlement are community ...

What is a divorce agreement between husband and wife?

An agreement entered into by a Husband and Wife in connection with a Divorce that provides for the division of their assets between them.

What does "undue influence" mean in a property settlement?

Undue influence means that one party used pressure or misrepresentations to force the other to sign or agree to the terms in the property settlement. When a court finds either fraud or undue influence, it modifies the property settlement to correct the unfairness.

What is the reason for altering a property settlement?

If the parties make a genuine mistake about the terms of the settlement, the court can reform or modify the settlement to correct that mistake. Fraud and undue influence are also reasons to alter or modify a property settlement.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

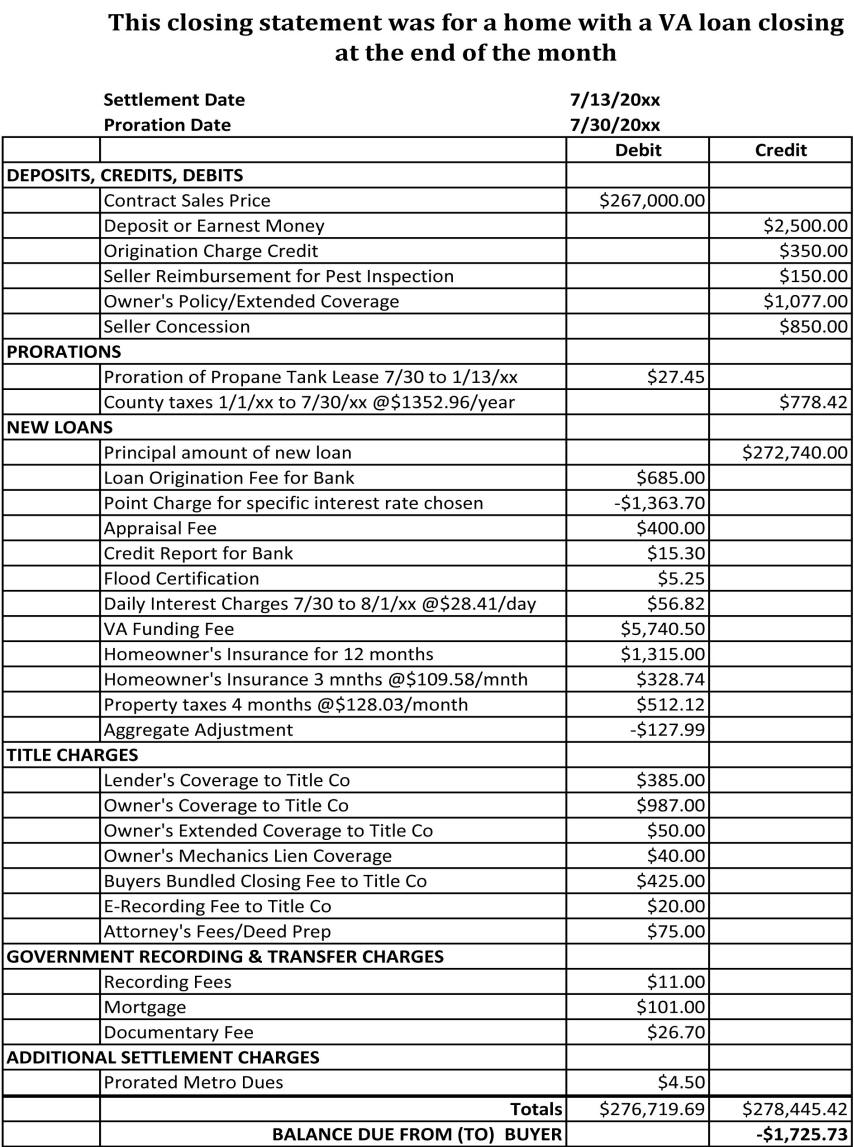

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

Why does my soil heave?

Just as moisture in clayey type soils causes heaving, the removal of moisture in these soils causes subsidence. Another common cause is tree roots near or under a foundation that draws out moisture from the soil through a process called transpiration. ( Read about how transpiration works) Seasonal changes and ground water issues may likewise contribute to subsidence.

Why is the foundation of a house compacted?

Primary and secondary compaction. Generally the soil that a homes foundation is built on will be compacted in order to better support the bottom of the foundation and if the soil is not well (consolidated) compacted the foundation will settle more than normal, especially in the first few years.

What is the first form of compaction?

The first compaction done, usually by mechanical equipment, such as compactors or heavy construction equipment could be referred to as primary consolidation. It forces air and some water out of minuscule spaces between the soil particles; the particles of soil are pushed (compacted) closer together.

What happens when the weight of a home causes the soil particles to consolidate tighter?

When the weight of a home causes the soil particles to consolidate tighter, then the home drops down or settles. There are 3 basic types of settlement and one type usually causes more damage to the home, than the other two types.

What is the good news about foundations?

The good news is that before a home is built, the footings and foundation are generally engineered for the type of soil conditions that a house will sit on, unfortunately mother nature, time and other events occur that over-rides the original engineering.

What to look for when settling a house?

Evidence that a home may be having settlement include: Foundation appears to have dropped down or sunk. Top of foundation not level. Cracks in the foundation. Basement walls cracked, leaning or bowed. Roof sags, wavy or has a hump. Cracks in drywall or plaster; cracks in stucco, block or brick siding.

How to tell if a house has settled?

Evidence that a home may be having settlement include: 1 Foundation appears to have dropped down or sunk 2 Top of foundation not level 3 Cracks in the foundation 4 Basement walls cracked, leaning or bowed 5 Roof sags, wavy or has a hump 6 Cracks in drywall or plaster; cracks in stucco, block or brick siding 7 Sloping floors, doors and windows sticking

What is HUD-1 settlement statement?

The HUD-1 settlement statement outlines your exact mortgage payments, a loan’s terms (such as the interest rate and term) and additional fees you’ll pay, called closing costs (which total anywhere from 2% to 7% of your home’s price). Compare your HUD-1 to the good-faith estimate your lender gave you at the outset; make sure they’re similar and ask your lender to explain any discrepancies.

How long before closing do you get your HUD-1?

Thanks to new regulations put in effect in October 2015 known as TRID (which stands for TILA-RESPA Integrated Disclosure), you will receive your HUD-1 three days before closing so that you have plenty of time to check it over. (Before TRID, home buyers received this form only 24 hours ahead of time, which resulted in a lot more last-minute surprises and holdups.)

How long before closing can you walk through a home?

Do a final walk-through: A buyer’s contract usually allows for a walk-through of the home 24 hours before closing. First and foremost, you’re making sure the previous owner has vacated (unless you’ve allowed a rent-back arrangement where they can stick around for a period of time before moving). Second, make sure the home is in the condition agreed upon in the contract. If you’d had a home inspection done earlier and it had revealed problems that the sellers had agreed to fix, make sure those repairs were made.

What to do if you find an issue during a walk through?

If you find an issue during your walk-through, bring it up with the sellers as soon as possible. There’s no need to panic; at worst you can simply delay the closing until you resolve it.

Where is Margaret Heidenry?

Margaret Heidenry is a writer living in Brooklyn, NY. Her work has appeared in the New York Times Magazine, Vanity Fair, and Boston Magazine. Get Pre-Approved Connect with a lender who can help you with pre-approval. I want to buy a home. I want to refinance my home.

Who is present at closing?

The cast includes the home seller, the seller’s real estate agent as well as your own, buyer and seller attorneys, a representative from a title company (more on that below), and, occasionally, a representative from the bank or lender where you got your loan.

Does realtor.com make commissions?

The realtor.com ® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission.

What is a HUD-1 settlement statement?

This five-page document combines the previous HUD-1 Settlement Statement, the Truth in Lending Act disclosures and the Good Faith Estimate. On its own, however, a settlement statement can be defined as a document which fully summarizes all fees that both a borrower and lender will be required to pay during the settlement of a loan.

What is page 2 of closing costs?

Page 2 is dedicated to all the details associated with your closing costs. It is here that you'll want to examine origination charges, like application and underwriting fees, and service fees, such as appraisals and credit reports. There's also a section for other costs that include things like taxes and government fees, initial escrow payments due at closing and real estate commissions.

What is page 4 on a loan?

Page 4 is exclusively for loan disclosures. It is here that you will learn how much a late payment will cost you, if the lender will accept a partial payment and whether or not you will have an escrow account. Should the lender not require an escrow account, page 4 will reveal if you are being charged an escrow waiver fee.

When is a closing disclosure required?

All lenders are required to provide a Closing Disclosure at least three business days prior to any settlements or refinance closing dates. This time gives you a chance to review the terms of the document and ensure they are close to or match the estimates that were given by the lender at the beginning of the process.

What is included in closing disclosure?

The first is for your loan calculations, which include the total number of payments you'll make over the life of the loan, your finance charges and your APR. Section two lists other disclosures, such as your appraisal and contract details. The third section contains contact details for the lender, the buyer's real estate agent, the seller's agent and the settlement agent. The final section is where you sign and date that you have received and reviewed the document.

Who is Alicia Bodine?

Alicia Bodine is a New Jersey-based writer specializing in finance. With more than 13 years of experience, her work has appeared in LendingTree, GoBankingRates, Sapling, Zacks and Pocket Sense.