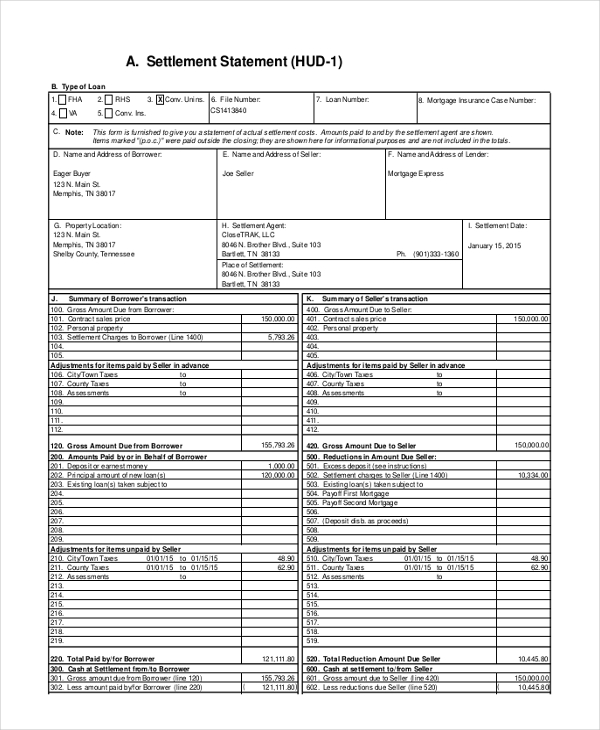

A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line. Source: (American Land and Title Association)

Full Answer

Is settlement statement same as Closing Disclosure?

You may also see the settlement statement come into play in along with the “Closing Disclosure” form. This is among the fairly common closing documents for seller. If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase.

What to expect from a settlement?

- For minor injuries, they often settle for 1 to 2 times the medical bills.

- For more serious injuries, your case could settle for 10 times or more of the medical bills.

- But in most cases, it is likely that your case will settle for somewhere between 1 1/2 to 4 times your medical bills.

What does the Bible say about settlement?

What Does the Bible Say About Settlement? And after you have suffered a little while, the God of all grace, who has called you to his eternal glory in Christ, will himself restore, confirm, strengthen, and establish you. So then let us pursue what makes for peace and for mutual upbuilding.

What is a good sentence with settlement?

use "settlement" in a sentence The government of Tunisia supports the peaceful settlement of conflicts, and dialog in its relations with foreign powers. A peace settlement in the Middle East would be a major triumph for American diplomacy. The last ice age had a profound effect upon the settlement patterns of man.

Is a closing statement the same as a settlement statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is the most commonly used form for settlement statements?

HUD-1 formA HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

Is a closing statement the same as a closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

Who prepares the closing statement?

In real estate transactions, a closing agent prepares the closing statement which reflects the cost of the property for both the buyer and the seller. It is important that closing statements reflect the agreement of both buyers and sellers of properties, as well as a mortgage loan that backed up the home purchase.

What is a settlement letter?

A settlement letter is a letter that provides a quote for the amount you need to pay in order to settle your vehicle finance account in full.

What form contains a settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

Where do I find closing statements?

If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase. Other parties that may have copies of the settlement documents include your real estate agent, or the financial institution that holds the loan for the property.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

What is a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

What comes after the closing disclosure?

What happens after the closing disclosure? Three business days after you receive your closing disclosure, you will use a cashier's check or wire transfer to send the settlement company any money you're required to bring to the closing table, such as your down payment and closing costs.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

What is FnF in salary?

What is full and final settlement? Whether an employee resigns from the job or is let go by the management, they are paid all the dues for their service till the last working day as FnF or full and final settlement. This includes any additional earnings or deductions as well.

How is FnF amount calculated?

Calculation of per day basic: (number of days of non-availed leaves * basic salary) / 26 days ( Avg paid days in a month). As per Section 7 (3) of the Payment of Gratuity Act 1972, Gratuity should be offered within 30 days of the resignation. If you fail to do so you need to pay with interest.

What if company is not paying FnF?

Answers (2) Send a letter to the HR of the Company including the managing director telling all situation and that fnf has not been done. If they do not respond or reply in negative then a legal notice then a case in labour court is legal remedy.

What is F&F process?

The F&F process is mainly a financial settlement such as unpaid salary (including annual benefits - leave travel allowance) and arrears, unpaid bonus, payment for non-availed leaves or earned leave, and Gratuity if one completes four years and 240 days, and pension.

What is the purpose of a settlement statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest.

Who prepares the settlement statement?

The settlement statement is prepared by an impartial third party to the transaction, usually an officer with the title or escrow company that performs the closing.

What are closing costs on settlement statement?

In California, as a rule of thumb, closing costs amount to approximately 11 percent of the total sales price of a home. They usually include a real estate commission, loan fee, escrow charge, title insurance premium, a pest inspection and the like.

Does seller get check at closing?

Sellers receive their money, or sale proceeds, shortly after a property closing. It usually takes a business day or two for the escrow holder to generate a check or wire the funds.

When should I get a settlement statement?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Is a settlement statement the same as a closing statement?

A settlement statement is also known as a HUD-1 form or a closing statement. Until 2015, when the rules changed, this form was provided twice. First, within three business days of applying for a mortgage loan, the borrower receives one in the mail with the person’s estimated closing costs.

When should seller Get settlement statement?

It is usually handed out at least three days before the closing, so that the seller and their agent can review it. The document is usually prepared by a lawyer, escrow firm, or a title company.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

What is a RESPA?

The Real Estate Settlement Procedures Act (RESPA) govern s the formulation of both closing disclosures and HUD-1 statements for the mortgage lending market. RESPA has been revised and updated throughout history to help manage mortgage lending disclosures and protect borrowers. RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure.

How many pages are required for HUD-1?

The HUD-1 is a three-page form generally required to be provided to a borrower one day before closing. The mortgage closing disclosure is a five-page form generally required to be provided to a borrower three days before closing.

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

What is a Settlement Statement?

The Settlement Statement or closing statement is a document that outlines what the buyer has to pay to the vendor on settlement day. It includes all payments and receipts that are related to the settlement. This may include stamp duty, the First Home Owner Grant and the Statement of Adjustments. It also includes the total purchase price less any deposit paid. The Settlement Statement is usually put together by your conveyancer or property lawyer when they are getting ready to settle the property purchase.

What is a settlement?

Real estate settlement happens when the land is transferred over to the buyer. Settlement day usually marks the end of the transaction. Aside from handing over keys, there are several things that happen on settlement day. A settlement day checklist includes:

What is included in a statement of adjustment?

Some of the most common include: Municipal Rates: The seller is liable to pay for the rates up to settlement day.

How is a statement of adjustments calculated?

The Statement of Adjustments will be calculated assuming that all of the expenses have been paid. If they haven’t then they will be paid out of the total money that is to be paid to the seller. This means that the seller will effectively pay them up to settlement date. Sometimes this involves having a bank cheque for settlement drawn up so that these expenses can be paid.

How are water and sewerage charges adjusted?

Water and sewerage charges: These are adjusted based on the number of days, rather than the amount of water consumed, up to settlement date . Because water meters are usually read every quarter, the Statement of Adjustment may use the average usage in the period preceding the sale to estimate the amount of water and sewerage charges that the seller must pay.

Why do you need to adjust settlement dates?

Because settlements rarely occur at the end of the year or month, adjustments need to be done to make sure both the buyer and the seller only pay (and receive) their fair share. If for some reason the settlement date is delayed, then the adjustments will need to be recalculated.

Why are settlement statements included in the Statement of Adjustments?

Settlement Statements are usually incorporated into the Statement of Adjustments because the income and expenses related to the property also need to be settled between the parties. These expenses may include things like municipal rates, land tax and other periodic expenses related to the property.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is line 902 on a mortgage?

Line 902 shows mortgage insurance premiums that are due at settlement. Escrow reserves for mortgage insurance are recorded later. It should be noted here if your mortgage insurance is a lump sum payment that's good for the life of the loan.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is line 903 used for?

Line 903 is used to record hazard insurance premiums that must be paid at settlement to have immediate insurance coverage on the property. It's not used for insurance reserves that will go into escrow.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What Is the Real Estate Settlement Procedures Act (RESPA)?

The Real Estate Settlement Procedures Act (RESPA) was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures. RESPA was also introduced to eliminate abusive practices in the real estate settlement process, prohibit kickbacks, and limit the use of escrow accounts. RESPA is a federal statute now regulated by the Consumer Financial Protection Bureau (CFPB).

What is required by RESPA?

RESPA requires lenders, mortgage brokers, or servicers of home loans to disclose to borrowers any information about the real estate transaction. The information disclosure should include settlement services, relevant consumer protection laws, and any other information connected to the cost of the real estate settlement process. Business relationships between closing service providers and other parties connected to the settlement process should also be disclosed to the borrower. 2

What is a RESPA loan?

The types of loans covered by RESPA include the majority of purchase loans, assumptions, refinances, property improvement loans, and equity lines of credit. 1. RESPA requires lenders, mortgage brokers, or servicers of home loans to disclose to borrowers any information about the real estate transaction. The information disclosure should include ...

What is a RESPA lawsuit?

A plaintiff has up to one year to bring a lawsuit to enforce violations where kickbacks or other improper behavior occurred during the settlement process.

How long does it take to file a complaint against a loan servicer?

If the borrower has a grievance against their loan servicer, there are specific steps they must follow before any suit can be filed. The borrower must contact their loan servicer in writing, detailing the nature of their issue. The servicer is required to respond to the borrower’s complaint in writing within 20 business days of receipt of the complaint. The servicer has 60 business days to correct the issue or give its reasons for the validity of the account's current status. Borrowers should continue to make the required payments until the issue is resolved.

What is RESPA in real estate?

What Is the Real Estate Settlement Procedures Act (RESPA)? The Real Estate Settlement Procedures Act (RESPA) was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures. RESPA was also introduced to eliminate abusive practices in the real estate settlement process, prohibit kickbacks, ...

What is the advantage of RESPA?

In place of this would be a system where services are bundled, but the real estate agent or lender is responsible for directly paying for all other costs. The advantage of this system is that lenders (who always have more buying power) would be forced to seek out the lowest prices for all real estate settlement services.

What is HUD-1 settlement statement?

The HUD-1 settlement statement outlines your exact mortgage payments, a loan’s terms (such as the interest rate and term) and additional fees you’ll pay, called closing costs (which total anywhere from 2% to 7% of your home’s price). Compare your HUD-1 to the good-faith estimate your lender gave you at the outset; make sure they’re similar and ask your lender to explain any discrepancies.

How long before closing do you get your HUD-1?

Thanks to new regulations put in effect in October 2015 known as TRID (which stands for TILA-RESPA Integrated Disclosure), you will receive your HUD-1 three days before closing so that you have plenty of time to check it over. (Before TRID, home buyers received this form only 24 hours ahead of time, which resulted in a lot more last-minute surprises and holdups.)

How long before closing can you walk through a home?

Do a final walk-through: A buyer’s contract usually allows for a walk-through of the home 24 hours before closing. First and foremost, you’re making sure the previous owner has vacated (unless you’ve allowed a rent-back arrangement where they can stick around for a period of time before moving). Second, make sure the home is in the condition agreed upon in the contract. If you’d had a home inspection done earlier and it had revealed problems that the sellers had agreed to fix, make sure those repairs were made.

What to do if you find an issue during a walk through?

If you find an issue during your walk-through, bring it up with the sellers as soon as possible. There’s no need to panic; at worst you can simply delay the closing until you resolve it.

Where is Margaret Heidenry?

Margaret Heidenry is a writer living in Brooklyn, NY. Her work has appeared in the New York Times Magazine, Vanity Fair, and Boston Magazine. Get Pre-Approved Connect with a lender who can help you with pre-approval. I want to buy a home. I want to refinance my home.

Who is present at closing?

The cast includes the home seller, the seller’s real estate agent as well as your own, buyer and seller attorneys, a representative from a title company (more on that below), and, occasionally, a representative from the bank or lender where you got your loan.

Does realtor.com make commissions?

The realtor.com ® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission.