What is a settlement agent fee in real estate?

The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for. Costs bundled under the Settlement Fee may include the cost of:

What does a settlement agent actually do?

What Does a Settlement Agent Do? While you closely work with a loan officer to finalize the terms of your loan like interest rate and cash out, the settlement agent is the one who actually handles the transfer of the property being sold.

Do I need a settlement agent?

You'll need to appoint a settlement agent to conduct settlement on your behalf. The seller will also have a settlement agent involved. Settlement day is the actual date you become the legal owner of your home. In fact, settlement occurs at a specific time and location, but you won't need to be there as your settlement agent will do this on your behalf. All the parties need to agree on the date of settlement and representatives will sign the official sales documents on the same day.

Who pays settlement closing fees?

When it comes down to paying the settlement fees, the buyer and seller will have typically negotiated an agreement. Generally, settlement fees are handled by the home buyer, but it is not unusual for the seller to agree to cover the costs as part of the negotiations while selling their home.

What are settlement expenses?

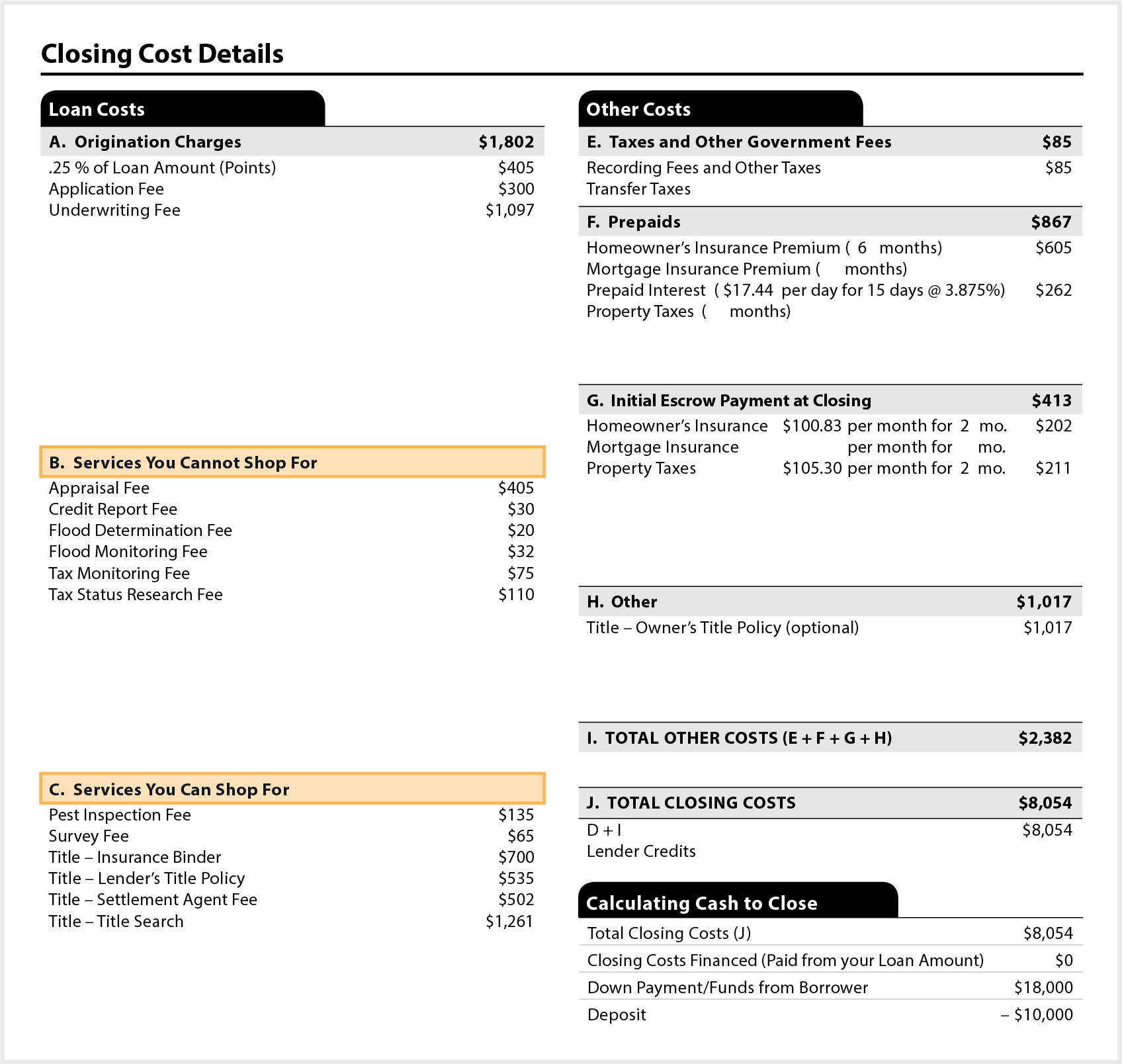

Settlement costs (also known as closing costs) are the fees that the buyer and/or seller have to pay to complete the sale of the property. Depending on the lender, these may include origination fees, credit report fees, and appraisal fees, as well as property taxes and recording fees.

What are the responsibilities of the closing agent?

The duties of a closing agent include ordering title work and a property survey, assisting with obtaining requisite insurance, communicating with the lender and mortgage broker, issuing and sending the title insurance policy to both the buyer and lender, issuing the title commitment, assembling the loan closing package ...

How much does conveyancing cost in WA?

Based on 6 quotes in Western Australia, ranging from $750 to $1,100, the average base conveyancing fee is about $920.

What is the role of the settlement agent?

Settlement agents are third parties or intermediaries that help a buyer and seller complete a transaction. In financial markets, settlement agents are clearing houses responsible for ensuring the delivery of securities to the buyer, transferring the funds to the seller, and recording the details of the transaction.

What not to do after closing on a house?

What Not To Do While Closing On a HouseAvoid Big Charges on a Credit Card. Do not rack up credit card debt. ... Be Careful with Trends. ... Do Not Neglect Your Neighbors. ... Don't Miss Tax Breaks. ... Keep Your Real Estate Agent Close. ... Save That Mail. ... Celebrate!

Who prepares the closing statement?

In real estate transactions, a closing agent prepares the closing statement which reflects the cost of the property for both the buyer and the seller. It is important that closing statements reflect the agreement of both buyers and sellers of properties, as well as a mortgage loan that backed up the home purchase.

Can you negotiate conveyancing fees?

You can try to negotiate conveyancing fees but generally, if a quote looks comparatively 'cheap' or a firm is willing to discount, you may find what looks like a short-term gain actually costs you in the end.

What do conveyancing fees include?

Conveyancers transfer the ownership of a property from one party to another, and you will need one when buying or selling a home. A few common conveyancing fees include land registration fees, transfer fees and local authority searches. John Fitzsimons Published on 25 February 2021.

Do you pay stamp duty when you sell a house in WA?

Who pays stamp duty? In WA, the purchaser of the property or the transferee is liable to pay stamp duty when the sale or transfer takes place.

What happens on a settlement day?

What happens on settlement day? On settlement day, at an agreed time and place, your settlement agent (solicitor or conveyancer) meets with your lender and the seller's representatives to exchange documents. They organise for the balance of the purchase price to be paid to the seller.

What is the difference between title and settlement?

Once titles are issued and your contract conditions are met, settlement takes place. At settlement, the balance of the purchase price transferred to the seller and your representative will ensure documents are registered so the title reflects the change of land ownership.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What important tasks must the closing agent complete in preparation for closing?

To close the deal on your home, you need a closing agent (also called a settlement or escrow agent). They'll coordinate document signing for all the parties, verify that both you and the seller have met the terms of the purchase agreement, and finally pay out all funds, transfer the title, and record the deed.

Which of the following tasks should be done in preparation for closing by the closing agent?

Which of the following tasks should be done in preparation for closing by the closing agent? The answer is the deed. The closing agent must prepare the deed and the Closing Disclosure.

What are the primary objectives of closing?

Closing Entries Purpose The objective of closing entries is to transfer temporary account balances (stemming from the revenue and expense accounts found in the income statement) to a permanent account on the balance sheet.

Who is responsible for ensuring that the closing disclosure is delivered to the consumer?

The creditorThe creditor is responsible for ensuring that the Closing Disclosure meets the content, delivery and timing requirements. If the Closing Disclosure is provided in person, it is considered received by the consumer on the day it is provided.

What Is a Settlement Agent?

A settlement agent is a party who helps complete a transaction between a buyer and a seller. This is done through the transfer of securities to the buyer and the transfer of cash or other compensation to the seller.

What is a closing agent?

For a real estate transaction, closing agents are professionals who function chiefly for the buyer by conveying the selling interest from the buyer to the seller and ensuring the orderly transfer of the legal title from the seller to the buyer through the closing process. A settlement agent plays a central role in ensuring a "quick close.".

What is clearing house?

For stock trades and other security transactions, a clearing firm or clearing house acts as a settlement agent. Stock exchanges have clearing houses that have a wide range of responsibilities to ensure the smooth settlement of trades. These responsibilities include collecting and maintaining margin funds, ensuring delivery of purchased securities, and reporting transaction details to all parties.

What is default risk in forex?

Default risk is when one of the parties completely fails to deliver on their obligations, such as when a firm goes bankrupt. Settlement timing risk is when the transaction eventually settles, but not within the agreed-upon time frame. In the past, settlement timing risk occurred more often in the forex (FX) market, although the development of the continuous linked settlement system has lessened the frequency of these occurrences.

What is clearing in financial markets?

This process can occur several days after the original transaction. In the financial markets, clearing is the process by which trades settle. Clearing is the reconciliation of orders between the transacting parties in the purchase and sale of options, futures, stocks, and other securities.

Why do clearing houses have margin requirements?

In financial markets, clearing houses will impose margin requirements on traders in order to mitigate default risk.

What are the hurdles buyers and sellers must overcome in order to successfully settle the transaction?

A home inspection could show expensive defects, the title search could reveal problems with legal claims to the property, or the buyer's financing could fall through.

What happens if a creditor does not allow the consumer to shop for a settlement service?

If the creditor did not allow the consumer to shop for a settlement service, the creditor may need to reimburse the borrower for any additional charges for that service that are added later in order to comply with the Know Before You owe rule.

What does the creditor have to do with a settlement?

If the creditor permits the borrower to shop for a settlement service , the creditor must provide the borrower with a written list identifying at least one available provider of that service and stating that the consumer may choose a different provider for that service. §1026.19 (e) (1) (vi) (C).

What is a creditor's permit to shop for a settlement service?

A creditor permits a borrower to shop for a settlement service if the creditor permits the borrower to select the provider of that service, subject to reasonable requirements. §1026.19 (e) (1) (vi) (A).

Why is coordination important for mortgage borrowers?

Coordination with creditors so that they have complete, detailed information for timely disclosures on mortgage borrowers’ Loan Estimates will enhance compliance as well as the experience for those mortgage borrowers.

What is a creditor's requirement for settlement?

A creditor is permitted to impose reasonable requirements regarding the qualifications of the settlement services provider. For example, the creditor may require that a settlement agent chosen by the borrower must be appropriately licensed in the relevant jurisdiction.

What is home insurance?

Homeowner’s insurance. Condominium, homeowner’s association or similar required costs related to the property. This includes any arrearages owed by the current owner as well as transactional costs, and monthly or annual obligations of the property owner. Sales contract.

What is a file number?

Under §1026.38 (a) (3) (v), the File # is the “number assigned to the transaction by the settlement agent for identification purposes.”

What is a point fee?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front.

What is a point in a mortgage?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front. For example, paying $1,000 US Dollars (USD) up front might lower a person’s interest paid over the life of his loan by one percent. Points paid at settlement are tax deductible in some jurisdictions as well.

What is settlement fee?

In real estate, a settlement fee is a charge that covers expenses in excess of the amount a person pays to purchase or sell a property. Settlement fees can encompass many types of expenses, but often include such things as application and attorney ’s fees, loan origination fees, and fees for title searches.

Why do you need an appraisal before you get a mortgage?

Before a lender will grant a mortgage for a particular property, an appraiser is usually sent out to determine how much the property is worth. Lenders may also require an inspection by a professional home inspector in order to analyze the structure of the property and look for evidence of issues such as termites.

Is an appraisal included in settlement fees?

Lenders may also require an inspection by a professional home inspector in order to analyze the structure of the property and look for evidence of issues such as termites. Appraisers and home inspectors charge fees, which are often included in settlement fee totals.

Do appraisers charge fees?

Appraisers and home inspectors charge fees, which are often included in settlement fee totals. In most cases, the settlement fees a seller pays are negotiable. In order to make his home more attractive or easier to buy, a seller may agree to pay one or more of the settlement fees usually paid by the buyer.

Is it legal to have a seller assist with a settlement fee?

Having the seller assist with a settlement fee is usually legal, as long as the seller's contribution is detailed in the official agreement between the buyer and seller and doesn't violate any terms set by the lender.

How to settle a property?

Your settlement agent, conveyancer or lawyer, will complete a variety of tasks on your behalf including: 1 Search land titles to verify you are the legal owner. 2 Ensure the property is compliant with regulatory requirements such as ATO clearance certificates, outstanding rates and smoke alarm and electrical building codes. 3 Ensure any special conditions in the contract have been completed to your satisfaction before settlement takes place. 4 Prepare and verify all necessary legal documents and forms. 5 Attend to all adjustment of rates, taxes and levies as required. 6 Liaise with your financial institutions to confirm existing loan balances and provide payout instructions. 7 Coordinate the settlement date and time with your financial institution and the buyer’s settlement agent. 8 Provide updates on settlement progress and advise you of any potential delays, including your rights when it comes to compensation. 9 Attend settlement on your behalf to ensure correct exchange of legal documents and funds and let you know once settlement has occurred. 10 Provide a settlement statement.

How to prepare for settlement?

Ensure all inspections and any special conditions in the contract have been completed to your satisfaction before settlement takes place. Prepare and verify all necessary legal documents and forms. Ensure you have conducted your final inspection and all parties are ready for settlement.

Why do you attend settlement?

Attend settlement on your behalf to ensure correct exchange of legal documents and funds and let you know once settlement has occurred.

What is a liaise with your financial institutions?

Liaise with your financial institutions to confirm existing loan balances and provide payout instructions.

Who has the necessary qualifications and licenses to ensure that all legal requirements for the transfer of the title to the property are?

Lawyers and settlement agents have the necessary qualifications and licenses to ensure that all legal requirements for the transfer of the title to the property are complied with for the title to be registered in the name of the new owner.

Who coordinates the settlement date and time with the seller?

Coordinate the settlement date and time with your financial institution and the seller’s settlement agent.

Is settlement process complex?

The settlement process can be complex and it is prudent to use a qualified professional to guide you through the process to the completion of the settlement.

Why do lenders need to factor settlement in their mortgage?

Because this shift in thinking has accelerated the adoption of digital mortgage strategies, including hybrid e-closings, lenders must start factoring settlement into their digital mortgage plans in order to achieve success. By making e-closing adoption as easy as possible for settlement, lenders can dramatically increase their volume of digitally executed loans, resulting in financial and operational benefits on all sides of the transaction.

What is the role of title and settlement agent?

It is no secret that title and settlement agents play a crucial role in the execution of the mortgage closing process. However, as the industry continues its push towards widespread e-closing and e-mortgage adoption, this role is often overlooked. That oversight, or failure to account for title/settlement buy-in, can be one of the biggest stumbling blocks to e-closing adoption.

What does slim closing mean?

Slim closings can mean lower notary costs and/ or closing costs, and because e-closings result in a largely electronic closing package, there is usually a corresponding decrease in shipping expenses. As an added bonus, nearly 85% of the U.S. population is covered by e-recording, which further reduces expenses for title and settlement professionals ...

How does hybrid e-closing help?

This helps settlement professionals, as well as the closing departments, as it eliminates the need for both parties to “pick their swim lane.”.

Why do settlement agents have to manually tag title documents?

While lenders are able to electronically draw documents through these platforms with ease, settlement agents are often forced to manually tag the title documents because these documents come from various sources.

Why is e-closing not feasible?

If title and settlement professionals are only being asked to conduct e-closing on a tiny portion of their overall business , it may simply not be feasible from a financial or operational standpoint for them to do so.

Why do people use e-closing?

E-closings dramatically improve the customer experience, which provides a significant benefit to everyone involved in the transaction. Consumers are accustomed to conducting transactions digitally, including financial ones. As such, many homebuyers, especially millennials and/ or first-time buyers, are going to enter into the mortgage process expecting a digital experience and may be disappointed if presented with a more manual, paper-driven transaction.

What Is A Settlement Agent?

How A Settlement Agent Works

- During the settlement of a trade in which actual securities and money are exchanged, settlement agents are responsible for settling the accounts of traders and making the process more efficient. This process can occur several days after the original transaction. In the financial markets, clearingis the process by which trades settle. Clearing is the reconciliation of orders between th…

Types of Settlement Agents

- For stock trades and other security transactions, a clearing firm or clearing house acts as a settlement agent. Stock exchanges have clearing houses that have a wide range of responsibilities to ensure the smooth settlement of trades. These responsibilities include collecting and maintaining margin funds, ensuring delivery of purchased securities, and reportin…

Special Considerations

- Settlement riskrefers to the risk that a buyer or seller fails to meet their obligations in the transaction. This frequently results in the failure of the transaction to successfully close or settle. In the securities market, there are two main types of settlement risk: default risk and settlement timing risk. Default risk is when one of the parties completely fails to deliver on their obligations…