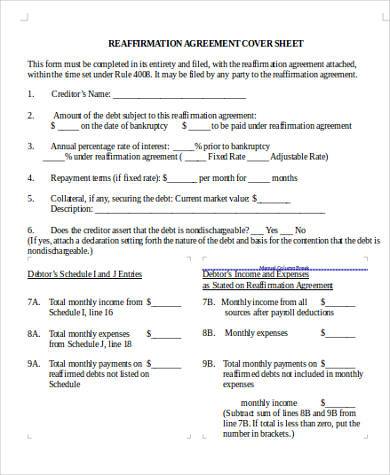

A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line. Source: (American Land and Title Association)

Full Answer

What is a settlement statement on a balance sheet?

Like your typical budget balancing sheet, the settlement statement is organized into Debits (expenses) and Credits (deposits or increases) to the account. Other forms might have columns labeled as “Seller Charge” and “Seller Credit,” which mean the same thing.

What does A HUD-1 Settlement Statement look like?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

Is a settlement statement the same as closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

What are the different types of settlement statements for a mortgage?

In mortgage lending, there are two main types of settlement statements a borrower may encounter: closing disclosures and HUD-1 settlement statements. A mortgage closing disclosure is a type of standard settlement statement that is formulated and regulated for the mortgage lending market.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What is the most commonly used form for settlement statements?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is the primary purpose of the settlement statement?

A The primary purpose of the settlement statement is to set forth all of the financial details of closing, showing each party's costs and credits.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

Who prepares the closing statement?

Typically, closing agents are real estate attorneys, title companies or escrow officers. Unlike the HUD-1, which closing agents generally provided to buyers and sellers on the day of a real estate closing, closing statements must be issued at least three business days before closing.

Which two items will appear on a closing disclosure?

Credits and debits appear on the closing statement.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

Are HUD-1 settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What is a settlement statement quizlet?

HUD-1 Settlement Statement itemizes: All charges imposed upon the borrower and the seller by the loan originator.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

When should I receive the HUD-1 Settlement Statement?

In contrast, lenders must give you a closing disclosure at least three business days before closing. If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing.

What is a legal settlement statement?

Legal Settlement Statement Example. Once the Legal Settlement gets signed by both parties, it will take its form. Legal Settlements bear all the necessary details like date, place, lease amount, etc and filling the form is as easy as writing with a pen.

What is the difference between a lease agreement and a settlement statement?

But in reality, there is a big difference between the two. A lease agreement is a contract between two parties (the lessor and the lessee) about land and/or property for a specific period of time, whereas, a settlement statement templates as the name implies, settles the issue without much hassle.

What is vendor settlement?

A Vendor settlement phase occurs between the distributor and vendor. This Vendor Settlement Statement Example contains the details such as name and address of both parties, settlement amount and time. The example entails the details in an organized manner.

Why include confidentiality clauses in settlement agreements?

The purpose of including confidentiality clauses in settlement agreements is to keep both parties away from sharing the details with the World. This Confidential Settlement Statement Example is a well-drafted confidentiality agreement that can settles most potential litigation nightmares.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

How many pages are required for HUD-1?

The HUD-1 is a three-page form generally required to be provided to a borrower one day before closing. The mortgage closing disclosure is a five-page form generally required to be provided to a borrower three days before closing.

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is a HUD-1 settlement statement?

This five-page document combines the previous HUD-1 Settlement Statement, the Truth in Lending Act disclosures and the Good Faith Estimate. On its own, however, a settlement statement can be defined as a document which fully summarizes all fees that both a borrower and lender will be required to pay during the settlement of a loan.

What is page 4 on a loan?

Page 4 is exclusively for loan disclosures. It is here that you will learn how much a late payment will cost you, if the lender will accept a partial payment and whether or not you will have an escrow account. Should the lender not require an escrow account, page 4 will reveal if you are being charged an escrow waiver fee.

What is page 2 of closing costs?

Page 2 is dedicated to all the details associated with your closing costs. It is here that you'll want to examine origination charges, like application and underwriting fees, and service fees, such as appraisals and credit reports. There's also a section for other costs that include things like taxes and government fees, initial escrow payments due at closing and real estate commissions.

What is included in closing disclosure?

The first is for your loan calculations, which include the total number of payments you'll make over the life of the loan, your finance charges and your APR. Section two lists other disclosures, such as your appraisal and contract details. The third section contains contact details for the lender, the buyer's real estate agent, the seller's agent and the settlement agent. The final section is where you sign and date that you have received and reviewed the document.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is line 805 on credit report?

The amount would be shown, but it would not be included in the total fees you bring to settlement. Line 805 is used to record the cost of the credit report if it's not included in the origination fee.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long does a HELOC loan last?

This revolving product has a set draw period that usually ends after 10 years. After the draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

Does lending tree include all lenders?

LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Do you need to review a HUD-1 settlement statement before closing?

If you’re getting ready to close on a mortgage, you’ll typically review a closing disclosure. However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate or a reverse mortgage, you’ll need to review a HUD-1 settlement statement before you head to the closing table.

What are the two categories of closing statements?

We can simplify our approach by separating items in the closing statement into two categories: expenses and costs.

Is cash that ends up in the seller's hands considered boot?

Furthermore, any cash that ends up in the seller’s hands rather than going through a qualified intermediary will be considered boot. If you took money out to pay expenses that you did not document on your closing statement, you will be taxed on it.

Is a relinquished property taxable?

The exchange code stipulates that the net proceeds of the sale from the relinquished property will be taxable if not fully reinvested. As simple as this concept seems, varied costs could trigger some tax liability if processed incorrectly. For more-detailed information, you may click this link to the IRS Fact Sheet on Like-Kind Exchanges under IRS Code Section 1031.