Chargeback: A chargeback occurs when PayPal returns funds to a consumer. This approach is used when the consumer feels that PayPal will resolve their complaint better than their funding source, or when the PayPal payment was funded directly from the consumer's PayPal balance.

What is a PayPal chargeback?

The PayPal defines it as “ …when a customer files a chargeback with their credit card issuer, it means that they’re disputing a charge and asking the card issuer for a refund. ” Buyers can simply demand refunds for transactions and inform their credit card company to cancel/refund the payment.

What does it mean when someone files a chargeback on credit card?

When a customer files a chargeback with their credit card issuer, it means that they’re disputing a charge and asking the card issuer for a refund. A customer might file a chargeback because they: Didn’t receive their item. Received a damaged or defective item. Don’t recognize a credit card charge.

What happens if you dispute a PayPal chargeback?

Upon filing a dispute, the cardholder’s bank withdraws funds from your account, meaning you lose revenue, as well as merchandise. You’re also responsible for the PayPal chargeback fee, which covers the cost of administering the chargeback. Don’t panic, though: you still have some options.

What is a t1107 chargeback on PayPal?

Payment reversal, initiated by PayPal. Completion of a chargeback. T1107 Payment refund, initiated by merchant. T1108 Fee reversal. T1109 Fee refund. T1110 Hold for dispute investigation (T15nn). To cover possible chargeback.

See more

What happens when PayPal does a chargeback?

The chargeback specialist will then dispute the chargeback on your behalf and try to recover your funds from the buyer's credit card company. If the credit card company decides in your favor, the buyer will be charged for the transaction and you'll get the payment back.

What does chargeback settlement mean?

A chargeback is the payment amount that is returned to a debit or credit card, after a customer disputes the transaction or simply returns the purchased item. The chargeback process can be initiated by either the merchant or the cardholder's issuing bank.

What happens if you lose a chargeback PayPal?

As long as you are eligible for PayPal Seller Protection, PayPal will cover your loss even if you lose the chargeback. PayPal Seller Protection. While most buyers file claims and chargebacks for reasons they believe are legitimate, there are those who try to take advantage of the system.

Does chargeback mean refund?

What's the difference between chargebacks and refunds? Chargebacks are bank-initiated transaction reversals that withdraw funds deposited into your business's bank account and return them to the cardholder. Refunds are merchant-led, voluntary repayments to the customer.

What happens after a chargeback?

When a chargeback happens, the disputed funds are held from the business until the card issuer works things out and decides what to do. If the bank rules against you, those funds are returned to the cardholder. If the bank rules in your favor, they'll send the disputed funds back to you.

How many chargebacks are you allowed PayPal?

First, make sure that you read PayPal's privacy policy and stick with it. Also, make efforts to protect yourself from PayPal disputes ahead of time. For example, if you find that you are getting up to 10 chargebacks and PayPal disputes per month, you should get a PayPal Dispute Automation Service.

How do I fight a chargeback on PayPal?

How to Fight PayPal Chargeback FraudEnable Instant Payment Notifications. ... Try to Speak with the Buyer. ... Check if the order is covered by PayPal's Seller Protection Program. ... Provide Proof of Online Tracking. ... Prepare Proof of Delivery or Proof of Shipment. ... Respond to the Chargeback Notice within 10 Days.More items...

Will PayPal refund me if I get scammed?

You can also get refunded for unauthorized transactions made using your PayPal account as long as you report it within 180 days of the payment date. But if you sent money to a fraudster as part of a phishing scam or via PayPal's peer-to-peer payments system—you're likely out of luck.

Do customers always win chargebacks?

Chargebacks are easy to initiate and are often successful, but they don't cover all scenarios. Chargebacks are designed as a last resort; the first step should generally be to try to resolve the issue with the merchant directly.

How long does it take to get money back from a chargeback?

Depending on the reason code, issuing bank, and credit card network, the entire process usually takes around 30-90 days. Cases that go to arbitration will take longer.

What does chargeback mean on a check?

A return item chargeback is simply a fee for a check that has been rejected. Specifically, it's a fee charged by a bank to a customer who deposits a bad check. This fee is also sometimes called a deposited item returned fee.

How long does it take for a chargeback to be reversed?

How Long Does a Transaction Reversal Take? A transaction reversal takes 1-3 days, depending on the issuing bank.

What is a chargeback on PayPal?

Chargeback: A chargeback occurs when PayPal returns funds to a consumer. This approach is used when the consumer feels that PayPal will resolve their complaint better than their funding source, or when the PayPal payment was funded directly from the consumer's PayPal balance.

What is a chargeback on a credit card?

Chargeback: Buyer contacts their card issuer and requests a refund.

What is a dispute fee on PayPal?

PayPal charges a Dispute Fee to manage the dispute resolution process on transactions that were completed by a buyer with a PayPal account or a buyer using PayPal Checkout as a Guest. This Dispute Fee applies to such transactions both when the buyer files a claim directly with PayPal and when they file through a chargeback with their card issuer or a reversal with their bank. The Dispute Fee does not apply to transactions processed through PayPal Pro or Advanced credit and debit card processing, sometimes called “unbranded” transactions.

How long does it take to get a chargeback?

Once a chargeback has been filed, you’ll have 10 days to respond to it. The chargeback process could take 75 or more days to be resolved. Because the debit/credit card issuer determines this process, allowable time frames are determined by the credit card industry.

Why do we use reserve on PayPal?

Reserves are used to prevent transaction losses that may occur from payment reversals like chargebacks and claims filed by your buyers. Ordinarily, if you have a reserve on your account and receive a chargeback or dispute, we will deduct that amount from your available balance and not from any reserve balance. However, if a seller goes out of business or stops processing payments through PayPal, we will use any reserve to satisfy future payment reversals.

What happens when a buyer complains to PayPal?

At this point, PayPal becomes directly involved and will make a decision using the information that’s provided.

How long does it take to get a chargeback from a credit card company?

It typically takes 30 days for us to dispute the chargeback, and it may take your buyer's card company up to 75 days to resolve a chargeback and come to a final decision. To resolve a chargeback complaint, please follow the instructions listed below: 1. Go to the Resolution Center.

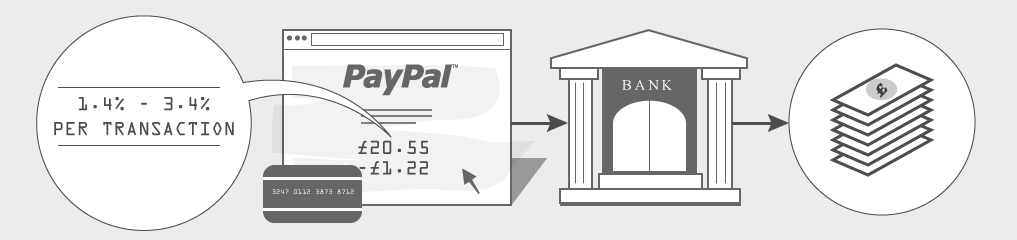

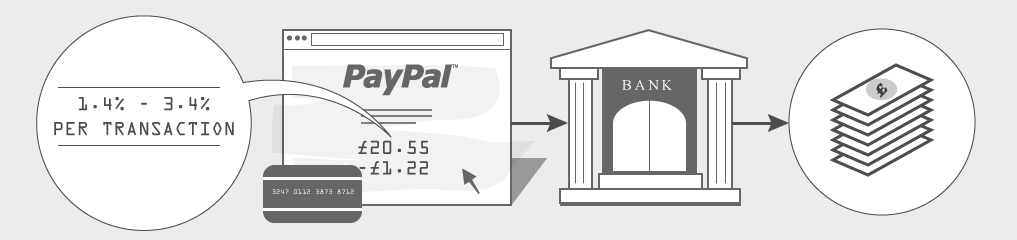

How does PayPal chargeback work?

How a PayPal Chargeback Works. Generally, when a buyer requests a chargeback, the service immediately contacts the buyer’s credit card issuer. PayPal does not hold any authority during the chargeback process though.

How long do you have to chargeback on PayPal?

When dealing with chargebacks, some points you need to remember: Buyers are eligible for chargebacks on PayPal transactions for 120 days or more after placing the order. Sellers who receive chargebacks have a 10 day time period to respond to the dispute.

how to get a refund on PayPal if scammed?

For a buyer, getting money from PayPal, after being scammed, process is very easy and can be done by reporting a dispute with PayPal using their dashboard. Decisions usually take 5 to 10 days and are mostly ruled in favor of the buyer. PayPal will return money to the buyer after an investigation.

Is PayPal safe for sellers on Craigslist?

Sending and receiving payments on PayPal are safe most of the time. Nonetheless, on these websites, there is higher for you to come across with a scammer who would promise to make payment via PayPal but does not follow through it. To identify the Craigslist scam here are some points PayPal mentioned for your guideline.

How to get money back from PayPal friends and family dispute?

There no guarantee of getting a refund from PayPal friends and family dispute. Because there is no buyer’s protection option available if you transfer money as a friend.

Can you get scammed by using PayPal?

You have to be sharp to identify forged email or any uncertain activity on PayPal account. PayPal usually reimbursed the payment if you could confirm about being scammed or hacked.

What happens to the Seller PayPal Dispute?

If that doesn’t happen, then the PayPal dispute resolution comes to resolve the issue and moves the dispute to claim.

What is chargeback in PayPal?

A chargeback is different from a PayPal claim. With a P2P transaction in which both parties are PayPal users, for example, the company can resolve the claim internally, without the need to involve the bank. In contrast, a chargeback occurs when a customer either is not a PayPal user, or chooses to bypass PayPal and go straight to the bank for help.

What happens when a customer files a chargeback on PayPal?

In contrast, a chargeback occurs when a customer either is not a PayPal user, or chooses to bypass PayPal and go straight to the bank for help. In that case, resolving the dispute easily is out of PayPal’s control. When the cardholder files a chargeback, you’ll lose the funds from your account, and be charged a PayPal chargeback fee ...

How much is PayPal chargeback?

The company deducts a nonrefundable PayPal chargeback fee directly from your account. The fee is currently set at $20 for transactions conducted using US Dollars. For transactions conducted using other currencies, refer to the table below:

What is PayPal Seller Protection?

This program is basically like “chargeback insurance,” covering the cost of chargebacks so sellers don’t have to pay.

What happens if you dispute a PayPal card?

Upon filing a dispute, the cardholder’s bank withdraws funds from your account, meaning you lose revenue, as well as merchandise. You’re also responsible for the PayPal chargeback fee, which covers the cost of administering the chargeback. Don’t panic, though: you still have some options. After PayPal notifies you of the chargeback, ...

Does PayPal cover chargebacks?

Even if a customer files a chargeback, though, some PayPal users still have one very valuable safeguard: PayPal Seller Protection. This program is basically like “ chargeback insurance ,” covering the cost of chargebacks so sellers don’t have to pay. The problem is, not all transactions are covered by Seller Protection.

Is PayPal a P2P payment?

Most people are familiar with PayPal as a P2P (person-to-person) payment s platform. The company pioneered the concept that’s now been taken up by newcomers like Venmo and Zelle. In turn, PayPal is now more widely-used as a simple, straightforward approach to accept payments for businesses .

How long does it take for a chargeback to be settled?

Focused on charges that have been fully processed and settled, chargebacks can often take several days for full settlement as they must be reversed through an electronic process involving multiple entities.

What Is a Chargeback?

A chargeback is a charge that is returned to a payment card after a customer successfully disputes an item on their account statement or transactions report. A chargeback may occur on debit cards (and the underlying bank account) or on credit cards. Chargebacks can be granted to a cardholder for a variety of reasons.

How does a chargeback work?

If a chargeback is initiated by the issuing bank, then the issuing bank facilitates the chargeback through communication on their processing network. The merchant bank then receives the signal and authorizes the funds' transfer with the confirmation of the merchant.

What is chargeback reversal?

Chargebacks can be granted to a cardholder for a variety of reasons. In the U.S. chargeback reversals for debit cards are governed by Regulation E of the Electronic Fund Transfer Act. Chargeback reversal for credit cards are governed by Regulation Z of the Truth in Lending Act.

What is chargeback initiated by a merchant?

For example, a chargeback initiated by a merchant would begin with a request sent to the merchant’s acquiring bank from the merchant.

Why are charges disputed?

Charges can be disputed for many reasons. A cardholder may have been charged by a merchant for items they never received, a merchant could have duplicated a charge by mistake, a technical issue may have caused a mistaken charge, or a cardholder’s card information may have been compromised.

What happens when you chargeback a company?

When customers realize that they've authorized a payment to a company whose name seems strange and unknown to them , they frequently end up requesting a chargeback. It happens even where the payment is made to a legitimate merchant account. The primary solution is to make all charges straightforward and use a name which is pretty much familiar to my potential customers.

How Do You Request a Chargeback?

If you don’t get any luck with that avenue, you can request a chargeback with the issuer of your credit card. The bottom line is that many card issuers will allow you to dispute card transactions in a variety of ways.

How long does it take to get a chargeback from a credit card company?

Once you submit the chargeback request, remember that it can take up to 90 days for you to get any response about the credit card transactions. Some companies are better at dealing with customer contacts than others. If you’re worried about a fraudulent transaction, your first port of call should be your credit card company, the bank you’re using, or the police.

What is chargeback advertising?

Advertisment ⓘ. A Chargeback, in ordinary terms, means a reversal. It's more of a buyer protection measure. The customer gets their money back. Take for instance, if the products they receive are faulty, a chargeback is always the feasible remedy. In usual circumstances, this is the last thing a merchant wants to come across.

Why are chargebacks and refunds similar?

The reason for their parallelism is because both involve money which comes from the merchant, back to the buyer. Both processes revolve around a buyer's product guarantee. Basically, a bank doesn't meddle in refund issues. Arguably, a chargeback is a far much worse experience if we compare it to a refund. And the merchants can very well attest to this.

Why does a customer want a chargeback?

Sometimes, it happens that a customer wants a chargeback since it quickens the results over a refund.

Why do businesses charge back customers?

Also, customers are prone to credit card theft. If their information gets stolen and is used fraudulently to purchase goods, then this highly attracts a chargeback claim. And this is where a Chargeback comes to enforce customer protection rights. Unfortunately, this isn't quite impressive for any business owner. And the reason is pretty obvious. It's all at my expense as a seller.

What is chargeback fee?

So, what is a chargeback fee? Simply put, it’s the fee charged by acquiring banks to cover the administrative expenses incurred when processing the chargeback. A credit card chargeback fee occurs when a cardholder (customer) disputes a previous credit card charge, and wants to nullify the sales transaction.

How much do chargeback fees cost?

Generally speaking, chargeback fees range from $15 to $50. High-risk merchants will pay considerably more than that.

What happens if your business has a high chargeback ratio?

Note: If your business falls into the “high chargeback ratio” group, your chargeback fee will be considerably higher. And, if you’re placed into a monitoring program, you’ll also incur that service fee.

What happens if you get hit with chargebacks?

If you’re hit with numerous chargebacks, your chargeback fees will keep going up. At some point, your acquiring bank will likely designate your business as a “high chargeback ratio” client. This means you have a chargebacks-to-transactions ratio of one percent or greater, and you’ll incur extra fees for each subsequent chargeback.

Why does my bank chargeback my card?

First, the card-issuing bank just dipped into their funds, and returned the customer’s purchase amount back to their card. The bank wants to recoup that cash outlay, so they’ll retrieve the funds from your account .

What to do if you know the chargeback is your fault?

Finally, if you know the chargeback is your fault, admit your mistake and let the chargeback stand. Although you’ll take a financial hit, you’ll maintain your honest reputation in the marketplace.

What happens if your chargeback ratio keeps climbing?

If your chargeback ratio keeps climbing, your acquiring bank will probably place your business into a chargeback monitoring program, which carries its own service fee. In extreme cases, your bank may even terminate your merchant account. In a worst-case scenario, all your potential acquiring banks will blacklist your business, and you won’t be able to accept credit cards, period.