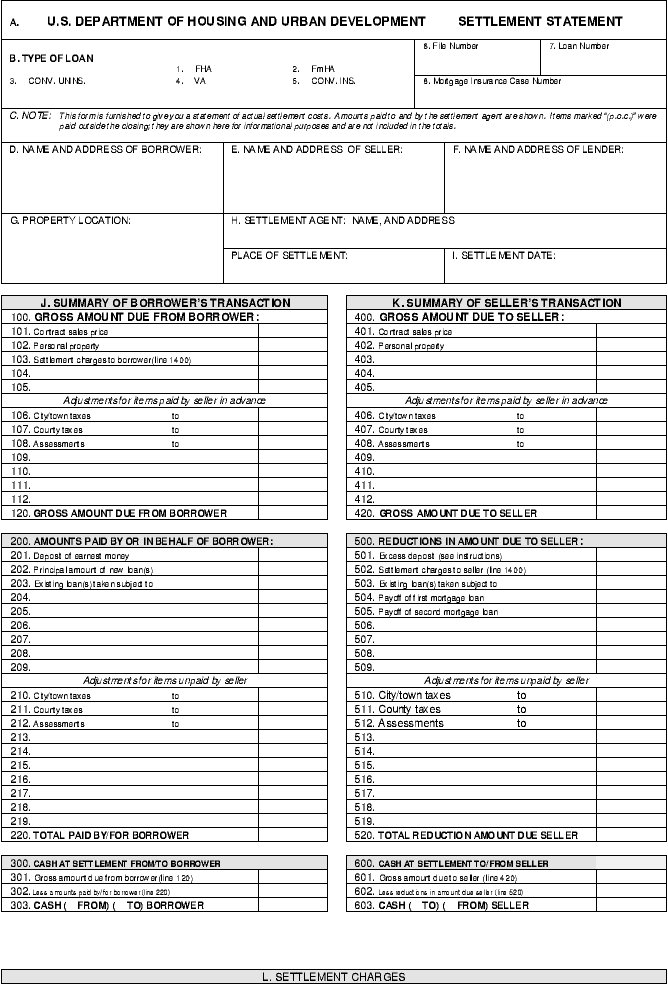

What does a HUD-1 look like? The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller. The breakdown of the pages is as follows: Page One

Full Answer

What details are included in A HUD-1 Settlement Statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement, details every charge associated with your new loan . It also outlines who is responsible for each of those charges - the buyer or the seller - as well as any credits you may receive for things like taxes, insurance or deposits.

How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

What does a HUD statement look like?

What does a HUD-1 look like? The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller. The breakdown of the pages is as follows: Page One

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Is a HUD statement the same as a settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What replaced the HUD settlement statement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Is the HUD-1 Settlement Statement the same as the closing disclosure?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table.

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What is the HUD statement called now?

If you applied for a mortgage after October 3, 2015, for most kinds of mortgage loans you receive a form called the Closing Disclosure instead of a HUD-1.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Who prepares the HUD settlement statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

Where can I find my HUD-1?

HUD-1 Forms | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

When did the CD replace the HUD?

Oct. 3, 2015The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Is a closing disclosure the same as a settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What is the difference between a HUD statement closing disclosure and combined Alta statement?

Unlike the Closing Disclosure that is meant to show the closing costs exclusively to the borrower (buyer), the ALTA statement is like a receipt given to agents and brokers on both sides of the transaction.

What is the difference between a closing statement and a closing disclosure?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How long does a HELOC loan last?

This revolving product has a set draw period that usually ends after 10 years. After the draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a government form that was used widely before 2015 when buying, selling, and refinancing real estate. It lists all the charges and credits to the buyer and seller in a real estate settlement or a mortgage refinance. You will also hear people refer to it as a settlement or closing statement.

What does a HUD-1 look like?

The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller.

What is page 3 of HUD?

Page 3 relates to the figure in the Good Faith Estimate (GFE) which has been replaced by the Loan Estimate. The lender would have supplied GFE estimate figure to the settlement agent upon application of the loan. The HUD figures are listed side by side with the GFE so that a comparison can be made and discrepancies highlighted. The standard loan terms shown here will include the origination fee, interest rate, term, and payment.

Can you search for unlisted properties on Marketproof?

With Marketproof New Development, you can easily search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites. Create an account today and get a 7-day free trial.

What is a HUD-1 statement?

When you refinance or purchase a home, one of the first things that your lender is going to provide you with is a HUD-1 Settlement Statement. This particular statement contains all the fees and costs that incurred with the financing of your home. In order to ensure that it is 100% accurate, it is important for both the seller and buyer to fully comprehend this document and to review it as it contains a handful of details that are important for both parties. The Real Estate Settlement Procedures Act (RESPA) requires that the HUD-1 statement is utilized in every federally regulated mortgage loan.

How many sections are there in HUD-1?

The HUD-1 Settlement Statement form contains twelve main sections, and a lot more subsections. You will notice that some sections on the form are specifically referred to the borrower’s costs and fees. Other sections on the form refer to the seller that’s in the transaction. One day prior to the closing, every party to the transaction is required to attain a copy of the HUD-1 Settlement Statement form. However, in a lot of cases, the form’s entries are still changing a couple of hours before the closing is conducted. A title agent, lender, or real estate professional can answer any question you may have that regard to the HUD-1 Settlement Statement form.

What is section L on HUD?

This section on the HUD-1 Settlement Statements details information on loan fees, costs that were paid to real estate professionals, items paid in advance such as homeowners insurance and interests, and several required escrow items. You will notice that additional subsections detail items such as home warranties, survey, home inspections, deed fees, and title fees. Section L subsections are 1400-Total Settlement Charges, 1300-Additional Settlement Charges, 1200-Government Recording and Transfer Charges, 1100-Title Charges, 1000-Reserves Deposited with Lender, 900-Items Required by Lender to be Paid in Advance, 700-Total Sales/Broker’s Commission on Price, and 800-Items Payable in Connection with Loan. Before signing any closing document, make sure to carefully review each of these items in this section. In order to make sure that you understood all the charges stated in this section, prior to closing, ask any questions. If you stop and think about it, it is better to prevent than lament.

Who is responsible for reviewing HUD-1?

Buyers and sellers are the ones who are responsible for reviewing their HUD-1 Settlement Statement form in order to ensure that it is accurate. Before the end of closing, every error found must be corrected. Until every question that relates to the HUD-1 Settlement Statement has been satisfactorily answered, no seller or buyer is obligated to complete a closing. Alongside his or her loan officer, the HUD-1 needs to be especially reviewed by the buyer before the closing of a home purchase or mortgage loan. Comparing the mortgage loan documents to the HUD-1 Settlement Statement will prevent the buyer from obligation to loan terms that are incorrect.

What is section J in a mortgage?

This section contains details on the buyer’s amounts paid, amount due, and amount of cash that the borrower gets or pays at closing. The subsections in section J are 300-Cash at Settlement To/From Borrower, 200-Amounts Paid or in Behalf of Borrower, and 100-Gross Amount Due from Borrower. In order to determine what exactly the borrower will need to take or pay home from closing, it is important that this section is carefully reviewed.

What is the HUD-1 statement?

Using the HUD-1 statement to reconcile what your mortgage loan broker promised on your Good Faith Estimate will give you an accurate picture of your loans actual fees and closing costs. Here are tips to help you make sense of this important mortgage document.

How to find broker rebate on HUD?

Once you have the HUD-1 statement from your lender you’ll find that it closely resembles the Good Faith Estimate you received. If Yield Spread Premium you will find it around lines 810 or 811. If these lines are blank you’ll have no broker rebate…that’s exactly what you want to find on the HUD-1 statement. If you find a “Broker Rebate” with a number next to it you’ve got Yield Spread Premium, and yes that large number is in dollars. This is your mortgage broker’s cash compensation for overcharging you. In most cases this is being paid in addition to the origination fee you’re already paying for the broker’s services (and are probably overpaying).

How to find yield spread premium?

The first opportunity you’ll have during the mortgage process to spot the infamous broker rebate is on your wholesale lender’s rate lock confirmation. Once you’ve agreed to lock in your mortgage rate if you’re dealing with an honest mortgage broker you will receive written confirmation FROM THE LENDER. Shady mortgage brokers will try and pass off written confirmation typed up on their own letterhead. If you get rate lock confirmation like this from your mortgage company or broker, you have not locked in your mortgage rate. Unless you have written confirmation FROM THE LENDER you could be a victim of a bait-and-switch scam when the loan you were promised falls through because your mortgage broker did not properly lock in your mortgage rate.

What is a POC on HUD?

The broker rebate or Yield Spread Premium is frequently referred to as POC charges, meaning Paid Outside of Closing. This is simply legal speak for Yield Spread Premium…don’t be fooled.

What is a good faith estimate?

Your Good Faith Estimate is just an estimate. The law requires that your get this document after submitting your application; however, it does not require that it accurately reflect the fees associated with any mortgage offer. After all the Good Faith Estimate is only an estimate and mortgage brokers frequently low ball closing costs and leave their markup of your lowest mortgage rate off this document completely.

Why do homeowners get ripped off on their first mortgage?

Most homeowners get ripped off on their first few mortgages because they just don’t know better. You can prevent your mortgage broker and lender from ripping you off and save thousands of dollars per year on your next mortgage by doing your homework and learning how to negotiate for wholesale mortgage rates.

Do you have to get a copy of the HUD-1 settlement statement before closing?

You should always request this document prior to closing and should be provided a copy 24 hours before closing on your new mortgage.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What are the two categories of closing statements?

We can simplify our approach by separating items in the closing statement into two categories: expenses and costs.

What is the 200% identification rule?

Understanding the details of a closing statement is essential to completing a successful 1031 exchange when using the 200% identification rule because the 200% rule involves a number of important numerical limits ...

Is cash that ends up in the seller's hands considered boot?

Furthermore, any cash that ends up in the seller’s hands rather than going through a qualified intermediary will be considered boot. If you took money out to pay expenses that you did not document on your closing statement, you will be taxed on it.

Is a relinquished property taxable?

The exchange code stipulates that the net proceeds of the sale from the relinquished property will be taxable if not fully reinvested. As simple as this concept seems, varied costs could trigger some tax liability if processed incorrectly. For more-detailed information, you may click this link to the IRS Fact Sheet on Like-Kind Exchanges under IRS Code Section 1031.