What does POC borrower mean on a settlement statement?

When POC is listed on the Settlement Statement, the letters are often followed by the words Borrower, Seller, Broker, or Lender. This refers to who paid the fee. For example, if the borrower paid for the appraisal before the closing, the fee would be marked as "POC Borrower" on the Settlement Statement.

What does POC stand for in real estate?

Here's the answer: POC stands for Paid Outside of Closing, and refers to any fee that is not being disbursed at the closing. The two most common POC charges are the appraisal fee (if it has been paid by the borrower before the closing) and the yield spread premium (the rebate that the lender pays the mortgage broker).

Who prepares the settlement statement when closing?

Depending on what state you’re in, the settlement statement, a separate document, will be prepared by either an attorney, a title company, or an escrow firm, and the actual closing will be held at the offices of one of these three locations.

Is a settlement statement the same as closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

What does POC mean in a closing statement?

Paid outside closing (POC) is the fees or payments rendered outside of normal title insurance and underwriting fees due at the time of closing a loan.

What is a POC item?

A proof of concept (POC) is a demonstration of a product, service or solution in a sales context. A POC should demonstrate that the product or concept will fulfill customer requirements while also providing a compelling business case for adoption.

Where may Items listed as POC paid outside closing appear on the HUD-1?

Charges that are paid outside of closing by any party must be included on the HUD, but they must be marked “P.O.C” and should not be included in the totals. P.O.C. items should be disclosed outside of the columns.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is the full form of POC?

What is the full form of POC? The full form of the POC is Proof of Concept.

How long should a POC take?

Run your POC project From the point of configuring the project solution to concluding the POC pilot, a reasonable POC timeline should not exceed three months. During this time, it's critical to note any challenges and/or problems that came up during the project and to identify the solutions to these problems.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What are some of the transactions recorded on the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Which of the following fees Cannot increase at settlement?

Charges That Cannot Increase: The origination charge, credit charge, adjusted origination charges, and transfer taxes have a zero tolerance.

What happens at settlement for the seller?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

Is settlement date same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What is total reduction amount due seller?

Section 500, Reductions in Amount Due to Seller Line 501 is used when the seller's real estate broker or another party holds the borrower's earnest money deposit and will pay it directly to the seller.

What is POC in a project?

A proof of concept (POC) is an exercise in which work is focused on determining whether an idea can be turned into a reality. A proof of concept is meant to determine the feasibility of the idea or to verify that the idea will function as envisioned.

What is a POC in technology?

A proof of concept (POC) is how startups demonstrate to a corporation that their technology is financially viable. The startup essentially creates a prototype in a sandbox-environment to prove their technology is capable of handling real-world applications.

What does a proof of concept look like?

A POC typically involves a small-scale visualization exercise to verify the potential real-life application of an idea. It's not yet about delivering that concept, but showing its feasibility.

What does POC stand for in software?

A POC (proof of concept) is an advanced demo project that reflects a real-world scenario. Since developing products from emerging technologies can be too risky or troublesome, POCs are often used to “prove” that a new technology, service, or idea is viable for the market.

What is POC in mortgage?

Paid Outside of Closing. POC stands for Paid Outside of Closing, and refers to any fee that is not being disbursed at the closing. The two most common POC charges are the appraisal fee (if it has been paid by the borrower before the closing) and the yield spread premium (the rebate that the lender pays the mortgage broker).

Why are POC fees listed on the mortgage settlement statement?

POC fees are listed on the Settlement Statement because the Real Estate Settlement Procedures Act (RESPA) states that all fees associated with a federally regulated mortgage must be shown on the Settlement Statement, regardless of whether they have already been paid or not.

Why is POC not included in settlement statement?

If a fee is marked as POC, it is not included in the bottom line on the settlement statement because someone has already paid it (in the case of a paid appraisal) or the borrower does not owe it (in the case of a yield spread premium).

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How long does a HELOC loan last?

This revolving product has a set draw period that usually ends after 10 years. After the draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

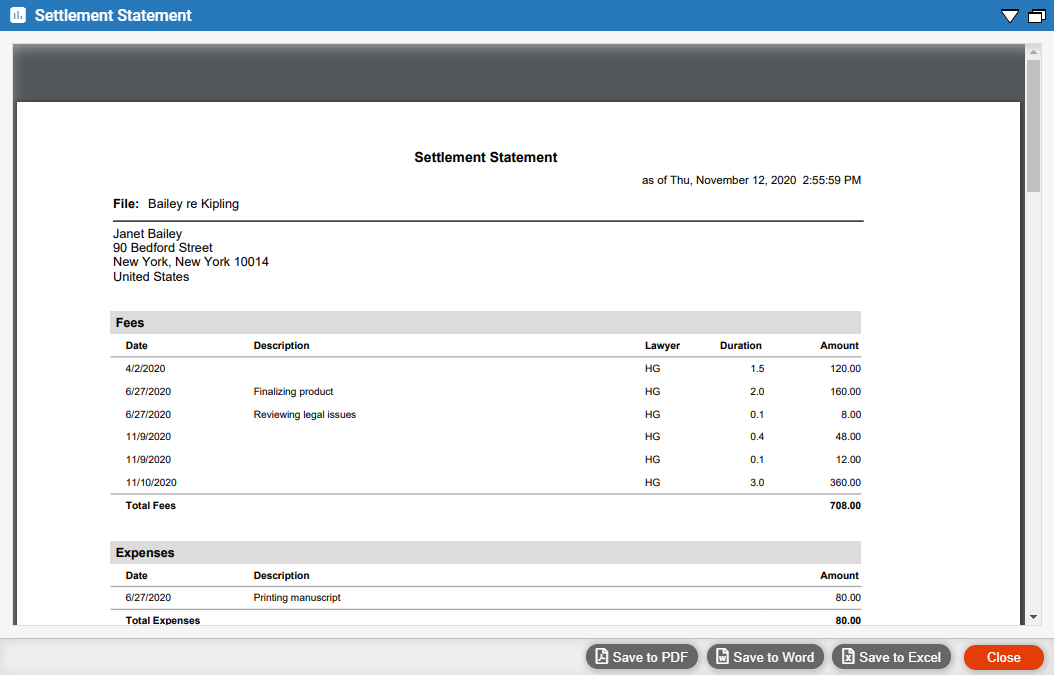

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

What can I expect to see on my settlement statement?

Several items are listed and organized within a settlement statement, including:

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, “it’s safe to say that you are at the tail end of the process,” Moreira says. It’s crucial to review this document carefully to ensure all costs are accurate.

What is HUD-1 Settlement Statement?

The Settlement Statement, or HUD-1, reflects all of the costs associated with a purchase or refinance. Below are explanations of certain key lines. For further clarification, feel free to call us.

What is VA loan origination fee?

801. Loan Origination Fee- This fee, a percentage of the amount of the new loan, compensates the lender for the expense of processing the loan. VA loans require that the veteran buyer pay no more than 1% of the loan amount. On other loans the buyer may pay more than 1% provided the lender approves such payment.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

What is a mortgage payoff?

Mortgage Payoff. The payoff amount is sent to the existing mortgage company and includes additional interest a few days beyond closing. Title Insurance (Owner’s Policy) Typically paid for by the seller, however the contract gives the option for either buyer or seller to pay.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

When are prior year taxes due?

Prior year taxes are not due and payable until the next calendar year. Amounts due for any prior year taxes will be collected from the seller. Typically, any closings after June 15th should already have their taxes for the prior year paid.