Pending Settlement means the agreement between the Company and its shippers in the Company’s FERC tariff rate case filed on July 1, 2013 (Docket Number RP13-1031), which agreement has received certification from the presiding administrative law judge and is awaiting final approval from the FERC. Sample 1 Sample 2 Based on 2 documents

Full Answer

What is a DC settlement?

A DC Settlement is the Debit/Credit settlement. Here’s how a signature (not PIN-based) debit or credit card transaction actually works under the covers; it’s a two step process: Step 1: You (or the merchant) swipes the card in a card reader. The card reader connects to the acquirer; this is the credit card processing company.

What does it mean when a settlement is pending?

Pending Settlement definition Pending Settlement means the agreement between the Company and its shippers in the Company’s FERC tariff rate case filed on July 1, 2013 (Docket Number RP13-1031), which agreement has received certification from the presiding administrative law judge and is awaiting final approval from the FERC. Sample 1 Sample 2

What is a pending capture status?

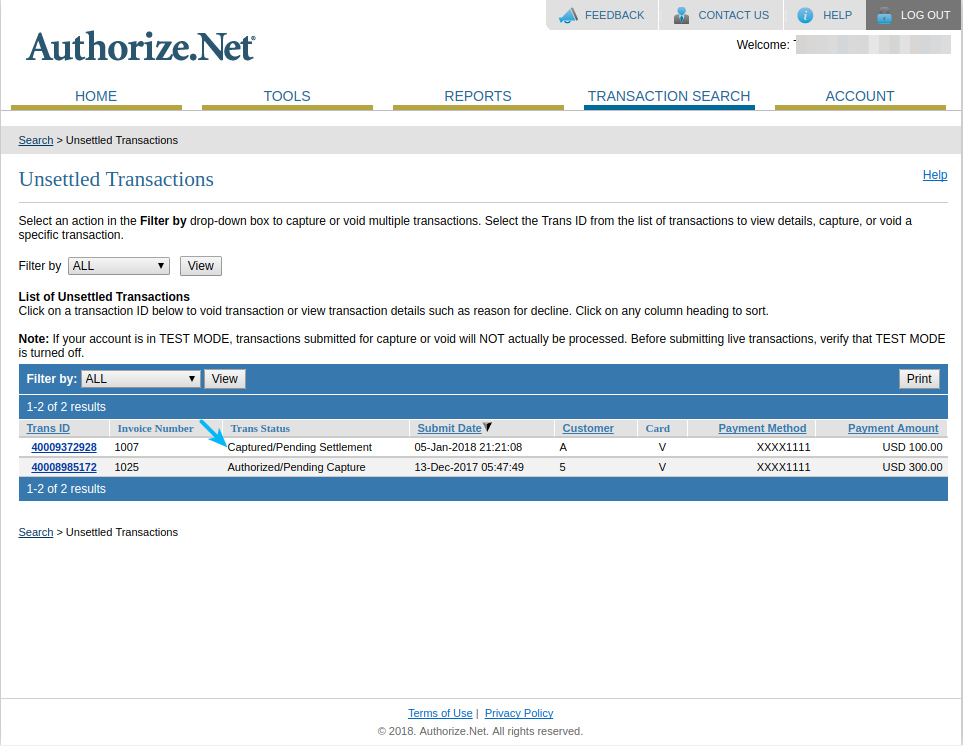

Authorized/Pending Capture – Transactions with this status have been authorized by the processor but will not be sent for settlement until a capture is performed. - If the transaction is pending thats mean is the transaction was success (not declined) and that will move to Settled Successfully?

When a contingent deal advances to a pending state?

If all goes well, contingent deals will advance to a pending state. What does pending mean in real estate? When a property is marked as pending, an offer has been accepted by the seller and all contingencies have been satisfactorily addressed or waived.

What does D C settlement mean on my bank statement?

D/C Settlement: This is usually where the exact amount is put under. This is almost always the amount we take from the account. So if it is classified as D/C Settlement, it's usually past the Preauth point and this is where we get the currency, and the transaction is closed.

What does D C mean in a bank transaction?

The Documentary Credit (DC) (Letter of Credit, LC), is commonly used for settling international trade. It offers a payment and financing method and is a practical tool for risk management that also can give your company a competitive edge.

What does amount in DC mean?

In this case the system uses the following formulas: Open Amount in Document Currency. Invoice amount in document currency (DC)

What does DC payment mean?

Delayed contribution payment means an amount paid by an employee for purchase of current service.

Whats does DC mean?

direct currentDC (direct current) is the unidirectional flow or movement of electric charge carriers (which are usually electrons). The intensity of the current can vary with time, but the general direction of movement stays the same at all times.

What is CC and DC in banking?

when you use a debit card, you use your own money so you make a purchase and the money is deducted from your account on the spot. when you use a credit card, you use the bank's money so you make a purchase and you pay for it in the future.

What is DC track?

A D.C. track circuit has two ends i.e. feed end and relay end. Both the ends are insulated by a Nylon joint or glued joint. ♦ Feed end is connected to power source and. relay end is connected to track relay. Track.

How long does a direct credit transfer take?

three working daysUsually, a Bacs payment takes three working days to go through. This applies both to Direct Debits and Direct Credits.

How long does a direct credit take?

A direct credit is an electronic transfer of funds through the ACH (Automated Clearing House) system. The payment is initiated by the payer, which sends funds directly into the bank account of the payee. Settlement usually occurs within one or two business days.

What is a debit card settlement adjustment?

Authorization adjustment, also known as auth adjustment, allows eligible merchants to adjust the authorized amount of a transaction immediately before settlement for Visa transactions. Common use cases for authorization adjustments are tipping and order add-ons.

What is DC track?

A D.C. track circuit has two ends i.e. feed end and relay end. Both the ends are insulated by a Nylon joint or glued joint. ♦ Feed end is connected to power source and. relay end is connected to track relay. Track.

What is DC charges in Bank of Baroda?

Bank of Baroda deposit & withdrawal Charges: Savings bank (SB) account holders of Bank of Baroda will be charged Rs 40-50 per transaction for depositing money beyond three free deposits in a month and Rs 100-125 post three free withdrawals.

What is a debit card recovery charge?

A debit card chargeback is a debit card charge that has been reversed by a bank. This often happens after a cardholder contacts their bank to dispute a transaction, claiming that it resulted from fraud or abuse.

What is credit card preauthorization?

Credit/Debit Card Pre-Authorization is a feature commonly used in high-volume bars and nightclubs. This feature allows bartenders and waitstaff to swipe a card on a customer's order, save that information as their bar tab, and verify the validity of the customer's bank account while also checking for funds.

What does debit and credit mean?

Debit and Credit simply mean ‘left’ and ‘right’ .

How does credit affect assets?

A Credit decreases an Asset Account, Increases a Liability Account and increases a Revenue account.

How long does a hold on a credit card last?

Holds eventually expire on their own, if no batch settlement happens, but at the top end, you are talking maybe 8 days for a debit card hold, and 30 days for a credit card hold, so it can take a while — during which you may believe you have more money than you actually do.

What is DC settlement?

A DC Settlement is the Debit/Credit settlement . Here’s how a signature (not PIN-based) debit or credit card transaction actually works under the covers; it’s a two step process: Step 1: You (or the merchant) swipes the card in a card reader. The card reader connects to the acquirer; this is the credit card processing company.

What is double hold gas?

Another place a double hold typically happens is gas stations ; gas pumps tend to authorize and hold a set amount, like $75 or $100, up front. This protects them in case you try to game the pump in multiple locations before the transactions on all of them finalize (you get the gas at all locations, but only one location actually gets paid).

Where is the DR on a bank statement?

The letter DR (should really be dr.) indicate a debit entry, and should be shown in figures on the left hand coloumn of your accounting sheet, whether that be balance sheet, profit & Loss account of bank statement.

How many people use Wise?

Get the world's most international account. Join 10 million people using Wise.

What is pending settlement?

Pending Settlement means the agreement between the Company and its shippers in the Company’s FERC tariff rate case filed on July 1, 2013 (Docket Number RP13-1031) , which agreement has received certification from the presiding administrative law judge and is awaiting final approval from the FERC.

How long does it take for a pending settlement to be redetermined?

In the event the Pending Settlement, as presented to the presiding administrative law judge, is rejected or modified by the FERC, the parties agree to work together in good faith to redetermine the Cash Amount (the “Redetermined Cash Amount”) within thirty (30) days following final resolution of the Company’s rate case, whether by a settlement approved by the FERC or otherwise (the “Final Resolution”).

What is redemption rescission?

Redemption Rescission Event means the occurrence of (a) any general suspension of trading in, or limitation on prices for, securities on the principal national securities exchange on which shares of Common Stock or Marketable Securities are registered and listed for trading (or, if shares of Common Stock or Marketable Securities are not registered and listed for trading on any such exchange, in the over-the-counter market) for more than six-and-one-half (6-1/2) consecutive trading hours, (b) any decline in either the Dow Jones Industrial Average or the S&P 500 Index (or any successor index published by Dow Jones & Company, Inc. or S&P) by either (i) an amount in excess of 10%, measured from the close of business on any Trading Day to the close of business on the next succeeding Trading Day during the period commencing on the Trading Day preceding the day notice of any redemption of Securities is given (or, if such notice is given after the close of business on a Trading Day, commencing on such Trading Day) and ending at the time and date fixed for redemption in such notice or (ii) an amount in excess of 15% (or if the time and date fixed for redemption is more than 15 days following the date on which such notice of redemption is given, 20%), measured from the close of business on the Trading Day preceding the day notice of such redemption is given (or, if such notice is given after the close of business on a Trading Day, from such Trading Day) to the close of business on any Trading Day at or prior to the time and date fixed for redemption, (c) a declaration of a banking moratorium or any suspension of payments in respect of banks by Federal or state authorities in the United States or (d) the occurrence of an act of terrorism or commencement of a war or armed hostilities or other national or international calamity directly or indirectly involving the United States which in the reasonable judgment of the Company could have a material adverse effect on the market for the Common Stock or Marketable Securities.

What is structured settlement payment rights?

Structured settlement payment rights means rights to receive periodic payments under a structured settlement , whether from the structured settlement obligor or the annuity issuer, where:

What is standard settlement period?

Standard Settlement Period means the standard settlement period, expressed in a number of Trading Days, on the Company’s primary Trading Market with respect to the Common Stock as in effect on the date of delivery of a certificate representing Warrant Shares issued with a restrictive legend.

What is default settlement method?

Default Settlement Method means Combination Settlement with a Specified Dollar Amount of $1,000 per $1,000 principal amount of Notes; provided, however, that the Company may, from time to time, change the Default Settlement Method by sending notice of the new Default Settlement Method to the Holders, the Trustee and the Conversion Agent.

What is net settlement amount?

Net Settlement Amount means the Gross Settlement Amount minus: (a) all Attorneys’ Fees and Costs paid to Class Counsel; (b) all Class Representatives’ Compensation as authorized by the Court; (c) all Administrative Expenses; and

What is pending settlement receivable?

Pending Settlement Receivable means, as of any Business Day, the net payment obligation of any counterparty to the Fund under (a) any executed sale, assignment, novation or other similar transaction in relation to any Investment or any Other Investment Position or (b) any Investment or Other Investment Position that that has been terminated or which otherwise ceases to be an Investment or Other Investment Position, in each case, which has not settled as of such Business Day.

What is Scheduled Settlement Date?

Scheduled Settlement Date means a date on which a payment or delivery is to be made under Section 2 (a) (i) with respect to a Transaction.

What is structured settlement payment rights?

Structured settlement payment rights means rights to receive periodic payments under a structured settlement , whether from the structured settlement obligor or the annuity issuer, where:

What is daily settlement price?

Daily Settlement Price means the settlement price for a Swap calculated each Business Day by or on behalf of BSEF. The Daily Settlement Price can be expressed in currency, spread, yield or any other appropriate measure commonly used in swap markets.

How long is a delinquent receivable?

Delinquent Receivable means a Receivable as to which any payment, or part thereof, remains unpaid for 61 days or more from the original due date for such payment.

What is NSCCL trading?

A clearing corporation . The National Securities Clearing Corporation Ltd (NSCCL) is the clearinghouse for trades done on the National Stock Exchange (NSE ) & takes care of the se

Why do day traders have margin accounts?

In short, it's because day traders have a different type of brokerage account than most other investors. To day trade, which would involve you buying and selling stock with unsettled funds (in other words, in a shorter time frame than T+3 for US equities), you must apply and be approved for a margin account.

What is a buy in auction?

announce a buy-in auction, where it would buy the securities due for delivery and deliver the same to the counter party of the defaulting member. This will be done via auction and the member’s account will be debited for the auction payment.

How long does it take to settle a stock trade?

This means that the stock trade must settlewithin three business days after the stocktrade was executed. If you sell stock, the money for the shares should be in your brokerage firm on the third business day afterthe trade date.

How long do you have to sell shares to avoid penalty?

I will recommend you to sell shares only after T2 days. If you try selling your shares before this time, you can face penalty for selling blank shares. In penalty, you will be charged 20 percent of selling price/share besides deducting money which you got after selling your shares.

How long do you have to wait to buy SPY?

But if you wait 31 days to buy SPY---or you immediately replaced SPY with another Large Cap fund with different holdings--the IRS will accept the tax-loss as the product of a bonafide investment decision.

What is clearing corporation?

The clearing corporation acts as the counter party for all trades and settles them without default. To provide such a guarantee, the clearing corporation collects margins from members. These margins comprise of both initial margins (for capital adequacy) and markto-market margins that vary based on the marked-to-market open position of a member.

Can you make an offer on a contingent or pending home?

If you’ve fallen in love with a home that is contingent or pending, you should get in touch with a Redfin real estate agent right away to explore your options for making an offer.

What does contingent mean in real estate?

When a property is marked as contingent , an offer has been accepted by the seller. Contingent deals are still active listings because they are liable to fall out of contract if requested provisions are not met. If all goes well, contingent deals will advance to a pending state.

How often do contingent offers fall through?

While it’s hard to track how many contingent or pending offers fall through each year, research shows that around 4 percent of overall home sales fail. Meaning that the vast majority of sales do close, but deals can fall apart for many different reasons.

What are the contingencies when buying a house?

Some of the more common contingencies when buying a house include: Financial Contingency: If a buyer cannot get the home loan or mortgage they anticipated, the seller can opt-out. Appraisal Contingency: If an appraisal reveals that the home is worth less than the offer, the buyer can request a lower price or opt-out.

What is an active kick out?

Active - Kick Out: If the buyer cannot sell their current home in time to pay, the seller can opt-out.

How to avoid putting in offers on pending homes?

One easy way to do this is to search for homes on Redfin, and then save the search so that you receive email updates when homes that match your criteria hit the market. If you really want to snag a home that’s listed as contingent or pending, you’ll need a well-informed strategy.

What is accepted offer?

The accepted offer is a short sale and must be approved by additional lenders or banks outside of the buyer or seller’s control, which may take a long period of time to process.

Why is the Court approving the settlement notice?

The Court authorized the Notice because Class Members have a right to know about the proposed Settlement of certain claims against Settling Defendants in this class action lawsuit and about Class Members' options before the Court decides whether to approve the Settlement. If the Court approves the Settlement, and after objections ...

What is a class action lawsuit?

In a class action lawsuit, one or more people or businesses called class representatives sue on behalf of others who have similar claims. All of the people or businesses who have similar claims together are a “class” or “class members” if the class is certified by the Court. Individual class members do not have to file a lawsuit to participate in ...

How many members of large, geographically dispersed, self-funded national Employers are eligible for the second blue?

The Second Blue Bid provision of the Settlement Agreement was designed to enable 33 million Members of large, geographically dispersed, self-funded national Employers to have the opportunity to receive a Second Blue Bid.

Can you sue a settlement defendant?

This means that you cannot sue, continue to sue, or be part of any other lawsuit against Settling Defendants that makes claims based on the facts and legal theories involved in this case or any of the business practices the Settling Defendants adopt pursuant to the Settlement Agreement.

Did the court decide in favor of the plaintiffs or settlement defendants?

The Court did not decide in favor of the Plaintiffs or Settling Defendants. Instead, both sides have agreed to the Settlement. Both sides want to avoid the risk and cost of further litigation. The Plaintiffs and their attorneys think the Settlement is best for the Settlement Classes. 5.

Do you have to file a lawsuit to join a class action?

Individual class members do not have to file a lawsuit to participate in the class action settlement or be bound by the judgment in the class action. One court resolves the issues for everyone in the class, except for those who exclude themselves from the class. 4. Why is there a Settlement?

Is Medicare Supplemental covered by Settlement?

Medicare Advantage policies are not within the scope of products included in the Settlement classes. However, Medicare Supplemental policies are within the scope of products included in the Settlement classes, so long as they meet the other criteria (e.g., dates of coverage).