What is a reverse payment patent settlement?

Reverse payment patent settlements, also known as "pay-for-delay" agreements, are a type of agreement that has been used to settle pharmaceutical patent infringement litigation (or threatened litigation), in which the company that has brought the suit agrees to pay the company it sued.

What happens if you reverse a settlement?

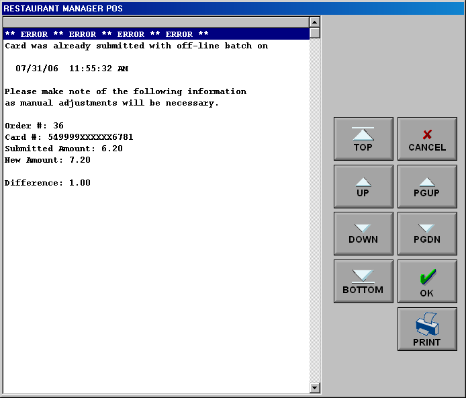

You might do this if the wrong date or settlement amount was used. When you reverse a settlement, all transaction distributions that were involved in settling an invoice with a payment are reversed, such as general ledger postings, exchange rate gains or losses, penny differences, and cash discount transactions.

What does it mean to reverse a payment?

Payment Reversal. A payment reversal is a situation in which funds from a transaction are returned to the cardholder's bank account. A payment reversal can be carried out by several different methods and can be initiated by a cardholder, merchant, acquiring or issuing bank, or the card network.

What is the US Supreme Court's stance on reverse payment settlements?

The first ruling by the US Supreme Court in relation to reverse payment settlements came in 2013, in which the Court ruled that the " Federal Trade Commission can sue pharmaceutical companies for potential antitrust violations" in the face of such settlements.

What is a reverse payment antitrust?

Reverse-payment or “pay-for-delay” lawsuits arise when parties settle patent litigation under the Hatch-Waxman Act with an alleged agreement under which a brand-name drug patent holder compensates a generic drug maker to end or avoid litigation.

What is a reverse payment Pharma?

Abstract. Reverse payments are payments that are made as a component of a patent infringement settlement, between a brand-name pharmaceutical company to a competitor who is attempting to market a generic version of the patented brand-name drug.

What are pay for delay agreements?

Our research indicates that one significant cause is the practice called “pay for delay,” which inflates the drug prices paid by tens of millions of Americans. In a pay-for-delay deal, a brand-name drug company pays off a would-be competitor to delay it from selling a generic version of the drug.

Is pay for delay legal?

The California law went further. AB 824, a bill signed into law in 2019 by Governor Gavin Newsom, a Democrat, prohibits pay-for-delay agreements between brand name and generic drug manufacturers by making them presumptively anticompetitive.

What did the Hatch Waxman Act do?

The "Drug Price Competition and Patent Term Restoration Act of 1984," also known as the Hatch-Waxman Amendments, established the approval pathway for generic drug products, under which applicants can submit an abbreviated new drug application (ANDA) under section 505(j) of the Federal Food, Drug, and Cosmetic Act (FD&C ...

What have pay for delay settlements done?

These “pay-for-delay” patent settlements effectively block all other generic drug competition for a growing number of branded drugs. According to an FTC study, these anticompetitive deals cost consumers and taxpayers $3.5 billion in higher drug costs every year.

What is the best pharmaceutical patent?

An active ingredient patent, or active pharmaceutical ingredient patent (API), is probably the strongest means of protecting a newly invented drug, as active ingredient patents cover the structural formula of the drug.

What is reversal transaction?

Reversal transaction refers to situations where a client has sent the money but it is yet to be received by the merchant's account. While it is still being processed, the transaction can be reversed.

What is the difference between refund and reversal?

General rule to keep in mind: If the payment in question was deposited into the account, it would be a Refund. If it was not deposited, it would be a Reversal.

How long does a reverse payment take?

Yes, credit cardholders can cancel any transaction made, either at the store or online. 3:How long does it usually take to reverse a charge on my credit card? Credit card reversals generally take about 2-4 business days to reflect on your account.

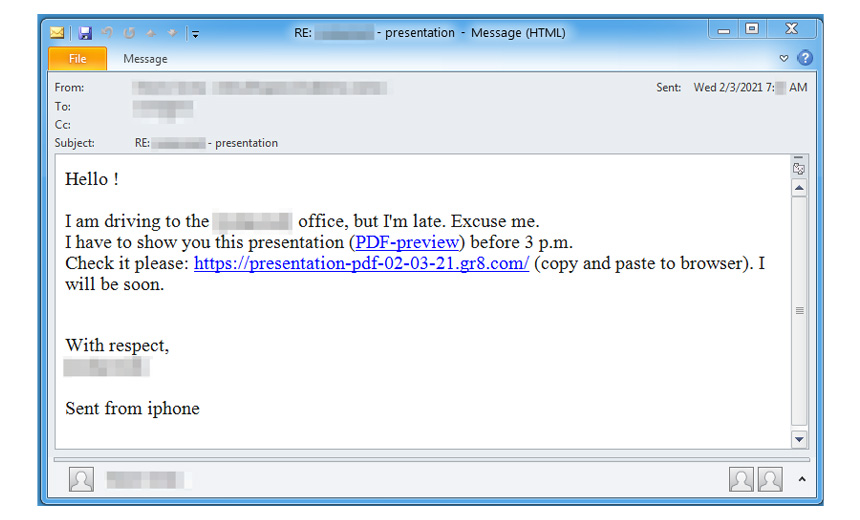

Why did my payment get reversed?

Common reasons why payment reversals occur include: The item ended up being sold out. The customer is trying to commit fraud. The customer changed their mind after ordering.

What is reverse payment?

Reverse-payment or “pay-for-delay” lawsuits arise when parties settle patent litigation under the Hatch-Waxman Act with an alleged agreement under which a brand-name drug patent holder compensates a generic drug maker to end or avoid litigation.

Which state has reverse payment laws?

In October 2019, California became the first state to enact a law that specifically addresses reverse-payment settlements.

Which circuit dismissed a challenge to a California law addressing reverse payment arrangements between drug makers?

The Ninth Circuit dismissed a challenge to a California law addressing reverse payment arrangements between drug makers.

Is testimony relevant to a factfinder's assessment of whether the consideration in a reverse payment settlement is reasonable?

One side or the other may argue that such testimony is relevant to a factfinder’s assessment of whether the consideration in a reverse-payment settlement is reasonable in light of the underlying litigation’s posture.

Is reverse payment litigation still active?

Litigation concerning reverse-payment settlements remains active. In the coming year, we expect to see material developments regarding treatment of non-monetary settlements of underlying patent litigation, as courts continue to grapple with what constitutes a “large and unjustified” payment. Likewise, we expect further insights regarding the admissibility of expert opinions concerning the likelihood of success of the underlying patent litigation.

What is a payment reversal?

A payment reversal is a situation in which funds from a transaction are returned to the cardholder's bank account. A payment reversal can be carried out by several different methods and can be initiated by a cardholder, merchant, acquiring or issuing bank, or the card network.

Where do payment reversals come from?

Where do payment reversals come from? What circumstances would lead a bank to take money from the merchant’s account and return it to the cardholder? Actually, there are multiple reasons why you might experience a credit card payment reversal. Some are the result of a genuine merchant error, while others occur at the customer’s discretion.

What is the first form of payment reversal to discuss?

The first form of payment reversal to discuss is the authorization reversal.

What is the worst way to reverse a credit card payment?

Of the three methods for reversing a payment, chargebacks are the worst for merchants. A chargeback involves all the negative consequences associated with other forms of a credit card payment reversal, including lost sales revenue, merchandise, shipping costs, and interchange fees. Unlike a return, though, chargebacks come with several other unpleasant effects:

Why should each transaction be sent along for clearing?

Each transaction should be sent along for clearing as soon as all information can be collected and confirmed so the cardholder is not caught off-guard with insufficient funds. Even worse, the cardholder might forget about the transaction and believe it to be fraud, which could lead to a chargeback.

What are the three ways a transaction can be reversed?

The customer is trying to get something for free. There are three primary methods by which a transaction can be reversed: an authorization reversal, a refund, or a chargeback. Obviously, none of these are ideal, but some methods are significantly worse than others.

What is a refund in a transaction?

Most people understand the basic concept of a refund; a customer was dissatisfied with a purchase for one reason or another, and that person wants the money back. This occurs after a transaction clears, but before the customer files a payment dispute.

Non-Monetary Settlements

Expert Testimony on Merits of The Underlying Patent Suit

- The new year is also likely to see further development regarding when courts permit expert testimony concerning the likelihood of success of the underlying suit that resulted in the challenged settlement. One side or the other may argue that such testimony is relevant to a factfinder’s assessment of whether the consideration in a reverse-payment settlement is reason…

California’s New Restriction on Reverse-Payment Settlements

- In October 2019, California became the first state to enact a law that specifically addresses reverse-payment settlements. With certain exceptions, the statuteprovides that “an agreement resolving or settling, on a final or interim basis, a patent infringement claim, in connection with the sale of a pharmaceutical product, shall be presumed to have...