The longer the insurance company delays settlement of your claim, the more likely that:

- the applicable statute of limitations will run out

- witnesses' memories will fade

- evidence will be lost or tainted

- you will take a lesser settlement just to put the matter behind you, or

- you will give up and abandon your claim.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease payments or deny claims for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

What is it called when an insurance company refuses to pay a claim?

Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate claim or investigate and process a policyholder's claim within a reasonable period.

What happens if insurance doesn't pay enough?

If your insurance claim check is not enough, take a second (or third, or fourth) look through your insurance policy to see if you can find anything that might help you win your case against your insurance company to get them to give you a higher settlement.

Why would an insurance company not want to settle?

Insurance companies are businesses. Settling a claim often means paying out more than they want to. Their goal is paying as little as possible and limiting their liability in the event of an accident. For this reason, insurers may refuse to settle because they want to try to lessen how much they pay, if anything.

Can you sue insurance company for taking too long?

Insurers can be sued for unreasonable delay in the claim process even prior to giving you an adverse claim decision.

How long does an insurance company have to investigate a claim?

In general, the insurer must complete an investigation within 30 days of receiving your claim. If they cannot complete their investigation within 30 days, they will need to explain in writing why they need more time. The insurance company will need to send you a case update every 45 days after this initial letter.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

When an insurance company needs to provide a payout?

When an insurance company needs to provide a payout, the money is removed from: the consumer's income.

What happens if someone sues you for more than your insurance covers?

If you were in an accident that was your fault and the auto accident settlements exceed your coverage, the company will simply deny or process payments up to the insurance policy limit. You can expect the injured person to come after you by suing you for damages if the insurance company pay is less than their damages.

Is it better to settle or go to trial?

A faster, more cost-efficient process. Your litigation can end within a few months if you settle out of court, and it is much less stressful. A guaranteed outcome. Going to trial means there is no certainty you will win, but when you settle, you are guaranteed compensation for your injuries.

Why do insurance companies take so long to settle?

Generally, the money an insurance company receives in premiums goes into investment accounts that generate interest. The insurance company retains this money until the time they pay out to a policyholder, so an insurance company may delay a payout to secure as much interest revenue as possible.

Can I force my insurer to settle?

This unreasonable denial or failure to meet obligations under an insurance policy may be considered “bad faith,” and a lawyer can file a lawsuit to force the insurer to settle and get you the benefits you deserve.

What are the two main reasons for denying a claim?

Here are the top 5 reasons why claims are denied, and how you can avoid these situations.Pre-certification or Authorization Was Required, but Not Obtained. ... Claim Form Errors: Patient Data or Diagnosis / Procedure Codes. ... Claim Was Filed After Insurer's Deadline. ... Insufficient Medical Necessity. ... Use of Out-of-Network Provider.

When an insurance company needs to provide a payout?

When an insurance company needs to provide a payout, the money is removed from: the consumer's income.

Can an insurance company decline a claim?

The insurer can reject your claim if they have reason to believe you didn't take reasonable care to answer all the questions on the application truthfully and accurately.

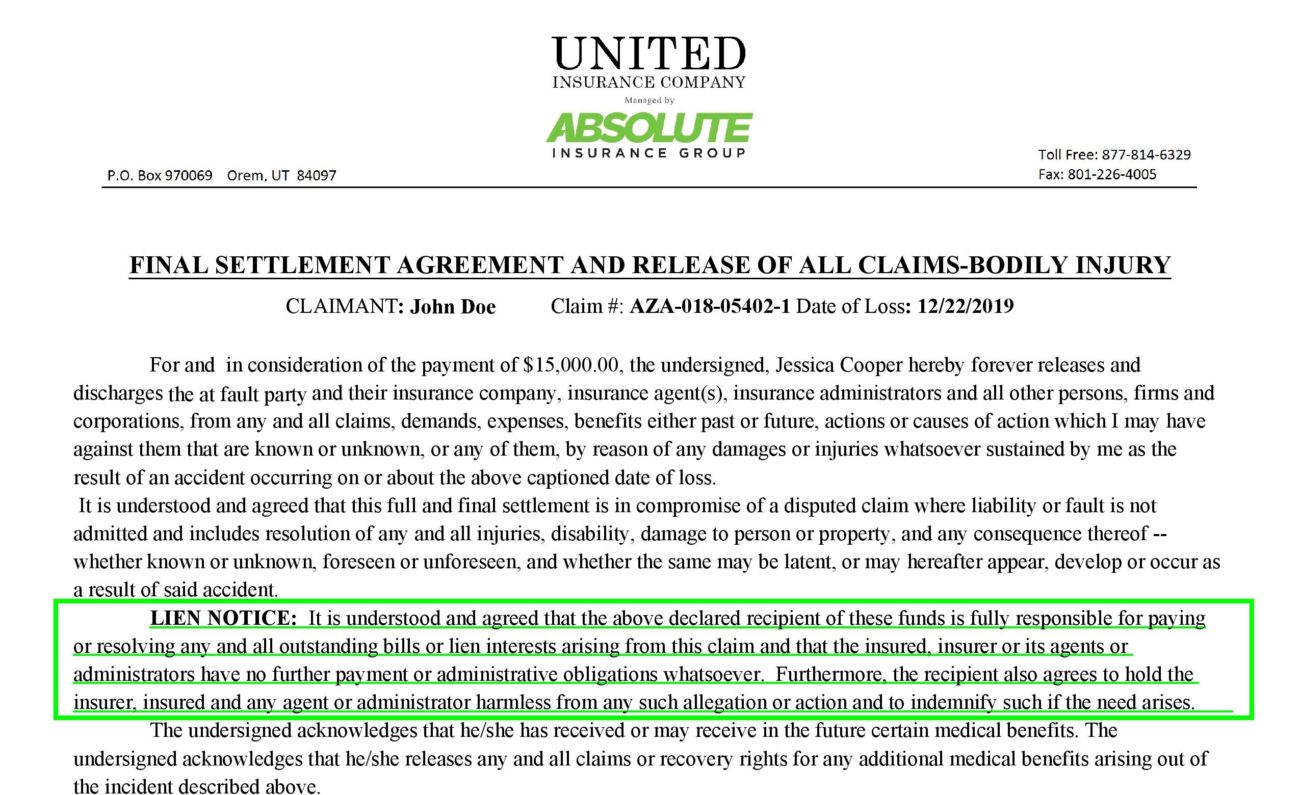

What is a subrogation agreement?

A waiver of subrogation is an agreement that prevents your insurance company from acting on your behalf to recoup expenses from the at-fault party. A waiver of subrogation comes into play when the at-fault driver wants to settle the accident but with your insurer out of the picture.

What if the Insurance Company Refuses to Settle?

Insurance companies might try to delay or just refuse to give you the settlement you deserve after a serious injury. When insurance companies refuse to cooperate, you may need to consider filing an official lawsuit and possibly taking that case to court.

Why do insurers refuse to settle?

Therefore, the biggest reason insurers refuse to settle is because they want to try to minimize how much they pay or work in a way to pay nothing.

What does it mean to settle a claim?

An insurance company is a business. Settling a claim means that they will tap into their reserves and possibly harm their annual revenue report that year. No business wants to pay more than they should – or even what they should. The entire goal is to pay as little as possible and limit their liabilities so that they can walk away unharmed.

Why is it harder to use witnesses in a lawsuit?

Likewise, any witness statements you have are harder to use, especially because witnesses continue to forget key details as time passes on. Think about it yourself. Can you remember exact details of any event that happened last week? How about three weeks ago? Now, think of a serious event that happened more than one year ago and how much fine details you can recall. Most likely, you cannot recall much of anything. The insurance company hopes that your witnesses will be the same, because if they cannot recall those details about your case, it is harder to prove the defendant was at fault.

Can you settle a claim that you have hit a wall?

You might feel as though you have hit a wall and will never finalize your injury claim, but you still have options. Even when insurance companies refuse to settle or purposely delay, the law allows for victims to seek compensation in other ways and prevent insurers from trying to delay paying out on valid claims.

Will you lose your will to fight?

You Will Lose Your Will to Fight – The insurer plans to settle, but not until you are desperate. They know if they eat away at your patience and you start to face serious financial difficulties, you will give in and take whatever settlement they bring to you – even if it is well under the amount you deserve.

Can insurance companies delay settlement?

Anyone trying to recover damages from an insurance company knows how tiring, frustrating, and time consuming the process can be. Insurers often try to delay and sometimes refuse outright to settle an injury case. When negotiations are not moving or you feel like an insurance company is purposely stalling, you have options.

What is liability insurance?

Liability insurance protects the purchaser (i.e., the insured) against liability for claims made by a third party. In such cases, the insurance company pays to cover any third-party claims made against the insured. In the above example, the other driver is the insured and you are the third party. The insurance policy requires the insurance company to pay for your claims against the other driver if you prevail at trial.

What is an excess judgment in Illinois?

Recognizing that this arrangement gives insurance companies the incentive to go to trial, even when it would be better for the insured to settle to avoid a judgment in excess of the policy limits (called an “excess judgment”), Illinois law imposes a duty of good faith on the insurance company in responding to settlement offers. When an insurance company refuses to settle, it may be liable for the full amount of the excess judgment after trial, notwithstanding the lower policy limits.

Does liability insurance pay for legal defense?

In addition, liability insurance generally requires the insurance company to pay for the insured’s legal defense. Not only does the insurer pay for the defense of its insured, but it also gets to control how that defense is conducted. That is, the insurance company is generally the only one that can decide to settle a case or not. In fact, if the insured were to attempt to settle the case with the third party directly, the insurance company could try to get out of paying the third party’s claim at all.

Can a plaintiff sue the insurance company for bad faith?

What does this mean for plaintiffs? First, plaintiffs don’t have their own claim against the defendant’s insurance company when it breaches its duty of good faith. That claim belongs to the defendant. But the defendant can assign his or her claim to the plaintiff. Defendants often do so in exchange for the plaintiff’s agreement not to collect the judgment from the defendant him- or herself, but only from the insurance company. When the defendant’s claim for bad faith against its insurance company is assigned to the plaintiff, the plaintiff and their car accident attorney can then sue the insurance company to recover the excess judgment.

When does an insurer expect a plaintiff to work for his compensation?

In short, the insurer expects the plaintiff to work for his compensation when there is any doubt as to the validity of their case. The insurer can, and also will, look to satisfy itself that the loss really is covered by the policy.

Why do insurers take a wait and see approach?

And because, generally, time is on the side of the insurer, they are often willing to take a “wait and see” attitude toward settling more doubtful claims. The insurer can also force the plaintiff to prove the extent of his injuries and/or economic losses (like medical costs).

What is the obligation of insurance companies?

The insurer’s obligation is to defend you from lawsuits for covered losses u0014 e.g. when you are liable for another’s lossu0014and, if necessary to pay any claims, all up to the coverage limit. But insurance companies have a right to:

Can an insurer pay less than the policy limits?

It may therefore be the case that the insurer could end up paying substantially less than the policy limits.

Can an insurer open their wallet?

They could be lying; they could be exaggerating; they could be wrong. The insurer does not have to simply open their wallet.

Does an auto insurance policy cover a DUI?

For example, say it was an auto accident; many automobile liability policies will not cover an insured who was DUI/DWI. The insurer can look into the event, to see if under the circumstances, they are fact obligated to defend and pay for you.

Can an insurer refuse to settle a claim?

An insurer can reasonably refuse to settle, and thus run the risk of a larger ultimate award against the insured. If there is reason to doubt either liability or the extent of the injuries, the insurer can in good faith refuse to settle and contest the claim.

What is a settlement on a homeowner's policy?

Where a homeowner's policy is being used, your settlement will be based on the type of policy you purchased. If your policy was written for Actual Cash Value, then your claim will be settled for the depreciated value of the property, and may not be sufficient to cover all of the repairs to the home.

What to do if your insurance policy does not contain wording?

If your policy does not contain such wording, contact the insurance company and voice your concerns, then ask the agent you speak with how your policy can be modified to give you more complete protection.

What to do if your insurance policy is not enough to cover repairs?

Planning ahead is your best recourse for a situation where the settlement is insufficient to cover the cost of repairs. Read through your policy carefully and make sure that it contains wording which guarantees repair or replacement to original condition. If your policy does not contain such wording, contact the insurance company ...

What type of insurance do you need for a car when you are financed?

In a situation where the car is being financed, your best solution is to carry a special type of insurance rider, called General Auto Protection or GAP insurance coverage for short. This will not help you with making repairs, but it will pay off the difference between what you owe and the depreciated value of the car.

Can you get a higher settlement on car insurance?

When this happens, you have the option of disputing the settlement in the hope of getting the repairs made, but there is no guarantee that doing so will result in getting a higher settlement. In the case of a car insurance claim, you probably will not be able to get the settlement increased.

What happens if you pay a settlement?

Late payment could have other unforeseen consequences. Settlement agreements can provide for payment of sums other than the settlement sums as consideration for other provisions. For instance, some agreements provide for separate payments for new post-termination restrictive covenants such as non-competes. Late payment of the consideration risks an employee arguing that the covenants are not enforceable. This could have serious consequences for a business dealing with a key individual, particularly since injunctions to enforce disputed covenants tend to be costly to pursue.

What is the key to a settlement agreement?

The key is to ensure that appropriate time is built into the settlement agreement for making payment and to consider carefully whether there are any factors that could lead to delay.

Why is there a delay in payment?

This may be an administrative error or something more substantive, such as a concern that the employee is in breach of the agreement, e.g. breach of the non-disparagement obligation, or the employee having taken up a new job in breach of warranty. If there is good reason to suspect a breach, then the risks of delaying payment will have to be weighed against the risks of making payment and thereby undermining the value of those obligations.

Why is enforcement of payment terms a last resort?

Because of the time and cost involved in bringing proceedings , enforcement of payment terms is likely to be a last resort for most employees, when payment had been delayed for a prolonged period.

How to deal with additional obligations?

Where compliance with additional obligations is key, consider allocating more than a nominal sum as consideration for specific obligations. This may be a more effective deterrent and, in the event of a suspected breach, this sum could be withheld (or claimed in respect of if paid) and the agreement should still be valid. Another option is to agree staged payments to encourage ongoing compliance.

Can a waiver of claims be void?

However, if the employee’s waiver of claims is conditional on receipt of payment, late payment could have more serious consequences for the employer. The agreement may be void and the employee may be free to pursue the claims purportedly settled. Settlement agreements are, however, not normally drafted in this way.

When should approval be sought for a payment?

If the payment is subject to approval, e.g. by the remuneration committee, approval should ideally be sought before the agreement is signed. If this is not possible, the drafting will need to be considered carefully.

How many days does an insurer have to pay a claim?

The Department of Insurance’s regulations make it clear that every insurer shall immediately, but in no event more than thirty (30) calendar days later, tender payment of the amount of the claim which has been determined and is not disputed by the insurer.

What is total loss settlement?

1.) The Total-Loss-Settlement Amount Your Insurance Company Offers Include Mandatory Taxes And Fees. Your insurance company is required to pay you what is known as the actual cash value (ACV) of your vehicle. ACV is the market value of the vehicle taking into consideration pre-loss condition, options, and mileage. To determine the amount it will pay you, your insurance carrier researches your vehicle’s market value by comparing your vehicle to vehicles that are for sale in your local area.

What happens if the appraisers are unable to agree?

If the appraisers are unable to agree, then a third party called an “evaluation umpire” will then listen to both sides and make a determination as to which appraiser is right about the vehicle’s value. NOTE: State law requires both sides to share the cost of an appraisal hearing equally.

How long does a rental car insurance policy last?

Even if the insured’s policy provides for rental car coverage, that coverage is usually limited to a maximum of 30 days, seldom long enough to resolve a total loss claim, especially where the insured can’t accept the insurance company’s offer.

What does it mean when an insurance company owes you a valuation?

In presenting its valuation to you (extending an offer), your insurance company is admitting that it owes at least the valuation amount on the claim. Under the Department of Insurance regulations, your insurance company is required to promptly tender the amount not in dispute (the carrier’s valuation amount).

What to do if you disagree with total loss value?

3.) If You Disagree With The Total Loss Value Your Insurance Company Arrives At, You Can Challenge That Amount. Insurance companies will generally ask you to provide documentation to back up the reason for your disagreement. Insurance companies then review the documentation for accuracy and applicability to the total loss vehicle. If there is still disagreement, state law and the terms of your policy describe how an appraisal process will resolve the differences.

What does total loss mean in insurance?

You have been involved in a car accident and your car is totaled (this means that the car costs more to fix than it is worth). If the insurance company offers you a settlement on your total-loss claim, the following six (6) items are things your insurance company definitely does not want you to know about when you’re negotiating the value of your vehicle.

What happens if you total your car?

However, if you total your car when you're still paying the loan, you may wind up owing more than the car is actually worth . Here's what you need to know if you totaled your vehicle.

What does it mean when your car is totaled?

If your car is totaled, this means the insurance company has determined that the damages to repair the vehicle are more than the vehicle is worth. In general, that means the damage exceeds 65%-70% of the vehicle's market value.

What is total loss in Pennsylvania?

Pennsylvania -- "A total loss is settled based upon the pre-loss fair market value of the damaged vehicle plus the state sales tax on the cost of a replacement vehicle."

Does auto insurance pay more than the value of a vehicle?

Auto insurance providers never pay more than the value of the vehicle when it is deemed a total loss. (See " Understand your options for a totaled car. ") Your collision deductible will be deducted from the actual cash value.

Do insurance companies have to pay sales tax in Kansas?

Kansas -- "Insurers have an obligation to pay sales tax and fees for all total loss claims."

Do you pay sales tax on a crashed car?

Most states require insurers to pay sales tax after you replace your crashed vehicle. For states that reimburse sales tax, insurance companies will provide that money on the total loss settlement for your original vehicle and not your new car. Here's an example.

Background: Liability Insurance

Insurers’ Good-Faith Duty to Settle

- Recognizing that this arrangement gives insurance companies the incentive to go to trial, even when it would be better for the insured to settle to avoid a judgment in excess of the policy limits (called an “excess judgment”), Illinois lawimposes a duty of good faith on the insurance company in responding to settlement offers. When an insurance com...

Plaintiffs’ Remedies

- What does this mean for plaintiffs? First, plaintiffs don’t have their own claim against the defendant’s insurance company when it breaches its duty of good faith. That claim belongs to the defendant. But the defendant can assign his or her claim to the plaintiff. Defendants often do so in exchange for the plaintiff’s agreement not to collect the judgment from the defendant him- or he…

Conclusion

- As you can tell, the duty of good faith that Illinois imposes on insurance companies can impact a personal injury plaintiff’s litigation strategy. However, there are several steps that the plaintiff must follow to be able to later pursue a claim of a bad-faith refusal to settle against the defendant’s insurance company. And not every refusal to settle within policy limits will qualify a…