Key Takeaways

- An official settlement account is used to track and account for international balance of payments between central banks.

- It is used to settle transfers of assets and global monetary reserves that circulate among nations' central banks.

- Countries look to these accounts to monitor capital outflows and inflows to and from other countries.

What is a good settlement amount?

What is a good settlement amount? Very roughly, if you think that you have a 50% chance of winning at trial, and that a jury is likely to award you something in the vicinity of $100,000, you might want to try to settle the case for about $50,000.

What exactly is a cash settlement?

What is a Cash Settlement? A cash settlement is a settlement method used in certain futures and options contracts where, upon expiration or exercise, the seller of the financial instrument does not deliver the actual (physical) underlying asset but instead transfers the associated cash position.

What is quarterly settlement of account?

What is Quarterly Settlement/Running Account Settlement? SEBI mandates stockbrokers to settle (transfer available credit balance from Trading account to Bank account) the client’s funds lying in the trading accounts at least once in a quarter (90 days) or 30 days. This process of transferring unused funds back is called ‘Running Account ...

What are exchange settlement accounts?

Exchange Settlement Accounts (ESAs) are the means by which providers of payments services settle obligations that have accrued in the clearing process. This document outlines the Reserve Bank's policy on ESA eligibility; and provides additional information on management of an ESA and the application process. 1.

What type of account is a settlement account?

If you record payments you owe to a lender or other business until you pay off the funds you owe, the account you settle is an account payable (i.e., a liability account).

What is settlement in bank transaction?

Settlement can be defined as the process of transferring of funds through a central agency, from payer to payee, through participation of their respective banks or custodians of funds.

How do you do a bank settlement?

To facilitate the process, the merchant must open a merchant account and sign an agreement with the acquiring bank specifying the terms & conditions and settlement of transactions for the merchant. Such banks charge transaction fees for their service.

What is the difference between settlement and balance?

Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account. The account will be reported to the credit bureaus as "settled" or "account paid in full for less than the full balance."

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

How do settlements work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

What is the difference between settlement and reconciliation?

A settlement is a time between customers making payment and merchant account receiving the fund. In contrast, payment reconciliation is a term used for reviewing all business transactions, including income and expenses.

What is the settlement process?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

Do banks settle payments?

Interbank clearing and settlement networks allow banks to settle USD payments within a day and international payments within two days.

What is a settlement of account and how can it be done?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.

What does a settlement amount mean?

Settlement Value means the amount which the holder of a Contract may receive for a Contract held until Expiration. The Settlement Value of a Binary Contract is $100.

How long does a settled account stay on your credit report?

How Long Do Settled Accounts Stay on a Credit Report? Settling an account will cause the status to show that you no longer owe the debt, but the account will stay on your credit report for seven years from the original delinquency date.

What is settlement in payment processing?

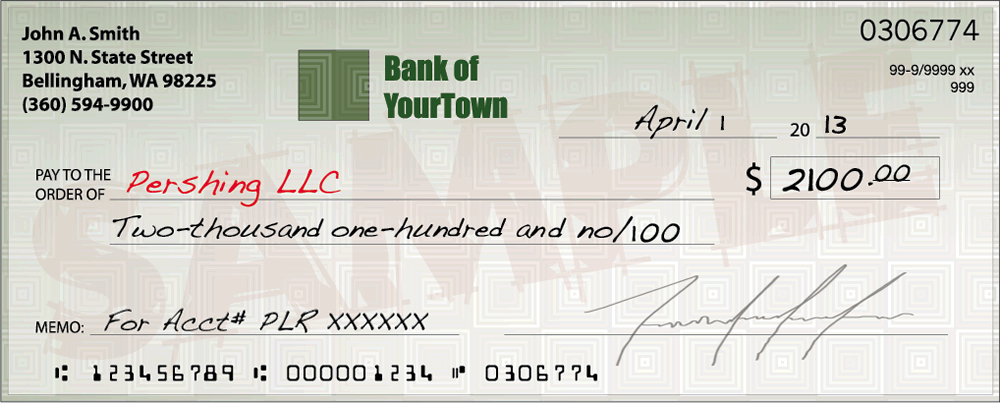

Payment settlement involves collecting the funds for the amount recorded for an order. For example, when using credit cards, the settlement process specifically involves contacting the payment system and collecting the required amount of funds against the credit card.

What is difference between settlement and clearing?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

What is settlement cycle on bank statement?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank. The business will then receive the authorized funds in its merchant account.

How do debit card transactions settle?

Settlement and Funding of Payment For approved transactions, the acquirer submits a settlement request to the card network on behalf of the merchant. The card network then sends the settlement request to the consumer's bank, which issued the card, for clearing.

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

What is the account receivable department?

The accounts receivable department of a company is charged with the account settlement process of collecting money owed to the firm for providing goods or services. The ages of the receivables are broken down into intervals such as 1–30 days, 31–60 days, etc. Individual accounts will have amounts and days outstanding on record, and when the invoices are paid, the accounts are settled in the company's books.

What is offset in insurance?

Amounts receivable and payable to reinsurers are offset for account settlement purposes for contracts where the right of offset exists, with net insurance receivables included in other assets and net insurance payables included in other liabilities. 1.

What is an account settlement?

An account settlement, or settlement of accounts, is the action of paying off any outstanding balances to bring an account balance to zero.

Why do you settle your accounts?

When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books only when you fulfill the transaction.

What happens to the clearing account balance after employees deposit their checks?

After the employees deposit their checks and you remit the taxes, the clearing account balance is zero. So, you settled the account.

What is an example of an outstanding balance?

For example, you have one outstanding balance in an account. Customer A owes the entirety of the balance because of Invoice A. When Customer A pays the invoice, the account is now settled.

What is settlement date accounting?

With settlement date accounting, enter the transactions into your general ledger when the transaction happens. This method ensures that everything on your general ledger has actually happened with the exact amount recorded. You settle the account at the time you record the transaction.

Can you hold multiple payments in a clearing account?

You may choose to hold multiple payments in the clearing account until you receive the total balance due on an invoice.

Is a settlement an account payable?

If you record payments you owe to a lender or other business until you pay off the fund s you owe, the account you settle is an account payable ( i.e., a liability account).

What Is an Official Settlement Account?

An official settlement account is a special type of account used in international balance of payments (BoP) accounting to keep track of central banks' reserve asset transactions with one other. The official settlement account keeps track of transactions involving gold, foreign exchange reserves, bank deposits and special drawing rights (SDRs).

Why do nations keep an eye on the official settlement account?

Nations keep an eye on the official settlement account to gauge their economic health in the global economy. If there are continual outflows of reserve assets for a country, it means that its competitiveness in producing exported goods is relatively weak, or it's business environment is not as attractive as that offered by other countries for direct foreign investment.

What is capital account?

The capital account records the change in foreign and domestic investments, government borrowing and private sector borrowing. When there is either a balance of payments deficit or surplus, inflows of reserve assets or outflows of reserve assets bring the ledger back into balance. This is recorded in the official settlement account.

Why do countries look to these accounts?

Countries look to these accounts to monitor capital outflows and inflows to and from other countries.

What would a country do if it had a chronic current account deficit?

A nation running chronic current account deficits may then formulate policy prescriptions to improve the quality of its goods for export or seek exchange rate adjustments to make their exports more price competitive. It also may try to create better conditions for international companies looking to build new factories abroad. Tax incentives, infrastructure projects, and workforce training programs could be promoted by a country to address unwanted outflows recorded in its official settlement account.

What is BIS bank?

The Bank for International Settlements ( BIS) is an international financial institution that aims to promote global monetary and financial stability and maintains oversight of official settlement accounts.

What is a settlement account?

Settlement Account means an account at a central bank, a settlement agent or a central counterparty used to hold funds or securities and to settle transactions between participants in a system;

When will merchants pay the amount due?

Merchant will pay the amounts due by the next Business Day if sufficient funds are not available in the Settlement Account.

Can a merchant change a settlement account?

Merchant may change the Settlement Account upon prior written approval by Bank, which approval will not be unreasonably withheld.

Is a settlement account a repurchase asset?

The Settlement Account is (and shall continuously be) part of the Repurchase Assets. The Settlement Account shall be subject to setoff by the Agent for the benefit of the Agent and any Buyer against any of the outstanding Obligations.

Examples of Cash Settlement Account in a sentence

Currently no interest will be paid on cash held in a Cash Settlement Account or ISA Cash Account.

More Definitions of Cash Settlement Account

Cash Settlement Account means, in respect of an Option, an amount (if any) that is payable by Seller on the applicable Payment Date (s) and is determined as provided in the Confirmation governing such Option.

What is an FBO account?

An FBO account, or a For Benefit Of account, allows a company to manage funds on behalf of—or for the benefit of—one or more of their users, without assuming legal ownership of the account.

Why do I need a virtual account?

Virtual accounts seamlessly help businesses track individual payments and automate the reconciliation process, which otherwise would be a time-consuming, manual process.

What Is An Account Settlement?

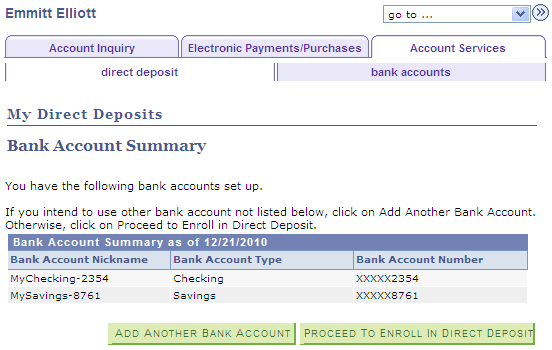

Account Settlements and Clearing Accounts

- Settling an account often occurs with clearing accounts. What is a clearing account? A clearing account is either a: 1. Bank account used to hold funds until payments can move to another account (e.g., payroll accounts to employee bank accounts), OR 2. Temporary account used to record transactions in the general ledger until the funds can be accurately or completely classifi…

Examples of Account Settlements

- Settling your accounts can be confusing, especially since there are several different ways you can do so. Here are some examples of account settlements.

Settlement Accounts vs. Account Settlements

- So, what is the difference between settlement accounts and account settlements? Despite the names being so similar, there is quite a difference between the two. Again, account settlements are when you settle outstanding balances either through payments or offsets. But, settlement accounts are bank accounts used to track the balances of payments between banks. Internation…

Settlement Date Accounting

- When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books onlywhen you fulfill the transaction. With settlement date accounting, enter the transactions into your general ledger when the transa…