Full Answer

How much does it cost to settle a batch of transactions?

Typically, batches must be settled every 24 hours or else all the transactions of the batch will be charged the maximum transaction fees no matter which pricing tier each transaction fell into originally. Batch fees usually cost around 15 – 25 cents per batch and vary by processor.

How much does it cost to process a batch?

Batch fees usually cost around 15 – 25 cents per batch and vary by processor. Other known name variations for “Batch Fee” are: Batch Capture Fee, Batch Header Fee, Batch Settlement Fee or Daily Closeout Fee.

What is a batch fee for merchant account?

Merchant Account Batch Fee Explained: What is a Batch Fee? A “batch” is the total dollar amount of credit card sales charged in a single business day that will be deposited into a business owner’s checking account. Instead of business owners getting a deposit for every credit card sale, the sales are “batched” together into one overall deposit.

What are settlement fees in real estate?

In real estate, a settlement fee is a charge that covers expenses in excess of the amount a person pays to purchase or sell a property. Also called closing costs, some of the most common settlement fees are application and loan origination fees.

What does batch settlement mean?

Batch Settlement means the process by which transactions are settled in the Settlement Facility in accordance with Section 10 whether or not in DvP Batch Settlement.

What is a batch fee?

What is a Batch Fee? A “batch” is the total dollar amount of credit card sales charged in a single business day that will be deposited into a business owner's checking account. Instead of business owners getting a deposit for every credit card sale, the sales are “batched” together into one overall deposit.

What does payment batched mean?

A batch payment is when you send multiple payments to different recipients at once, but through a single payment as opposed to many individual transactions.

What is Batch Close fee?

Payment processors charge a fee each time a terminal with transactions is settled, or batched out. This fee varies from processor to processor, Host Merchant Services charges merchants a Batch Close Fee of only $0.20 per batch.

What happens if you dont settle the batch?

If you don't settle within 24 hours, you're subject to higher interchange fees – typically in the range of 0.25% – 0.50%. For this reason, we always recommend settling on any day you process sales.

How long does a batch payment take?

48-72 hoursOnce the transactions are cleared (or settled), the funds are usually delivered to the specified merchant account within 48-72 hours.

What is an example of batch processing?

Examples of batch processing are transactions of credit cards, generation of bills, processing of input and output in the operating system etc. Examples of real-time processing are bank ATM transactions, customer services, radar system, weather forecasts, temperature measurement etc.

What is batch processing in banking?

Batch processing is the processing of transactions in a group or batch. No user interaction is required once batch processing is underway. This differentiates batch processing from transaction processing, which involves processing transactions one at a time and requires user interaction.

What does batch mean in accounting?

a group of transactionsAn important accounts payable concept is the use of batches. A batch is a group of transactions that have been posted to the AP-MASTER file. These transactions are summarized and can then be released to your general ledger.

What does closing a batch mean?

Related Definitions Close Batch means the process of sending a batch of transactions for settlement.

What does batch close mean?

Batch Close means the process of sending a batch to the financial institution for settlement.

How do I close a batch on my credit card machine?

0:090:57How To Close Batch Pax S300 Credit Card Terminal - YouTubeYouTubeStart of suggested clipEnd of suggested clipThis is how you close your batch on your pax. Device from the main screen hold down the blueMoreThis is how you close your batch on your pax. Device from the main screen hold down the blue function key then press the number one enter in the terminals password.

What is a daily batch fee?

With other firms, batch fees are assessed on every day that transactions are sent in for processing, regardless of how many transactions are processed. Batch fees are paid if you process one transaction or one hundred. So, if your business is open every day, you'd be subject to 30 batch fees in a month.

What does batch mean in accounting?

a group of transactionsAn important accounts payable concept is the use of batches. A batch is a group of transactions that have been posted to the AP-MASTER file. These transactions are summarized and can then be released to your general ledger.

What is an example of batch processing?

Examples of batch processing are transactions of credit cards, generation of bills, processing of input and output in the operating system etc. Examples of real-time processing are bank ATM transactions, customer services, radar system, weather forecasts, temperature measurement etc.

What is a credit card batch?

Batch credit card processing is the practice of a merchant processing all of its authorized credit card transactions for the day after the close of the business day, or at a time determined by the credit card processor.

What do you need to know about batch settlements?

What You Need to Know About Batches and Settlements. If you’re a merchant accepting credit and debit payments for your business, then batches and settlements are an important part of your day-to-day. Settling the day’s transactions is what gets the money you earned from your customers into your business’s bank account.

How long does it take to settle a batch of cash?

If batches are left open for too long (typically 48 hours to 6 days), some processors will choose to automatically close and settle the batch, while others will let the unsettled transactions expire.

What is a Batch?

A batch is a group of transactions that have been processed but have yet to be settled. When a transaction is approved, it is added to your batch. When a batch hasn’t been settled yet, it is called an open batch, and transactions in the batch can still be voided and reversed if needed. This is important to know because voiding a transaction is less costly and time-consuming than refunding a transaction.

What is a Settlement?

Once a batch is closed and submitted, the business’s credit card processor receives the processed funds from each issuing bank whose credit cards were part of the batch (in other words, retrieving the money from every customer’s account). The total batch amount will then be transferred via bank-transfer to the merchant’s bank account.

Why are credit cards processed in batches?

If you’ve ever looked at your credit card statement in your online banking app for example, you’ll notice pending and posted transactions, right ? Well, those transactions are all tied to this two step process. When you tap your credit card, you and the merchant both see an “approved” message flash across the screen. This means the merchant’s terminal has communicated with your issuing bank to determine that there are enough funds on that card to pay for whatever it is you’re buying. So far so good!

Why is it important to settle a business?

If you’re a merchant accepting credit and debit payments for your business, then batches and settlements are an important part of your day-to-day. Settling the day’s transactions is what gets the money you earned from your customers into your business’s bank account.

How long does it take for a closed batch to settle?

Without holds, funds should appear in your bank account within 1-2 business days. Some processors have longer wait times and might make you wait 7-10 business days to receive your funds, while others might offer same-day deposits, but for a higher fee.

Examples of Batch Settlement in a sentence

For clarity, Settlement using eftpos Batch Settlement will take place on every RITS Business Day.

Related to Batch Settlement

Cash Settlement shall have the meaning specified in Section 14.02 (a).

What does batching transactions mean?

Batching transactions (also known as batch clearing, batch processing, and dual message processing), is when a merchant takes a “batch” of authorization requests and sends them to the processor to be settled.

When do you batch process credit card transactions?

If you’ve owned, worked, or been around the restaurant industry, you’ve probably heard of batch processing credit card transactions at the end of each shift. It’s when you tally up the tips, add them onto the authorizations, and submit the transactions to be processed.

What is processing in a transaction?

Processing is about getting your money. This is when you tell the payment processorto actually go and get your money. This moves that “hold” into a finalized transaction. Again, this is also known as a settlement.

How many automatic batches per day?

People usually opt for 1-2 automatic batches per day or manual uploads at the end of the day.

How long does it take for a merchant account to receive funds?

Once the transactions are cleared (or settled), the funds are usually delivered to the specified merchant account within 48-72 hours.

Is batch processing manual or automatic?

1. Batch processing can be automatic or manual.

Can Tidal process thousands of transactions?

Instead of processing hundreds or thousands of transactions individually, batch upload your transactions directly from your POS, mobile app, or web dashboard with Tidal’s merchant services software .

How long does it take for a batch settlement to happen?

Here are the steps involved in a batch settlement. Several transactions, usually within a 24-hour time frame , are aggregated (batched) together and transaction information is sent to the acquiring bank from the processor.

What is a batch of credit card transactions?

When a transaction is approved, it is added to your batch. A batch is a group of transactions that have been processed but have yet to be settled. When a batch hasn’t been settled yet, it is called an open batch, and transactions in the batch can still be voided and reversed if needed.

What happens when a batch is closed?

Once a batch is closed, the settlement occurs when the processor receives the processed funds from each issuing bank whose credit cards were part of the batch. The total batch amount will then be transferred via bank-transfer to your bank account.

Can you close a batch and trigger a settlement?

Once you’re ready, you can close a batch and trigger a settlement. For most merchants, this is typically done automatically at a set time each day. However, some merchants, like retailers and restaurants, prefer to manually settle their batches during their end of day cash-out.

What is settlement fee?

In real estate, a settlement fee is a charge that covers expenses in excess of the amount a person pays to purchase or sell a property. Settlement fees can encompass many types of expenses, but often include such things as application and attorney ’s fees, loan origination fees, and fees for title searches.

What is a point fee?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front.

Do appraisers charge fees?

Appraisers and home inspectors charge fees, which are often included in settlement fee totals. In most cases, the settlement fees a seller pays are negotiable. In order to make his home more attractive or easier to buy, a seller may agree to pay one or more of the settlement fees usually paid by the buyer.

Is it legal to have a seller assist with a settlement fee?

Having the seller assist with a settlement fee is usually legal, as long as the seller's contribution is detailed in the official agreement between the buyer and seller and doesn't violate any terms set by the lender.

Is an appraisal included in settlement fees?

Lenders may also require an inspection by a professional home inspector in order to analyze the structure of the property and look for evidence of issues such as termites. Appraisers and home inspectors charge fees, which are often included in settlement fee totals.

What Is A Batch?

How Batch Credit Card Processing Works

- Once you’ve finished processing for the day and you’re ready to close up shop, you can close a batch and trigger what’s called a settlement (see below). For most merchants, settlement is typically done automatically at a set time each day. However, some merchants, like retailers and restaurants, prefer to manually settle their batches during their end-of-day cash out. If batches a…

Why Batch Credit Card Processing Is Used

- The reason credit cards are processed in batches is because credit card transactions are a two-step process. If you’ve ever looked at your credit card statement in your online banking app for example, you’ll notice pending and posted transactions, right? Well, those transactions are all tied to this two step process. When you tap your credit card, you and the merchant both see an “appr…

What Is A Settlement?

- Once a batch is closed and submitted, the business’s credit card processor receives the processed funds from each issuing bank whose credit cards were part of the batch (in other words, retrieving the money from every customer’s account). The total batch amount will then be transferred via bank-transfer to the merchant’s bank account. How fast a cl...

How Does The Settlement Process Work?

- Settling a batch triggers the process of delivering funds to the merchant and charging the customer’s account. Here are the steps involved in a batch settlement: 1. Several transactions, usually within a 24-hour time frame, are aggregated together into a batch and all the transaction information is sent to the payment processor. 2. The processor then transfers the funds to the …

Batches and Settlements History

- In the earlier days of credit card processing, each card-brand (Visa, Mastercard, etc.) would require a separate processor and financial arrangement. This required individual batches and settlements for each type of card, resulting in multiple bank deposits. Changes in laws have since allowed banks to issue and process multiple card types, letting processors offer merchant acco…

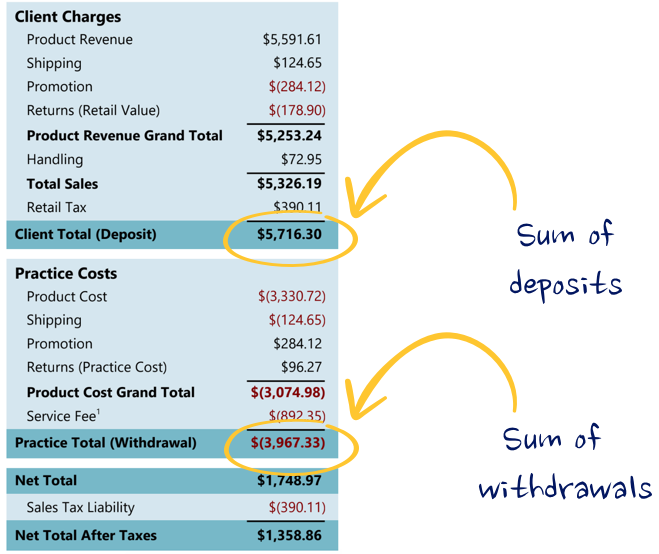

Understanding Gross Settlements vs. Net Settlements

- Some merchant accounts are configured for gross settlements, meaning that the total batch amount you processed will be deposited into your bank account for that day. The actual processing fees that applied to those transactions, and all other transactions that month, are then withdrawn from your bank account on the 1st day of the following month. Other processors will …