A cash settlement is a financial transaction in which one party pays actual money to another party, as opposed to compensating them with a commodity such as stocks. Many insurance claims can be paid in cash in lieu of other forms of compensation, such as repairs.

What is cash settlement in trading?

Cash settlement is a settlement option that is commonly applied in financial derivatives trading. When a financial asset is sold for cash, the seller doesn't really provide the tangible underlying asset but rather delivers the related cash position at the time of expiry or execution.

What is a settlement transaction?

What is a settlement transaction? When you approve a payroll, Wave creates a journal transaction on your Transactions page that records all of the expenses and liabilities related to that payroll. Once you’ve paid your employees, Wave will create a settlement transaction to your "Wave Payroll Clearing" for the amount you are paying your employees.

What are the advantages of using cash settlements?

Cash settlements have enabled the traders to buy and sell contracts on indices and certain commodities which are either impossible or impractical to physically transfer. It is a preferred method since it helps in reducing the transaction costs which otherwise would be expenditure in case of physical delivery.

What is settlement in options trading?

The actual delivery is of the cash where the accounts get debited or credited with the difference, and there is no physical delivery of shares to either of the parties. This type of settlement in options avoids high costs and transaction fees where securities are not transferred, but the upside is enjoyed by all the traders.

What is the difference between physical settlement and cash settlement?

Cash settlement is an arrangement under which the seller in a contract chooses to transfer the net cash position instead of delivering the underlying assets whereas physical settlement can be defined as a method, under which the seller opts to go for the actual delivery of an underlying asset and that too on a pre- ...

What is the difference between cash settlement and delivery?

In the case of physical delivery, the holder of the contract will either have to take the commodity from the exchange or produce the commodity. However, cash settlement does not involve any delivery of assets, but just net cash is settled on contract expiration.

Is cash settlement same day?

Transaction in which a contract is settled on the same day as the trade date, or the next day if the trade occurs after 2:30 p.m. EST and the parties agree to this procedure. Often occurs because a party is strapped for cash and cannot wait until the regular three-business day settlement.

Are cash transactions settled immediately?

Although the price and quantity of an item to be sold are agreed upon when the parties enter into the contract, the exchange of money and delivery of the item does not happen immediately.

What options are cash settled?

Cash-settled options include digital options, binary options, cash-or-nothing options, as well as plain-vanilla index options that settle to the cash value of an index. Cash-settled options may be contrasted with physical settlement.

What is the process of settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

How long does a cash settlement take?

According to industry standards, most securities have a settlement date that occurs on trade date plus 2 business days (T+2). That means that if you buy a stock on a Monday, settlement date would be Wednesday.

Why does cash need to settle?

Since a trade held less than two days in a cash account requires settled funds to avoid a good faith violation, it may become necessary to wait at least two days between trades so that the day trades or short-term trades may be executed using settled funds only.

What time of day does cash settle?

9:00 AM ET on the settlement date.

How much cash transaction is allowed in a day?

Rs 2 lakhAccording to Section 269ST, no person can receive an amount of Rs 2 lakh or more in aggregate from a person in a day in a single transaction; or, in multiple transactions relating to one event or occasion from a person.

What is considered a cash transaction on a credit card?

If you use your credit card to withdraw money from a cashpoint, this is called a cash advance or cash transaction. Unlike with card purchases, you'll be charged interest from the date the transaction is added to your account. You'll most likely pay a transaction fee too.

What is the difference between a cash transaction and credit transaction?

A cash transaction is a transaction where payment is settled immediately and that transaction is recorded in your nominal ledger. The payment for a credit transaction is settled at a later date. Try not to think about cash and credit transactions in terms of how they were paid, but rather when they were paid.

What is a cash settlement for insurance?

A cash settlement is an amount of money we offer to settle your claim. We can settle some or all of your insurance claim using a cash settlement.

What is a delivery payment?

Cash on delivery (COD) generally deals with goods, and the transaction stipulates that the purchaser must pay for the goods when they are delivered. If the purchaser fails to pay for the goods upon delivery, the goods are returned to the seller.

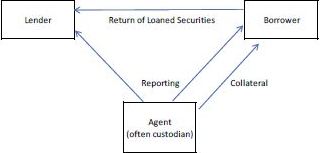

What is delivery and settlement of a forward contract?

A forward contract can be customized for any asset, for any amount, and for any delivery date. The parties can settle in cash, paying out the net benefit/loss on the contract, or deliver the underlying. When the contract settles in delivery of the underlying asset, that final stage is called forward delivery.

Is cash and delivery same in share market?

Intraday trades are driven purely by profits, and are closed within the same day. Delivery trades on the other hand, involve holding stocks for more than a day, and therefore require a person to open a demat account.

Why is cash settlement important?

The main contribution of cash settlement would be to reduce the cost and time for the contract settlement since it is cash-settled, there is only one transaction bound to happen during the end of the contract reducing the cost, and since there is no physical delivery , it saves a lot of time and money resulting in high volumes in the market.

What is a sash settlement?

Sash settlement is a type of settlement where there is no transfer of securities, and only the difference amount is transferred against the physical settlement where securities are ought to be transferred.

Is it safe to trade cash settlement accounts?

It is equally safe, too, as cash-settled accounts require margins to trade and they have to maintain a minimum balance in the account to facilitate trading in the market, which kind of ensures the party against any future default.

Is transaction cost limited?

The transaction cost is also very limited since there is only one transaction bound to happen in the whole deal, and that is on the settlement day.

What is a cash settlement?

In general, a cash settlement is simply the process of using cash to settle some sort of outstanding obligation, thus fulfilling the terms of the transaction and allowing the matter to be considered resolved ...

Why is a cash settlement ordered?

In the matter of legal situations, a cash settlement is often ordered as a means of restitution in the event of a lawsuit.

Why do vendors offer cash settlements?

Some vendors will also offer a client a cash settlement in order to discharge an outstanding debt. This is often the case when the customer is facing severe financial problems and may be considering bankruptcy. In order to avoid being included as a listed creditor in the bankruptcy, the vendor may offer a cash settlement offer to the client that may be up to half the actual amount owed. Often, this is sufficient to at least cover the actual expenses of the vendor, although it eliminates any profit on the invoiced transactions.

What happens if you don't honor a cash settlement?

In the event that the terms of the cash settlement are not honored, then additional restitution may be ordered, assets may be seized to settle the debt, or one of the parties may spend time behind bars. Is Amazon actually giving you the best price? This little known plugin reveals the answer.

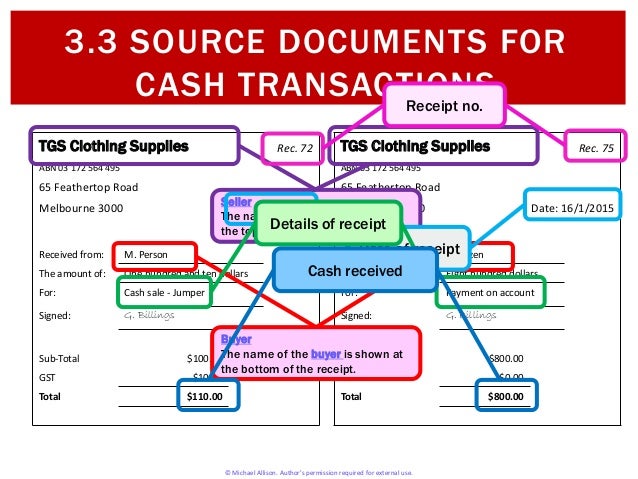

What is cash transaction?

A cash transaction is a transaction where there is an immediate payment of cash for the purchase of an asset. It differs from other types of transactions that involve delayed delivery of the purchased item, or delayed payment for the item, such as forward contracts, futures contracts, credit transactions, and margin transactions.

How much cash do you have to report to the IRS?

Federal law requires a person to report cash transactions of more than $10,000 to the IRS. Here are some facts about reporting these payments.

What is a debit card?

The debit card functions the same as cash as it removes the payment for the apple immediately from the purchaser's bank account. This is a cash transaction. If the person had used a credit card to purchase the apple, no money would have been immediately forfeited ...

How long does it take to file Form 8300?

Form 8300 must be filed within 15 days after the date the cash is received. Take the Next Step to Invest. Advertiser Disclosure.

Is a stock transaction a cash transaction?

Under some definitions, market stock transactions can be considered cash transactions because they happen close to instantly in the marketplace at whatever the current price is at that point in time.

Is a futures contract a cash transaction?

In contrast, a futures contract is not considered a cash transaction. Although the price and quantity of an item to be sold are agreed upon when the parties enter into the contract, the exchange of money and delivery of the item does not happen immediately.

Is a stock transaction considered cash?

Some market stock transactions are considered cash transactions although the trade may not settle for a few days .

What is the difference between cash settlement and physical settlement?

Cash settlement is an arrangement under which the seller in a contract chooses to transfer the net cash position instead of delivering the underlying assets whereas physical settlement can be defined as a method, under which the seller opts to go for the actual delivery of an underlying asset and that too on a pre-determined date and at the same time rejects the idea of cash settlement for the transaction.

What is the advantage of cash settlement?

The single largest advantage of cash settlement is that it represents a way of trading Futures & Options based on assets and securities, which would practically very difficult with the physical settlement.

What is a Physical Settlement/Delivery?

This refers to a derivatives contract A Derivatives Contract Derivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Counterparties for each other, and involve either a physical transaction of an underlying asset in the future or a financial payment by one party to the other based on specific future events of the underlying asset. In other words, the value of a Derivative Contract is derived from the underlying asset on which the Contract is based. read more requiring the actual underlying asset to be delivered on the specified delivery date, rather than being traded out net cash position or offsetting of contracts. The majority of the derivative transactions are not necessarily exercised but are traded prior to the delivery dates. However, physical delivery of the underlying asset does occur with some trades (largely with commodities) but can occur with other financial instruments Financial Instruments Financial instruments are certain contracts or documents that act as financial assets such as debentures and bonds, receivables, cash deposits, bank balances, swaps, cap, futures, shares, bills of exchange, forwards, FRA or forward rate agreement, etc. to one organization and as a liability to another organization and are solely taken into use for trading purposes. read more.

Why is cash settlement used in derivatives?

In derivatives, cash settlement is used in the case of a Futures contract since it is monitored by an exchange, ensuring smooth execution of the contract.

What is the benefit of physical settlement?

The primary benefit of Physical settlement is that it is not subject to manipulation by either of the parties since the entire activity is being monitored by the broker and the clearing exchange. The possibility of the counterparty risk will be monitored, and consequences are known for the same.

Which method of settlement offers greater liquidity in the derivatives market?

The cash settlement method offers greater liquidity in the derivatives market, whereas the physical settlement method offers an almost negligible amount of liquidity in the derivatives market.

What is settlement in finance?

In the world of finance, settlement of securities, including derivatives, is a business process whereby the contract is executed on pre-decided settlement date.

Why do you have to settle cash?

The reason why the cash must be “settled” is that the trader must wait a sufficient amount of time to receive the cash proceeds resulting from a sale transaction or a trade position.

What does it mean when a settlement is over?

When the settlement period is over and cash is “settled”, it means that you are free to withdraw the money or use the money to make buy transactions.

How long do you have to wait to sell XYZ shares?

If you choose to sell your the XYZ shares prior to the three business days you need to wait for your sale transaction of ABC to settle, then you’ll end up being in good faith violation as you are selling securities for which you have not paid for using cash or settled funds (coming from the sale of ABC).

How long does it take to get cash from a stock you sold?

This means that within three business days, you will effectively received the cash from your buyer (settled cash) and the buyer effectively receives the stocks you sold.

What is cash available to trade?

Cash available to trade, as the name suggests, is cash that you currently have in your account that you can use to purchase stocks.

When you transfer funds from your bank account to your cash trading account, what happens?

When you transfer funds from your bank account to your cash trading account, once the cash is transferred and effectively deposited into your brokerage account, that amount will also be money available for trading.

How long does it take to settle a stock?

Depending on the stock exchange, you may have a different settlement period for trading stocks like two business days, three business days or longer.

What is a wave settlement?

The settlement transaction that Wave creates to your "Wave Payroll Clearing" (which will match the direct deposit withdrawal from your bank statement) is categorized to Payroll Liabilities. This debits the Payroll Liabilities balance, decreasing the amount owed, and showing that you have paid off the amount your business owes to your employees. If your bank account is connected to Wave, or if you upload statements electronically, then when the withdrawal transaction from your bank account is imported, it will automatically be categorized as a "Transfer to Wave Payroll Clearing" to show that the funds have cleared.

Does Wave Payroll Clearing automatically pay contractor bills?

If you’re paying contractors through direct deposit, Wave will create individual bill payments for each contractor bill that's on the approved payroll, originating from the "Wave Payroll Clearing". These auto-generated bill payments will mark the contractor bills as Paid, so you don't have to worry about it. If your bank account is connected to Wave, or if you upload statements electronically, then when the withdrawal transaction from your bank account imports, it will automatically be categorized as a "Transfer to Wave Payroll Clearing" to show that the funds have cleared.