A lump sum disability settlement is where an insurance company pays an entire long term disability benefit immediately with one check, instead of at a regular interval (usually monthly) over time.

Are disability benefits affected by a settlement?

Your SSDI and Medicare benefits are not affected by your income, but rather your work history. However, income-based programs such as Supplemental Security Income (SSI) and Medicaid may be affected by a settlement and if you receive personal injury legal funding.

Should you accept a lump sum disability settlement?

Should I accept a lump-sum settlement offer? It depends. You should, however, hire an experienced disability attorney to review the offer and the particular details of your case. Additionally, most offers are negotiable. Never accept the first offer from an insurance carrier. Instead, hire an experienced attorney to negotiate on your behalf.

Will my settlement be taxable?

Taxation on settlements primarily depends upon the origin of the claim. The IRS states that the money received in a lawsuit should be taxed as if paid initially to you. For example, if you sue for back wages or lost profits, that money will typically be taxed as ordinary income.

Should I accept a lump sum disability insurance settlement?

Once you accept a lump sum offer, there is no going back. That said, there are very clear circumstances where, with proper negotiation, a lump sum settlement is a good and beneficial option. A lump-sum buyout gives you the certainty of a steady source of money for many years to come.

See 4 key topics from this page & related content

Can you settle a long-term disability claim?

If your long-term disability insurer has paid monthly benefits for an extended period of time, they sometimes decide that a buyout is a more reasonable option. A long-term disability buyout is similar to a personal injury or workers' compensation settlement.

What exactly does disability cover?

Disability insurance protects your paycheck if you lose your ability to work due to an illness or injury. This type of insurance pays a sum roughly equivalent to your take-home pay after a waiting period.

How does a lump-sum settlement affect Social Security disability?

If you receive a lump-sum payment in settlement of your workers' compensation case, Social Security divides the amount of the settlement by your monthly SSD benefits. For example, if you get a lump-sum payment of $20,000 and divide it by the $2,000 monthly SSDI benefit, the result is 10.

Can you cash out disability insurance?

Can you cash out disability insurance? Unlike certain types of life insurance, you can't cash out your disability policy — unless you have a return-of-premium rider, which can pay out a lump-sum refund when you reach certain milestones.

What are the four sources of disability income?

Disability insurance or income replacement insurance as it is sometimes called can help you do just that.Group Short-Term Disability Insurance and Group Long-Term Disability Insurance. ... Social Security. ... Workers' Compensation. ... Savings. ... Borrowing. ... Other Income. ... Individual Disability Income Insurance.

What are the two types of disability insurance?

There are two basic types of disability insurance: Short-term and long-term.

Does Social Security Disability monitor your bank account?

To verify resources, SSA uses an electronic system that verifies bank account balances to determine if claimants are eligible for SSI. In addition, SSA's system searches for accounts geographically near the SSI applicant or beneficiary. If a claimant fails to report a account, they will find it.

What is the monthly amount for Social Security disability?

Social Security disability pays an average monthly benefit of $815 to approximately 5.1 million workers with disabilities. In addition, some 1.6 million members of their families receive monthly benefits.

Does disability pay more than Social Security?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

Are disability benefits paid in one lump-sum?

Quite simply, a lump-sum buyout is when your disability insurance company agrees to make a one-time payment to you. They do this in exchange for you agreeing to sign away your rights under the policy. This lump-sum payment represents the value of future disability payments.

Can I collect Social Security and disability at the same time?

Many individuals are eligible for benefits under both the Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) programs at the same time. We use the term “concurrent” when individuals are eligible for benefits under both programs.

Is lump-sum disability insurance payment taxable?

Some Lump-Sum Settlements Are Taxable Tax laws regarding disability settlements are no exception. Generally, if the long-term disability (LTD) policy was provided by the employer as a fringe benefit, the payments you receive—or the lump-sum settlement in an ERISA lawsuit—would be taxed as income.

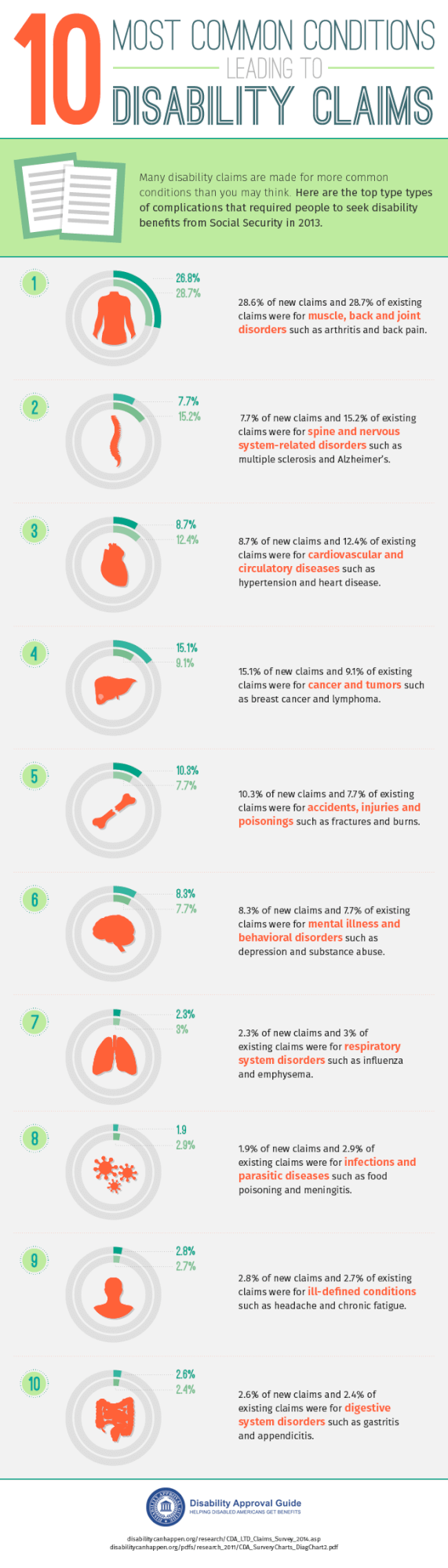

What conditions qualify for disability?

What Conditions Qualify for Disability?musculoskeletal problems, such as back and joint injuries.cardiovascular conditions, such as heart failure or coronary artery disease.senses and speech issues, such as vision and hearing loss.respiratory illnesses, such as COPD, cystic fibrosis, or asthma.More items...

What is the most approved disability?

1. Arthritis. Arthritis and other musculoskeletal disabilities are the most commonly approved conditions for disability benefits. If you are unable to walk due to arthritis, or unable to perform dexterous movements like typing or writing, you will qualify.

What should you not say in a disability interview?

Making Statements That Can Hurt Your Claim – Unless you are specifically asked pertinent questions, do not talk about alcohol or drug use, criminal history, family members getting disability or unemployment, or similar topics. However, if you are asked directly about any of those topics, answer them truthfully.

What are the 21 types of disability?

There are many types of disabilities....1 - Mobility and Physical Impairments. ... 2 - Spinal Cord Disability. ... 3 - Head Injuries - Brain Disability. ... 4 - Vision Disability. ... 5 - Hearing Disability. ... 6 - Cognitive or Learning Disabilities. ... 7 - Psychological Disorders. ... 8 - Invisible Disabilities.

What are the symptoms of disability discrimination?

You might have experienced fear, depression, and anxiety among other things. Before being compensated for the mental and emotional distressed caused by the disability discrimination, you will likely be evaluated by a professional.

Can you get compensation for lost wages?

Lost wages —if you were discriminated against and subsequently experienced illegal firing, you will likely be eligible to receive compensation for the wages you lost after being fired because of your disability. If you did not experience wrongful firing, you might still be eligible to receive compensation for lost wages. If the discrimination affected your ability to earn wages in the form of pay raises, pay increases with promotions, or bonuses, you might be eligible to receive that compensation.

What happens if the settlement agreement is not clear?

If the language of the settlement agreement is not clear, SSA will likely ask for immediate documentation of the medical and legal expenses associated with the settlement. The rules about which items have to be written specifically into the settlement agreement are determined by state law, not federal law; therefore, settlement agreements vary widely from state to state.

How much is reduced in SSDI?

In this situation, SSA generally requires a reduction in SSDI benefits so that the total monthly amount received is not more than 80% of the amount the individual earned when he or she was employed and working.

How does SSA determine offsets?

In determining offsets, SSA will look closely at the specific language of the workers’ compensation settlement agreement. As a result, workers’ compensation attorneys try to draft settlement agreements that will minimize potential SSDI benefit offsets. They will specifically exclude medical and legal expenses from the total lump sum so that SSA cannot consider those items part of the total settlement amount. If the language is not clear, however, SSA can consider the whole amount as eligible for offsets.

How does the SSA offset workers compensation?

They divide the lump sum by the periodic workers’ compensation payments the individual had been receiving and then apply the SSDI offset for those number of months.

How does lump sum affect Social Security?

How Do Lump Sum Settlements Affect Social Security Disability? Some workers who are eligible for Social Security Disability Insurance (SSDI) benefits may also be eligible for workers’ compensation benefits if their injury or condition is the result of a work-related accident or illness.

Do workers compensation claims settle?

Many times, claimants for workers’ compensation settle their cases before their claim gets to the hearing or trial stage. They choose to give up their entitlement to monthly workers’ compensation benefits in exchange for an immediate lump sum cash settlement.

Can SSA reduce SSDI benefits?

If you are worried that SSA will reduce your SSDI benefits because of a lump sum workers’ compensation settlement, talk to a disability attorney so that your workers’ compensation case can be resolved in a way that leaves you with the maximum payment amount each month.

What is workers compensation settlement?

Workers Compensation Settlements. Workers compensation insurance provides a safety net for medical expenses and lost wages of those who get hurt on the job. But that doesn’t mean such workers have to accept whatever the insurance company offers. A workers compensation settlement is a way you can negotiate the immediate payment ...

How Is a Settlement Calculated for Workers Compensation?

The formula for calculating a workers compensation settlement package involves four major factors:

What happens if you dispute a workers comp claim?

If your claim is disputed, a trial or workers comp hearing is time-consuming and risky. The judge or hearing officer may award you less money than the insurance company offered to settle your workers comp claim. Note: Workers comp settlements are entirely voluntary. You don’t have to agree to a settlement offer proposed by your employer ...

How long does it take to settle a workers comp case?

Short answer: It varies greatly. The Martindale-Nolo survey of readers turned up an average of 15.7 months to resolve a case, and less than 20% of cases are resolved in less than six months. Obviously, those who try to negotiate a better workers comp settlement may hire legal assistance to negotiate the best terms for a settlement or to bring a hearing if there is a disputed issued. This can be time consuming. However, a shorter time frame is not always better. Those actions that lengthen the process can also bring higher settlements.

Why do you settle a lump sum claim?

If you settle the claim, you can choose or change your physicians. However, if you have severe and complicated work-related injuries, you may not want to settle the medical portion of the claim because you can be entitled to medical benefits for your accident for the rest of your life. Some injuries are too complicated to take the risk that you will not have enough money through a settlement to meet your medical needs.

What happens if you don't receive temporary benefits?

If the injured worker did not receive temporary benefits for medical expenses and lost wages prior to the settlement, those variables will be included in a final agreement. Typically, however, settlement negotiations only involve workers who were permanently disabled.

How long does it take for a settlement to be approved?

Those actions that lengthen the process can also bring higher settlements. Once an agreement is reached, it can take four-to-eight weeks for money to arrive while settlement contracts are drafted, signed and approved.

How to contact LTD disability legal team?

We would be happy to answer all of your questions related to your LTD claim and to help you make the decision that is right for you. Call us at (888) 321-8131 or contact us online.

How much of your disability is offered by LTD?

Once the present value of your claim has been calculated, the LTD insurance company will offer you some percentage of that amount—typically between 50% and 70% of the total value of your disability claim. It is important to note that these percentages can vary considerably. The initial offer may be just the starting point – some insurance companies may be willing to negotiate.

What is present value in disability?

Present value is also an important concept in the disability insurance world. Insurance companies use the concept of present value to calculate your LTD lump sum buyout amount and, as you might expect, the insurance companies will do everything possible to ensure the calculation works in their favor. The calculation is based on a variety of factors including:

Can you go back to the insurance company for a lump sum disability?

Not only is it hard to determine if the amount offered by the insurance company is fair, but if you do accept an LTD lump-sum buyout offer, the decision is final—you can’t go back to the insurance company and ask for more money. For these reasons, you need to consider your options carefully before you give up your monthly disability insurance benefits.

What happens if you don't settle your workers comp claim?

If you don't take the settlement and your claim proceeds to a hearing at the workers' comp appeals board or litigation at the state court level in your state, the judge may rule in your employer's favor , leaving you with little or no benefits.

What are the two types of settlement agreements?

Types of Settlement Arrangements. There are two primary types of settlement arrangements: lump-sum and structured settlements. In a lump-sum settlement, you will sign a settlement agreement giving up certain rights in exchange for a one-time, lump-sum payment from your employer or its insurance company.

What is an unpaid medical bill?

Unpaid Medical Bills. Your workers' comp claim entitles you to continued medical care for your injury or illness. And if your injuries were relatively minor, you may be seeking only to have your medical bills paid for by your employer under your worker's compensation claim. Your employer may offer you a lump-sum settlement in exchange ...

What happens if you are partially disabled?

If your work-related injuries resulted in some type of permanent impairment, but did not render you totally disabled, you are likely to be entitled to a monetary award to compensate for your permanent impairment.

Is a workers comp settlement a guarantee?

On the other hand, you may prevail and actually win more than the settlement offer. A settlement is a guarantee to provide you with certain benefits and takes out the risk associated with litigation.

Do you have to agree to a workers comp settlement?

Your employer or its workers' comp insurance company does not have to agree to settle your claim, and you do not have to agree with a settlement offer proposed by your employer or its insurance company. If you are discussing settlement regarding one ...

Does Oregon allow settlements?

What is, and what is not, permitted regarding settlements is often not described in state statutes. Oregon, for instance, does not have a statute that allows settlements regarding medical benefits. However, attorneys can and regularly do draft settlement agreements that effectively extinguish a worker's right to future medical benefits. An attorney in your area familiar with workers' compensation can help you determine what your settlement options you have and whether it's in your best interest to accept a settlement offer.

The Basics of A Lump-Sum Disability Settlement

Present Value

- When your insurance company offers you a lump-sum they are paying you the present-day value for your disability benefits. If you receive payments, then they will likely be worth less over time due to inflation. If you got all of your lump-sum settlement now, you might be able to invest it or put it in a high-yield savings account and earn interest to protect yourself from the value erosion …

Mortality Assessment

- There’s something called a mortality assessment to be aware of when considering a lump sum payout. An insurance company will consider whether or not your disability leads to a higher likelihood of you dying before your benefits end. The insurance carrier assesses risk based on the specific injury or illness. Long-term disability insurance benefits are usually paid until your Socia…

Tax Implications

- If you’re weighing a lump sum, there are tax implications. If you paid for your long-term disability insurance premium with after-tax dollars, then your disability benefits should probably be tax-free. If your employer paid for your premium as an employment benefit or you paid with pre-tax money, then your benefit is probably taxable at the same rate as income tax. If you receive a lump-sum …

What Should You Consider?

- There are some pros and cons of both taking a lump-sum buyout or receiving regular payments. One big perk of the buyout is that it may keep you from getting denied from your benefits, or from having your claim be terminated. When you receive long-term disability benefits, you often have to show documentation from your health care providers to prove you still need them. With a buyout…