The draft settlement statement shall contain the Seller Parties’ good faith estimate of the amounts (based on facts and circumstances then known to the Seller Parties), as of the anticipated applicable Adjustment Time, of the items to be prorated between the Parties, or to be credited to either Party, pursuant to this Section 8 (a).

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

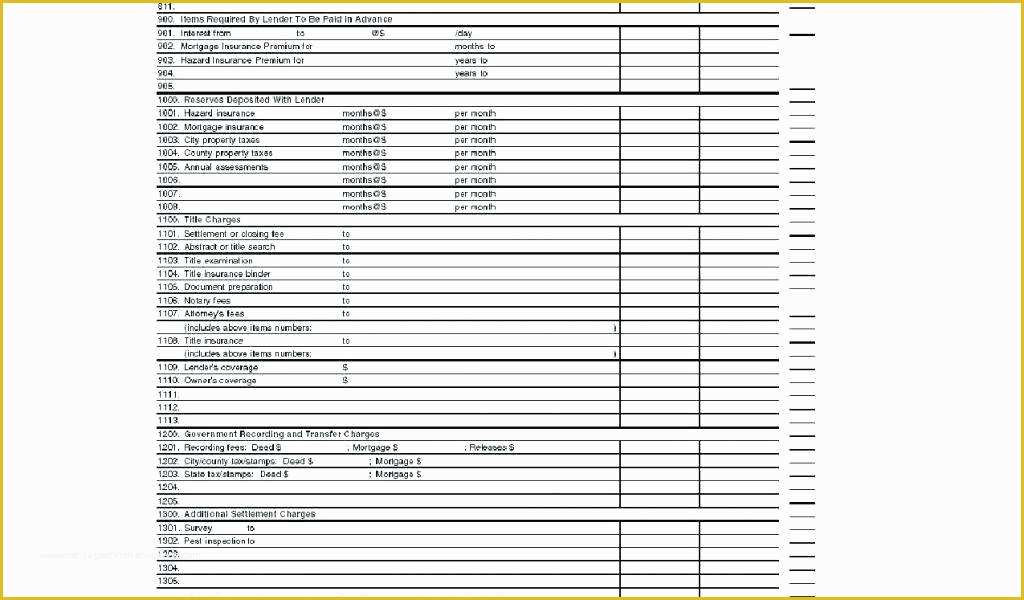

What details are included in A HUD-1 Settlement Statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement, details every charge associated with your new loan . It also outlines who is responsible for each of those charges - the buyer or the seller - as well as any credits you may receive for things like taxes, insurance or deposits.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Is the settlement statement the same as the closing?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

How do you write a settlement statement?

A settlement agreement should be in writing....Those requirements include:An offer. This is what one party proposes to do, pay, etc.Acceptance. ... Valid consideration. ... Mutual assent. ... A legal purpose.A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

Who typically drafts the closing statement?

Draft Closing Statement means a draft closing statement, prepared by Seller, as of the close of business of the third (3rd) business day preceding the Closing Date setting forth an estimated calculation of both the Purchase Price and the Estimated Payment Amount.

What is settled statement?

A settled statement is a summary of the superior court proceedings approved by the superior court. An appellant may either elect under (b)(1) or move under (b)(2) to use a settled statement as the record of the oral proceedings in the superior court, instead of a reporter's transcript.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

How do you draft a settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

What is a draft closing statement?

Objective: The closing statement is the attorney's final statement to the jury before deliberation begins. The attorney reiterates the important arguments, summarizes what the evidence has and has not shown, and requests jury to consider the evidence and apply the law in his or her client's favor.

What happens at settlement for the seller?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

Do lenders check bank statements before closing?

Do lenders look at bank statements before closing? Your loan officer will typically not re-check your bank statements right before closing. Lenders are only required to check when you initially submit your loan application and begin the underwriting approval process.

What is an example of settlement?

An example of a settlement is when divorcing parties agree on how to split up their assets. An example of a settlement is when you buy a house and you and the sellers sign all the documents to officially transfer the property. An example of settlement is when the colonists came to America.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Are HUD-1 settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

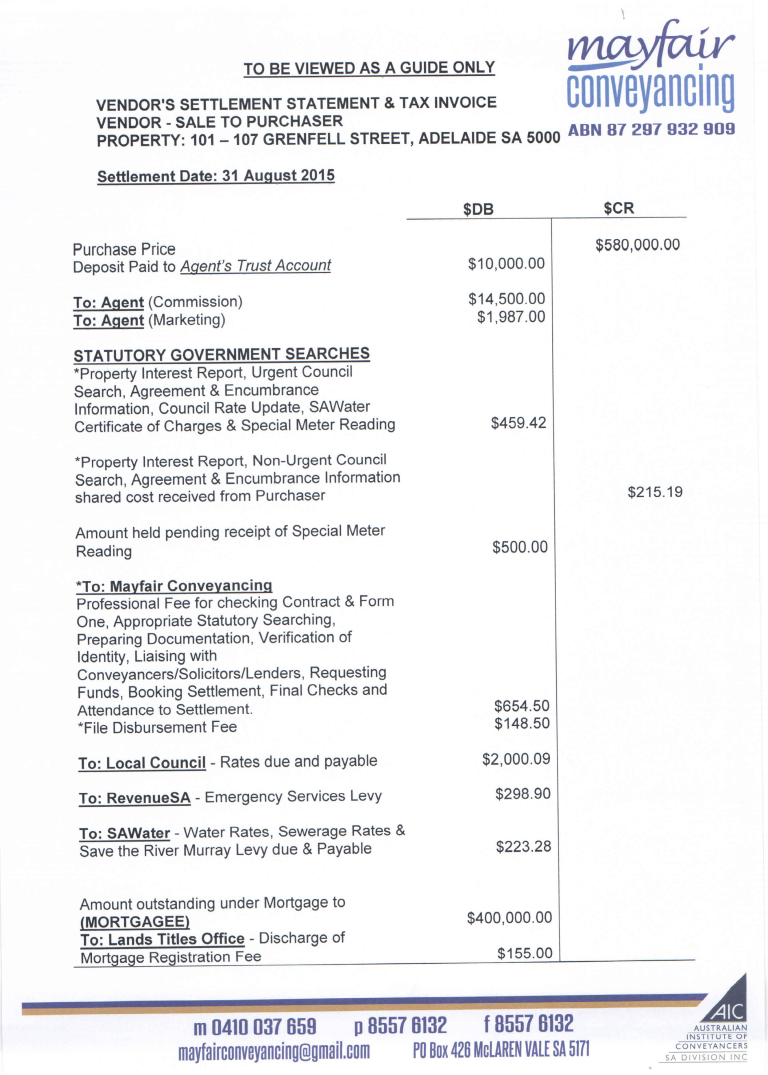

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

What Is a Settlement Statement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client.

What to consider when writing a settlement statement?

Either way, one needs to consider many things when writing a settlement statement. Here are some of those things: Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. If you don’t have one, don’t write it.

Why do both parties need to check the contents of a document?

Both parties need to check the contents of the document thoroughly in order to avoid future conflicts and lawsuits. This will serve as one of the final agreements both parties will undergo upon the completion of their transaction. The process, however, might vary from one service provider to another, so the client also need to review the process properly.

Why do people use financial statements?

People involved in business also make use of statements in conducting their business operations. Financial statements express a company’s financial status, operations, and plans over a certain time period. This goes to show that statements are reliable even in the world of business.

Is a statement a reliable source of information?

Most of us are aware that statements are reliable sources of information. Statements vary from being accounts of people about certain topics (as in statement of purpose ), to being used as an evidence in the court of law (as in witness statements ). These, among other things prove that statements are useful sources of facts and information.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

What does a well-researched and cogent statement tell the judge?

A well-researched and cogent statement tells the judge you’ve thought about—and care about—your case. Your thought and care promotes theirs

What did panelists draw on their experiences and observations from the bench and practice on enhancing pre-settlement?

Panelists drew on their experiences and observations from the bench and practice on enhancing pre-settlement conference position papers, as well as tips and suggestions for more successful settlement conferences.

Should you talk to a settlement conference judge?

With notice to the other side, talk with the settlement conference judge beforehand about aspects of your case that you’re uncomfortable disclosing ( e. g., difficult client) or intricate details the judge to may need to delve into beforehand to get perspective they’ll need. Oftentimes judges aren’t prepared to “rule” on the case, and if a litigant wants the judge to understand a particular aspect, they should tell the judge in advance. This technique often proves especially useful for nuances, awkward facets, and explaining why a defendant really can’t go above a maximum they’ve set

Is it too early to file a settlement?

Judge Finnegan replied that yes, sometimes it’s too early for a settlement conference, but she generally encourages litigants to prepare for a conference before filing a motion for summary judgment.

Can you attack a discharge decision maker?

For employment discharge cases: don’t attack the discharge decisionmaker. That makes it more difficult to “sell” a settlement to the settlement decisionmakers

Should litigants jointly memorialize their principal settlement terms?

If the litigants successfully reach a settlement, to avoid later confusion and dispute, they should jointly memorialize their principal settlement terms in detail before anyone leaves

Paul William Ralph

From the sound of it the insurance carrier (I assume yours) is trying to resolve your property damage claim. Typically, if they do pay such a claim and another driver involved in the accident is determined to be at fault, they will seek reimbursement from that driver or his insurance carrier.

Jeffrey Shawn Hughes

It sounds like your car was totaled and the insurance company is giving you the fair market value of your car and wants to salvage the vehicle. Fill out the forms they have sent you and return them. If you were injured be sure to make sure that you DO NOT SIGN any form that says Release of Bodily Injury claim.

Matthew R. Newborn

It's a check and yes, it's part of the "process". Make sure any forms (Release) you sign indicate for Property Damage Only - if you were injured too. Once you send in the paperwork, it takes about a week until you get your "draft" a/k/a "check".

Christian K. Lassen II

Make sure you don't sign a release if you were injured, so have a local personal injury lawyer review the docs. Avvo has a great lawyer finder tool to locate an attorney close to your home. Good luck.

John M. DeProspo

Settlement draft is another way of saying settlement check. It is hard to say how long it might take you to get the check.

Bruce Ward Bain

It is part of the process. They sound like they want to send you money for your car. They will not until you send them the docs back. Probably about a week once you return the docs.