Essentially, the estate settlement process occurs immediately after a loved one passes away, leaving behind assets and debts. This process involves applying for probate

Probate

Probate is the legal process whereby a will is "proved" in a court and accepted as a valid public document that is the true last testament of the deceased. The granting of probate is the first step in the legal process of administering the estate of a deceased person, resolving all claims and distributing the deceased person's property under a will.

What is the difference between an estate and an estate settlement?

Estate: The assets owned by a person at the time if their death, which are to be distributed according to a Will or court ruling. Estate Settlement: Refers to the process of notifying Ameriprise of a death and requesting payment according to the terms of the account.

What does estate settlement mean on Ameriprise?

Estate Settlement terminology. Estate: The assets owned by a person at the time if their death, which are to be distributed according to a Will or court ruling. Estate Settlement: Refers to the process of notifying Ameriprise of a death and requesting payment according to the terms of the account.

How do I navigate the estate settlement process?

We are here to help you navigate the Estate Settlement process: Ameriprise financial advisors are able to explain the various investments and products owned by the deceased. We encourage you to contact the deceased's Ameriprise financial advisor listed on their Ameriprise Client Statement to start the settlement process.

How long does it take to settle an estate?

The national average for the estate settlement process is typically between 14 and 18 months, however, Clear Estate can reduce it to less than a year. It will ultimately come down to a variety of factors, including the complexity of the estate, the assets being distributed, and the jurisdiction.

What does it mean to settle someone's estate?

Estate Settlement Overview. The settling of an estate is essentially the administrative process of settling someone's financial affairs after he or she is deceased. Settling an estate will vary based on the state laws where property was owned and whether there was a Will.

What is the legal term for settling an estate?

The probate process for an intestate estate includes distributing the decedent's assets according to state laws. If a deceased person has no assets, probate may not be necessary. In general, a probate court proceeding usually begins with the appointment of an administrator to oversee the estate of the deceased.

How long do most estates take to settle?

The Basics of Probate Timelines A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

How much does it cost to settle an estate in Canada?

Estate settlement is often charged as a percentage of the estate value and can range from 2.5 per cent to 5 per cent.

Do beneficiaries pay taxes on estate distributions?

While beneficiaries don't owe income tax on money they inherit, if their inheritance includes an individual retirement account (IRA) they will have to take distributions from it over a certain period and, if it is a traditional IRA rather than a Roth, pay income tax on that money.

How much can you inherit from your parents without paying taxes?

What Is the Federal Inheritance Tax Rate? There is no federal inheritance tax—that is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022.

What debts are forgiven at death?

What Types of Debt Can Be Discharged Upon Death?Secured Debt. If the deceased died with a mortgage on her home, whoever winds up with the house is responsible for the debt. ... Unsecured Debt. Any unsecured debt, such as a credit card, has to be paid only if there are enough assets in the estate. ... Student Loans. ... Taxes.

Can an administrator of an estate take everything?

The simple answer is no. The executor has the authority to hold the assets for a certain time for safe-keeping before distributing it. But he cannot withhold assets for any selfish benefit. In a few rare situations, the fee of an executor exceeds the value of the estate in which case he will have to take everything.

How does an executor distribute money?

How long do executors have to pay bequests? The executor has a duty to collect in the estate's assets and settle any outstanding debts (or liabilities), including the funeral bill. After all liabilities have been settled, whatever's left can then be distributed to the beneficiaries.

Who gets paid first from an estate in Canada?

The Canada Revenue Agency (CRA) has priority to estate assets for any amounts owed to it over the reasonable funeral expenses charged by a funeral home for their services to the deceased. This priority becomes important when a personal representative (executor or administrator) is dealing with an insolvent estate.

How long does an executor have to settle an estate Canada?

one yearIf the executor has obtained a grant of probate, the executor is generally allowed one year to gather in the assets and settle the affairs of the estate. This is called the executor's year. During this time the executor cannot be compelled to pay cash gifts described in the will.

Do executors get paid?

Does the executor get paid for the work they do? Normally the executor is not a paid role unless the Will makes special provision for this. Sometimes the executor may be a professional, such as a lawyer or an accountant, so the Will might have a specific clause that allows for payment for their services.

How long does it take to settle an estate after house is sold?

Probate typically takes 9-12 months to settle an estate. However, it can sometimes take longer if, for example, there is a property to sell, complex Inheritance, Income or Capital Gains Tax affairs to resolve or there are complications regarding the personal representatives or beneficiaries of the estate.

How do I settle an estate in Massachusetts?

Settling an Estate in MassachusettsFile a petition for probate and the will with the court in the county where the decedent lived along with any necessary fees.An executor or personal representative will be appointed or approved by the court to act on behalf of the estate.More items...

How long does an executor have to settle an estate in New Jersey?

Generally, they are 9 months from the date of death for a Federal Estate Tax Return and 8 months for a NJ Inheritance Tax Return. When all obligations of the estate are satisfied, the executor should disburse the remaining estate assets to beneficiaries.

How long do you have to settle an estate in Pennsylvania?

There is no specific deadline for filing probate after someone dies in Pennsylvania. However, the law does require that within three months of the death, creditors, heirs, and beneficiaries are notified of the death. Then, within six months, an inventory of assets must be prepared and filed with the Register of Wills.

When can an estate be closed?

Once all assets have been distributed to the relevant beneficiaries and all fees and taxes have been paid, the estate can officially be closed.

How long does probate take in Ontario?

Most probate proceedings take several months. In Ontario, for example, probate can last up to 6 months.

What is the note on beneficiaries?

A note on beneficiaries: As an estate executor, dealing with beneficiaries will be one of your responsibilities. However, this can be a tricky road to navigate, since the death of a loved one brings up a lot of emotions and beneficiaries can often feel abandoned and ignored during the settlement process.

Can executors distribute assets?

Once all fees and debts have been taken care of, the executor can petition the court to finally distribute the remaining assets to the designated beneficiaries. The court will usually only grant this step once the executor has provided the probate court with a detailed list of every financial transaction that’s been done on behalf of the estate throughout the probate process.

What is Probate?

Probate: the official proving of a will. The probate process is intended to establish the legal validity of a will but it involves so much more than merely confirming that the signed, witnessed, and registered copy of a will is authentic.

What Happens When There is No Will?

When someone dies without leaving a dated, signed and properly witnessed will, the court decides who should receive the deceased's assets. It won't matter what your familial relationships were really like; the state will award property and cash to the survivors based solely on their legal relationship to the deceased.

Hiring an Attorney

Losing a loved one can be an overwhelming experience and when you add in estate settlement issues, the months following the death can be much more than we bargained for. That's when it might be advantageous to hire an attorney.

What is Probate?

Probate: the official proving of a will. The probate process is intended to establish the legal validity of a will but it involves so much more than merely confirming that the signed, witnessed, and registered copy of a will is authentic.

What Happens When There is No Will

When someone dies without leaving a dated, signed and properly witnessed will, the court decides who should receive the deceased's assets. It won't matter what your familial relationships were really like; the state will award property and cash to the survivors based solely on their legal relationship to the deceased.

Hiring an Attorney

Losing a loved one can be an overwhelming experience and when you add in estate settlement issues, the months following the death can be much more than we bargained for. That's when it might be advantageous to hire an attorney.

What is probate in a will?

Probate: the official proving of a will. The probate process is intended to establish the legal validity of a will but it involves so much more than merely confirming that the signed, witnessed, and registered copy of a will is authentic.

What Happens When There is No Will?

When someone dies without leaving a dated, signed and properly witnessed will, the court decides who should receive the deceased's assets. It won't matter what your familial relationships were really like; the state will award property and cash to the survivors based solely on their legal relationship to the deceased. This is called dying "intestate". Generally only spouses, common-law spouses, and blood relatives inherit under intestate succession laws.

Is estate settlement the hardest part of the process?

Sometimes estate settlement is one of the hardest aspects of dealing with the death of a family member. This doesn't have to be the case if proper preparation of all estate documents took place prior to the death. If you have the services of an experienced estate lawyer at your disposal, there can be even less worry and strife.

Why is a genealogist needed?

The appointed administrator is often represented by an attorney, and a genealogy has already been ordered by the court. A professional genealogist is hired to conduct the research to determine all of the living heirs, and the genealogist’s report is presented to all attorneys (some known heirs also have their own attorneys) and to the court.

Does a genealogist require specific accreditation to conduct the search?

Each court has the discretion of setting its own standards for the requirements to be considered an “expert” in the field of genealogy. The standard that is often used is the passing of a certification test (BCG – Board Certified Genealogist; or AG – Accredited Genealogist) or proof of education in genealogy.

Other than a genealogist who else can do such a search?

Anyone can do the search, but the court will generally require the report of a professional genealogist. Prior to having my credentials, I often participated in the research phase for estate settlements, but the report was prepared by a credentialed researcher.

What challenges does a genealogist face when conducting a search?

There are a few challenges. The biggest challenge is obtaining the needed records. The genealogy must be proven with evidence, and this usually requires obtaining the birth, marriage, and death records of every heir, and the records must be certified original records, not copies.

What is the basic process of conducting a search?

Once we’ve had a chance to review the case, we usually begin with the decedent, and the client is asked to provide us with any information, documents or evidence already in possession that would help with creating a family tree.

How long does it take to settle a mortgage?

While the real estate settlement process can be a lengthy endeavor, it is also an exciting one. Most federal mortgage loans close within 30 to 45 days on average, although the type of home buyer program can sometimes extend this timeline. No matter what type of loan you choose, you can expect your closing to be filled with countless contracts, documents, and other types of paperwork that requires your careful review and signature. To learn more about the real estate settlement process or the importance of acquiring title insurance for your new home, contact the title service professionals at Mathis Title Company.

What is the closing of a home?

Buying or selling a home is often a long, tedious process with many variables involved. One part of the process that everyone can look forward to is the closing. Also referred to as a ‘real estate settlement,’ the closing on a home is the final step before the buyer receives the keys, documents get recorded and proceeds disbursed. While the concept of a closing seems fairly straightforward, there are some important aspects to consider before transferring the deed from seller to buyer. As you get closer to your closing date, familiarize yourself with the real estate settlement process.

Why do you need an escrow account?

All parties involved in a real estate transaction, including the buyer, seller, borrower, and lender, want assurance that their funds are safe and secure. As the buying/selling process can take several weeks or months to complete, having an escrow account in good standing can mitigate certain risks and provide peace of mind. An escrow account allows a neutral third party to take possession of all funds relating to the transaction until the real estate has been settled. After closing, the funds are transferred from the escrow account to the rightful parties.

What happens after closing on a house?

After closing, the funds are transferred from the escrow account to the rightful parties. A title search is a crucial part of the home buying process as it helps reveal possible defects in the title of a property. Along with performing a title search comes title insurance.

What documents are needed to complete a real estate transfer?

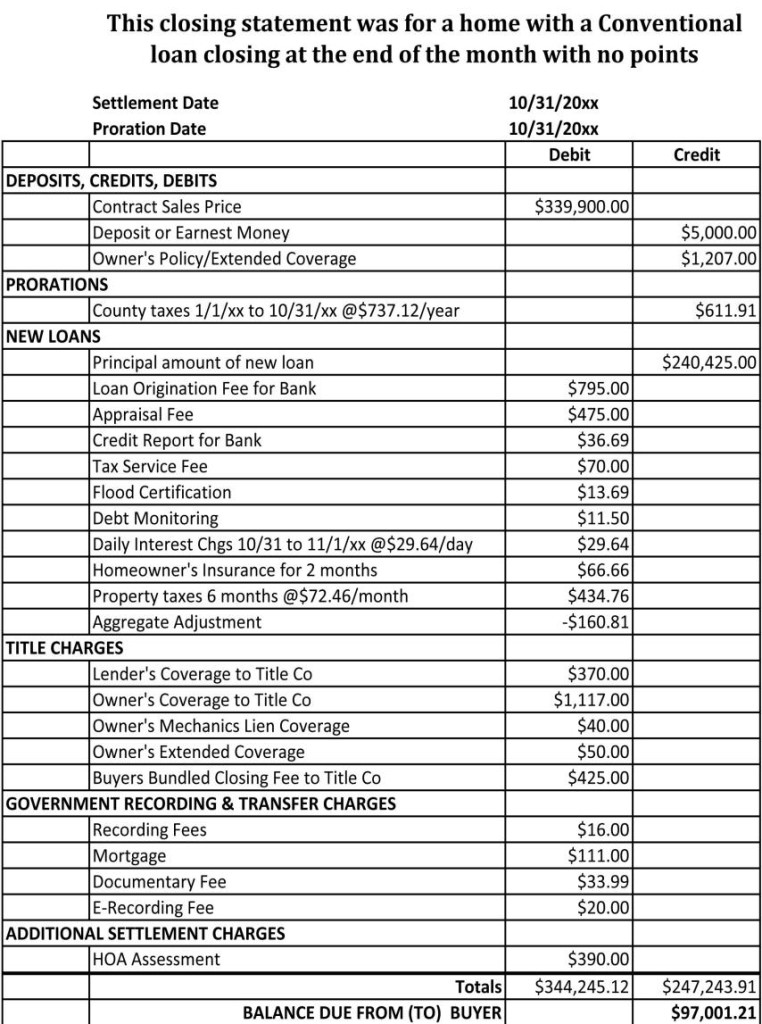

There are a number of documents involved in this process, including a bill of sale, an insurance certificate, the deed, and a settlement statement which includes all settlement costs . The buyer will also need to review the proration agreements and acknowledgements of reports. Some of these legal documents may need to be notarized.

What to do if a deceased person leaves a will and a living trust?

If the deceased person left both a will and a living trust, as many people do, you'll need to work closely with your counterpart who's in charge of trust assets, the successor trustee. A living trust is like a will in that it lets someone leave property to named beneficiaries.

How to determine if a property is subject to probate?

To make this determination, you'll have to tally up the value of the property subject to probate, see how title is held, and learn your state's rules on what estates qualify for simplified procedures. If you need to conduct a probate court proceeding, you can probably get help from the court's website or other materials. You may also want to hire a lawyer to help with probate paperwork or to help solve any disputes among beneficiaries or creditors.

How to notify beneficiaries of a probate?

Your court, or a lawyer, can help you notify beneficiaries. If the estate goes through probate, you'll have to send very particular kinds of notices to a certain group of people. Whether or not there's a court proceeding, it's always a good idea to be in regular communication with beneficiaries.

Do small estates owe state taxes?

Smaller estates may owe a separate state estate tax; it all depends on where the deceased person lived and owned property. 12. Distribute the assets. When the debts and taxes are paid, when the probate (if any) is closed, your last job is to distribute property to the people who inherit it under the will or state law.

What is estate settlement?

Estate Settlement: Refers to the process of notifying Ameriprise of a death and requesting payment according to the terms of the account.

Why are estate settlements placed in a new account?

Estate Settlement proceeds are often placed in a new account in the name of the claimant, to support tax reporting and establish correct ownership. From that point forward the recipient (s) may treat the account and proceeds as their own, investing or disbursing as allowed by the product.

What age can a claimant be?

A claimant is under the age of 18. A claimant has a fiduciary, such as a court-appointed Guardian/Conservator or Attorney-in-fact, who acts on their behalf. The Estate of the deceased will not be going to Probate court, and the Executor would like to discuss alternate options.

What factors influence the settlement of an account?

Some of the common factors that influence the settlement include: The type of financial product (stock, mutual fund, annuity contract, etc.), the unique features of that investment, and laws and regulations governing that investment.

How to mail an estate settlement claim?

If you are mailing the materials yourself, place the Estate Sett lement claim form and the required documents together in one envelope. Include the deceased's name, an identifier such as an Ameriprise client ID number, and the submitter's name and contact information on documents you send. Our mailing address is:

How long does it take to settle a claim?

Once the claim form and required documents are received in good order, the settlement is processed within several business days. Often it is possible to settle just the portion for the person who sent in their completed forms and requirements.

Is it difficult to settle an estate?

The passing of a loved one is always difficult. Managing the tasks involved in estate settlement during an already stressful time can seem overwhelming. Ameriprise is here to help guide you through the process.