What is a final settlement statement? A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. Generally, loan settlement statements can also be referred to as closing statements.

What is a final settlement statement for closing?

The final settlement statement breaks down all the numbers for the transaction. For more information on closing disclosures, see the Consumer Financial Protection Bureau. A lot of numbers go into the closing process. The closing settlement statement is your document of truth for all the charges related to your closing.

What is a settlement statement in real estate?

The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement. Some of these costs include loan origination fees, closing costs, and appraisal fees. Here’s Investopedia’s definition of a Settlement Statement .

What should I do if I have a question about settlement statements?

If you have a question about your settlement statement, HomeLight always encourages you to reach out to your own advisor. It’s the moment when you can’t bear to see another piece of paper related to your home sale that you’ll receive the settlement statement — also known as a closing statement in real estate.

What types of transactions are typically consummated with a settlement statement?

Business transactions: Large business transactions, such as mergers and acquisitions, are usually consummated with some type of closing or settlement statement.

Is a settlement statement the same thing as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is a settlement statement for taxes?

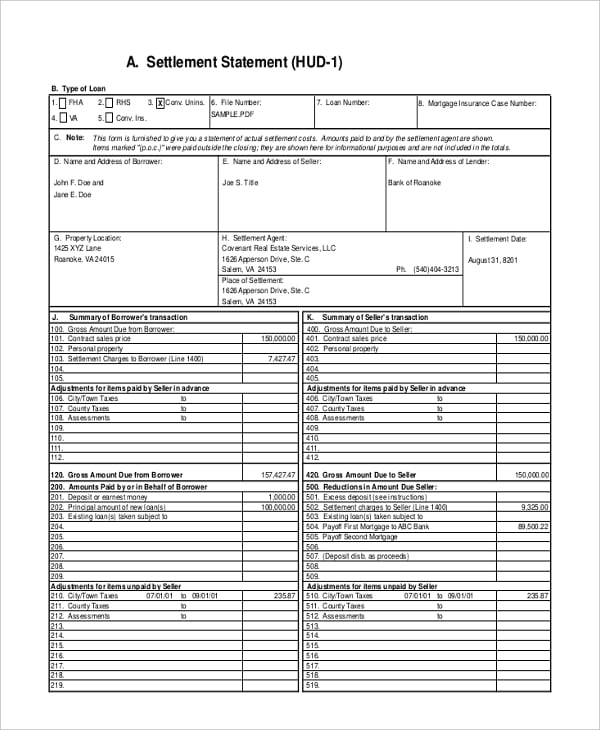

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

Is a closing statement the same as a closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

What is the purpose of the closing statement?

The purpose of a closing statement is to summarize the transaction. The sales contract negotiated between the seller and buyer controls all aspects of the closing. Virtually every item in a closing is subject to negotiation and all costs and charges will be allocated on the basis of that negotiation.

How can I avoid paying taxes on a settlement?

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

Are lawsuit settlements taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Who typically prepares the closing statement?

Typically, closing agents are real estate attorneys, title companies or escrow officers. Unlike the HUD-1, which closing agents generally provided to buyers and sellers on the day of a real estate closing, closing statements must be issued at least three business days before closing.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What comes after closing disclosure?

What happens after the closing disclosure? Three business days after you receive your closing disclosure, you will use a cashier's check or wire transfer to send the settlement company any money you're required to bring to the closing table, such as your down payment and closing costs.

Is a closing statement necessary?

If you're selling a home at a profit, you'll need the closing statement to record the details of the sale when you file your taxes.

What is a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

What should be included in a closing statement?

Guide to Writing Closing ArgumentsFactual Evidence. How it supports your case.Factual Evidence. How it supports your case.Factual Evidence. How it supports your case. Comments on the credibility of witnesses: How do the puzzle pieces of evidence and testimony fit into a compelling whole?

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Do settlement payments require a 1099?

The IRS requires the payer to send the recipient a 1099-MISC, as long as the settlement meets the following conditions: The payee received more than $600 in a calendar year. The settlement money is taxable in the first place.

Will I get a 1099 for a lawsuit settlement?

You won't receive a 1099 for a legal settlement that represents tax-free proceeds, such as for physical injury. A few exceptions apply for taxed settlements as well. If your settlement included back wages from a W-2 job, you wouldn't get a 1099-MISC for that portion.

Where do you report settlement income on 1040?

Attach to your return a statement showing the entire settlement amount less related medical costs not previously deducted and medical costs deducted for which there was no tax benefit. The net taxable amount should be reported as “Other Income” on line 8z of Form 1040, Schedule 1.

What is a Final Settlement Statement?

Before you can actually receive any money, however, you will meet with your attorney or insurance adjuster to discuss the settlement agreement and how the proceeds will be disbursed. Generally speaking, your attorney will have a final settlement statement prepared that will explain where each and every dollar and cent came from and where it will be going.

What is the recovery section of a personal injury settlement?

Generally, this will consist of the amount paid by the at-fault party’s insurance and any medical payment coverage (MedPay) your attorney has received on your behalf. Section 1 also includes a Total Recovery section. The total recovery amount is the final amount that has been received for your personal injury settlement in lump sum. Also, please note that no reductions have been taken yet. The Total Recovery section reflects the Gross Recovery. In other words, attorney’s fees, liens and advanced costs have not been subtracted from this amount.

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

What can I expect to see on my settlement statement?

Several items are listed and organized within a settlement statement, including:

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, “it’s safe to say that you are at the tail end of the process,” Moreira says. It’s crucial to review this document carefully to ensure all costs are accurate.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What is full and final settlement?

Whether an employee resigns from the job or is let go by the management, they are paid all the dues for their service till the last working day as FnF or full and final settlement. This includes any additional earnings or deductions as well.

Major activities included in the full and final settlement

The full and final settlement consists of clearances from various departments like IT, finance, HR, and admin. Also, it is important to understand which components to include while calculating the final dues payable to the employee. Let’s look at each of the activities in detail:

When does the full and final settlement take place?

It is essential to note that an employee, whether resigning or being terminated, has the right to get all the dues settled within a reasonable timeframe. It is a common practice to finalise the process within 30-45 days from the employee’s last working day.

Full and final settlement payslip format

The FnF settlement letter is issued with reference to the resignation letter submitted by the employee. There is no set format for the FnF letter and sometimes companies just generate a payslip in place of the letter. The following details should form part of the payslip.

A few pointers for employers to keep in mind

While computing the value of FnF settlement amount, the employers should keep the following points in mind:

Calculate employee full and final settlement with RazorpayX Payroll

Now that you know about the full and final settlement process, isn’t it a lot to do manually?

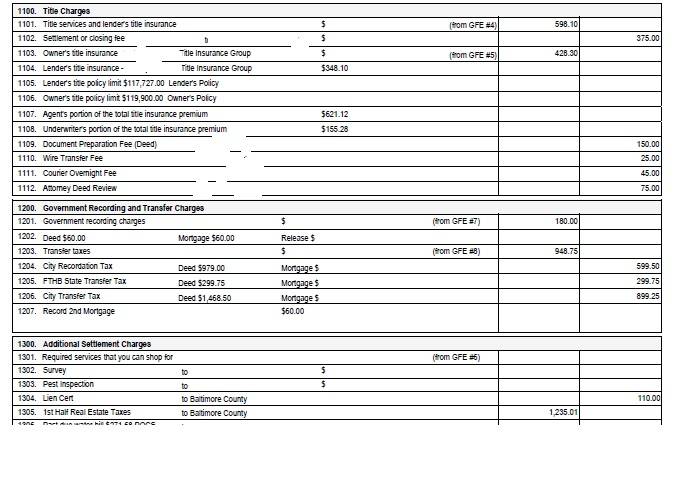

How many pages are in a settlement statement?

The settlement statement consists of two pages and is read from the second page to the first page, which shows the final amounts. It is divided into two columns, one for the buyer and one for the seller. Fees are grouped together according to what they cover and who is charging the fee. The statement’s final numbers must balance; the buyer’s credits and debits have to equal the seller’s total amount, according to the California Land Title Association.

What is HUD-1 Settlement Statement?

The Real Estate Settlement and Procedures Act, or RESPA, mandates that the HUD-1 settlement statement is used for all real estate closings, according to the U.S. Department of Housing and Urban Development. The HUD-1 shows an itemized list of charges for both the buyer and the seller.

What is the first section of fees?

At the top of the second page, the first section of fees contains the commissions paid to the real estate companies, as well as how the commissions are split. The next three sections include all charges related to the buyer’s loan, and even include fees that have already been paid by the buyer prior to closing.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What Is A Final Settlement Statement?

Section 1 – Recovery

- Section 1, labeled “Recovery,” on the final settlement statement covers the total recovery amount received from the various sources, if applicable. This section will include all the money received for your accident claim. Generally, this will consist of the amount paid by the at-fault party’s insurance and any medical payment coverage (MedPay) your attorney has received on your beh…

Section 2 – Less Attorney’s Fees

- Section 2, labeled “Less Attorneys Fees,” on the final settlement statement includes the amount that will be deducted for attorney’s fees as agreed upon by you and your attorney in your retainer agreement. This amount, the attorney’s fees, will be deducted from total recovery identified in Section 1. Under Section 2, you will see two separate amounts for attorney’s fees in this exampl…

Section 3 – Deductions For Bill and Liens

- Section 3, labeled as “Deducted and Retained to Pay Others,” on the final settlement statement covers the amount that will be deducted for any bills, liens or assignments attached to your personal injury recovery. Generally, medical providers and certain health insurance plans such as Medicare and Medicaid will have a lien on your settlement. These liens must be paid with the pr…

Section 4 – Costs Advanced

- Section 4, labeled as “Costs Advanced,” on the final settlement statement covers the amount that will be deducted for any advancement costs your attorney may have had to pay for your personal injury case. Generally, these costs are relatively low and usually include costs of postage and records. These cost are deducted from your portion of the settlement amount. Thus, here the $9…

Section 5 – Client Recovery

- Section 5, labeled as “Net Recovery to Client,” on the final settlement statement covers your share of the settlement proceeds. This section is most important to you because it is the actual amount you will take home. In other words, your attorney will hand you a check for this amount at the conclusion of your meeting. Here, the client will receive a check for $15,988.05 from his attorne…