What is a financial settlement?

What is a financial settlement? A divorce settlement is an agreement between you and your ex to fairly separate your money and assets once the marriage is over. You can draw one up at any point during divorce proceedings or civil partnership dissolution.

How to negotiate a loan settlement?

To settle a private student loan:

- For private student loans, there is no database to see all of your outstanding loans. ...

- Contact your lender to let them know you would like to settle your student loan.

- Use a polite tone to start the conversation off on a positive note.

- Let your private student loan lender make the initial offer. ...

What is a settlement transaction?

Transaction settlement is the process of moving funds from the cardholder’s account to the merchant’s account following a credit or debit card purchase. The issuer will route funds to the acquirer via the card network. For debit card payments, the funds will be withdrawn directly from the cardholder’s bank account.

What is a sentence for settlement?

sentence. 1. This may reflect the ambivalent nature of a “ settlement ”, based on a blanket amnesty and with the territory’s future wide-open. 2. Yet, these ties do not translate into Moscow pushing the Palestinians into a settlement with the Israelis. 3.

What is a settlement in financial terms?

Settlement is the "final step in the transfer of ownership involving the physical exchange of securities or payment". After settlement, the obligations of all the parties have been discharged and the transaction is considered complete.

What is a settlement process?

SETTLEMENT PROCESS OVERVIEW In the financial industry, settlement is generally the term applied to the exchange of payment to the seller and the transfer of securities to the buyer of a trade. It's the final step in the lifecycle of a securities transaction.

What is a settlement banking?

Key Takeaways. A settlement bank refers to a customer's bank where payments or transactions finally settle and clear for customer use. Often times, the payer of a transaction will be a customer of a different bank from the receiver, and so an interbank settlement process must occur.

What is Treasury settlement?

Settlement involves the finalization of a payment, so that a new party takes possession of transferred funds. The treasurer should be aware of these processes in order to understand the timing of payment transfers.

How long after settlement will I get my money?

If your matter settles electronically, the funds should appear in your nominated account within a couple of hours after settlement. However, PEXA does recommend allowing a maximum of 24 hours just in case banking delays occur.

How do I find out how much my settlement is?

After your attorney clears all your liens, legal fees, and applicable case costs, the firm will write you a check for the remaining amount of your settlement. Your attorney will send you the check and forward it to the address he or she has on file for you.

How do settlements work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

What is the difference between settlement and payment?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank. The business will then receive the authorized funds in its merchant account.

What is a settlement amount?

Settlement Amount means, with respect to a Transaction and the Non-Defaulting Party, the Losses or Gains, and Costs, including those which such Party incurs as a result of the liquidation of a Terminated Transaction pursuant to Section 5.2.

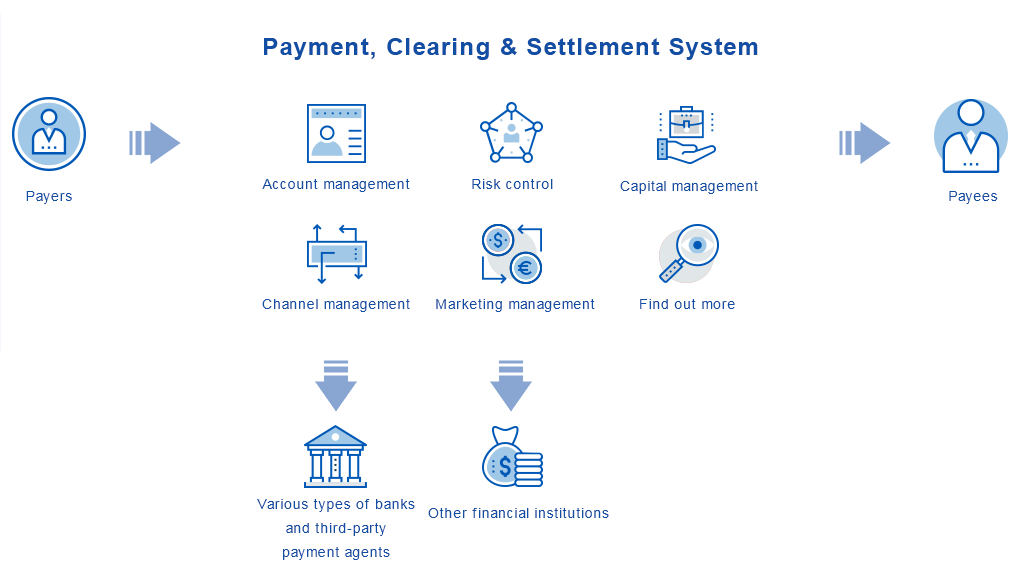

What is payment clearing and settlement?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

Where does settlement occur?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

How long is Treasury settlement?

Bonds and stocks are settled within two business days, whereas Treasury bills and bonds are settled within the next business day.

What is the settlement step of the payment process?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank. The business will then receive the authorized funds in its merchant account.

Why do lawyers take so long to settle a case?

There are legal or factual issues to resolve Cases may also take a long time to settle if there are important legal or factual questions that have not been resolved. Factual disputes can be questions about: who was at fault for the accident, or. the true cost of your medical care and lost wages.

What does it mean to settle a case?

If a case settles after court proceedings have started, your lawyer will need to formally end court proceedings via a consent order. This document is drawn up and agreed by both parties and may incorporate the settlement terms. Your lawyer will advise if you need to be involved with any element of the order.

How is settlement money divided?

The percentage of the settlement or judgment that attorneys charge does vary slightly, usually between 25% to 50%, depending on the type of case being handled.

What is settlement of securities?

Settlement of securities is a business process whereby securities or interests in securities are delivered, usually against ( in simultaneous exchange for) payment of money, to fulfill contractual obligations , such as those arising under securities trades.

Where does settlement take place?

Nowadays, settlement typically takes place in a central securities depository.

What is immobilization of securities?

Securities (either constituted by paper instruments or represented by paper certificates) are immobilised in the sense that they are held by the depository at all times. In the historic transition from paper-based to electronic practice, immoblisation often serves as a transitional phase prior to dematerialisation.

What are the two goals of electronic settlement?

Immobilisation and dematerialisation are the two broad goals of electronic settlement. Both were identified by the influential report by the Group of Thirty in 1989.

How does electronic settlement work?

If a non-participant wishes to settle its interests, it must do so through a participant acting as a custodian. The interests of participants are recorded by credit entries in securities accounts maintained in their names by the operator of the system . It permits both quick and efficient settlement by removing the need for paperwork, and the simultaneous delivery of securities with the payment of a corresponding cash sum (called delivery versus payment, or DVP) in the agreed upon currency.

How long does it take to settle a stock?

In the United States, the settlement date for marketable stocks is usually 2 business days or T+2 after the trade is executed, and for listed options and government securities it is usually 1 day after the execution. In Europe, settlement date has also been adopted as 2 business days after the trade is executed.

What is clearing in a settlement?

A number of risks arise for the parties during the settlement interval, which are managed by the process of clearing, which follows trading and precedes settlement. Clearing involves modifying those contractual obligations so as to facilitate settlement, often by netting and novation .

What are the factors that determine a financial settlement?

There are four factors considered in the calculation of a financial settlement: 1. The asset pool. This refers to the assets or liabilities that you have. Your assets and financial resources may include cash, investments, real estate, cars, jewellery, artworks, shares, trusts, interest in companies and trusts, superannuation and cryptocurrencies.

How long does it take to settle a divorce?

Financial settlements and any claim on property have to occur within 12 months of the divorce order for married couples, within 24 months from break-up for de facto couples or an Application for Orders by Consent outside of the time period.

How to settle a divorce with your ex?

1. Settlement by consent. This is the fastest and cheapest option is that you and your ex-partner are able to reach an agreement and formalise it in writing. It involves setting out your financial and/or parenting agreement in a document and seeking the approval of that settlement by the Family Court which makes the agreement an Order. Alternatively, the financial agreement reached can be set out in a Binding Financial Agreement which requires each of you to obtain independent legal advice.

What is an assessment of contribution?

An assessment of contribution isn’t only financial, but also looks at the non-financial contributions and their parenting and home maker contributions. The non-financial efforts are considered. 3. Consideration of a Section 75 (2) adjustment under the Family Law Act, namely a Future needs and adjustments. a.

How many steps are there in a divorce?

Assets in a divorce are usually divided in four steps.

What is legal aid?

1. Legal Aid. A government funded, free or minimal contribution legal service. There is an application process to assess the suitability of your case and whether you meet the stringent criteria for Legal Aid.

How to make a debt payment smooth?

To make the process smooth, here are some guidelines for you to follow: 1. Where possible, consult the bank to ensure that taking on sole responsibility of the debt is something that is financially feasible (especially if you are nominating yourself for the debt) 2.

What is settlement agreement?

A settlement is an agreement to end a disagreement or dispute without going to a court of law, for example by offering someone money. COBUILD Advanced English Dictionary. Copyright © HarperCollins Publishers.

What does financial mean?

Financial means relating to or involving money.

Has News International received settlements?

A handful of people have received financial settlements from News International in relation to phone hacking.

What is the meaning of "delay settlement"?

The transfer of the security (for the seller) or cash (for the buyer) in order to complete a security transaction. See also delayed settlement, early settlement.

What is clearing a security?

The process in which a buyermakes payment and receives the agreed-upon good or service. This term is used on exchangesto indicate when a securityactually changes hands, which often occurs several days after a tradeis made. See also: Clearance.

What is clearing on a stock exchange?

The process in which a buyer makes payment and receives the agreed-upon good or service. This term is used on exchanges to indicate when a security actually changes hands, which often occurs several days after a trade is made. See also: Clearance.

What happened to the savages after they landed?

Within two years after their landing, they beheld a rival settlementattempted in their immediate neighborhood; and not long after, the laws of self- preservation compelled them to break up a nest of revellers, who boasted of protection from the mother country, and who had recurred to the easy but pernicious resource of feeding their wanton idleness, by furnishing the savages with the means, the skill, and the instruments of European destruction.

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

What is offset in insurance?

Amounts receivable and payable to reinsurers are offset for account settlement purposes for contracts where the right of offset exists, with net insurance receivables included in other assets and net insurance payables included in other liabilities. 1.

How to be excluded from a settlement?

To be excluded from the Settlement, you must send an “Exclusion Request” by mail. You may download a form to use or you may send your own letter which must include:

What is the second settlement in Plain Green?

This is the second Settlement and Notice relating to a series of lawsuits alleging that Plain Green and Great Plains loans and MobiLoans lines of credit did not comply with various state and federal laws because they were made at annual interest rates greater than what is permitted by state law or the lenders did not have a license to lend when one was required. Defendants deny all allegations in these lawsuits. The first settlement (“Think Finance Settlement”) was finally approved in 2019 by the U.S. District Court for the Eastern District of Virginia in Gibbs, et al. v. Plain Green, LLC, et al., Case No. 3:17-cv-495; and the Bankruptcy Court for the Northern District of Texas in In re Think Finance, LLC, Case No. 17-33964 (“Think Finance Bankruptcy”). You can find documents related to the first Think Finance Settlement here .

What companies were involved in the settlement of the Native American Indian Tribes?

The claims involved in the Settlement arise out of loans and lines of credit made in the name of three companies that are owned by Native American Indian Tribes: Great Plains, Plain Green, and MobiLoans. Services were provided to the Native American Indian Tribes by several companies known collectively as Think Finance, in which Defendant Rees was, for a time, the CEO and Defendants TCV and Sequoia had ownership interests. Defendant NCA purchased and collected or sought to collect on certain loans that were originated by the Native American Indian Tribes and/or serviced by Think Finance. The terms “loan” and “loans” refer to both installment loans and cash advances on lines of credit.

What is the anticipated distribution from the Rees Settlement?

The anticipated distribution from the Rees Settlement is part of the resolution of Commonwealth v. Think Finance, Inc., Case No. 2:14-cv-07139 in the United States District Court for the Eastern District of Pennsylvania.

How long does it take to get a payment from NCA?

If you are seeking a payment for amounts you paid over your state’s interest rate cap to Defendant NCA on or after April 17, 2019, you must contact Class Counsel to request such payment no later than 90 days after the Settlement is approved by the Court. You can click here to make this request.

How long does it take to receive a check from Think Finance?

If you are entitled to a cash payment and cashed your check from the first Think Finance Settlement, the Settlement Administrator will mail you a check automatically approximately 60 days after the Court grants final approval to the Settlement and any appeals are resolved. If you are entitled to a cash payment and DID NOT cash your check from the first Think Finance Settlement, you must affirmatively request payment from the Settlement Administrator in order to receive any cash payment to which you are entitled. Click here to make this request. to make this request.

Who are the release parties on a plain green loan?

The Released Parties include: (1) Kenneth Rees, Jeanne Margaret Gulner, Kenneth Earl Rees Family Investments, Ltd., and Jeanne Margaret Gulner Family Investments, Lt d. (“Rees Defendants”), (2) Sequoia Capital Operations, LLC; Sequoia Capital Franchise Partners, L.P.; Sequoia Capital IX, L.P.; Sequoia Capital Growth Fund III, L.P.; Sequoia Capital Entrepreneurs Annex Fund, L.P.; Sequoia Capital Growth III Principals Fund, LLC; Sequoia Capital Franchise Fund, L.P.; SCFF Management, LLC; SC IX.I Management, LLC; SCGF III Management, LLC; and Sequoia Capital Growth Partners III, L.P. (“Sequoia” or “Sequoia Defendants”); (3) TCV V, L.P.; TCV Member Fund L.P.; and Technology Crossover Management V, LLC (“TCV” or “TCV Defendants”); and (4) National Credit Adjusters, LLC (“NCA”). However, if you made a payment to Defendant NCA on or after April 17, 2019, you will not release any individual claim you have against NCA for actual damages, unless you receive a payment for amounts paid to NCA over your state’s interest rate cap from NCA.