Full Answer

How to negotiate a loan settlement?

To settle a private student loan:

- For private student loans, there is no database to see all of your outstanding loans. ...

- Contact your lender to let them know you would like to settle your student loan.

- Use a polite tone to start the conversation off on a positive note.

- Let your private student loan lender make the initial offer. ...

How to calculate full settlement on your personal loans?

To use it, all you need to do is:

- Enter the original Loan amount (the full amount when the loan was taken out)

- Enter the monthly payment you make

- Enter the annual interest rate

- Enter the current payment number you are at - if you are at month 6, enter 6 etc.

- Click Calculate!

Can I take a loan against my structured settlement?

The short answer is, no, you cannot get a structured settlement loan. Structured settlement loan rates don’t matter because you cannot, legally, take out a loan against your structured settlement.

Can I get a settlement loan?

You can start requesting a loan settlement in delinquency, but only if it’s on its way to default. You can also request a settlement once your loan has passed into default. You might qualify for a student loan debt settlement with your federal loans if:

Is closing and settlement the same thing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What does mortgage settlement mean?

Commonly used for loan agreements, a settlement statement details the terms and conditions of the loan and all costs owed by or credits due to the buyer or seller. It also details any fees that a borrower must pay in addition to a loan's interest.

What is settlement of a loan?

The settlement of a loan is the act of paying back the amount of money owed to the lender. If you've ever been out on the town and had to settle your tab before leaving an establishment, you're familiar with the notion.

What is settlement of a house?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

How long does it take to get money after house settlement?

The timeframe in which it takes for mortgage funds to be released does vary between lenders, however, it is common for funds to be released within between 3 and 7 days.

What happens during settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

Can we take loan after settlement?

The banks and lenders mainly look for the borrower's past repayments before considering offering him a loan. And if the borrower has the settlement in his credit report, the banks and lenders will reject the loan.

What is a loan settlement fee?

Also known as early-exit fees, settlement fees are charged when borrowers pay out their home loan in full within a specified time period. This covers the losses your lender might incur due to the early termination of the home loan.

What happens on house settlement day?

Settlement day is the contractually agreed date on which the sale of the property is finally settled. It's the day the buyer pays the balance of the sale price to the seller and ownership changes hands.

How do settlements work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

What should I do before settlement?

Settlement Day ChecklistConfirm the important details. ... Prepare the money required for settlement. ... Check the registration fee. ... Approve the settlement statement. ... Check your solicitor's tax invoice. ... Check the adjustment for local council rates. ... Adjust your water and sewer charges. ... Follow up on the registration of your title.More items...

What is a settlement period?

Property settlement is the final stage of a property sale wherein the buyer completes payment of the contract price to the vendor and takes legal possession of the property. The 'settlement period' is the amount of time between the exchange of contracts and the property settlement.

Is settlement is possible in mortgage loan?

It is usually not feasible to negotiate and settle secured loans like home loans, auto loans or gold loans because the bank can always take possession of the asset which is mortgaged against the loan.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is the purpose of a settlement agent?

A settlement agent (also known as a conveyancer) is a licensed, qualified agent who handles the preparation of documentation to sell or buy a property. They also handle all necessary searches to ensure all debts are removed and you are made aware of all important information about the property you're looking to buy.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What is personal loan settlement?

Personal loan settlement process, also known as personal loan defaulter settlement refers to an agreement between a lender and a borrower wherein the loan is ‘settled’ by repaying only a part of the loan. The lender may forgive a part of the debt in order to help the borrower repay the loan at least partially.

What happens if you settle a personal loan?

When you opt for a personal loan defaulter settlement, it negates the original credit agreement between you and your lender. Also, when your lender reports the same to credit rating agencies as ‘ settled’ instead of ‘paid as agreed’ or ‘paid in full’- it will have a negative impact on your credit score, and discourage other lenders ...

What is loan closure?

Loan closure is a term that refers to the closing of an existing loan account after the borrower repays the loan fully on time. This will have a positive impact on one’s credit score.

How does a loan settlement affect your credit score?

Loan settlement process can negatively affect your credit history and reduce your credit score drastically thereby limiting your chances of receiving credit in the future. When you opt for a loan settlement, even if it is for a genuine reason, the amount paid will be lesser than the original amount which reduces your creditworthiness.

What to do if you can't repay a loan?

In case you are unable to repay your loan due to unavoidable circumstances, then one of the options available is loan settlement. However, this is not a recommended option due to various reasons, one of which includes the adverse impact on your credit score.

How to opt for a mortgage loan?

Opt for a mortgage loan or secured loan by pledging financial assets like gold, properties, etc., and pay off the current debt

How long does it take to get a credit score back?

For a borrower, it takes nearly seven years or so to reestablish a positive score and improve his/her credit history.

What Is a Mortgage Settlement?

A mortgage settlement generally refers to legal remedies in a mortgage lawsuit. In many cases, the judge may make a ruling and determine the legal damages in a mortgage/foreclosure claim. One party may have to pay the other for losses caused by issues like mortgage default or mortgage fraud.

Why are mortgage settlements not available?

Lastly, mortgage settlements are not available if laws and regulations prohibit them, or if previous agreements between the parties prevent them from doing so. Mortgage

Is a mortgage settlement beneficial?

Thus, mortgage settlements may be advantageous to both parties. They can involve lengthy and costly court proceedings. Also, the debtor may be able to avoid bankruptcy filings and negative credit scores.

Do you need a lawyer for a mortgage settlement?

A mortgage attorney is generally required during the settlement process, as the parties will be engaging in detailed negotiations. You may wish to hire a lawyer for help with a mortgage settlement.

Can a mortgage lender rework a contract?

In many instances, the mortgage lender may not be willing to rework a contract with the debtor. They may decide to pursue legal action and force the debtor to repay according to the original lending terms.

What is settlement in real estate?

The settlement is the final stage in the home transaction. This is when the ownership of the property will be transferred from the seller to the buyer. The funds will be distributed in the form of a check to the sellers, the real estate agents that were involved in the sale will receive a check for the commissions that they earned, ...

How many times do you sign a settlement?

The escrow company will have the documents ready; they will just need to be signed. Buyers will sign their names anywhere from 10 to 30 times during this process. There are many important things that happen on the day of the settlement.

What is a foreclosed loan?

An agreement by the lender not to exercise the legal right to foreclose in exchange for an agreement by the borrower to a payment plan that will cure the borrowers delinquency. ...

What is mortgage loan?

A written document evidencing the lien on a property taken by a lender as security for the repayment of a loan. The term 'mortgage' or 'mortgage loan' is used loosely to refer both to the ...

Why don't wholesale lenders use fixed dollar fees?

While some retail lenders view fixed-dollar fees as an easy way to generate additional revenue from unwary borrowers, wholesale lenders don't because it would cause them problems with brokers.

What is mortgage insurance premium?

A mortgage insurance premium is a policy that insures the lender against loss if the homeowner defaults on a mortgage. ...

What is rate protection?

Protection for a borrower against the danger that rates will rise between the time the borrower applies for a loan and the time the loan closes. Rate protection can take the form of a ...

What is lease purchase mortgage?

Wondering what is the best lease purchase mortgage definition?A lease purchase mortgage is a financing option that allows potential homebuyers to lease a property with the option to ...

How to find the best mortgage deal?

It isn't easy to do right, as a summary of the major steps involved will demonstrate. Step 1: Decide if you are a potential shopper. Step 2: ...

What is a mortgage settlement?

Mortgage settlement--sometimes called mortgage closing--can be confusing. A settlement may involve several people and many documents and fees. This information will help you understand all that is involved. Although the focus of this guide is on settlements for home purchases, much of it will also be useful if you are refinancing a mortgage.

When are mortgage payments due?

Your first regular mortgage payment is usually due about 6 to 8 weeks after you settle (for example, if you settle in August, your first regular payment will be due on October 1; the October payment covers the cost of borrowing the money for the month of September). Interest costs, however, start as soon as you settle.

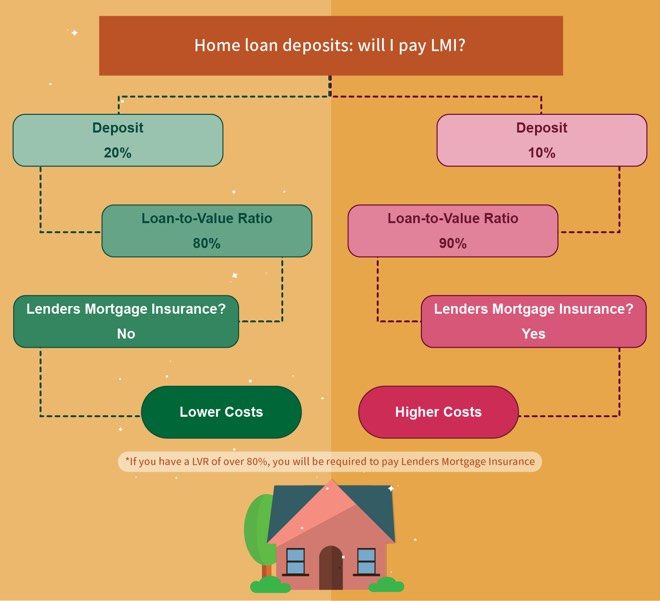

What are the fees for FHA mortgage insurance?

As with Private MI, insurance premium payments will stop when you acquire 22% equity in your home. FHA fees are about 1.5% of the loan amount. VA guarantee fees range from 1.25% to 2% of the loan amount, depending on the size of your down payment (the higher your down payment, the lower the fee percentage). RHS fees are 1.75% of the loan amount.

How long does it take to get a good faith estimate of closing costs?

The Real Estate Settlement Procedures Act (RESPA) requires your mortgage lender to give you a good faith estimate of all your closing costs within 3 business days of submitting your application for a loan, whether you are purchasing or refinancing the home. This is a good faith estimate, but the actual expenses at closing may be somewhat different. If you are purchasing the home, you will also get an information booklet, Buying Your Home: Settlement Costs and Helpful Information.

What happens if you don't pay down on a mortgage?

If your down payment is less than 20% of the value of the house, the lender will usually require mortgage insurance. The insurance policy covers the lender's risk in the event that you do not make the loan payments. Typically, you will pay a monthly premium along with each month's mortgage payment. Your private MI can be canceled at your request, in writing, when your reach 20% equity in your home, based on your original purchase price, if your mortgage payments are current and you have a good payment history. By federal law your private MI payments will automatically stop when you acquire 22% equity in your home, based on the original appraised value of the house, as long as your mortgage payments are current.

How much is prepay for a mortgage?

Estimated cost: 0.5% to 1.5% of the loan amount to pre-pay for the first year

How much does a 142,500 loan cost?

Estimated cost: Depends on loan amount, interest rate, and the number of days that must be paid for (a $120,000 loan at 6% for 15 days, about $300; a $142, 500 loan at 6% for 15 days, about $356).