What is a HUD-1 Settlement Statement?

The HUD-1 settlement statement is a standard government real estate form that was once used by the settlement agent (also called the closing agent) to itemize all charges imposed upon a borrower and seller for a real estate transaction. It is typically no longer used except for one exception.

Is the HUD-1 still used in real estate?

It is still used in reverse mortgages, loan transactions that allow sellers to pull equity out of their home. Since October 2015, the Closing Disclosure has replaced the HUD-1 for most real estate closings. When Was the HUD-1 Used?

Do manufactured home borrowers receive HUD-1 Settlement statements?

Some manufactured home borrowers may receive a Truth-in-Lending disclosure instead of a HUD-1 settlement statement or closing disclosure. In the past, most borrowers received a HUD-1 settlement statement before closing. However, since October 2015, the majority of mortgage borrowers now receive closing disclosures rather than settlement statements.

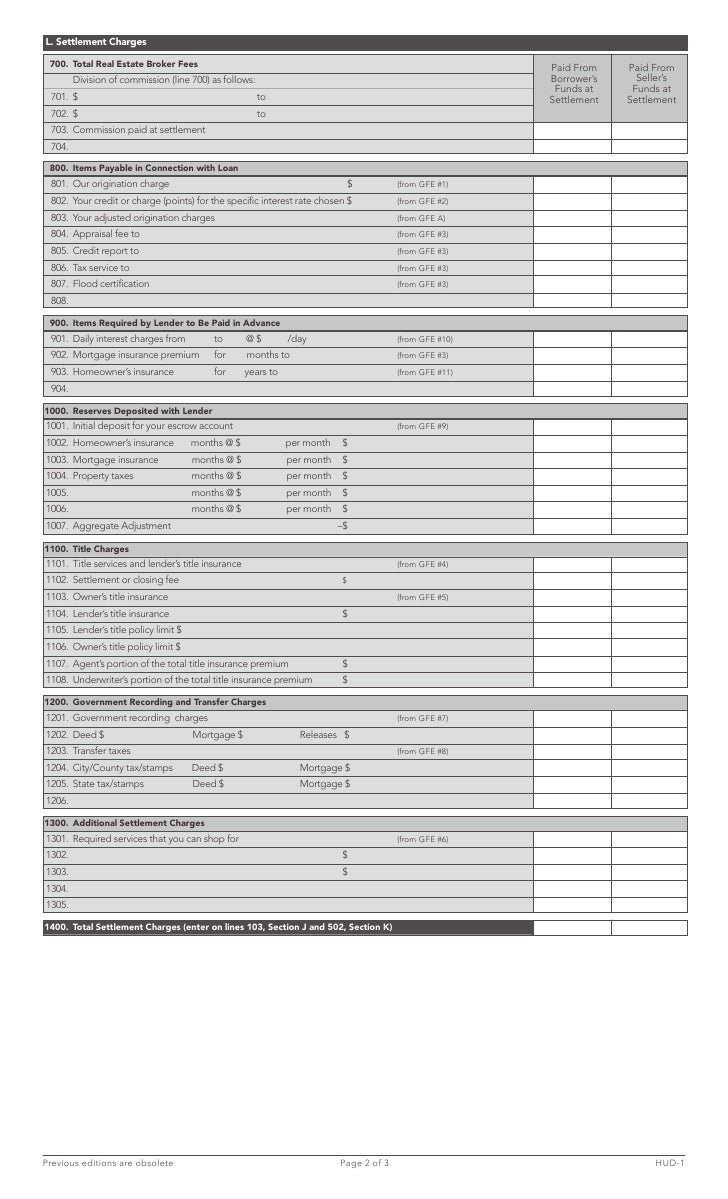

What does page 2 of the HUD-1 mean?

On the HUD-1, Page 2 spells out all the itemized charges associated with your loan and whether the buyer (you) or the seller will pay them. Check that you’re not paying fees that the seller or the lender agreed to pay. Manufactured homebuyers may see entries in the seller’s section.

Is a settlement statement the same as a HUD-1?

A HUD-1 settlement statement, also referred to simply as a settlement statement, details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the difference between a HUD and a settlement statement?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means 'Good Faith Estimate'.

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Who prepares a HUD-1 statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is the purpose of a HUD-1 statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is the HUD-1 called now?

The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

Where can I find my HUD-1?

HUD-1 Forms | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

What replaced the HUD-1 Settlement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Is closing disclosure same as settlement statement?

Closing Disclosure When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

How do I read a HUD statement?

Look at the first page of the HUD statement. Look over the basic details in Part B, such as your name, the seller's name and the property address. Read sections J and K, which give a summary of the total amounts owed from or due to the borrower or seller.

What is HUD statement called now?

If you applied for a mortgage after October 3, 2015, for most kinds of mortgage loans you receive a form called the Closing Disclosure instead of a HUD-1.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What replaced the HUD-1 settlement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What form do you use for a refinance loan?

In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

Do you need to review a HUD-1 settlement statement before closing?

If you’re getting ready to close on a mortgage, you’ll typically review a closing disclosure. However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate or a reverse mortgage, you’ll need to review a HUD-1 settlement statement before you head to the closing table.