Full Answer

How to properly record a HUD settlement?

- Deposit made by the buyer

- The loan amounts

- The amount owed by the seller to the buying party is a credit entry and must record. ...

- Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement

- Lastly, any additional credits to the buyer will be entered here from any source, if not from the seller

Is HUD 1 statement required for refinancing?

What is a HUD-1 Settlement Statement? The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

What type of loan uses HUD 1?

Which loan types require a HUD-1 settlement statement?

- HELOCs. A HELOC is a mortgage-based line of credit that works much like a credit card. ...

- Reverse mortgages. A reverse mortgage is a specialized type of mortgage for homeowners that are 62 or older. ...

- Mortgages for manufactured homes not secured by real estate. Manufactured homes can be an affordable alternative to conventional homes built on a foundation. ...

What is HUD settlement statement?

The HUD-1 form, often also referred to as a “ Settlement Statement ”, a “ Closing Statement ”, “ Settlement Sheet ”, combination of the terms or even just “ HUD ” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means ‘ Good Faith Estimate ’.

What is the purpose of the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Is a HUD-1 the same as a closing statement?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate.

What is the difference between HUD-1 and settlement statement?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is the HUD-1 called now?

The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

Are HUD-1 settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Who prepares the HUD settlement statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

Where can I find my HUD-1?

HUD-1 Forms | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What does HUD mean in real estate?

U.S. Department of Housing and Urban DevelopmentHUD Homes | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

What does HUD stand for?

United States Department of Housing and Urban DevelopmentUnited States Department of Housing and Urban Development / Full name

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

When Is a HUD-1 Used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

What is line 902 on a mortgage?

Line 902 shows mortgage insurance premiums that are due at settlement. Escrow reserves for mortgage insurance are recorded later. It should be noted here if your mortgage insurance is a lump sum payment that's good for the life of the loan.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is a HUD-1?

The HUD-1 (or a similar variant called the HUD-1A) is used primarily for reverse mortgages and mortgage refinance transactions. The reference to 'HUD' in the form's name refers to the Department of Housing and Urban Development . Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, ...

What is the HUD-1A used for?

Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, as appropriate, must be used for all mortgage transactions that are subject to the Real Estate Settlement Procedures Act.

When do you need to inspect a HUD-1?

The settlement agent must permit the borrower to inspect the HUD-1 or HUD-1A settlement statement, completed to set forth those items that are known to the settlement agent at the time of inspection, during the business day immediately preceding settlement. Items related only to the seller's transaction may be omitted from the HUD-1.

Is a HUD-1 exempt from the Truth in Lending Act?

The TRID rule mandates the use of a Closing Disclosure form instead. The use of the HUD-1 or HUD-1A is also exempted for open-end lines of credit (home -equity plans) covered by the Truth in Lending Act and Regulation Z. A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts ...

What is HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a government form that was used widely before 2015 when buying, selling, and refinancing real estate. It lists all the charges and credits to the buyer and seller in a real estate settlement or a mortgage refinance. You will also hear people refer to it as a settlement or closing statement.

What does a HUD-1 look like?

The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller.

What is page 3 of HUD?

Page 3 relates to the figure in the Good Faith Estimate (GFE) which has been replaced by the Loan Estimate. The lender would have supplied GFE estimate figure to the settlement agent upon application of the loan. The HUD figures are listed side by side with the GFE so that a comparison can be made and discrepancies highlighted. The standard loan terms shown here will include the origination fee, interest rate, term, and payment.

Can you search for unlisted properties on Marketproof?

With Marketproof New Development, you can easily search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites. Create an account today and get a 7-day free trial.

What is a HUD-1 Settlement Statement?

We can define the HUD-1 statement, also known as the HUD-1 form, as a settlement form that itemizes and reconciles all the charges that the buyer and seller pay in purchasing real estate. These charges include a loan origination fee and discount points.

Meet some of our Real Estate Lawyers

Mr. LaRocco's focus is business law, corporate structuring, and contracts. He has a depth of experience working with entrepreneurs and startups, including some small public companies.

What is HUD-1 form?

In a sentence, the HUD-1 form is a document that itemizes every financial transaction that is happening between all parties involved in the transfer of property. That’s the short of it.

Who prepares HUD forms?

The HUD is prepared by the settlement or closing agent at closing time. You have the right to inspect this form one day prior to settlement. Compare the HUD to the GFE to make sure you weren’t overcharged for a loan, title, escrow fees, or document recording.

What is the HUD?

HUD refers to the Department of Housing and Urban Development, which is the arm of the federal government that makes legislation relating to home ownership and property development.

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

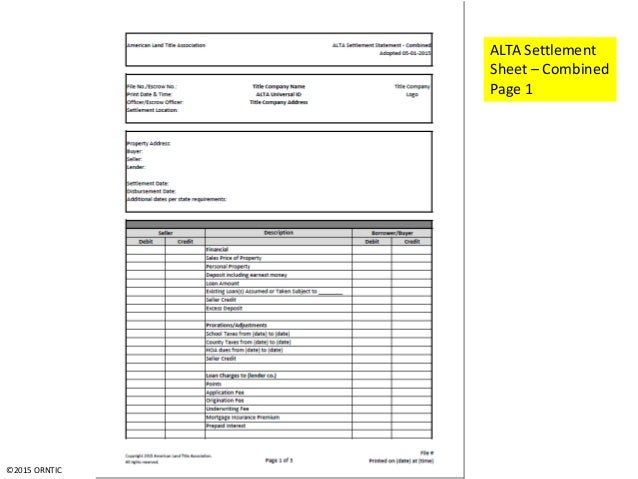

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

What is a HELOC loan?

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What Is A HUD-1 Statement?

- The HUD-1 form is a three-page mortgage document required in certain cases. This document contains an itemized list of every fee charged for the loan. This form is also commonly referred to as a settlement statementbecause it’s one of the final pieces of paperwork that comes before the transaction officially closes, or “settles.”

Mortgages That Require A HUD-1 Statement

- The HUD-1 form used to be furnished in most real estate transactions, but today, it doesn’t play a role in typical home purchases. If you receive a HUD-1 form nowadays, you’re likely dealing with one of these specific types of mortgages: 1. Reverse mortgage: If you’re an older homeowner tapping your equity via a reverse mortgage, you’ll receive the HUD-1 statement. 2. Refinance: If y…

HUD Settlement Statement vs. Closing Disclosure

- The more common settlement statementin real estate is a closing disclosure, which is now issued to most borrowers. Both the HUD-1 and closing disclosure have the same aim: to educate borrowers about all the costs of their mortgage. The differences between the two include: 1. How long it is– The closing disclosure is designed to be easier to read for borrowers. It’s a bit longer …

Understanding The HUD-1 Form

- The three pages of the HUD-1 form include a summary of all the costs associated with the mortgage (page 1), an itemized list of each expense (page 2) and a comparison between your initial loan estimate and the final settlement (page 3). Here’s a rundown of everything you’ll see: 1. Commission feesdue to real estate agents 2. Loan charges, including origination fee, prepaid poi…

Bottom Line

- If you receive the HUD-1 statement, read this document closely. Ideally, have a real estate attorney help you double-check it to make sure you aren’t overpaying for anything and that there are no mistakes that could cost you extra money. Remember: You could be paying back this amount for decades to come, so the day you receive the HUD-1 plays a very important role in your financial f…