How is settlement figure calculated?

Once the settlement date has been decided, we calculate your settlement figure by taking the current capital element of the balance outstanding, adding the interest due up to the agreed settlement date, plus one month's additional interest (as outlined above).

Why is my settlement figure higher than my balance?

Your balance might be lower than your settlement figure because of a Direct Debit payment you've made. A Direct Debit could still go out after you get a settlement figure and before you pay off your loan. This will reduce the amount you owe and make your balance lower.

How long does it take to get a settlement figure?

Some lenders will provide you with your settlement figure over the phone or via email (which can take 2-3 days) and they will all do it by post (which could take 7 or so days). Your settlement figure is usually valid for 14 days from the date you request it.

Is settlement figure same as balloon payment?

For example, a settlement figure for a PCP deal will include your 'final' or 'balloon' payment – and may very well include some early redemption charges. As such, simply adding up your remaining monthly payments wouldn't even come close to being an accurate figure.

Can debt settlement hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Is it good to pay off a loan early?

You have a little extra money and you'd love to pay off your personal loan early. Doing so will save you on interest and put a few extra dollars to spend in your pocket each month. So, should you repay your personal loan ahead of schedule? Paying off debt is generally good for your finances—and good for your credit.

Do you pay less interest if you pay off a loan early?

Yes. By paying off your personal loans early you're bringing an end to monthly payments, which means no more interest charges. Less interest equals more money saved.

How much is an early settlement fee?

Early Repayment Fees Also known as early settlement fees, these early repayment costs amount to one or two months' worth of interest that the borrower would have paid.

What is a settlement amount?

Settlement Amount means, with respect to a Transaction and the Non-Defaulting Party, the Losses or Gains, and Costs, including those which such Party incurs as a result of the liquidation of a Terminated Transaction pursuant to Section 5.2.

What happens if you can't afford balloon payment?

If the vehicle is worth less at the end of the agreement, then the lender will face the financial loss if you return it. As the optional final payment title suggests, this payment is optional. If you don't want to buy the car you can hand it back to the finance company and walk away.

Should I pay the balloon payment?

Paying the balloon payment will mean you won't have anything to repay, and you can put that money towards something else each month, or simply start saving. Even if you take out a loan to cover the cost of the balloon payment, you'll have a definitive end date in sight.

How much is a typical balloon payment?

Generally, a balloon payment is more than two times the loan's average monthly payment, and often it can be tens of thousands of dollars. Most balloon loans require one large payment that pays off your remaining balance at the end of the loan term.

What does payment after charge off collection settled less than full balance?

What does "less than full balance" mean? When talking about debt repayment, "less than full balance" just means that you've reached an agreement with the lender or collector to pay less than the amount owed. This is more commonly referred to as a debt settlement.

Is settled in full good on credit report?

A settled account is considered a negative entry on your credit report since it indicates the lender agreed to accept less than the full amount owed. A settled account on your credit report tends to lower your credit scores, but its effect will lessen over time.

What is the difference between principal balance and payoff?

The current principal balance is the amount still owed on the original amount financed without any interest or finance charges that are due. A payoff quote is the total amount owed to pay off the loan including any and all interest and/or finance charges.

Is a mortgage statement the same as a payoff statement?

A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. The payoff amount isn't just your outstanding balance; it also encompasses any interest you owe and potential fees your lender might charge.

What is a loan settlement statement?

A loan settlement statement is the document that describes the amount of a loan, typically for a mortgage, given to the borrower once the loan has been settled. In addition to the amount, the settlement statement will also contain the frequency of installments expected from the lender in regards to repayment.

Is there any downside to settling a loan early?

On the surface, paying off your loan before the terms agreed to seems like an obvious decision. If you're looking at a mortgage, it's likely that this is going to be the largest debt that you encounter in your lifetime, and the faster you settle your debt, the less interest you'll pay. Seems like a clear-cut decision, right?

Is a loan settlement statement different from a normal settlement statement?

Quick answer: yes. It's not uncommon to mix the two up, though, because a "settlement statement" is another document that's involved in buying a home. So how do you keep track of which one is which?

What does a tick mean on a mortgage?

Tick to remove mortgages that have Early Repayment Charges. Early Repayment Charges are applied by the lender if you repay the mortgage, or remortgage to a different lender within a certain period of time or date set by the lender. Typically a percentage of the outstanding balance at the point of repayment.

How much of the balance is a payment on a 401(k)?

Payments will be assumed to be made at either 3% of the total outstanding balance or £5, whichever is the higher.

How to arrange credit card product details?

Click the arrows to arrange the product details by the name of the lender. Click the arrows to arrange the product details by the purchase rate (APR) of the credit card. Click the arrows to arrange the product details by the balance transfer rate ( APR) of the credit card .

Is annual deposit charge taken into account when calculating costs?

No initial, annual or per deposit charges are taken into consideration when calculating costs.

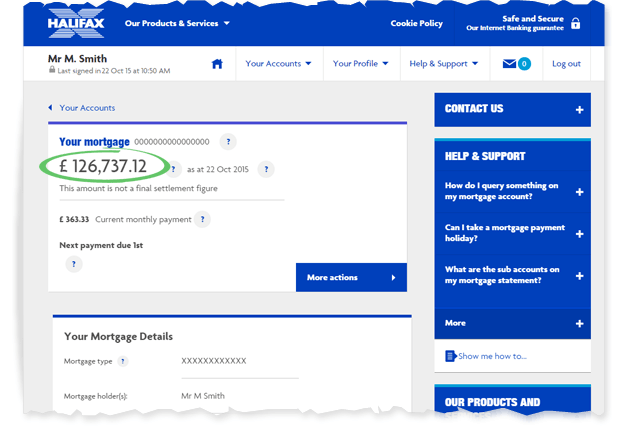

Is my current balance shown on my loan?

Your current balance will be shown - this may be different to a balance you quote from your loan provider as they may have fees or other charges they apply when giving a settlement figure.

Do tracker and discount mortgages assume the same rate?

With tracker and discount mortgages, please note that the costs will assume the base rate or lenders variable rate stay the same as now for the duration of the comparison.

What is personal loan settlement?

Personal loan settlement process, also known as personal loan defaulter settlement refers to an agreement between a lender and a borrower wherein the loan is ‘settled’ by repaying only a part of the loan. The lender may forgive a part of the debt in order to help the borrower repay the loan at least partially.

How does a loan settlement affect your credit score?

Loan settlement process can negatively affect your credit history and reduce your credit score drastically thereby limiting your chances of receiving credit in the future. When you opt for a loan settlement, even if it is for a genuine reason, the amount paid will be lesser than the original amount which reduces your creditworthiness.

What happens if you settle a personal loan?

When you opt for a personal loan defaulter settlement, it negates the original credit agreement between you and your lender. Also, when your lender reports the same to credit rating agencies as ‘ settled’ instead of ‘paid as agreed’ or ‘paid in full’- it will have a negative impact on your credit score, and discourage other lenders ...

What is loan closure?

Loan closure is a term that refers to the closing of an existing loan account after the borrower repays the loan fully on time. This will have a positive impact on one’s credit score.

What to do if you can't repay a loan?

In case you are unable to repay your loan due to unavoidable circumstances, then one of the options available is loan settlement. However, this is not a recommended option due to various reasons, one of which includes the adverse impact on your credit score.

How to opt for a mortgage loan?

Opt for a mortgage loan or secured loan by pledging financial assets like gold, properties, etc., and pay off the current debt

How long does it take to get a credit score back?

For a borrower, it takes nearly seven years or so to reestablish a positive score and improve his/her credit history.

Why settle a personal loan early?

Another good reason for you to settle your personal loan early is to allow your money to grow to its fullest potential. When you have an outstanding personal loan, you will always have to pay interest rates as a cost to the bank for the loan.

How long is the notice period for a loan restructure?

Notice Period: One month. Loan restructure: Not allowed once the loan is approved and disbursed. The extra payment will be treated as an advance payment to reduce your installment in the following month. You will not be able to redraw the extra payment made.

How many personal loans are there in Malaysia?

However, recognizing that not many know the terms or the benefits you can reap, here are 16 personal loans in Malaysia and their terms for an early settlement to help you find the loan for your needs.

How long is a bank notice period?

Notice period: Three months prior written notice to the Bank, or payment of three (3) months’ interest on the amount redeemed in lieu of notice.