The contract can be settled net by any of the following means:

- Its terms implicitly or explicitly require or permit net settlement.

- It can readily be settled net by a means outside the contract.

- It provides for delivery of an asset that puts the recipient in a position not substantially different from net settlement.

Full Answer

What is net settlement in banking?

Net Settlement. Reviewed by Julia Kagan. Updated Jan 31, 2018. Net settlement refers to the resolution of all of a bank's transactions at the end of the day. Since banks engage in so many electronic transactions, they cannot simply count their cash at the close of business. Instead, they have to add up all of their electronic credits and debits.

What is'continuous net settlement-CNS'?

What is 'Continuous Net Settlement - CNS'. CNS includes an automated book-entry accounting system that centralizes the settlement of transactions, keeping the flows of security and money balances orderly and efficient.

What are the different types of net settlement?

There are two types of net settlement systems: Bilateral settlement systems require the final resolution of payments made between two banks over the course of a day. These are due to be settled at the close of business, typically via a transfer between their accounts at the central bank.

What is a net share settlement for stock options?

Normally exercising a stock option takes money. A net share settlement lets you buy the stock when you're short on cash. Instead of paying the company for a certain number of optioned shares, you get a smaller packet of stock, but no cash changes hands. This can work out well for both you and the company. Close-up of stock data on digitized board.

What is meaning of net settlement?

Net settlement is a bank's routine resolution of the day's transactions at the end of the business day. Since many or most bank transactions are now sent electronically, this is no longer a matter of counting the cash in the drawer. Instead, the bank has to add up all of their electronic credits and debits.

What is net settlement in a lawsuit?

Net Settlement Amount means the Gross Settlement Amount minus: (1) all Attorneys' Fees and Costs approved by the Court; (2) all Class Representative Compensation approved by the Court; (3) all Administrative Expenses approved by the Court and all tax-related expenses pursuant to Paragraph 5.3.

What is the difference between gross settlement and net settlement?

Gross settlement is where a transaction is completed on a one-to-one basis without bunching with other transactions. On the other hand a Deferred Net Basis (DNS), or net-settlement means that the transactions are completed in batches at specific times. Here, all transfers will be held up until a specific time.

What does net settlement mean insurance?

Net Settlement Amount means the Gross Settlement Amount minus (a) all Attorneys' Fees and Costs paid to Class Counsel as authorized by the Court; (b) all Case Contribution Awards as authorized by the Court; (c) all Administrative Expenses; and (d) a contingency reserve not to exceed an amount to be mutually agreed upon ...

What does net settlement for equity mean?

The net settlement amount in your Funds statement in Console is the money due to you (Credit) or is receivable from you (Debit) for your equity trades. The net settlement amount in your Funds statement will match the net amount receivable or payable as per the contract note .

What is a net recovery?

Net Recovery refers to a recovery of the total overpayment less the applicable taxes [i.e. Federal, State, and/or FICA]. Agencies must use the Net Recovery method when dealing with Full Pays; however, they have the option of using the Gross or Net Recovery method for Partial Pays.

What is meant by gross settlement?

Ans. The acronym 'RTGS' stands for Real Time Gross Settlement, which can be explained as a system where there is continuous and real-time settlement of fund-transfers, individually on a transaction by transaction basis (without netting).

What is net settlement for equity with settlement number?

This is the money that is due to you (Credit) or is receivable from you for (Debit) your equity trades. By EOD, the same entries will be posted in your account saying “Net settlement for NSE-Equity with settlement number”. You can cross check the same with the trade book.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

Can I keep extra money from insurance claim?

Homeowners can keep the leftover money if there is nothing in writing saying that they must return the unused claim money. Make sure to be truthful when explaining your situation to the insurance company for the claim payout, as lying is considered insurance fraud for which the consequences are harsh.

What happens if you don't use insurance money for repairs?

You must keep your home up to your home insurance company's standards. If you don't make required repairs, you could have future claims denied and even lose your policy altogether. If you have a mortgage on your home, your claims checks may be payable to both you and your mortgage lender.

How long does it take for insurance to pay out after accident?

Ideally the money will be paid within 14-28 days of settlement. - Some insurance companies are faster at settling claims than others. - This allows them to maintain their reputation of having a quick claim process. - Sometimes you may be tempted to get your money as soon as possible.

What is net settlement?

A net settlement is an inter-bank payment settlement system wherein banks collect data on transactions throughout the day and exchange the information with the clearinghouse and the central bank. Federal Reserve (The Fed) The Federal Reserve is the central bank of the United States and is the financial authority behind the world’s largest free ...

Why is the Net Settlement System Important?

The net settlement system allows banks to be flexible and gain more freedom in exchanging and transferring funds between each other.

What is bilateral net settlement?

Bilateral net settlement systems are payment systems in which payments are settled for each bilateral combination of banks. Banks that send out more funds in transfers than they receive (i.e., banks with a positive net settlement balance) are credited with the difference, and banks with a negative net settlement balance pay the difference.

What is the net settlement amount of Bank A and B?

At the end of the day (i.e., the exchange period), the clearinghouse processes the transactions and confirms that Bank A’s net settlement amount is –$600,000, and Bank B’s net settlement amount is $600,000.

What does "600000" mean in the bank?

It means that at the end of the day, Bank A owes Bank B the full $600,000.

When was the Bank for International Settlements established?

Bank for International Settlements (BIS) The Bank for International Settlements (BIS) started in 1930, and is owned by the central banks of different countries. It serves as a bank for member central banks

When is a bank statement prepared?

Bank Statement A bank statement is a financial document that provides a summary of the account holder’s activity, generally prepared at the end of each month.

Why is net settlement used?

Net settlement is used because it reduces the amount of money that has to be held in the settlement medium compared to gross settlement , which requires immediate payment of each individual transaction. It also reduces inter-bank risks. Net settlement is a multilateral transaction, usually with the central bank for the currency being used.

What is net settlement in multilateral settlement?

Multilateral net settlement occurs when there are three or more parties involved. In this example, A pays B $200, B pays C $150, and C pays A $175. The net obligations in the multilateral model are for A and C to each pay $25 into the settlement 'pot', and for B to receive $50.

What happens if one of the participants in a net settlement system is unable to settle its obligations at the end?

Furthermore, if one of the participants in a net settlement system is unable to settle its obligations at the end of the settlement cycle, it prevents the settlement from completing for all parties: this may require unwinding all the transactions that have been placed into that settlement cycle.

What happens if a net settlement is not binding?

If the application of transactions to the netting is not legally binding, in the event of the insolvency of a participant, the other participants may end up legally owing their gross obligations to the failed participant, and not be due any settlement from the failed participant in return. Furthermore, if one of the participants in a net settlement system is unable to settle its obligations at the end of the settlement cycle, it prevents the settlement from completing for all parties: this may require unwinding all the transactions that have been placed into that settlement cycle.

What Is Continuous Net Settlement?

Continuous Net Settlement (CNS) is a settlement process used by the National Securities Clearing Corporation ( NSCC) for the clearing and settlement of securities transactions. CNS includes a centralized book-entry accounting system, which keeps the flows of securities and money balances orderly and efficient.

What is the CNS process?

During the CNS process, reports are generated that document the movements of money and securities. This system processes most broker-to-broker transactions in the United States that involve equities, corporate bonds, municipal bonds, American depositary receipts ( ADRs ), exchange-traded funds (ETFs), and unit investment trusts. NSCC is a subsidiary of the Depository Trust Clearing Corporation (DTCC).

How many NSCC entries will there be in 2021?

There were more than 3,480 NSCC member entries in 2021, and many of them were for divisions of a single company. 1 The NSCC acts as a sort of "honest broker" between brokerages in the continuous net settlement process. The CNS process helps the NSCC to reduce the value of payments exchanged by an average of 98% daily.

Can you set content filter to expand search across territories?

You can set the default content filter to expand search across territories.

Does IFRS require net settlement?

IFRS does not include a requirement for net settlement within the definition of a derivative. It only requires settlement at a future date. Under IFRS, instruments linked to unlisted equity securities are required to be recorded at fair value.

What is net settled in derivatives?

Another key concept in the definition of a derivative is whether a contract can be settled net, which generally means that a contract can be settled at its maturity through an exchange of cash, instead of through physical delivery of the referenced asset. A contract may be considered net settled when its settlement meets one of the criteria in ASC 815-10-15-99.

What are the terms of a settlement agreement?

Underlying, notional amount, payment provision. The contract has both of the following terms, which determine the amount of the settlement or settlements, and, in some cases, whether or not a settlement is required:#N#One or more underlyings#N#One or more notional amounts or payment provisions or both. 1 One or more underlyings 2 One or more notional amounts or payment provisions or both.

What is a notional amount?

A notional amount is a number of currency units, shares, bushels, pounds, or other units specified in the contract. Other names are used, for example, the notional amount is called a face amount in some contracts.

Can a mortgage contract be net settled?

However, as discussed in ASC 815-10-15-105, a contract cannot be net settled if the holder is required to invest funds in, or borrow funds from, the other party to obtain the benefits of a gain on the contract over time as a traditional adjustment of either the yield on the amount invested or the interest element on the amount borrowed. A fixed-rate mortgage commitment is an example of this type of contract. To benefit from the gain on a loan commitment (due to an increase in interest rates), the holder of the loan commitment must borrow money from the lender.

Does asymmetrical default provision constitute net settlement?

An asymmetrical default provision does not constitute net settlement. However, the presence of asymmetrical default provisions applied in contracts between the same counterparties indicates the existence of an agreement between those parties that the party in a loss position may elect the default provision, thus incorporating a net settlement provision within the contract.

Is a currency swap an initial net investment?

An exchange of currencies of equal fair values (e.g., in a currency swap contract) is not considered an initial net investment ; it is the exchange of one kind of cash for another kind of cash of equal value.

Is a fixed penalty for nonperformance a net settlement provision?

A fixed penalty for nonperformance is not considered a net settlement provision because the amount does not vary with changes in the underlying.

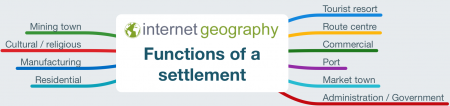

What is a settlement?

A settlement is a place where people live. It can range in size from an isolated dwelling to a million city. The site of a settlement is the location where it is built. It describes the physical nature of where a settlement is located. Factors such as water supply, defence, quality of soil, building materials, climate, ...

What factors were taken into account when establishing settlements in the past?

Factors such as water supply, defence, quality of soil, building materials, climate, shelter and defence were all taken into consideration when establishing settlements in the past. The situation of a settlement is the description of the settlement in relation to physical features around it and other settlements.