Payment settlement entities are the organizations responsible for reporting the payments made to participating payees. A payment settlement entity may be a domestic or foreign entity. For payment card transactions, merchant acquiring entities are the payment settlement entities, and for third party network transactions, third-party settlement organizations are the payment settlement entities.

Full Answer

What is a structured settlement and should you choose one?

The plaintiff can decide to get a lump sum payment or opt for a structured settlement. What is a structured settlement, and should you choose one? Here’s everything that you need to know about structured settlements. What is a Structured Settlement? With that said, a structured settlement is a payment made by the defendant in an annuity. Structured settlements are typical in civil cases including:

What is the best way to settle debt?

Part 1 of 3: Negotiating the Debt Amount Download Article

- Read the judgment. Debtors and creditors should review the court order (judgment) to determine the total amount due and any specific payment instructions ordered by the court.

- Evaluate your financial situation. Whether you are the creditor or the debtor, you should review your finances before negotiating the amount of the debt.

- Contact the other party. ...

What is a settlement annuity?

First, an annuity settlement is negotiated between the plaintiff and the defendant. The settlement is then distributed in a series of periodic payments over an agreed amount of time rather than a lump sum payment in most cases.

Is Wells Fargo settlement taxable?

Is Wells Fargo class-action settlement taxable? Generally, if these settlements are from overcharged interest, on nondeductible interest payments such as credit card debt or auto loans it is not a taxable event and does not need to be reported. … However, you may be able to exclude all or part of this settlement in in gross income, such as ...

What is the meaning of settlement payment?

Related Definitions Settlement Payment means the transfer, or contractual undertaking (including by automated clearing house transaction) to effect a transfer, of cash or other property to effect a Settlement.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

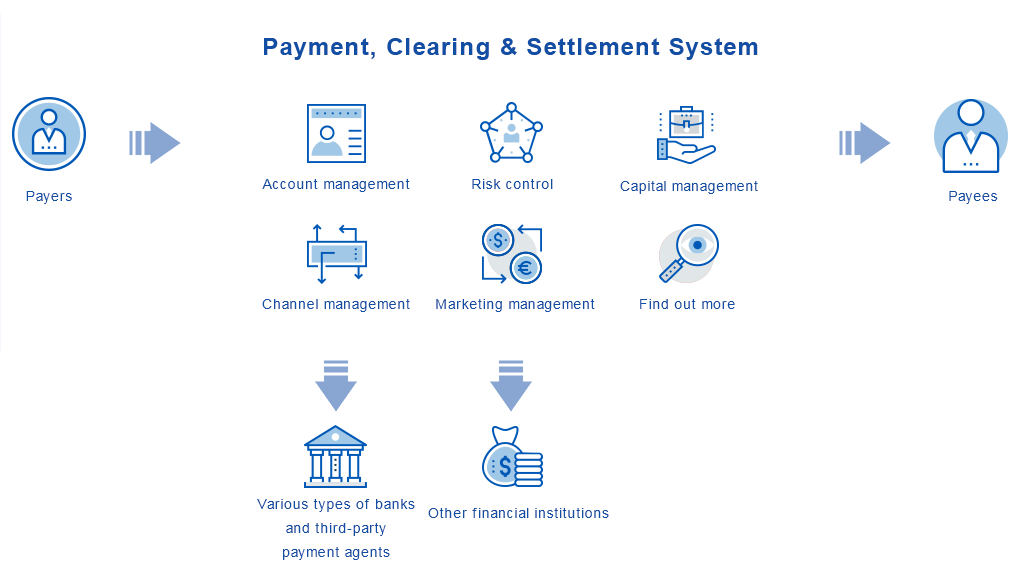

What is payment settlement and clearing?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

What does settlement pending mean on a credit card payment?

Once authorized the processor sends the confirmation to the merchant bank who notifies the merchant and begins the deposit settlement process in the merchant's account. Once the transaction has been confirmed by the issuing bank and merchant bank it is considered authorized and will post as pending.

What is the process of settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

How do banks settle payments?

The settlement bank will typically deposit funds into the merchant's account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

What is settlement risk in payment system?

The settlement risk is the risk that a counterparty, whether a participant or other entity, will have insufficient funds to meet its financial obligations as and when expected, although it may be able to do so at a future date. This risk could further lead to principal risk. (

Why is clearing and settlement important?

Clearing and settlement Clearing is necessary because the speed of trade is much faster than the cycle time for completing the transaction. In its widest sense, clearing ensures that trades are settled in accordance with market rules, even if a buyer or seller should become insolvent prior to settlement.

Do settlements hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

How do I clear my credit card settlement?

What is the credit card settlement processVisit the issuer or a debt settlement agency.Explain your inability to make payments via a credit card settlement letter and mention that you're open to negotiating other repayment terms.Offer a lump sum or inform the issuer of your plans to file for bankruptcy.

What happens if I go for credit card settlement?

Credit card bill settlement is the process wherein the bank asks a person to pay an overdue settlement instead of his dues if he is not able to pay his dues. The bank will thereafter discontinue the credit card. Although the person is free of the dues, it hurts your CIBIL™ score.

What do you mean by payment?

Payment is the transfer of money, goods, or services in exchange for goods and services in acceptable proportions that have been previously agreed upon by all parties involved. A payment can be made in the form of services exchanged, cash, check, wire transfer, credit card, debit card, or cryptocurrencies.

What does settlement mean in banking?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What is settlement in Bharatpe?

A. In Bharat QR, there is no settlement process. Settlement time will be midnight to midnight. Merchant will get the credit on T+1 basis except bank holidays.

What is the difference between settlement and reconciliation?

A settlement is a time between customers making payment and merchant account receiving the fund. In contrast, payment reconciliation is a term used for reviewing all business transactions, including income and expenses.

Examples of Settlement Payment in a sentence

At the request of Defendants’ counsel, the Settlement Administration Account Agent or its designee shall apply for any tax refund owed on the Settlement Payment and return the proceeds, after deduction of any expenses incurred in connection with such application (s) for refund, in accordance with the written direction of Defendants’ counsel.

More Definitions of Settlement Payment

Settlement Payment means an Up Settlement Payment or a Down Settlement Payment, as applicable.

What is the payment system in India?

According to definition of PSS Act 2007, Payment System means a system that enables payment to be effected between a payer and a beneficiary, involving clearing, payment or settlement service or all of them.

Is a payment system applicable to stock exchanges?

However, as per Section 34 of the PSS act, the above definition of payment system is not applicable to stock exchanges or clearing corporations set up under stock exchange. The “Settlement” means according to the above acts ‘the settlement of payment instructions received and these include settlement of securities, ...

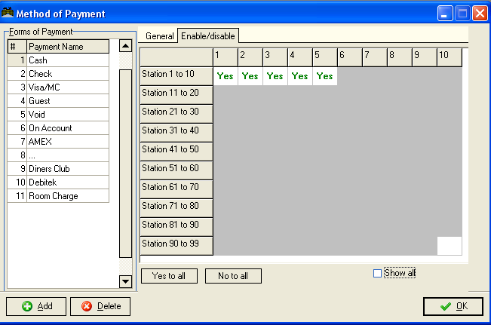

What is a payment settlement entity?

payment settlement entity as used in this document means the banks and other organizations with contractual obligations to make payment to participating payees ( merchants) in settlement of payment cards, or third- party settlement organizations.

What is cash settlement?

Cash Settlement means immediately available funds in U.S. dollars in an amount equal to the Redeemed Units Equivalent.

What is daily settlement price?

Daily Settlement Price means the settlement price for a Swap calculated each Business Day by or on behalf of BSEF. The Daily Settlement Price can be expressed in currency, spread, yield or any other appropriate measure commonly used in swap markets.

What is a qualified settlement fund?

Qualified Settlement Fund or “Settlement Fund” means the interest-bearing, settlement fund account to be established and maintained by the Escrow Agent in accordance with Article 5 herein and referred to as the Qualified Settlement Fund (within the meaning of Treas. Reg. § 1.468B-1).

What is default settlement method?

Default Settlement Method means Combination Settlement with a Specified Dollar Amount of $1,000 per $1,000 principal amount of Notes; provided, however, that the Company may, from time to time, change the Default Settlement Method by sending notice of the new Default Settlement Method to the Holders, the Trustee and the Conversion Agent.

What is net settlement amount?

Net Settlement Amount means the Gross Settlement Amount minus: (a) all Attorneys’ Fees and Costs paid to Class Counsel; (b) all Class Representatives’ Compensation as authorized by the Court; (c) all Administrative Expenses; and

What is the settlement date of a note?

Settlement Date means, with respect to the Called Principal of any Note, the date on which such Called Principal is to be prepaid pursuant to Section 8.2 or has become or is declared to be immediately due and payable pursuant to Section 12.1, as the context requires.

What is structured settlement?

A structured settlement can include a large lump-sum payment upon termination of the contract. A child recipient may receive regular payments while they are a minor and then one large lump sum to pay for their college tuition when they graduate from high school.

What is extra payment in a structured settlement?

Extra payments that occur in the form of periodic lump sums may be included in the terms of a structured settlement contract . For example, a structured settlement holder on a monthly payment schedule may receive an additional payment every five years to pay for the cost of replacing and upgrading medical devices.

Why do structured settlement contracts yield more than lump sum payouts?

In total, a structured settlement contract often yields more than a lump-sum payout would because of the interest earned over time.

How does a period-certain annuity work?

A life-only annuity will continue to pay out for the rest of your life, whereas a period-certain annuity will pay you only for the length of time specified in the contract.

How often can a structured settlement recipient receive payments?

A structured settlement recipient can receive payments at any reasonable regular interval, such as monthly, quarterly, annual ly or even some combination of schedules.

Why is structured settlement important?

One of the greatest strengths of a structured settlement is its ability to earn interest, which can allow the payments to be adjusted upward over time to keep up with inflation. In addition, payments can be set to rise according to a schedule. This may be necessary if the costs of the recipient’s health care are expected to increase over time.

What is a reviewer in the Wall Street Journal?

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.