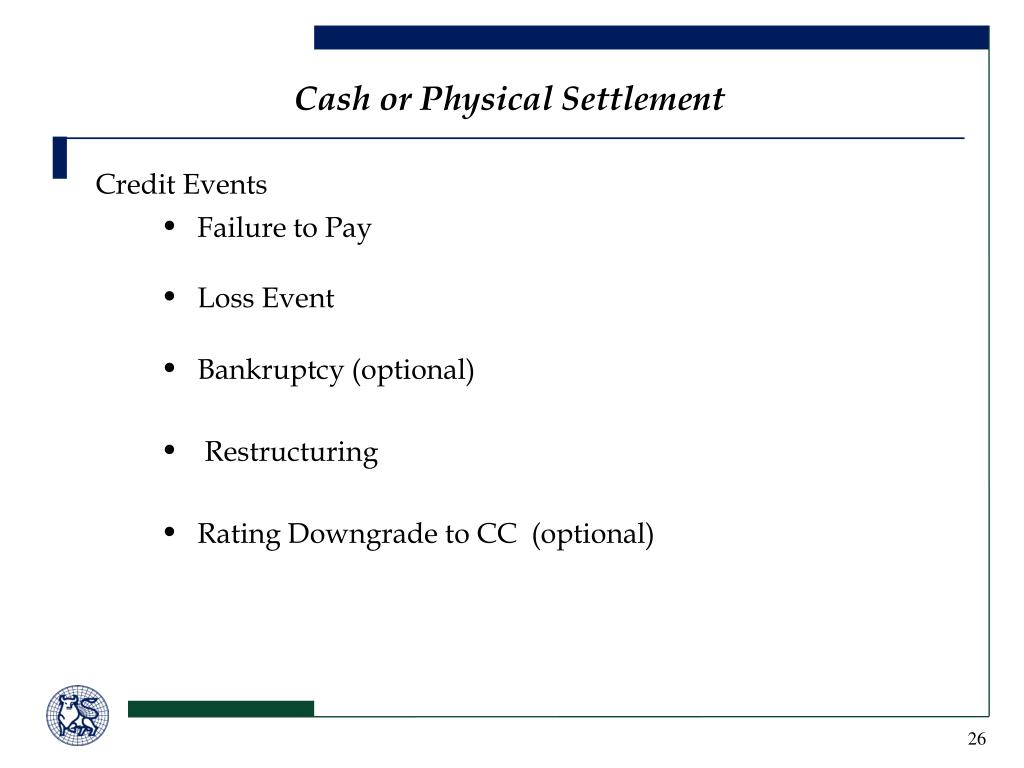

When a credit event occurs, settlement of the CDS contract can be either physical or in cash. In the past, credit events were settled via physical settlement. This means buyers of protection actually delivered a bond to the seller of protection for par. This worked fine if the CDS contract holder actually held the underlying bond.

What is physical settlement?

Physical settlement can be defined as a method or an arrangement in which the actual delivery of an asset is chosen which is supposed to be delivered on a particular date and the idea of cash settlement is discouraged.

How are credit events settled in CDs?

When a credit event occurs, settlement of the CDS contract can be either physical or in cash. In the past, credit events were settled via physical settlement. This means buyers of protection actually delivered a bond to the seller of protection for par. This worked fine if the CDS contract holder actually held the underlying bond.

What happens to offsetting CDS positions during physical settlement?

During physical settlement, if there are offsetting CDS positions, it is important to ensure that the contracts on which protection were sold are triggered no later than the date for the purchases of protection. This ensures that the market participant knows which bonds will be delivered before having to declare which ones to deliver.

Why cash settlement for single-name CDS?

To that end, cash settlement was introduced to more efficiently settle single-name CDS contracts when credit events occurred. Cash settlement better reflects the intent of the majority of participants in the single-name CDS market, as the instrument moved from a hedging tool to speculation, or credit-view, tool.

How does CDS settlement work?

Credit swaps can be cash-settled, where the CDS seller pays the CDS buyer the amount by which the bonds or other referenced financial instrument devalues because of the credit event. In a physical settlement, the seller buys the bonds from the buyer for their par value.

What is CDS recovery rate?

This tends not to be so important for investment-grade name CDSs as variations in their expected recovery rates tend to be low, and the standard recovery rate used by the industry in price calculations is 40%.

What are CDS transactions?

A "credit default swap" (CDS) is a credit derivative contract between two counterparties. The buyer makes periodic payments to the seller, and in return receives a payoff if an underlying financial instrument defaults or experiences a similar credit event.

What does CDS value mean?

The notional value of a CDS refers to the face value of the underlying security. When looking at the premium that is paid by the buyer of the CDS to the seller, this amount is expressed as a proportion of the notional value of the contract in basis points.

Are credit default swaps always physically settled?

When a credit event occurs, settlement of the CDS contract can be either physical or in cash. In the past, credit events were settled via physical settlement.

What does a high CDS spread mean?

The increase in CDS rates indicates that the risk of the debt or the economy has increased. Thus, beyond the insurance function against the default risk, CDS provides insight into the countries' risks.

How do you value a CDs contract?

Valuation of a CDS is determined by estimating the present value of the payment leg, which is the series of payments made from the protection buyer to the protection seller, and the present value of the protection leg, which is the payment from the protection seller to the protection buyer in event of default.

Is your money stuck in a certificate of deposit?

Certificates of deposit (CDs) A CD is the most restrictive of these savings accounts. You usually need to commit a minimum amount of money to open a certificate of deposit, and the money is locked away for a period of time, depending on the term you select.

What can you do with CDs?

How to Recycle CDs & TapesDonate your old CD, DVDs and tapes to a secondhand store or music reseller for reuse. Even if the items are scratched, it's likely they can be repaired and resold. ... Use them for a DIY art project.Mail your media to a company like the CD Recycling Center of America or GreenDisk.

What is a CDS to buyer?

Credit Default Swaps (CDS) Definition. A Credit Default Swap (CDS) is a financial agreement between the CDS seller and buyer. The CDS seller agrees to compensate the buyer in case the payment defaults. In return, the CDS buyer makes periodic payments to the CDS seller till maturity.

Do CDS have interest risk?

The potential for investment losses that result from a change in interest rates. Relative to CDs: Like bonds, CDs are subject to interest rate risk; however, the CD value is always its issue amount plus accrued interest.

What is CDS bond basis?

The CDS-bond basis captures the relative value between a cash bond and CDS contract of the same credit entity. It is defined as an entity's bond swap spread subtracted from its CDS spread.

How do you calculate recovery rate?

Divide the total amount of payments by the total amount of the debt to find the recovery rate. For example, if your company extended $7,000 worth of credit to customers in one week and received $1,000 in payments, the recovery rate for the week is 14 percent.

What is a recovery rating?

Recovery Risk Ratings indicate the variability in the extent of recovery from a loan, post default.

What does loan recovery Meaning?

Loan Recoveries means all payments and any other sums received with respect to a Program Loan, including, but not limited to, from the disposition of any collateral for such loan.

What is recovery rate in consulting?

The recovery rate of time spent on client work has remained static for several years – 77% this year (77% in 2020, 78% in 2019). This means that one-fifth of employees' time is not being billed to a client.

What happens to the protection buyer in a cash settlement?

In case of the cash settlement, the protection seller makes payment equal to a pre-determined value to the protection buyer. The obligation will be valued and the protection seller will pay the protection buyer the full face value of the reference obligation less its current value, that is, it will compensate the protection buyer for ...

What is protection sell?

In case of physical settlement, the protection sell will pay the face value of the asset to the buyer and the buyer will give the reference asset to the seller. The contract may also specify the alternative assets that can be delivered. If the contract has more than one alternative asset mentioned in it, then the buyer will always deliver the one that is the cheapest among them all. This is where the concept of cheapest to deliver comes in.

What is a credit default swap?

In a credit default swap, the credit protection buyer pays a fee to the credit protection seller to protect him from the default of a reference asset. As protection, the protection sell will make the payment to the protection buyer on the occurrence of a credit event.

How long does a buyer of protection have to settle a CDS contract?

Once the notice of default--accompanied by two pieces of publicly available information--has been served, the buyer of protection has up to 30 days to select the individual deliverable obligation for settlement of the contract. Once the notification has occurred, the buyer has a further 30 days from that date to deliver the chosen obligation, against which the buyer receives the notional of the CDS contract.

How does cash settlement work?

Cash settlement works by agreeing to a value of the individual bond that would have been delivered for physical settlement, and paying the compensation net of this amount. The International Swaps and Derivatives Association 2003 documentation specifies a number of ways to cash settle. Probably the most common is a single valuation date, using a dealer poll of at least five dealers. The valuation date is agreed at the time of executing the contract, but could be up to 122 days after the credit event. The final price would be determined by the highest bid price for a specified notional of bonds, and this price is used to determine the compensation amount. It is also possible to use multiple valuation dates. This final amount is paid five days after the dealer poll. The advantages to this method are that cash settlement 1) does not leave the seller of protection with a residual exposure to the defaulted entity and 2) one dealer poll can be used to agree on the settlement values of all relevant contracts with agreement between the counterparties, thus reducing operational loads at a busy time.

Why is it important to monitor CDS positions?

During physical settlement, if there are offsetting CDS positions, it is important to ensure that the contracts on which protection were sold are triggered no later than the date for the purchases of protection . This ensures that the market participant knows which bonds will be delivered before having to declare which ones to deliver. In the event that there are multiple deliverable obligations trading at different prices, then careful monitoring is necessary to ensure that one will not be delivered the cheapest bond while having purchased a more expensive one to deliver.

How to solve basis issue?

One solution to the basis issue is cash settlement using procedures that create an offsetting basis. Recent market developments in North America lead to one solution based around the separation of the bond trade from the process of physical settlement. This approach leaves a cash-settled contract that requires a trade of equal notional of deliverable obligations to be executed at the same time. In this case, the bond trade executed is used to create the same position that each counterparty would have had after standard physical settlement. A seller of protection would have expected delivery of bonds upon settlement and they are required to purchase bonds in the auction. By executing this trade at the same price that is used to cash settle the CDS contract, the counterparties are indifferent as to the final settlement price as any excessive gain or loss on the CDS settlement is offset by the bond trade. This auction system provides further benefits in that it allows for the settlement of a portion of trades not covered by the auction. As described in the previous example, the bonds purchased in the auction could be used to settle another contract where protection had been purchased.

What is a CDS?

The Bottom Line. Even though credit default swaps (CDS) are basically insurance policies against the default of a bond issuer, many investors used these securities to take a view on a particular credit event. The major bankruptcies in the fall of 2008 caught some investors in these contracts off-guard; after all, ...

What is credit event in CDS?

In the CDS world, a credit event is a trigger that causes the buyer of protection to terminate and settle the contract. Credit events are agreed upon when the trade is entered into and are part of the contract.

What is single name CDS?

A single-name CDS is a derivative in which the underlying instrument is a reference obligation or a bond of a particular issuer or reference entity . Credit default swaps have two sides to the trade: a buyer of protection and a seller of protection. The buyer of protection is insuring against the loss of principal in case ...

How long is a credit default swap?

In the interdealer market, the standard tenor on credit default swaps is five years. This is also referred to as the scheduled term since the credit event causes a payment by the protected seller, which means the swap will be terminated. When the tenor expires, so do the payments on the default swap.

Why are CDSs used less?

As CDSs grew in popularity, they were used less as a hedging tool and more as a way to make a bet on certain credits. In fact, the amount of CDS contracts written outnumbers the cash bonds they are based on. It would be an operational nightmare if all CDS buyers of protection chose to physically settle the bonds. A more efficient way of settling CDS contracts needed to be considered.

Why is tenor important in a credit default swap?

Tenor —the amount of time left on a debt security's maturity—is important in a credit default swap because it coordinates the term remaining on the contract with the maturity of the underlying asset. A properly structured credit default swap must match the maturity between contract and asset.

How much would you get if you bought Lehman Brothers bonds?

In other words, if you had held Lehman Brothers bonds and had bought protection via a CDS contract, you would have received 91.375 cents on the dollar. This would offset your losses on the cash bonds you held. You would have expected to receive par, or 100, when they matured, but would have only received their recovery value after the bankruptcy process concluded. Instead, since you bought protection with a CDS contract, you received 91.375. (To learn more, read: Case Study: The Collapse Of Lehman Brothers .)

What is a Physical Settlement/Delivery?

This refers to a derivatives contract A Derivatives Contract Derivative Contracts are formal contracts entered into between two parties, one Buyer and the other Seller, who act as Counterparties for each other, and involve either a physical transaction of an underlying asset in the future or a financial payment by one party to the other based on specific future events of the underlying asset. In other words, the value of a Derivative Contract is derived from the underlying asset on which the Contract is based. read more requiring the actual underlying asset to be delivered on the specified delivery date, rather than being traded out net cash position or offsetting of contracts. The majority of the derivative transactions are not necessarily exercised but are traded prior to the delivery dates. However, physical delivery of the underlying asset does occur with some trades (largely with commodities) but can occur with other financial instruments Financial Instruments Financial instruments are certain contracts or documents that act as financial assets such as debentures and bonds, receivables, cash deposits, bank balances, swaps, cap, futures, shares, bills of exchange, forwards, FRA or forward rate agreement, etc. to one organization and as a liability to another organization and are solely taken into use for trading purposes. read more.

Who does settlement by physical delivery?

Settlement by physical delivery is carried out by Clearing brokers or their agents . Immediately, after the last day of trading, the regulated exchange’s clearing organization shall report a sale and a purchase of the underlying asset at the prior day’s settlement price (normally the closing price).

What is the difference between cash settlement and physical settlement?

Cash settlement is an arrangement under which the seller in a contract chooses to transfer the net cash position instead of delivering the underlying assets whereas physical settlement can be defined as a method, under which the seller opts to go for the actual delivery of an underlying asset and that too on a pre-determined date and at the same time rejects the idea of cash settlement for the transaction.

What is the advantage of cash settlement?

The single largest advantage of cash settlement is that it represents a way of trading Futures & Options based on assets and securities, which would practically very difficult with the physical settlement.

Why is cash settlement used in derivatives?

In derivatives, cash settlement is used in the case of a Futures contract since it is monitored by an exchange, ensuring smooth execution of the contract.

What is the benefit of physical settlement?

The primary benefit of Physical settlement is that it is not subject to manipulation by either of the parties since the entire activity is being monitored by the broker and the clearing exchange. The possibility of the counterparty risk will be monitored, and consequences are known for the same.

Which method of settlement offers greater liquidity in the derivatives market?

The cash settlement method offers greater liquidity in the derivatives market, whereas the physical settlement method offers an almost negligible amount of liquidity in the derivatives market.

How is physical delivery settlement done?

The physical delivery settlement process is coordinated and settled via a clearing broker or a clearing agent. If the contract holder opts to take a short position, they are responsible for the physical delivery of the commodity. If the holder opts to take a long position, they will be taking, i.e., receiving physical delivery of the commodity.

What is cash settlement?

Cash settlement is the more simple and convenient mode of settlement, as it only involves the upfront net cash amount as the total cost. Settlement transactions do not come with additional costs or fees. Finally, cash settlement is one of the prime reasons for the increased entry of speculators in the derivatives market.

Why is cash settlement the most popular method of settlement?

Also, cash settlement is the more popular method of settlement because of the liquidity#N#Liquidity In financial markets, liquidity refers to how quickly an investment can be sold without negatively impacting its price. The more liquid an investment is, the more quickly it can be sold (and vice versa), and the easier it is to sell it for fair value. All else being equal, more liquid assets trade at a premium and illiquid assets trade at a discount.#N#it brings to the market.

What is the method of settling commodities?

1. Cash Settlement. The cash settlement method of settling commodities does not involve the physical delivery of the asset (s) under consideration. It instead involves the settlement of net cash on the settlement date. Cash settlement involves the purchaser or the contract holder to pay the net cash amount on the settlement date and execute ...

What is physical delivery?

Physical delivery involves a number of additional costs, including delivery costs, transportation costs, brokerage fees, and so on.

What is calendar spread?

Calendar Spread Calendar SpreadA calendar spread involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month.

Can't believe none of the L1 candidates have inquired about wearing suits this round

I hope that means they all know the dress code, because I'd hate for them to be underdressed, or have trouble networking after the exam.

Some of this material seems excessive

I'm scheduled to take level 2 on Friday, and I'm a serious person so I was hesitant to say anything before now, but some of this material seems excessive and off topic.

You study too much

Yes, you! The guy that spends every weekend studying 8 hours a day. The girl that wakes up at 5 am to study before works just to come home and study some more. The person who is contemplating taking a few vacation days just to cram in a few more hours. You're setting yourself up to fail.

Tip to my future self: use excel more

When the CFA text makes a big table, recreate the table in Excel! I spent so much time on trying to understand how to do everything that was written in CFA text by hand with my shitty BAII plus (fuck that thing), when I could have saved a ton of time and effort by replicating big tables in excel.