What is the real estate settlement procedures act?

What Is the Real Estate Settlement Procedures Act (RESPA)? The Real Estate Settlement Procedures Act (RESPA) was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures.

What is a settlement statement in real estate?

The Seller’s Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. This is one of many closing documents for seller. Who prepares the settlement statement?

What is a real estate settlement date?

This is the day you have been waiting for! Your real estate settlement date is the date that you will sign all the official documents to complete the purchase. Traditionally this is also the day that you will get the keys for the home and be able to move in.

What does settlement charge mean on escrow?

“Title Charges Escrow” or “Settlement Charges” are all fees charged by title or escrow companies for performing tasks like notarizing signatures. The “Commission” section refers to real estate agent commissions amounting to 5%-6% of the sale price on average.

What does real estate settlement mean?

Settlement involves the simultaneous exchange of documents, and funds required to complete the transaction. You pay the purchase price to the seller with a combination of your down payment, your own funds, and the proceeds of your loan.

What is the difference between settlement and closing?

Although different people use different terms, the "closing" or the "settlement" refers to the same finalization of your home purchase. At the closing or settlement date, the seller receives the sale proceeds, and the buyer pays any required expenses to close the transaction, known as closing costs.

What is the purpose of the Real Estate Settlement Procedures Act?

RESPA seeks to reduce unnecessarily high settlement costs by requiring disclosures to homebuyers and sellers, and by prohibiting abusive practices in the real estate settlement process.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

How long is settlement usually?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What happens after house settlement?

After settlement, your lender will draw down on your loan. This means that they'll debit the amount they've paid at settlement from your loan account. You're then responsible for paying land transfer duty or stamp duty. It's usually paid on the settlement date.

Which of the following activities is not allowed under the real estate Settlements and Procedures Act?

Which of the following activities is not allowed under the Real Estate Settlements and Procedures Act? A broker having any business relationship with an insurance company that is involved in the broker's transaction.

Which disclosure is required by the Real Estate Settlement Procedures Act?

What Information Does RESPA Require To Be Disclosed? If necessary, your lender or mortgage broker must provide an Affiliated Business Arrangement Disclosure. This disclosure indicates that the lender, real estate broker, or other participant in your settlement has referred you to an affiliate for a settlement service.

Which document provides an estimate of the cost a buyer is likely to pay at settlement?

A Good Faith Estimate (GFE) of settlement costs must also be provided to the borrower. The GFE must describe all the charges the buyer is likely to pay at closing. The GFE is only an estimate, and the total amount of the charges the borrower may be liable for may vary from the amount set forth in the GFE.

How long does it take to get money after house settlement?

The timeframe in which it takes for mortgage funds to be released does vary between lenders, however, it is common for funds to be released within between 3 and 7 days.

Do you get the keys on settlement day?

Once the documents have been signed by both parties, they're sent to the titles office to register you as the new owner of the property. On settlement day, you can pick up your keys and move into your new home.

Who attends the final walk through?

Typically, the final walk-through is attended by the buyer and the buyer's agent, without the seller or seller's agent present. This gives the buyer the freedom to inspect the property at their leisure, without feeling pressure from the seller. If the property is a new home, a builder or contractor may attend.

What not to do after closing on a house?

What Not To Do While Closing On a HouseAvoid Big Charges on a Credit Card. Do not rack up credit card debt. ... Be Careful with Trends. ... Do Not Neglect Your Neighbors. ... Don't Miss Tax Breaks. ... Keep Your Real Estate Agent Close. ... Save That Mail. ... Celebrate!

What is the settlement date for a bond?

What Is a Settlement Date? The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2).

What is difference between loan foreclosure and settlement?

A loan closure is paying off the monthly instalments until the last payment as per the schedule; thus, closing the loan account. A loan settlement, unlike the loan closure, has the status marked as 'settled', which has an adverse CIBIL impact on your credit score, which is dropped by 75-100 points.

What is the difference between settlement date and disbursement date?

Disbursement Date This is the date on which the lender/creditor funds the loan. Settlement Agent This is the individual or agency responsible for consummating the sale. File # This is the settlement agent's file number (GF#). Property This is the street address of the property, including the zip code.

How long does it take to settle a mortgage?

While the real estate settlement process can be a lengthy endeavor, it is also an exciting one. Most federal mortgage loans close within 30 to 45 days on average, although the type of home buyer program can sometimes extend this timeline. No matter what type of loan you choose, you can expect your closing to be filled with countless contracts, documents, and other types of paperwork that requires your careful review and signature. To learn more about the real estate settlement process or the importance of acquiring title insurance for your new home, contact the title service professionals at Mathis Title Company.

What is the closing of a home?

Buying or selling a home is often a long, tedious process with many variables involved. One part of the process that everyone can look forward to is the closing. Also referred to as a ‘real estate settlement,’ the closing on a home is the final step before the buyer receives the keys, documents get recorded and proceeds disbursed. While the concept of a closing seems fairly straightforward, there are some important aspects to consider before transferring the deed from seller to buyer. As you get closer to your closing date, familiarize yourself with the real estate settlement process.

What happens after closing on a house?

After closing, the funds are transferred from the escrow account to the rightful parties. A title search is a crucial part of the home buying process as it helps reveal possible defects in the title of a property. Along with performing a title search comes title insurance.

What documents are needed to complete a real estate transfer?

There are a number of documents involved in this process, including a bill of sale, an insurance certificate, the deed, and a settlement statement which includes all settlement costs . The buyer will also need to review the proration agreements and acknowledgements of reports. Some of these legal documents may need to be notarized.

What is a home inspection?

A home inspection is a necessary step in the real estate settlement process that helps identify any existing problems with a home before closing. If problems are found during a home inspection, the buyer has the opportunity to ask the seller to make repairs or the buyer may decide to cancel the transaction altogether.

What Is the Real Estate Settlement Procedures Act (RESPA)?

The Real Estate Settlement Procedures Act (RESPA) was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures. RESPA was also introduced to eliminate abusive practices in the real estate settlement process, prohibit kickbacks, and limit the use of escrow accounts. RESPA is a federal statute now regulated by the Consumer Financial Protection Bureau (CFPB).

What is a RESPA lawsuit?

A plaintiff has up to one year to bring a lawsuit to enforce violations where kickbacks or other improper behavior occurred during the settlement process.

How long does it take to file a complaint against a loan servicer?

If the borrower has a grievance against their loan servicer, there are specific steps they must follow before any suit can be filed. The borrower must contact their loan servicer in writing, detailing the nature of their issue. The servicer is required to respond to the borrower’s complaint in writing within 20 business days of receipt of the complaint. The servicer has 60 business days to correct the issue or give its reasons for the validity of the account's current status. Borrowers should continue to make the required payments until the issue is resolved.

What is RESPA in real estate?

What Is the Real Estate Settlement Procedures Act (RESPA)? The Real Estate Settlement Procedures Act (RESPA) was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures. RESPA was also introduced to eliminate abusive practices in the real estate settlement process, prohibit kickbacks, ...

How long does it take to respond to a borrower's complaint?

The servicer is required to respond to the borrower’s complaint in writing within 20 business days of receipt of the complaint. The servicer has 60 business days to correct the issue or give its reasons for the validity of the account's current status.

How long does a plaintiff have to file a lawsuit?

A plaintiff has up to one year to bring a lawsuit to enforce violations where kickbacks or other improper behavior occurred during the settlement process.

What is a RESPA loan?

The types of loans covered by RESPA include the majority of purchase loans, assumptions, refinances, property improvement loans, and equity lines of credit. 1. RESPA requires lenders, mortgage brokers, or servicers of home loans to disclose to borrowers any information about the real estate transaction. The information disclosure should include ...

What is a settlement agent?

Not only is a settlement agent responsible for prepping appropriate closing documents for the buyer and seller and working with the lender to execute any loan documents, but the agent is also responsible for maintaining an escrow account and keeping impeccable records.

What is a wet settlement?

That all parties have executed appropriate closing documents and the settlement agent is in possession of all funds. At this point, the settlement agent is able to record the applicable deed and/or deed of trust.

What is the fiduciary duty of a settlement agent?

Settlement agents act as stewards of millions of dollars of funds on a daily basis and that’s not to be taken lightly.

What is a closing in real estate?

What is a real estate closing? A real estate closing occurs when the seller has signed the deed conveying the property to the buyer, all parties have signed the final settlement statement, and the settlement company is in possession of all closing funds. If one of these items is missing, the deal is not closed.

What is a real estate settlement company?

A real estate settlement company’s primary purpose is to help you with the closing process after you purchase your house. Depending on the organization, a real estate settlement company may only provide title insurance, or just offer escrow services, or it may supply both. Be sure to ask your real estate settlement company how it can specifically assist you.

What is a settlement company?

A professional settlement company can act as both a closing agent and an escrow officer. If you choose an organization that is prepared to handle both of these responsibilities, this is generally a sign that you are in good hands. A home is one of the most important investments you will make in your life, and a settlement company can help you ensure that no aspect of the closing process is overlooked. Funds are placed in escrow to allow you (the homebuyer) to perform due diligence on your new investment.

What is a title search?

A title search is conducted to ensure that a title (e.g. a deed) is clean and that your home may be legally sold. All issues or “defects” to a title – such as mechanics liens, easements, property restrictions, undisclosed heirs, and public record errors – should be settled prior to the sale of a home. This is the key first step toward issuing title insurance.

Do title insurance companies charge fees at closing?

In some cases, a title insurance company may also provide you with an itemized list of fees upon closing. Although this sum may be different from the total amount listed on your mortgage loan estimate, this does not necessarily signify you are being forced to pay more.

What is the first step in settling an estate?

The first step (and one of the most important ones) in the process of settling an estate is getting organized . You’ll want to keep track of both your expenses and all the time you spend working on settling the estate, as you’re entitled to be compensated. You should look for a Will.

How Long Does an Executor of a Will have to Settle an Estate?

In short, an Executor generally has as long as he or she needs to settle an estate, provided all statutory deadlines are met.

How to Settle an Estate without a Will?

When it happens, the resolution of the estate will depend on how big it is, how complex it is and how many heirs claim to have rights to a piece of it. State law comes heavily into play in these cases, and the courts would determine who should be appointed to administer and settle the estate.

How much is a probate estate worth?

The baseline number to qualify for a simplified probate can range anywhere from $20,000 to up to $150,000 or more.

Do all estates need to go through probate?

Keep in mind, not all estates will need to go through probate - probate laws can vary significantly depending on what state you’re in and the size of the estate. If there was a Trust set up, or if the estate is very small in value, it may avoid probate all together. 3. File the Will & Notify Necessary Persons.

Is the estate settlement process complicated?

But when you have a solid checklist, with a timeline that details what to expect and when to expect it, you may find it's actually not as complicated as you first thought.

Do I need an EIN to Settle an Estate?

You need an EIN (Employee ID Number), also known as a Tax ID number, to settle an estate. The EIN is used to file taxes on the estate’s behalf.

Definition and Examples of RESPA

The Real Estate Settlement Procedures Act (RESPA) is a federal act that requires mortgage brokers, lenders, and servicers to provide borrowers with disclosures about costs they may incur and what to expect from the real estate settlement process.

How the Real Estate Settlement Procedures Act Works

By requiring lenders to provide information about settlement services, real estate transactions, and consumer protection laws, RESPA helps buyers become better equipped to navigate a real estate transaction. RESPA also entitles borrowers to both annual and initial escrow account statements and itemized statements of actual settlement costs.

What to Expect and How to Prepare for Your Settlement Date

This is the day you have been waiting for! Your real estate settlement date is the date that you will sign all the official documents to complete the purchase. Traditionally this is also the day that you will get the keys for the home and be able to move in.

Agreeing on a Real Estate Settlement Date

When it comes to a real estate settlement date in general, our primary goal is to find a date that is amicable to both sides.

Timelines and Expectations for Settlement

The average time it takes to get to settlement depends on a multitude of factors.

What to Bring With You on Settlement Date

On your settlement date, you’re likely going to be reviewing and signing documents related to your loan (if you have one) and the title of the home. In order to sign those documents and have your signature notarized, you’re going to need to prove you are who you say you are.

What Comes Next

Now that you are in your new house, there’s a few things that you can do, but start by changing the locks.

Closing Out

Your real estate settlement date is what you’ve worked so hard for throughout your home buying journey.

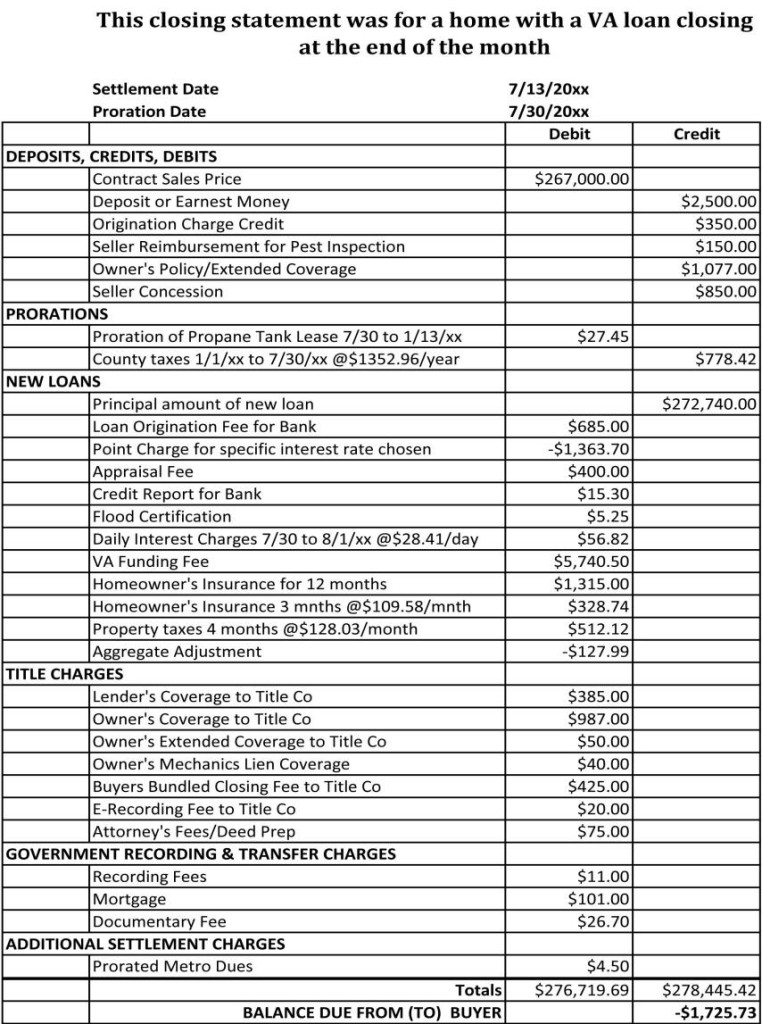

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.