"Settlement bonus" is a special bonus paid at the time of settlement, not only the meaning of returning profits when business performance is good, but also the section ...

Full Answer

What should my settlement agreement say about my bonus?

Your settlement agreement should properly reflect your bonus situation, including in relation to deferred payments and your “good leaver” status. For further information and advice in relation to your bonus, please contact Philip Landau on 020 7100 5256 or email him at [email protected]

What are bonuses based on?

Bonuses can be based on unique incentive programs, built into employment contracts or based on profit sharing. Many companies have bonus programs outlining the specific details that qualify employees to receive a bonus, while others might give an annual bonus to all employees at a company.

When is a company liable to pay a bonus?

If your appointment letter and compensation terms agree to pay bonus company is liable to pay bonus at the end of financial year. Some company clear bonus with final settlement or some pay at the end of financial year after declare bonus rate.

What are retention bonuses?

Retention bonuses are financial incentives given to valuable employees in exchange for company loyalty. Other terms for retention bonus include retention pay and retention package. A company may offer retention bonuses to key employees during a merger, acquisition, or particularly crucial part of the business cycle.

Do I still get my bonus if I quit?

Per Labor Code 201, you have a protected right to bonuses even if you get let go. It states, if the employer discharges an employee, the wages earned are due immediately. Though, if an employee quits, they are still entitled to all unpaid wages, including unpaid bonuses 72 hours of their final day.

How does bonus payout work?

A bonus payment is additional pay on top of an employee's regular earnings. A bonus payment can be discretionary or nondiscretionary, depending on whether it meets certain criteria. Bosses hand out bonus payments for a variety of reasons, including as a reward for meeting individual or company goals.

What is the average bonus payout?

A normal year-end bonus will vary from position to position, but the average bonus pay in the U.S. is 11% of exempt employees' salaries, 6.8% of nonexempt employees' salaries, and 5.6% of hourly employees' salaries.

Can an employer take back a bonus?

But the truth is that most employers — public or private — have the legal right to recoup bonuses or other wages if they can prove that the worker was overpaid.

Is bonus considered income?

Yes, bonuses are considered supplemental wages and therefore are taxable. As defined by the Internal Revenue Service (IRS) in the Employer's Tax Guide, “supplemental wages are compensation paid in addition to an employee's regular wages.

Is a 7% bonus good?

What is a Good Bonus Percentage? A good bonus percentage for an office position is 10-20% of the base salary. Some Manager and Executive positions may offer a higher cash bonus, however this is less common.

What is an average bonus 2022?

As of Aug 23, 2022, the average annual pay for a Bonus in the United States is $52,406 a year.

How much of a bonus is taxed?

10.23%In California, bonuses are taxed at a rate of 10.23%. For example, if you earned a bonus in the amount of $5,000, you would owe $511.50 in taxes on that bonus to the state of California. In some cases, bonus income is subject to additional taxes, including social security and Medicare taxes.

How do I calculate my bonus?

Multiply total sales by total bonus percentage.For example, you make $10,000 in sales, and your company offers you a 5% commission. ... $10,000 x .05 = $500.One employee makes $50,000 per year, and the bonus percentage is 3%. ... $50,000 x .03 = $1,500.More items...

Can your boss take away your bonus?

Eligibility For a Contractual Bonus A contractual bonus is paid within the terms of a contract of service and cannot be withdrawn by the employer without legal consequences. The employer can not change or remove the bonus terms from the contract unless the contract is amended.

Can an employee refuse a bonus?

If your company offers performance-based bonuses and you recently qualified for one, your employer has an obligation to follow through with their promise to pay you a bonus. If they refuse to do so, you have the right to take action and demand your unpaid wages in the form of a non-discretionary bonus.

Can I sue my employer for not paying my bonus?

Can I sue my employer for unpaid bonus pay? Yes. You can make a claim against your employer if: You have not been paid contractual bonus pay (as long as you have met any clauses included such as having worked the full year)

How are bonuses taxed in 2022?

Your total bonuses for the year get taxed at a 22% flat rate if they're under $1 million. If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every dollar over that gets taxed at 37%. Your employer must use the percentage method if the bonus is over $1 million.

Why are bonuses taxed so high?

Bonuses are taxed heavily because of what's called "supplemental income." Although all of your earned dollars are equal at tax time, when bonuses are issued, they're considered supplemental income by the IRS and held to a higher withholding rate. It's probably that withholding you're noticing on a shrunken bonus check.

How much do bonuses get taxed?

22 percentA bonus is always a welcome bump in pay, but it's taxed differently from regular income. Instead of adding it to your ordinary income and taxing it at your top marginal tax rate, the IRS considers bonuses to be “supplemental wages” and levies a flat 22 percent federal withholding rate.

What is a typical bonus structure?

A company sets aside a predetermined amount; a typical bonus percentage would be 2.5 and 7.5 percent of payroll but sometimes as high as 15 percent, as a bonus on top of base salary. Such bonuses depend on company profits, either the entire company's profitability or from a given line of business.

What are the different types of bonuses?

Bonuses can be contractual or discretionary, or sometimes a mix of the two.

How much of a bonus can be deferred?

The cap prevents bonuses of more than 100% of your salary being paid out, although this can rise to 200% of your salary with shareholder approval. A minimum of 25% of any bonus exceeding 1 x salary must be deferred for at least five years in the form of long-term deferred instruments (LTDI’s)

What are my rights to a bonus if I resign or have been given notice?

Often, the question will arise whether payment of a discretionary bonus should still be made on termination of your employment – whether you have resigned or been dismissed. The big issue will turn on whether or not your are still employed as at the “bonus payment date”. This is because most contracts of employment will link your eligibility to qualify for payment based on whether you are still in employment at this date. One way for your employer to ensure you don’t meet this qualification is to make you redundant or dismiss you for poor performance at the same time as making you a payment in lieu of notice. This means you will not be employed as at the bonus payment date. The courts have generally upheld this as a valid reason for employers not to pay- as long as your contract states you must be employed at the bonus payment date to be eligible to receive the bonus.

What is discretionary bonus?

A discretionary bonus is one that gives your employer the final say as to whether you are eligible for a bonus and if so, what amount you should receive under the bonus scheme. Most discretionary bonuses schemes will provide that the discretion by your employer is based on either the performance of your work individually, as a team, the business as a whole-or a mixture of these. Many contracts of employment also provide for your employer to amend the scheme from time to time, but any changes must be made reasonably and in good faith.

Can you get a pro rata bonus if you leave?

This will normally be governed by your contract of employment. Many contracts will state that you are not entitled to a pro-rata bonus if you leave without working the full year, or are not employed at the bonus payment date. Regardless of what your contract states, however, if it is your employers custom and practice to make a pro-rata bonus, then a strong argument can usually be made that your employer should be bound by such practice.

Is there an unfettered discretion on whether to pay a bonus?

It is now accepted that there is no such thing as an unfettered discretion on whether to pay a bonus by an employer. Various decisions by the courts in recent years have determined that an employer must exercise its discretion in good faith and on reasonable grounds. The decision must not be perverse or irrational. Accordingly if an employee meets the objectives set out in his bonus criteria, an employer must have reasonable grounds and justifcation for not paying it. An employer may find it difficult to establish such a reason if it is not clearly specified as being a relevant factor in the bonus clause.

Can contractual bonus arrangments be disputes?

You will also find a contractual bonus arrangments with reference to a set formula or target. If there is clarity in how the formula and objectives work when calculating the bonus, it is likely to minimise areas of dispute. Unfortunately though, disputes can still arise where targets have not been met, especially if an employer manipulates the level of work given to an employee so that a target becomes unattainable.

What is bonus pay?

A bonus is an additional amount of pay that an employee earns on top of their regular salary or hourly pay rate. Bonuses can be based on unique incentive programs, built into employment contracts or based on profit sharing. Many companies have bonus programs outlining the specific details that qualify employees to receive a bonus, ...

How do bonuses work?

Each company's bonus program works differently, but there are some general guidelines and best practices that inform how a company gives out bonuses. Bonuses can be built into a company's overall budget in a discretionary fund, or they can be determined by your department's overall success. Some bonuses have multiple criteria, including the financial success of a company, the performance of your team and your individual evaluation results.

What is the average bonus percentage?

While entry-level employees may not be eligible for a bonus at all, executives may receive a bonus that is over 100% of their yearly salary. Professionals in sales positions may rely on bonuses to make up most of their paycheck. Likewise, people who work for nonprofits rarely get bonuses due to limited budgets and a lack of profit opportunities.

What are the types of bonuses?

In order to understand the appropriate expectations for getting a bonus in the workplace, research the types of bonuses your company offers. There are several situations where employers commonly give out bonuses, although some companies may implement bonuses on a completely case-by-case basis. The most common types of bonuses include:

What is the difference between a bonus and commission?

Bonuses and commission are both additional pay that employers add to your standard salary, but they do have some key differences. Often, a commission is built into an employee's pay structure with the understanding that their performance determines how much they get paid. Employees who work on commission usually receive commission pay with every paycheck, and the amount they earn directly correlates to the profits they brought to their employer.

How do I know if my bonus is fair?

Ensure that your bonus is fair by researching an employer's bonus structure before accepting a position. In the final round of interviews, or whenever you discuss compensation with a potential employer, ask directly about how bonuses work. Pay attention to how much of your salary would be paid as a bonus and what the standards are to earn each bonus. You can also research other companies within your field to give you an idea of the compensation that other businesses offer.

How much do executive bonuses equal?

Executives tend to receive higher bonuses that can multiply based on performance, while most employees earn bonuses equal to 1% to 5% of their overall salary.

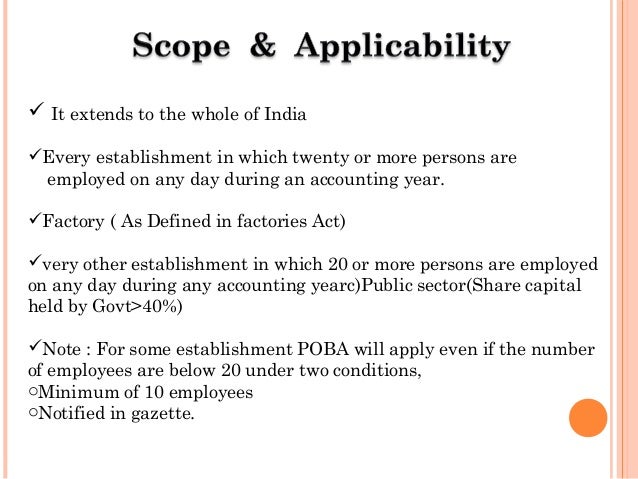

What is the Payment of Bonus Act?

The Payment of Bonus Act 1965 is applicable to all factories and companies who have 20 or more employees employed anytime with them during an accounting year. Also, as per the act, the bonus should be awarded on the basis of profit earned by the company or the productivity of an individual.

Why do employers give bonuses?

It is given by the employers as a remuneration for their dedication towards the company and work, which in turn helped the company achieve its business goals. The underlying purpose of offering a bonus is to distribute the benefit received by the company to the employees.

How much bonus is required for an accounting year?

According to the Bonus Payment Act, a minimum bonus of 8.33% of wage or salary earned by the employee for an accounting year or Rs 100, whichever is higher shall be paid to the employee. The employer shall also pay a higher bonus to employees if, in a year, the allocable surplus exceeds the amount of minimum bonus payable to the employees.

What is required before disqualifying a bonus?

Also, before disqualifying the bonus payment, employers must ensure that the process of domestic inquiry, appropriate documentation, and employee acceptance of misconduct are as per the standing orders.

What is the minimum bonus for a company?

The act states that a minimum bonus of 8.33% and a maximum bonus of 20% of wages can be awarded as a bonus to employees.

When are start ups exempt from bonus?

Under the act, start-ups and new establishments are exempted from bonus payments for the first five years. Employers are eligible to pay statutory bonus only in the year in which they derive profit after the commencement of operations.

Can a company pay a bonus if it incurs losses?

Companies incurring losses can be exempted from paying a minimum bonus to their employees for a certain period. Although, the factors of occurrence of losses to the company must be justifiable, and the employer must have no intentions to avoid payment of bonus by creating fake losses.

What is Full and Final Settlement in Payroll?

Full and Final Settlement commonly known as FnF process is done when an employee is leaving the organization. At this time, he/she has to get paid for the last working month + any additional earnings or deductions. The procedure has to be carried out by the employer after the employee resigns from their services.

What is the process of paying and recovering during the resignation process?

The procedure of paying and recovering during the resignation process is called the Final Settlement of the employee. You can relieve the employee first and then do the FnF or do the final settlement first then relieve the employee. It depends on your company policy.

What is cultural settlement?

Cultural Settlements enable the player to explore new cultures of humanity’s past during the different ages of Forge of Empires. As the main game has already moved beyond those times, Cultural Settlements are introduced as a new way to explore and experience those rich cultures of our history.

What makes it harder to build a settlement?

Impediments. Building up a settlement is not as easy as one may think, as impediments, unmovable rocks in the settlement, block part of the city grid , making it harder to arrange buildings, since buildings need to be placed around the impediments.

Do all settlement buildings require a road connection to the embassy?

All settlement buildings except some diplomacy buildings require a road connection to the embassy.

Can a settlement be abandoned?

Each settlement can be abandoned at any point. Abandoning a settlement will not change the existing Impediments nor will it change the prices in certain goods for the Embassy advancements .