A claim settlement is an agreement between two or more parties to settle a legal claim with payment and other terms. Claim settlements can come up in a number of legal contexts. It is important to be aware that settling a claim usually also eliminates the right to make future claims about the legal matter in the future.

How long does a company have to settle a claim?

Most states have regulations for how long an insurance company can take to settle your claim after it is filed. Many states are required to reach settlement within 30 to 45 days of accepting the claim. Some auto insurance claims take longer than others.

What is the meaning of claim settled in full?

When a case is settled, the document that brings the case to a close is sometimes referred to as a "full and final release".These words mean that there is no going back. Questions often crop up a year or more later, indicating that the injured person has now found some new symptom that was for whatever reason unknown at the time of the settlement.

Can I settle claim without lawyer?

Whether your home was damaged in a fire, you were the victim in an auto accident or you suffered a personal injury due to someone else's negligence, you can settle your claim without a lawyer by working directly with your insurance company or the company of the negligent party.

How long does an insurer have to settle a claim?

Sixty days is the maximum amount of time an insurer has to settle a claim without facing fines and penalties. To delay your claim further, the insurance company must submit an official request for more time with a valid reason, such as the need for further investigation.

What does it mean to settle a claim?

Settling a claim means a complete resolution of the case. It fully ends and resolves all issues that relate to the case. Both parties have the right to have a judge or jury decide the case. However, when you settle, you and the other party agree on what the resolution is going to be.

How is claim settlement done?

Claim settlement is one of the most important services that an insurance company can provide to its customers....Claims ProcessClaim intimation/notification. ... Documents required for claim processing. ... Submission of required documents for claim processing. ... Settlement of claim.

What is a settlement in insurance?

Insurance settlement. The payment of proceeds by an insurance company to the insured to settle an insurance claim within the guidelines stipulated in the insurance policy.

What are the types of claim settlement?

The claim settlement is the final stage of the claim process in insurance....4 Major Types Of Claims SettlementPayment of money.Replacement of the item covered.Reinstatement.Paying for repairs.

What are the documents required for claim settlement?

At the time of claim settlement, the below documents are generally asked by the insurance providers:Filled and Signed Claim Form.Original Policy Document.Death Certificate issued by the concerned authority.Police FIR (in the event of unnatural death)Age proof of Insured.More items...•

Why is claim settlement important?

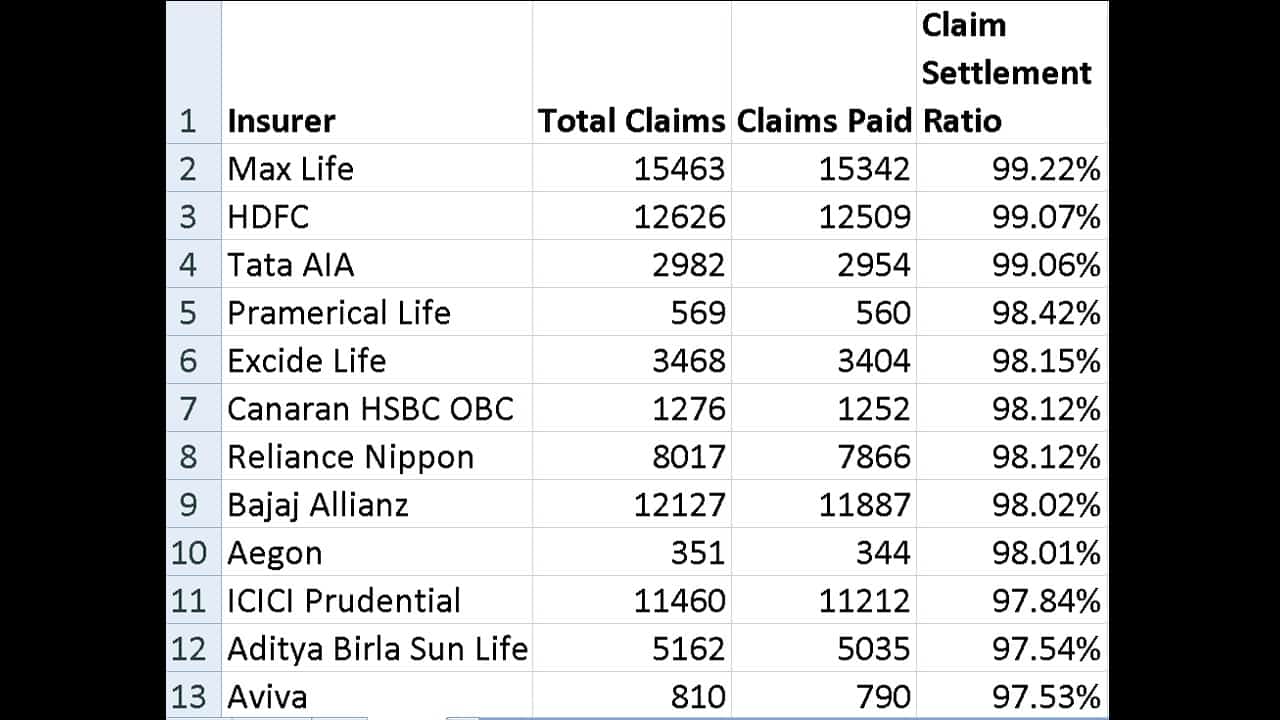

If the claims are not resolved, the entire point of purchasing insurance coverage is defeated. To put it another way, the settlement ratio is the ratio of the total number of insurance claims paid out by an insurance company to the total number of claims received.

How do settlements work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

Do insurance companies prefer to settle?

Often times, insurance companies want you to settle because they are trying to save money. When they present initial settlements, the sum is probably lower than what you deserve. Hiring an attorney to review any settlement proposals can benefit you and ensure that you are not cheated out of a fair sum.

What is insurance settlement cost?

The settlement of claim means the offering of compensation to policyholders for damage or loss to their cars. The car insurance claim can be settled in two ways which are cashless and reimbursement claim settlement, where the former is more preferred. Read More. Car insurance starting from Rs. 2072/year*

What are the stages of a claim?

However, in addition to being somewhat complicated, an injury claim can take some time to complete as it potentially consists of three main processing stages: filing, fact-finding and response, and trial.

What is the claim process?

Definition & How it Works. Businessdictionary.com defines claims processing as “the fulfillment by an insurer of its obligation to receive, investigate and act on a claim filed by an insured.

Why do insurance companies reject claims?

Every insurance provider states certain conditions under which the claim can be rejected. Some of them are suicide, drug overdose, death by accident under intoxication. Death due to any of these reasons are bound to be rejected as they do not come under a valid claim category as per the insurance companies.

What are the steps in processing a claim?

What happens to a claim after it gets submitted?Step 1: Submission. ... Step 2: Initial review. ... Step 3: Eligibility. ... Step 4: Network. ... Step 5: Repricing. ... Step 6: Benefits adjudication. ... Step 7: Medical necessity review. ... Step 8: Risk review.More items...•

What are the stages of a claim?

However, in addition to being somewhat complicated, an injury claim can take some time to complete as it potentially consists of three main processing stages: filing, fact-finding and response, and trial.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How do insurance companies pay claims?

Most insurers will pay out the actual cash value of the item, and then a second payment when you show the receipt that proves you'd replaced the item. Then you'll get the final payment. You can often submit your expenses along the way if you replace items over time.

What is claim settlement?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury.

Why do you need to be well-versed with the Claims Settlement Process?

If you’re an insurance carrier, you know clients who’ve been in vehicle accidents will be rattled after the experience. The last thing they need is delays from their insurer. But as we’ve all experienced, the claims settlement process can sometimes become a drag.

What is an adjuster in insurance?

Adjusters handle the many groups that branch out to study medical reports, investigate the accident scene, talk to witnesses if present, assess the vehicle damage, and start off the process of vehicle repairs and medical recuperations (known in the claims settlement process as ‘indemnification’).

How many stages are there in a claim settlement process?

These were the 4 primary stages of a typical claim settlement process. Depending on the insurance agency, there maybe additional intermediate steps.

How is an accident claim filed?

The accident claim is filed in the victim’s name after the details of the victim have been verified. While filing this claim, the person’s policy is reviewed against physical injuries and vehicle damage incurred by both parties.

What is Claim Genius?

Claim Genius has tools and mobile-based apps that can fast-track the claims settlement process. Our AI can speed up damage detection turn-arounds and give accurate vehicle inspection reports. If you want to know more about how we can help you further, write to us.

What is the final stage of the accident settlement process?

Now the claims settlement process arrives at its final stage: settling the claims payment.

What Does Settlement Mean?

A settlement, in the context of insurance, refers to a policy benefit or claims payment. The amount depends on the particular claim, the guidelines stipulated in the insurance policy, and the mutual agreement of the parties involved.

What happens if a policyholder gets into a car accident and is not at fault?

For example, a policyholder gets into a car accident and is not at fault. They file a claim, and once the insurer processes and confirms the details, there would be a settlement to pay for repairs and medical expenses within the appropriate coverage limits of the policy.

When did anyone get included in the class settlement?

Anyone is generally included in this class settlement if they own or owned buildings or residences built on or after January 1, 2002 that contain (or contained) Uponor yellow brass fittings.

What happens when a class action lawsuit settles?

When a class action lawsuit settles, people who could collect part of the settlement may receive a letter in the mail or an e-mail that contains instructions on how to claim their money or refunds. In some cases, however, attorneys working on the case have no way of gathering the contact information of people who could claim part of a final settlement.

What happens to money that’s left on the table after a settlement deadline has passed?

The lawyers get paid, and so should you. Don’t leave your money on the table – it could very well be returned to the defendant, leaving little encouragement for big corporations to change their ways.

What does the Dominion National settlement cover?

This settlement covers those whose personal information was stored on Dominion National’s computer network and may have been accessed during a security incident.

When did Hyatt settle fingerprints?

This settlement covers current and former Hyatt employees who scanned their fingerprint using Hyatt’s timekeeping system as a requirement for employment between October 30, 2012 and December 16, 2018.

When will Broward County settle parking?

Anyone in the United States who purchased parking from Broward County at Fort Lauderdale-Hollywood International Airport at any time between June 28 and October 31, 2018, or between April 5 and 22, 2019 may be able to claim a piece of this settlement. Visit Official Settlement Website.

Is a Mercedes Benz covered by a settlement?

If you bought or leased a Mercedes-Benz or Sprinter BlueTEC II diesel vehicle, you may be covered by this settlement.

What is workers compensation settlement?

Workers Compensation Settlements. Workers compensation insurance provides a safety net for medical expenses and lost wages of those who get hurt on the job. But that doesn’t mean such workers have to accept whatever the insurance company offers. A workers compensation settlement is a way you can negotiate the immediate payment ...

How Is a Settlement Calculated for Workers Compensation?

The formula for calculating a workers compensation settlement package involves four major factors:

What happens if you dispute a workers comp claim?

If your claim is disputed, a trial or workers comp hearing is time-consuming and risky. The judge or hearing officer may award you less money than the insurance company offered to settle your workers comp claim. Note: Workers comp settlements are entirely voluntary. You don’t have to agree to a settlement offer proposed by your employer ...

How long does it take to settle a workers comp case?

Short answer: It varies greatly. The Martindale-Nolo survey of readers turned up an average of 15.7 months to resolve a case, and less than 20% of cases are resolved in less than six months. Obviously, those who try to negotiate a better workers comp settlement may hire legal assistance to negotiate the best terms for a settlement or to bring a hearing if there is a disputed issued. This can be time consuming. However, a shorter time frame is not always better. Those actions that lengthen the process can also bring higher settlements.

Why do you settle a lump sum claim?

If you settle the claim, you can choose or change your physicians. However, if you have severe and complicated work-related injuries, you may not want to settle the medical portion of the claim because you can be entitled to medical benefits for your accident for the rest of your life. Some injuries are too complicated to take the risk that you will not have enough money through a settlement to meet your medical needs.

How long does it take for a settlement to be approved?

Those actions that lengthen the process can also bring higher settlements. Once an agreement is reached, it can take four-to-eight weeks for money to arrive while settlement contracts are drafted, signed and approved.

Do you have to agree to a workers comp settlement?

You don’t have to agree to a settlement offer proposed by your employer or its insurance company, nor do you have the ability to force the employer or insurer to settle your claim. Talk with an attorney for free today, and find out how much money you could receive in a workers comp settlement.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

Does gross income include damages?

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

How long does it take to file a class action claim?

If filing a claim is new to you, don’t stress! Typically, it takes only a few minutes to file a claim for cash, vouchers, coupons, warranty extensions, and other benefits that come from class action settlements.

How much can you claim on McCormick?

Consumers who purchased certain McCormick all-natural products may be eligible to claim up to $15 without proof of purchase thanks to a $3 million class action settlement resolving claims the company falsely advertised the products…. Read More

What is this Settlement about?

This settlement, arising from a class action antitrust lawsuit called In re: Blue Cross Blue Shield Antitrust Litigation MDL 2406, N.D. Ala. Master File No. 2:13-cv-20000-RDP (the “Settlement”), was reached on behalf of individuals and companies that purchased or received health insurance provided or administered by a Blue Cross Blue Shield company. Class Representatives (“Plaintiffs”) reached a Settlement on October 16, 2020 with the Blue Cross Blue Shield Association (“BCBSA”) and Settling Individual Blue Plans. BCBSA and Settling Individual Blue Plans are called “Settling Defendants.”

How do I participate in the Settlement?

To make a claim and receive a payment, you must file a claim form online or by mail postmarked by November 5, 2021. Claims may be submitted online or by mail to:

What is a settlement with Blue Cross Blue Shield?

Class Representatives (“Plaintiffs”) reached a Settlement on October 16, 2020 with the Blue Cross Blue Shield Association (“BCBSA”) and Settling Individual Blue Plans. BCBSA and Settling Individual Blue Plans are called “Settling Defendants.”. Plaintiffs allege that Settling Defendants violated antitrust laws by entering into an agreement not ...

Who decides whether to approve a settlement?

The Court in charge of this case still has to decide whether to approve the Settlement. Payments will be made if the Court approves the Settlement and after any appeals are resolved. Please be patient.

How did settlement defendants violate antitrust laws?

Plaintiffs allege that Settling Defendants violated antitrust laws by entering into an agreement not to compete with each other and to limit competition among themselves in selling health insurance and administrative services for health insurance. Settling Defendants deny all allegations of wrongdoing and assert that their conduct results in lower healthcare costs and greater access to care for their customers. The Court has not decided who is right or wrong. Instead, Plaintiffs and Settling Defendants have agreed to a Settlement to avoid the risk and cost of further litigation.

Why Do You Need to Be Well-Versed with The Claims Settlement Process?

The 4 Stages of The Claims Settlement Process

- <picture class="aligncenter wp-image-12897 size-full" title="The Claims Settlement Process - Sta…

1. At the accident site, immediately after the accident has taken place, the victim contacts the insurer directly or through the insurance broker agency.Your job as a carrier at this stage is to take down all the facts as an unbiased third party. A carrier takes detailed notes, either in a notebook …

Can We Help You?

- These were the 4 primary stages of a typical claim settlement process. Depending on the insurance agency, there maybe additional intermediate steps. But keep these broad-level steps in mind to have an overview of how the claims settlement is progressing. Claim Genius has tools and mobile-based apps that can fast-track the claims settlement process. Our AI can speed up d…