Settlement Fee Sometimes referred to the Closing Fee, the Settlement Fee covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for.

Can I get the seller to pay my closing costs?

Yes, the buyer can pay the seller’s closing costs, if both parties agree to this while negotiating a purchase agreement. However, this is very uncommon, for practical reasons. While home sellers almost always pay their closing costs out of the sale proceeds, buyers typically pay their closing costs out of pocket.

Does seller have to pay closing costs?

Yes, sellers sometimes agree to pay a portion of the buyer’s closing costs to help close a deal. This is known as a seller concession. Closing cost responsibilities are negotiable, and offering to help the buyer cover their closing costs can be a valuable bargaining chip.

What are closing costs and other fees?

Closing costs are processing fees you pay to your lender when you close on your loan. Closing costs on a mortgage loan usually equal 3 – 6% of your total loan balance. Appraisal fees, attorney’s fees and inspection fees are examples of common closing costs. The specific closing costs you’ll pay depend on the type of loan you have, your ...

Are there fees not related to closing costs?

When a buyer pays closing costs, it typically includes taxes and fees but is in no way related to reducing the principal on the mortgage loan. How To Avoid Closing Costs When Buying A House Although cutting out closing costs outright is not possible, there are strategies to minimize costs through negotiation.

What is a fee settlement?

Settlement fee means a charge imposed on or paid by an individual in connection with a creditor's assent to accept in full satisfaction of a debt an amount less than the principal amount of the debt.

Is settlement the same as closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What's the term for a charge that either party has to pay at closing?

Closing costs are fees due at the closing of a real estate transaction in addition to the property's purchase price. Both buyers and sellers may be subject to closing costs.

What does it mean to negotiate closing costs?

Anytime you're making a large purchase, it's your responsibility to negotiate for the best deal possible. Your lender will not offer to charge you fewer fees, and the seller will not offer to step in and help pay for the closing costs – you have to make the request.

What does settlement mean when buying a house?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

What not to do after closing on a house?

What Not To Do While Closing On a HouseAvoid Big Charges on a Credit Card. Do not rack up credit card debt. ... Be Careful with Trends. ... Do Not Neglect Your Neighbors. ... Don't Miss Tax Breaks. ... Keep Your Real Estate Agent Close. ... Save That Mail. ... Celebrate!

Why are closing costs so high?

Nationwide, home closing costs are now over $1,000 more expensive than before the pandemic. It's largely a consequence of lenders increasing their fees to offset soaring loan production expenses, including commissions and compensation, in addition to making up for the decline in business due to lower sales volume.

Who pays expenses and receives income for the day of closing?

If the buyer assumes the seller's existing mortgage or deed of trust, the seller usually owes the buyer an allowance for accrued interest through the date of closing. Unpaid& expenses that are owed by the seller, but not due at the closing are called accrued expenses. These expenses will later be paid by the buyer.

How do you figure closing costs?

To calculate your closing costs, most lenders recommend estimating your closing fees to be between one percent and five percent of the home purchase price. If you're purchasing your house for $300,000, you can estimate your total closing costs to be between $3,000 and $15,000.

What is the best way to negotiate closing costs?

7 strategies to reduce closing costsBreak down your loan estimate form. ... Don't overlook lender fees. ... Understand what the seller pays for. ... Think about a no-closing-cost option. ... Look for grants and other help. ... Try to close at the end of the month. ... Ask about discounts and rebates.

How do I convince seller to pay closing costs?

Ways to Get a Seller to Cover Your Closing CostsPay the Full Asking Price. If you want to propose seller concessions, avoid making a lowball offer. ... Be Prepared to Close. ... Don't Make Excessive Demands. ... Be Willing to Negotiate. ... Pay Attention to the Market.

Can you negotiate at closing?

Yes. You can always negotiate the terms of the mortgage loan up until you sign on the dotted line. However, your lender or the seller can refuse to agree to any changes. It's usually easier to negotiate the fees charged by your lender than it is to negotiate third-party fees.

Is closing date and settlement date the same?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

How long is settlement usually?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

Is settlement date the day you move in?

Settlement day is the day you assume legal ownership of your new home. Picture: iStock.

Is settlement date same as possession date?

Settlement day is the last milestone before you take possession of your new home. The purchase price is paid to the seller and the title of the home transfers to you. Your lawyer will handle most of the requirements on your behalf and guide you through the process.

What is title company settlement fee?

What is a Title Company Settlement Fee? The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations.

What are the costs associated with closing a home?

When you are buying a home, there are plenty of costs associated with closing that have nothing to do with the actual cost of the home. These costs are generally associated with insuring, reviewing, and modifying the title of that property. The costs can be broadly called “title fees”.

Does Scott Title Services work with real estate?

Settlement experts from Scott Title Services will seamlessly integrate into your real estate team by working with your lender, real estate agent and yourself to guarantee that the transaction is both successful and as stress free as possible. We coordinate everything to ensure that your interests and rights are protected during the entire closing process and beyond.

What is settlement fee?

Definition of Settlement Fee. When you're buying a home with a mortgage, it's important to understand the type of fees you might incur. Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase ...

What are closing costs?

Closing costs are the legitimate third-party expenses you incur when you buy a property. These are expenses that you would never get back even if you sold the home a day after you closed on it. Examples include the loan application fee, points, title search fees, appraisal fee, home inspection fees, escrow fees, credit reports, courier fees, ...

How Do You Calculate Settlement Costs?

Right at the beginning of your loan application, you'll get a good faith estimate. This document outlines all the fees you should expect to pay for your mortgage such as the loan application fee, appraiser's fees, points, title insurance, mortgage insurance and accrued mortgage interest from the closing date until the end of the month. It's an estimate of the total cost of buying the property and it's provided to help you compare the cost of different mortgage providers.

What are closing costs when buying a home?

Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase a property.

What happens when you close a mortgage?

When you close the mortgage loan, on top of the closing costs, you're going to pay interest on the new mortgage from the day you close until the day the first monthly mortgage payment is due. You're also going to pay your share of the property taxes and HOA fees the seller has paid upfront for the property from the closing date to the end of the month. On top of that, the lender will collect escrow reserves upfront on account of future property taxes and homeowner's insurance. And don't forget the down payment. That's required at closing, too, and it goes towards the equity in your home.

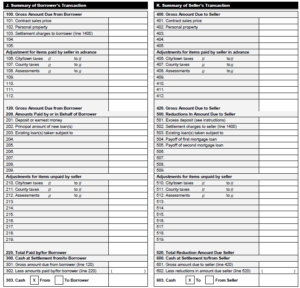

What is the HUD-1 settlement statement?

This looks a bit like the good faith estimate, only now it shows the true closing costs, including the final cost of items that could only be estimated before.

What happens when you combine closing costs?

If you combine all these various sums together and add them to the genuine closing costs, you get a complete account of everything you need to purchase the property. This total amount is what real estate professionals are referring to when they talk about "settlement costs," "settlement expenses" or "settlement fees."

Who pays closing fee?

Closing Fee or Escrow Fee: This is paid to the title company, escrow company or attorney for conducting the closing. The title company or escrow oversees the closing as an independent party in your home purchase. Some states require a real estate attorney be present at every closing.

How much are closing costs?

Typically, home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees. So, if your home cost $150,000, you might pay between $3,000 and $7,500 in closing costs. On average, buyers pay roughly $3,700 in closing fees, according to a recent survey.

How can home buyers avoid closing costs?

You can also avoid upfront fees on your loan by getting a no-closing cost mortgage, in which you don’t pay any of the closing costs when you close on the mortgage.

What is application fee?

Application Fee:This fee covers the cost for the lender to process your application. Before submitting an application, ask your lender what this fee covers. It can often include things like a credit check for your credit score or appraisal as well. Not all lenders charge an application fee, and it can often be negotiated.

How long do you have to put down escrow for property taxes?

Escrow Deposit for Property Taxes & Mortgage Insurance: Often you are asked to put down two months of property tax and mortgage insurance payments at closing.

How long before closing should you give closing disclosure?

Remember that you can shop around and you may be able to find other lenders who are willing to offer you a loan with lower fees at closing. At least three business days before your closing, the lender should give you Closing Disclosure statement, which outlines closing fees.

What is closing cost?

Closing costs are fees associated with your home purchase that are paid at the closing of a real estate transaction. Closing is the point in time when the title of the property is transferred from the seller to the buyer. Closing costs are incurred by either the buyer or seller.

Who pays settlement fee?

Settlement: This fee is paid to the settlement agent or escrow holder. Responsibility for payment of this fee can be negotiated between the seller and the buyer.

What is origination fee?

Origination: The fee the lender and any mortgage broker charges the borrower for making the mortgage loan. Origination services include taking and processing your loan application, underwriting and funding the loan, and other administrative services.

What is appraisal charge?

Appraisal: This charge pays for an appraisal report made by an appraiser.

What are points on a loan?

Points: Points are a percentage of a loan amount. For example, when a loan officer talks about one point on a $100,000 loan, this is 1 percent of the loan, which equals $1,000. Lenders offer different interest rates on loans with different points. You can make three main choices about points. You can decide you don’t want to pay or receive points at all. This is a zero-point loan. You can pay points at closing to receive a lower interest rate. Alternatively, you can choose to have points paid to you (also called lender credits) and use them to cover some of your closing costs.

What is document preparation fee?

Document Preparation: This fee covers the cost of preparation of final legal papers, such as a mortgage, deed of trust, note or deed.

What is flood determination?

Flood determination: This is paid to a third party to determine if the property is located in a flood zone. If the property is found to be located within a flood zone, you will need to buy flood insurance. The insurance is paid separately.

What is real estate commission?

Real estate commission: This is the total dollar amount of the real estate broker’s sales commission, which is usually paid by the seller. This commission is typically a percentage of the selling price of the home.

What is title settlement fee?

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

How much does a home buyer pay for closing costs?

Home buyers can typically expect to pay 2% – 5% of the loan amount in closing costs. One of the main costs is a title fee. Here we’ll cover what title fees are, who pays them and how much they cost.

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to review, adjust and insure the title of the property.

How to find closing costs?

You can find title fees and overall closing costs on a couple documents: 1 Closing disclosure: Your closing disclosure will break down total closing costs, including title fees, in an itemized list. 2 Loan estimate: The loan estimate will list your total closing costs, along with title service fees, and tell you the cash you need to bring to close.

How much does title fee vary?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing costs, which title fees are a large part of, cost from 2% – 5% of the total loan amount.

How much does it cost to record a deed?

The national average for this charge is around $125.

What is abstract of title?

The abstract is the summary of the title search from the title company. It compiles the details of the search and the related official documents and communicates them in a concise manner. Abstract of title fees can range from $200 – $400 for an update to the abstract to $1000+ if a new abstract of title must be created.

What is settlement fee?

Sometimes referred to the Closing Fee, the Settlement Fee covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for. Costs bundled under the Settlement Fee may include the cost of escrow, survey fees, notary fees, deed prep fees, and search abstract fees.

Why are title fees called title fees?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, so we’ve outlined a few of them below to help you know what to expect.

What is lender title insurance?

Lender’s Title Insurance. Lender’s Title Insurance is required in nearly all refinance and purchase transactions. As the name suggests, this policy protects the lender against losses incurred due to title disputes.

What is a CPL in closing?

Closing Protection Letter (CPL) The CPL is an agreement written by the title company that protects the lender in case of losses caused by misconduct on the part of the closing agent. (Title companies charge this fee to draft the document.) Commitment.

What is title fee?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, ...

When is a deed prep fee required?

A Deed Prep Fee is applicable when a title is transferred, or an existing deed has to be modified as part of a transaction. When a home is purchased, for example, the deed must be transferred title from the seller to the buyer.

Who is Better Settlement Services?

Better Settlement Services, an affiliate of Better Mortgage, has answers. Contact us at [email protected] and we’d be happy to provide you with any information you need.

Origination Costs

Title Settlement Closing Fee and Other Costs

- Additional costs may also apply whenever you take out a loan. Many of the title costs vary from company to company, allowing you to shop around to get a good deal on title as some are owned by attorneys, while others are not. Usually, you will pay a fee for title services, sometimes there are costs the seller will pay as well. A title is a document...

Administrative Settlement Fees

- Before finalizing a home sale, lenders and other agents must perform a range of administrative tasks. These imply additional fees. Financial institutions, for instance, have to ensure that they have collateral for making any loan. This usually involves an appraisal fee to confirm the value of your property. Banks and brokers will also need to check your credit history to determine if they …

How to Find Your Title Settlement Closing Fee

- You can find title settlement closing fees on your loan estimate and closing disclosure. This legally required document lists all the costs, risks and features associated with your mortgage. Lenders are obliged to provide you with a loan estimate within three days of making your application. Learning more about title settlement closing fees lets you plan for the transaction b…