The cost of a settlement is determined as follows for each of the different settlement types:

- For a cash settlement, the amount of cash paid to employees

- For a settlement using nonparticipating annuity contracts, the cost of the contracts

- For a settlement using participating annuity contracts, the cost of the contracts less the amount attributed to the participation rights. See paragraph 715-30-35-57.

How much does selling a structured settlement cost?

The bulk of the cost of selling your settlement will be the discount rate, which will vary greatly by company. Quotes can range from 7% to as high as 29%. Expect many companies to offer a high discount rate in their initial quotes. Do not accept the initial quote from any company. It is standard practice to negotiate with the company’s representative to get a lower rate.

What to expect from a settlement?

- For minor injuries, they often settle for 1 to 2 times the medical bills.

- For more serious injuries, your case could settle for 10 times or more of the medical bills.

- But in most cases, it is likely that your case will settle for somewhere between 1 1/2 to 4 times your medical bills.

What is a good settlement amount?

What is a good settlement amount? Very roughly, if you think that you have a 50% chance of winning at trial, and that a jury is likely to award you something in the vicinity of $100,000, you might want to try to settle the case for about $50,000.

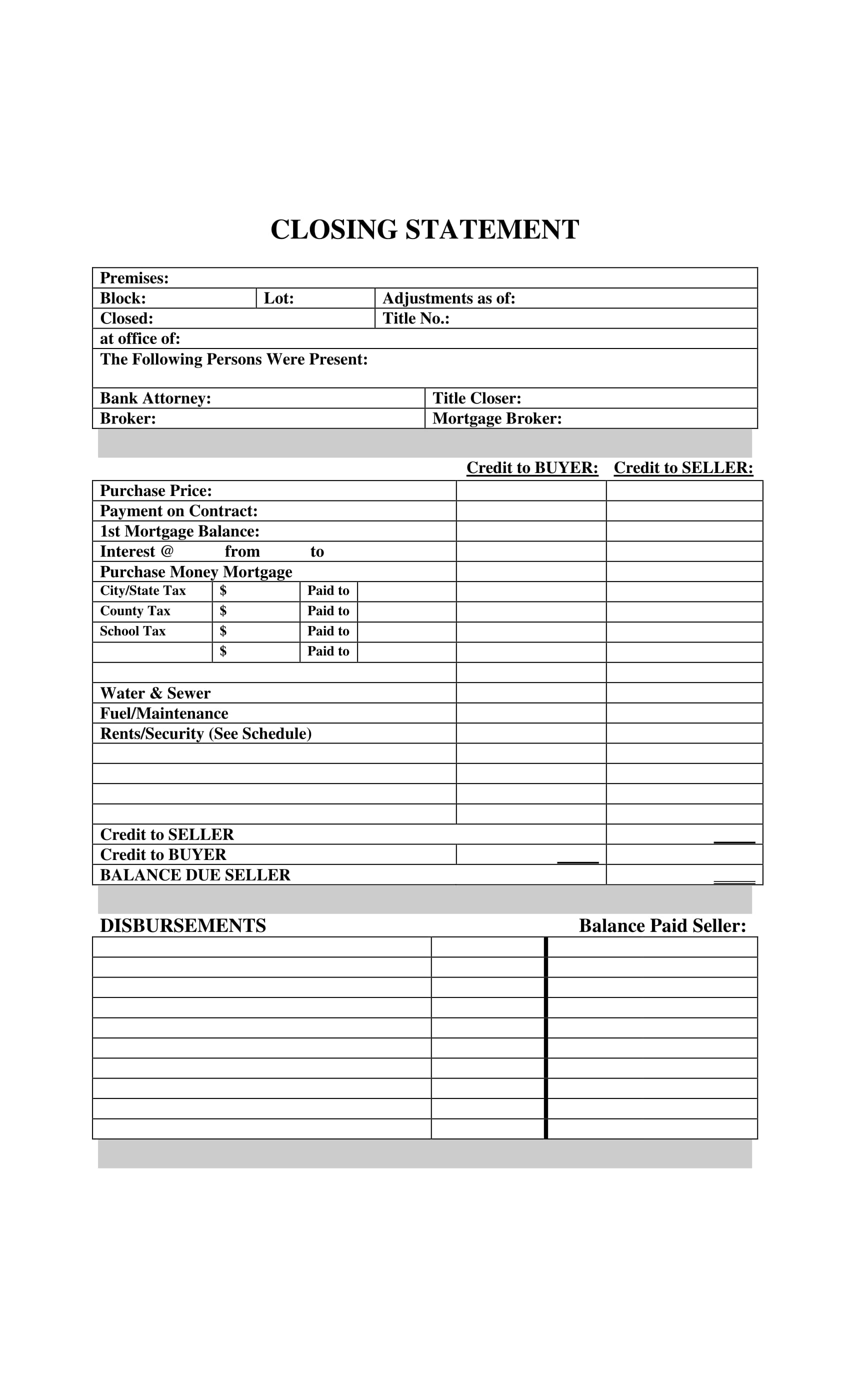

What Settlement Statement items are tax deductible?

What on the HUD-1 Statement Is Deductible on Federal Taxes?

- Prepaid Property Taxes. The HUD-1 settlement statement for taxes itemizes closing costs, including prepaid items such as real property taxes and mortgage interest.

- Mortgage Loan Points. When taking a look at a HUD statement example, you'll find mortgage loan discount points listed. ...

- Prepaid Mortgage Interest. ...

- Non-Deductible Settlement Charges. ...

What is a settlement in accounting?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.

What does cost settlement mean?

Settlement costs (also known as closing costs) are the fees that the buyer and/or seller have to pay to complete the sale of the property. Depending on the lender, these may include origination fees, credit report fees, and appraisal fees, as well as property taxes and recording fees.

How do you record settlement expenses?

To record a settlement cost, a corporate bookkeeper debits the corresponding settlement expense account and credits the vendors payable account.

What is the difference between settlement and balance?

Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account. The account will be reported to the credit bureaus as "settled" or "account paid in full for less than the full balance."

What is the journal entry for settlement of account?

The journal entry is debiting accounts payable and credit cash. The transaction will remove the accounts payable of a specific invoice from the supplier and reduce cash payment.

How are lawsuit settlement recorded in accounting?

You list it as a liability on the balance sheet and a loss contingency on the income statement. It's possible but not probable you'll lose money. You disclose it in the notes on the financial statement, but you don't include the amount in your statements.

How do I enter a settlement in Quickbooks?

First, we have to record the exact amount you've received from your client and apply it to the invoice.Open the affected invoice and click Receive payment.Enter the payment date and where to deposit the amount.Mark the invoice and enter the exact amount you've received ($3k).Click Save and close.

What is difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

How do settlement accounts work?

The settlement bank will typically deposit funds into the merchant's account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

What is asset settlement?

Related to Settlement Assets. Settlement Asset means any cash, receivable or other property, including a Settlement Receivable, due or conveyed to a Person in consideration for a Settlement made or arranged, or to be made or arranged, by such Person or an Affiliate of such Person.

Are legal settlements operating expenses?

Lawsuit settlements: While everyday legal fees associated with operating activities are operating expenses, a one-time legal settlement is a non-operating expense. Restructuring costs: Companies may incur one-time expenses as a result of a restructuring designed to improve competitiveness or business efficiency.

Are legal settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

How do I record a property purchase?

Add a home's purchase price to the closing costs, such as commissions, to determine the home's total cost. Write “Property” in the account column on the first line of a journal entry in your accounting journal. Write the total cost in the debit column. A debit increases the property account, which is an asset account.

How do you record land purchase in accounting?

Purchasing land with a loan affects the assets and liabilities sections of the balance sheet. The land is recorded at its full cost as a long-term asset. The cash down payment decreases the cash account. The loan amount is recorded in the current liabilities section if it will be paid off in one year or less.

What is Settlement Date Accounting?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is recorded on the "books" at the point in time when the given transaction has been fulfilled.

When is a settlement date recorded?

Under settlement date accounting, a transaction is recorded in the general ledger when it is "fulfilled" or "settled."

Can you see the impact of planned transactions that have not yet been finalized?

However, it does not allow financial statement users to see the impact of planned transactions that have not yet been finalized.

Is settlement date accounting conservative?

It is a conservative accounting method, which means that it errs on the side of caution when recording journal entries in the general ledger.

David Geloran Follow

Pension plans tend to have large, long-term liabilities, and their impact on financial statements attracts attention. However, pension accounting is complicated, and the footnotes are painfully long and difficult to understand.

David Geloran

I find it very helpful to try to put to paper what I have learned about a topic, to help me solidify my understanding and be able to present that material in a more articulate manner. I am not an accountant – so if I have misstated anything, please reach out to me to discuss.

What are settlement costs?

Settlement Costs. Total costs charged to the borrower that must be paid at closing, by the borrower, the home seller, or the lender. In dealing directly with a lender, settlement costs can be divided into the following categories: 1. Fees paid to lender. 2.

Why can't borrowers use settlement strategy effectively?

Until that happens, however, borrowers can't use this strategy effectively because lenders will not commit to any figures on total settlement costs that they might quote to shoppers. Suppose, for example, you are deciding between 7% 30-year fixed-rate mortgages offered by two lenders.

What are lender fees expressed in dollars?

Lender Fees Expressed in Dollars: Some of the common lender fees expressed in dollars cover processing, tax service, flood certification, underwriting, wire transfer, document preparation, courier, and lender inspection. They are almost always itemized, a deplorable practice that goes back to the days when interest rates were regulated and lenders had to justify their fees in terms of reimbursement for costs.

What are lender controlled fees?

Lender-Controlled Fees to Third Parties: These are fees for services ordered by lenders from third parties and include the costs of appraisals, credit reports, and (when needed) pest inspections.

What are lender fees?

1. Fees paid to lender. 2. Lender-controlled fees paid to third parties. 3. Other fees paid to third parties. 4. Other settlement costs. Fees Paid to Lender: Lender fees fall into two categories: those expressed as a percent of the loan and those expressed in dollars.

Is closing cost included in sale price?

Closing costs are not usually included in the sale price of the property. Some examples of closing costs are appraisal fees, deed-recording fees, and applicable taxes. Mortgage loans often include money for closing costs. They are also called settlement costs.

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

What is offset in insurance?

Amounts receivable and payable to reinsurers are offset for account settlement purposes for contracts where the right of offset exists, with net insurance receivables included in other assets and net insurance payables included in other liabilities. 1.

What is the account receivable department?

The accounts receivable department of a company is charged with the account settlement process of collecting money owed to the firm for providing goods or services. The ages of the receivables are broken down into intervals such as 1–30 days, 31–60 days, etc. Individual accounts will have amounts and days outstanding on record, and when the invoices are paid, the accounts are settled in the company's books.

What is an account settlement?

An account settlement, or settlement of accounts, is the action of paying off any outstanding balances to bring an account balance to zero.

What is settlement date accounting?

With settlement date accounting, enter the transactions into your general ledger when the transaction happens. This method ensures that everything on your general ledger has actually happened with the exact amount recorded. You settle the account at the time you record the transaction.

What happens to the clearing account balance after employees deposit their checks?

After the employees deposit their checks and you remit the taxes, the clearing account balance is zero. So, you settled the account.

What is an example of an outstanding balance?

For example, you have one outstanding balance in an account. Customer A owes the entirety of the balance because of Invoice A. When Customer A pays the invoice, the account is now settled.

Why do you settle your accounts?

When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books only when you fulfill the transaction.

Can you hold multiple payments in a clearing account?

You may choose to hold multiple payments in the clearing account until you receive the total balance due on an invoice.

Is a settlement an account payable?

If you record payments you owe to a lender or other business until you pay off the fund s you owe, the account you settle is an account payable ( i.e., a liability account).

What is settlement expense?

Settlement Expenses. A settlement expense may be associated with a real estate transaction or a charge a business incurs as part of a legal proceeding. Mortgage-related settlement costs refer to cash a borrower pays for things like land surveying, property appraisal, legal work and insurance.

When does a company record settlement expenses?

In other words, it posts expense entries when service providers have fulfilled their part of the contractual agreement. For example, if a business wants to buy a commercial building and lawyers have finished preparing all legal documents pertaining to the transaction, the company will record legal fees when it receives attorneys' bills -- not when it pays them. To record a settlement cost, a corporate bookkeeper debits the corresponding settlement expense account and credits the vendors payable account.

When do financial managers record settlement costs?

Financial managers record settlement costs when they are both probable and reasonably estimable. If not, managers disclose the extent and nature of the settlement contingencies at the bottom of a corporate balance sheet. They also tell investors whether settlement losses are probable, reasonably possible or remote.

Activity-Based Cost Analyses

Activity-based costing calls for the accumulation of overhead costs into cost pools, from which the costs are allocated to cost objects. The intent is to gain a better understanding of what causes overhead costs.

Breakeven Analysis

Breakeven analysis calls for the calculation of the sales level at which a business or product line breaks even. This is useful for determining business or product line viability.

Cost Control

Cost control is the analysis of expenditures to see if any can be reduced or eliminated. This is a significant driver of organizational profitability.

Minimum Pricing Analysis

Minimum pricing analysis delves into the lowest prices that can be charged, while still earning a profit. This analysis is usually conducted for large-volume special deals.

Standard Cost Development

Standard costing requires one to develop standard costs for products. This analysis is usually conducted in conjunction with the engineering department.

Target Costing

Target costing involves setting a price at which a product can be sold for a reasonable profit, and then designing the product to have the specific cost structure needed to achieve the targeted profit.

Throughput Analysis

Throughput analysis focuses on bottleneck operations, to see if their usage is being maximized. This is a major driver of company profitability, and so is of great concern to the cost accountant.