What are Mortgage Settlement Fees?

- Notary fees. Notary fees are the costs of getting a notary to meet at a specific location for the closing and sending a scanned copy of the closing and mailing ...

- Survey fees. Survey fees are paid to third-party vendors to survey a property and verify its boundaries.

- Fees to prep deeds. ...

- Search abstract fees. ...

- Endorsement fees. ...

- Recording fees. ...

How much does it cost to get a mortgage?

Mortgage fees you might have to pay

- Application fee ($100): Some lenders charge a small fee when you submit your application. ...

- Attorney fee ($150 to $500): In some states, you bring your own attorney to the closing table; in other states, you don’t. ...

- Flood certification ($5 to $10): This tells the lender if the home is in a flood zone.

How much are mortgage fees?

This payment often comes in the form of an origination fee—typically 1.0% to 2.0% of the loan amount. So if you have a mortgage of $250,000 and your broker charges a 1.5% borrower-paid commission, you’d owe them $3,750 at closing. Note that the fee amount varies based on several factors: your state of residence.

How do you calculate the mortgage on a house?

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly, and over the life of the loan

- Tallying how much you actually pay off over the life of the loan, versus the principal borrowed, to see how much you actually paid extra

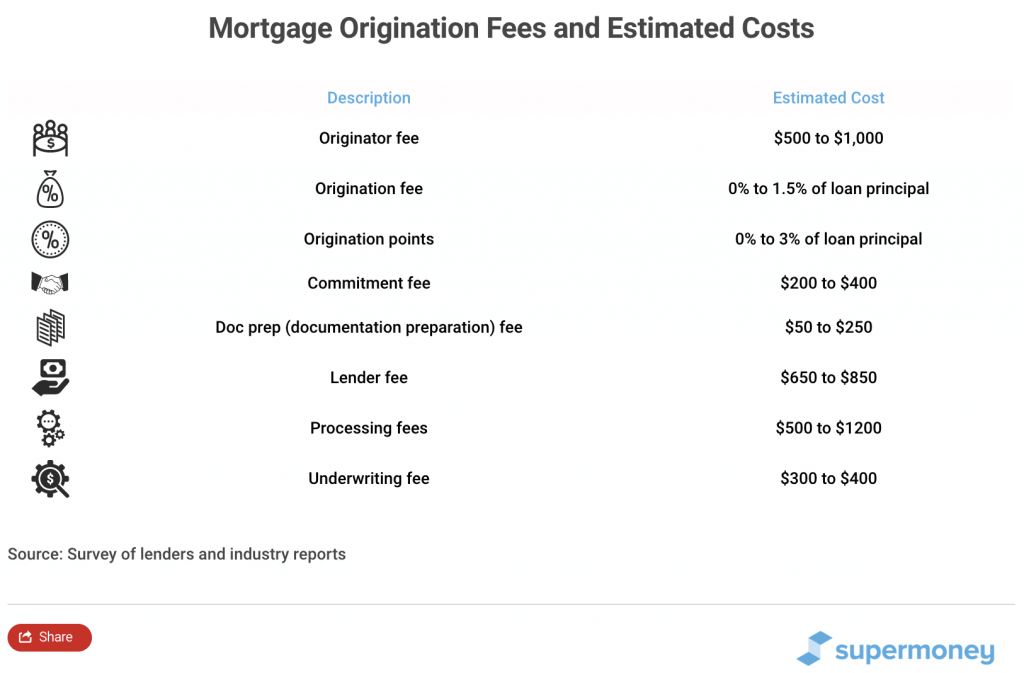

What are mortgage lender fees?

- Origination fees

- Processing fees

- Underwriting fees

- Commitment fees

- Points and

- Document preparation fees.

Do mortgage lenders charge a fee?

In total, buyers should expect to pay between 2% and 5% of purchase price in closing costs. Their portion of the costs typically includes: One or two origination points—lender fees—that equates to 1% to 2% of the loan amount, and usually includes loan origination fees of $750 to $1,200)

What fees can increase at settlement?

Others may change, but only by 10% or less. Some other closing costs can increase without limit....These include:Prepaid interest.Prepaid property taxes.Prepaid homeowners insurance premiums.Initial escrow account deposits.Real estate-related fees.

What if I can't afford closing costs?

Apply for a Closing Cost Assistance Grant One of the most common ways to pay for closing costs is to apply for a grant with a HUD-approved state or local housing agency or commission. These agencies set aside a certain amount of funds for closing cost grants for low-to-moderate income borrowers.

Why did my mortgage go up 300 dollars?

The answer to why your payment changed may simply be that your lender has added new fees to your monthly bill, increasing your payment. It's usually possible to avoid such servicing fees. To find out, check your monthly mortgage statement to see if any new items were added.

What are some common costs associated with the settlement of a real estate transaction?

Seller costs. One of the larger closing costs for sellers at settlement is the commission for the real estate agents involved in the real estate transaction. ... Loan payoff costs. ... Transfer taxes or recording fees. ... Title insurance fees. ... Attorney fees. ... Additional closing costs for sellers.

What are settlement expenses?

Settlement costs (also known as closing costs) are the fees that the buyer and/or seller have to pay to complete the sale of the property. Depending on the lender, these may include origination fees, credit report fees, and appraisal fees, as well as property taxes and recording fees.

What are underwriting fees?

An underwriting fee is a payment that a firm receives as a result of taking on the risk. With securities underwriting, a firm earns a fee as compensation for underwriting a public offering or placing an issue in the market.

What is a aggregate adjustment?

An aggregate adjustment is a calculation put into place on your escrow account to make sure that just the right amount is collected from you monthly in escrow.

What is settlement fee?

Definition of Settlement Fee. When you're buying a home with a mortgage, it's important to understand the type of fees you might incur. Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase ...

How Do You Calculate Settlement Costs?

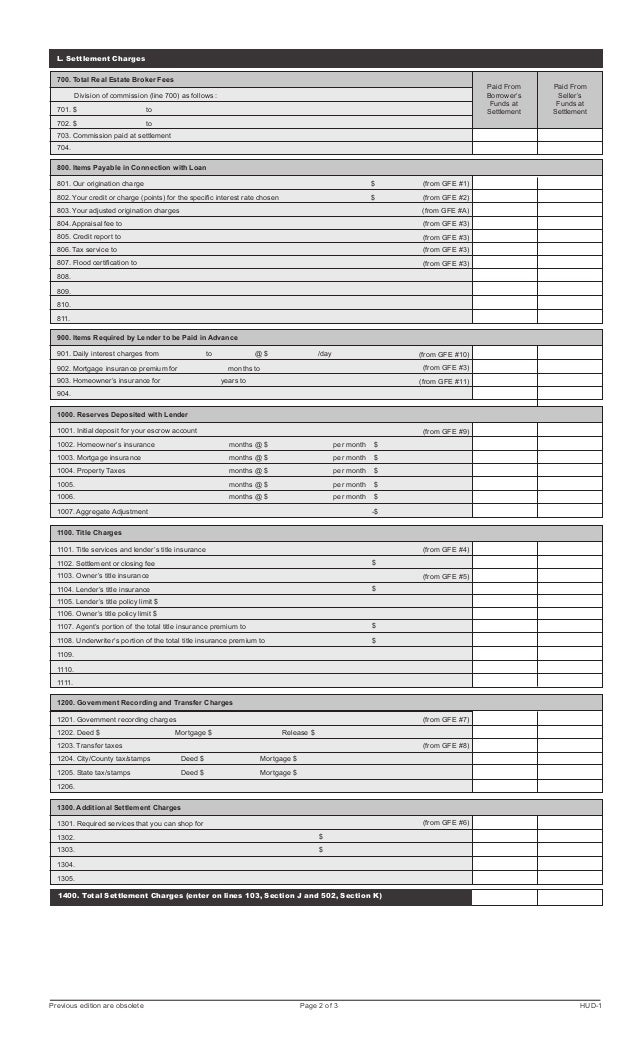

Right at the beginning of your loan application, you'll get a good faith estimate. This document outlines all the fees you should expect to pay for your mortgage such as the loan application fee, appraiser's fees, points, title insurance, mortgage insurance and accrued mortgage interest from the closing date until the end of the month. It's an estimate of the total cost of buying the property and it's provided to help you compare the cost of different mortgage providers.

What are closing costs when buying a home?

Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase a property.

What are closing costs?

Closing costs are the legitimate third-party expenses you incur when you buy a property. These are expenses that you would never get back even if you sold the home a day after you closed on it. Examples include the loan application fee, points, title search fees, appraisal fee, home inspection fees, escrow fees, credit reports, courier fees, ...

What happens when you close a mortgage?

When you close the mortgage loan, on top of the closing costs, you're going to pay interest on the new mortgage from the day you close until the day the first monthly mortgage payment is due. You're also going to pay your share of the property taxes and HOA fees the seller has paid upfront for the property from the closing date to the end of the month. On top of that, the lender will collect escrow reserves upfront on account of future property taxes and homeowner's insurance. And don't forget the down payment. That's required at closing, too, and it goes towards the equity in your home.

What is the HUD-1 settlement statement?

This looks a bit like the good faith estimate, only now it shows the true closing costs, including the final cost of items that could only be estimated before.

What happens when you combine closing costs?

If you combine all these various sums together and add them to the genuine closing costs, you get a complete account of everything you need to purchase the property. This total amount is what real estate professionals are referring to when they talk about "settlement costs," "settlement expenses" or "settlement fees."

Why don't wholesale lenders use fixed dollar fees?

While some retail lenders view fixed-dollar fees as an easy way to generate additional revenue from unwary borrowers, wholesale lenders don't because it would cause them problems with brokers.

What is mortgage insurance premium?

A mortgage insurance premium is a policy that insures the lender against loss if the homeowner defaults on a mortgage. ...

What is mortgage loan?

A written document evidencing the lien on a property taken by a lender as security for the repayment of a loan. The term 'mortgage' or 'mortgage loan' is used loosely to refer both to the ...

What is a foreclosed loan?

An agreement by the lender not to exercise the legal right to foreclose in exchange for an agreement by the borrower to a payment plan that will cure the borrowers delinquency. ...

What is rate protection?

Protection for a borrower against the danger that rates will rise between the time the borrower applies for a loan and the time the loan closes. Rate protection can take the form of a ...

What is lease purchase mortgage?

Wondering what is the best lease purchase mortgage definition?A lease purchase mortgage is a financing option that allows potential homebuyers to lease a property with the option to ...

How to find the best mortgage deal?

It isn't easy to do right, as a summary of the major steps involved will demonstrate. Step 1: Decide if you are a potential shopper. Step 2: ...

What is a mortgage settlement?

Mortgage settlement--sometimes called mortgage closing--can be confusing. A settlement may involve several people and many documents and fees. This information will help you understand all that is involved. Although the focus of this guide is on settlements for home purchases, much of it will also be useful if you are refinancing a mortgage.

What are the fees for FHA mortgage insurance?

As with Private MI, insurance premium payments will stop when you acquire 22% equity in your home. FHA fees are about 1.5% of the loan amount. VA guarantee fees range from 1.25% to 2% of the loan amount, depending on the size of your down payment (the higher your down payment, the lower the fee percentage). RHS fees are 1.75% of the loan amount.

What is appraisal fee?

Appraisal fee. Lenders want to be sure that the property is worth at least as much as the loan amount. This fee pays for an appraisal of the home you want to purchase or refinance. Some lenders and brokers include the appraisal fee as part of the application fee; you can ask the lender for a copy of your appraisal.

How long does it take to get a good faith estimate of closing costs?

The Real Estate Settlement Procedures Act (RESPA) requires your mortgage lender to give you a good faith estimate of all your closing costs within 3 business days of submitting your application for a loan, whether you are purchasing or refinancing the home. This is a good faith estimate, but the actual expenses at closing may be somewhat different. If you are purchasing the home, you will also get an information booklet, Buying Your Home: Settlement Costs and Helpful Information.

What happens if you don't pay down on a mortgage?

If your down payment is less than 20% of the value of the house, the lender will usually require mortgage insurance. The insurance policy covers the lender's risk in the event that you do not make the loan payments. Typically, you will pay a monthly premium along with each month's mortgage payment. Your private MI can be canceled at your request, in writing, when your reach 20% equity in your home, based on your original purchase price, if your mortgage payments are current and you have a good payment history. By federal law your private MI payments will automatically stop when you acquire 22% equity in your home, based on the original appraised value of the house, as long as your mortgage payments are current.

What is origination fee?

The origination fee (also called underwriting fee, administrative fee, or processing fee) is charged for the lender's work in evaluating and preparing your mortgage loan. This fee can cover the lender's attorney's fees, document preparation costs, notary fees, and so forth.

When are mortgage payments due?

Your first regular mortgage payment is usually due about 6 to 8 weeks after you settle (for example, if you settle in August, your first regular payment will be due on October 1; the October payment covers the cost of borrowing the money for the month of September). Interest costs, however, start as soon as you settle.

What Is a Mortgage Settlement?

A mortgage settlement generally refers to legal remedies in a mortgage lawsuit. In many cases, the judge may make a ruling and determine the legal damages in a mortgage/foreclosure claim. One party may have to pay the other for losses caused by issues like mortgage default or mortgage fraud.

Why are mortgage settlements not available?

Lastly, mortgage settlements are not available if laws and regulations prohibit them, or if previous agreements between the parties prevent them from doing so. Mortgage

Is a mortgage settlement beneficial?

Thus, mortgage settlements may be advantageous to both parties. They can involve lengthy and costly court proceedings. Also, the debtor may be able to avoid bankruptcy filings and negative credit scores.

Do you need a lawyer for a mortgage settlement?

A mortgage attorney is generally required during the settlement process, as the parties will be engaging in detailed negotiations. You may wish to hire a lawyer for help with a mortgage settlement.

Can a mortgage lender rework a contract?

In many instances, the mortgage lender may not be willing to rework a contract with the debtor. They may decide to pursue legal action and force the debtor to repay according to the original lending terms.

What is settlement fee?

Sometimes referred to the Closing Fee, the Settlement Fee covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for. Costs bundled under the Settlement Fee may include the cost of escrow, survey fees, notary fees, deed prep fees, and search abstract fees.

Why are title fees called title fees?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, so we’ve outlined a few of them below to help you know what to expect.

What is lender title insurance?

Lender’s Title Insurance. Lender’s Title Insurance is required in nearly all refinance and purchase transactions. As the name suggests, this policy protects the lender against losses incurred due to title disputes.

What is title fee?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, ...

Who pays the premium on a refinance?

In a refinance transaction, the lender’s premium is typically paid by the borrower , but in some purchase transactions, the borrower may be responsible for the cost. The lender’s premium is dependent on the loan amount or purchase amount. So if either increase, the premium will likely follow suit.

Who is Better Settlement Services?

Better Settlement Services, an affiliate of Better Mortgage, has answers. Contact us at [email protected] and we’d be happy to provide you with any information you need.

When is a deed prep fee required?

A Deed Prep Fee is applicable when a title is transferred, or an existing deed has to be modified as part of a transaction. When a home is purchased, for example, the deed must be transferred title from the seller to the buyer.