Do mortgage lenders charge a fee?

According to ValuePenguin, homebuyers pay an average of $1,387 in lender fees when buying property. While that may not sound like a ton of money, especially compared to the amount you're putting upfront as a down payment, these fees can still be significant when you're buying a home on a smaller budget.

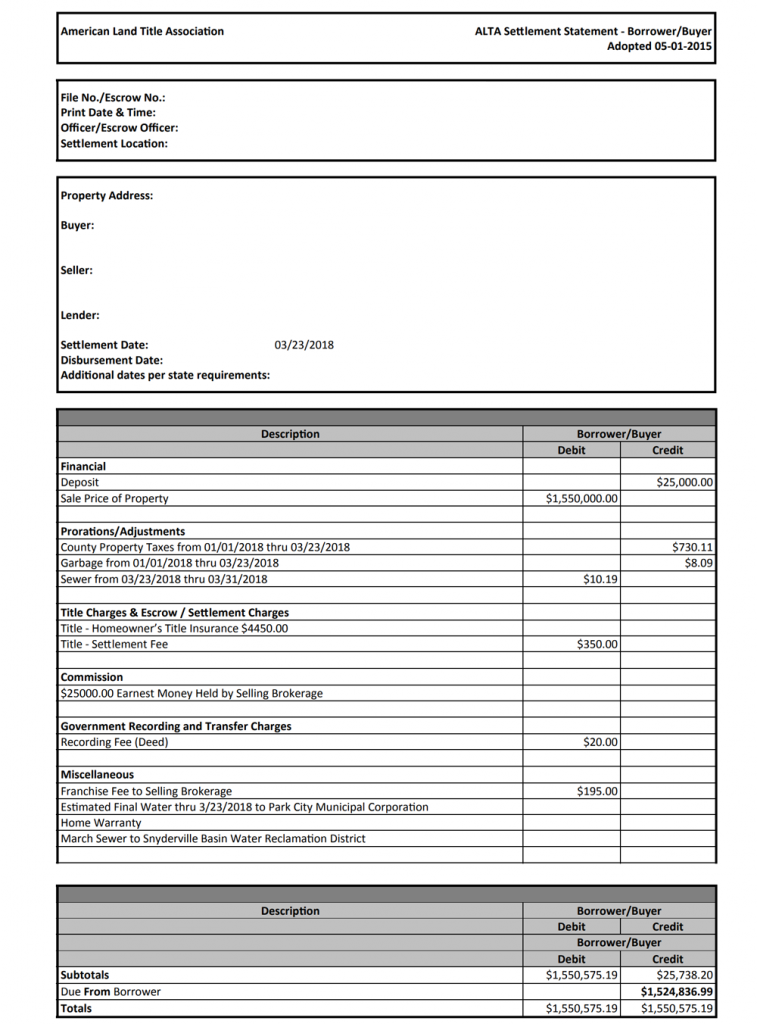

What fees can increase at settlement?

Others may change, but only by 10% or less. Some other closing costs can increase without limit....These include:Prepaid interest.Prepaid property taxes.Prepaid homeowners insurance premiums.Initial escrow account deposits.Real estate-related fees.

What's the term for a charge that either party has to pay at closing?

Closing costs are fees due at the closing of a real estate transaction in addition to the property's purchase price. Both buyers and sellers may be subject to closing costs.

Why did my mortgage go up 300 dollars?

The answer to why your payment changed may simply be that your lender has added new fees to your monthly bill, increasing your payment. It's usually possible to avoid such servicing fees. To find out, check your monthly mortgage statement to see if any new items were added.

What if I can't afford closing costs?

Apply for a Closing Cost Assistance Grant One of the most common ways to pay for closing costs is to apply for a grant with a HUD-approved state or local housing agency or commission. These agencies set aside a certain amount of funds for closing cost grants for low-to-moderate income borrowers.

How do I avoid mortgage fees?

For the best chance of avoiding late fees altogether, make sure you have an emergency savings account before you apply for a mortgage. Most experts recommend having at least 3 months of living expenses in your emergency fund. The best thing to do when you're about to fall behind is contact your lender.

Who pays closing cost?

Typically, buyers and sellers each pay their own closing costs. A home buyer is likely to pay between 2% and 5% of their loan amount in closing costs, while the seller could pay 5% to 6% of the sale price to their real estate agent.

Who pays expenses and receives income for the day of closing?

If the buyer assumes the seller's existing mortgage or deed of trust, the seller usually owes the buyer an allowance for accrued interest through the date of closing. Unpaid& expenses that are owed by the seller, but not due at the closing are called accrued expenses. These expenses will later be paid by the buyer.

What are some common costs associated with the settlement of a real estate transaction?

Seller costs. One of the larger closing costs for sellers at settlement is the commission for the real estate agents involved in the real estate transaction. ... Loan payoff costs. ... Transfer taxes or recording fees. ... Title insurance fees. ... Attorney fees. ... Additional closing costs for sellers.

What are settlement expenses?

Settlement costs (also known as closing costs) are the fees that the buyer and/or seller have to pay to complete the sale of the property. Depending on the lender, these may include origination fees, credit report fees, and appraisal fees, as well as property taxes and recording fees.

What are underwriting fees?

An underwriting fee is a payment that a firm receives as a result of taking on the risk. With securities underwriting, a firm earns a fee as compensation for underwriting a public offering or placing an issue in the market.

What is a aggregate adjustment?

An aggregate adjustment is a calculation put into place on your escrow account to make sure that just the right amount is collected from you monthly in escrow.