An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.

How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

How to cash out structured settlement payments?

- Withdraw any payment or amount of money earlier than the pre-set date

- Change the amount of the periodic payments (how much to get in a payment)

- Change the future payment structure (when to get the payments)

Is accrual accounting better than cash accounting?

While the accrual basis of accounting provides a better long-term view of your finances, the cash method gives you a better picture of the funds in your bank account. This is because the accrual method accounts for money that’s yet to come in.

What is a sentence for settlement?

sentence. 1. This may reflect the ambivalent nature of a “ settlement ”, based on a blanket amnesty and with the territory’s future wide-open. 2. Yet, these ties do not translate into Moscow pushing the Palestinians into a settlement with the Israelis. 3.

What does settlement mean in business terms?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete.

What is the difference between settlement and balance?

Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account. The account will be reported to the credit bureaus as "settled" or "account paid in full for less than the full balance."

What is a settlement asset?

settlement asset. An asset used for the discharge of obligations as specified by the rules, regulations or customary practice for an FMI.

What is the difference between clearing and settlement?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

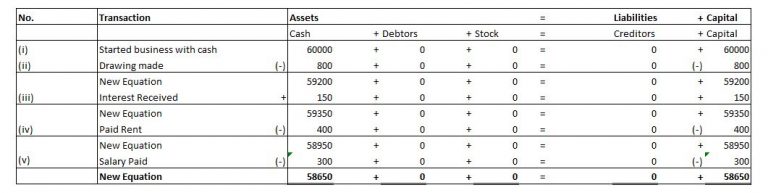

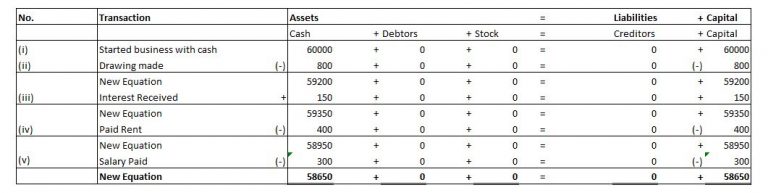

What is the journal entry for settlement of account?

The journal entry is debiting accounts payable and credit cash. The transaction will remove the accounts payable of a specific invoice from the supplier and reduce cash payment.

What is difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

Is a settlement considered an asset?

A settlement check is considered an asset, not income.

What are settlement assets on a balance sheet?

Settlement Asset means any cash, receivable or other property, including a Settlement Receivable, due or conveyed to a Person in consideration for a Settlement made or arranged, or to be made or arranged, by such Person or an Affiliate of such Person.

How do settlement accounts work?

The settlement bank will typically deposit funds into the merchant's account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

What is the process of settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What comes first settlement or clearing?

Clearing and settlement directly follows a trade. Clearing is what comes immediately after the trade, where all the terms of the deal are double-checked. Settlement is the final stage, in which the transfer of securities and money takes place.

What is transaction settlement?

trans - ac - tion set - tle - ment. The process through which a merchant receives funds for a transaction with a customer.

What is official settlement balance?

Official settlements balance (overall balance) An overall measurement of a country's private financial and economic transactions with the rest of the world.

How is official settlement balance calculated?

Official settlements balance = increase in home official reserve assets minus increase in foreign official reserve assets = 30 – 35 = –5. 3.

What does cash settlement mean?

What Is a Cash Settlement? A cash settlement is a settlement method used in certain futures and options contracts where, upon expiration or exercise, the seller of the financial instrument does not deliver the actual (physical) underlying asset but instead transfers the associated cash position.

What is settlement balance rate?

Settlement Balance means, initially, the Aggregate Public Offering Price and shall be (x) reduced at the Close of Business on each Pricing Date by an amount equal to the Aggregate Net Sale Price on such Pricing Date and (y) increased at the Close of Business on each Purchase Date by the amount of the purchase price of ...

What is an account settlement?

An account settlement, or settlement of accounts, is the action of paying off any outstanding balances to bring an account balance to zero.

What is settlement date accounting?

With settlement date accounting, enter the transactions into your general ledger when the transaction happens. This method ensures that everything on your general ledger has actually happened with the exact amount recorded. You settle the account at the time you record the transaction.

What happens to the clearing account balance after employees deposit their checks?

After the employees deposit their checks and you remit the taxes, the clearing account balance is zero. So, you settled the account.

What is an example of an outstanding balance?

For example, you have one outstanding balance in an account. Customer A owes the entirety of the balance because of Invoice A. When Customer A pays the invoice, the account is now settled.

Why do you settle your accounts?

When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books only when you fulfill the transaction.

Can you hold multiple payments in a clearing account?

You may choose to hold multiple payments in the clearing account until you receive the total balance due on an invoice.

Is a settlement an account payable?

If you record payments you owe to a lender or other business until you pay off the fund s you owe, the account you settle is an account payable ( i.e., a liability account).

What is Settlement Date Accounting?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is recorded on the "books" at the point in time when the given transaction has been fulfilled.

When is a settlement date recorded?

Under settlement date accounting, a transaction is recorded in the general ledger when it is "fulfilled" or "settled."

Does pending transactions go through the general ledger?

Under this method, any pending transactions that have not been finalized by the balance sheet date will not be recorded in the company's general ledger. Any transaction not recorded in the general ledger will also not flow through to the company's financial statements for that period. This causes issues when a large financial transaction occurs ...

Can you see the impact of planned transactions that have not yet been finalized?

However, it does not allow financial statement users to see the impact of planned transactions that have not yet been finalized.

Is settlement date accounting conservative?

It is a conservative accounting method, which means that it errs on the side of caution when recording journal entries in the general ledger.

What is settlement of securities?

Settlement of securities is a business process whereby securities or interests in securities are delivered, usually against ( in simultaneous exchange for) payment of money, to fulfill contractual obligations , such as those arising under securities trades.

Where does settlement take place?

Nowadays, settlement typically takes place in a central securities depository.

What are the two goals of electronic settlement?

Immobilisation and dematerialisation are the two broad goals of electronic settlement. Both were identified by the influential report by the Group of Thirty in 1989.

How does electronic settlement work?

If a non-participant wishes to settle its interests, it must do so through a participant acting as a custodian. The interests of participants are recorded by credit entries in securities accounts maintained in their names by the operator of the system . It permits both quick and efficient settlement by removing the need for paperwork, and the simultaneous delivery of securities with the payment of a corresponding cash sum (called delivery versus payment, or DVP) in the agreed upon currency.

How long does it take to settle a stock?

In the United States, the settlement date for marketable stocks is usually 2 business days or T+2 after the trade is executed, and for listed options and government securities it is usually 1 day after the execution. In Europe, settlement date has also been adopted as 2 business days after the trade is executed.

What is clearing in a settlement?

A number of risks arise for the parties during the settlement interval, which are managed by the process of clearing, which follows trading and precedes settlement. Clearing involves modifying those contractual obligations so as to facilitate settlement, often by netting and novation .

What was the weakness of paper based settlement?

In the United Kingdom, the weakness of paper-based settlement was exposed by a programme of privatisation of nationalised industries in the 1980s, and the Big Bang of 1986 led to an explosion in the volume of trades, and settlement delays became significant.

What is a settlement account?

Settlement Account means an account at a central bank, a settlement agent or a central counterparty used to hold funds or securities and to settle transactions between participants in a system;

When will merchants pay the amount due?

Merchant will pay the amounts due by the next Business Day if sufficient funds are not available in the Settlement Account.

Can a merchant change a settlement account?

Merchant may change the Settlement Account upon prior written approval by Bank, which approval will not be unreasonably withheld.

Is a settlement account a repurchase asset?

The Settlement Account is (and shall continuously be) part of the Repurchase Assets. The Settlement Account shall be subject to setoff by the Agent for the benefit of the Agent and any Buyer against any of the outstanding Obligations.

What Is An Account Settlement?

Account Settlements and Clearing Accounts

- Settling an account often occurs with clearing accounts. What is a clearing account? A clearing account is either a: 1. Bank account used to hold funds until payments can move to another account (e.g., payroll accounts to employee bank accounts), OR 2. Temporary account used to record transactions in the general ledger until the funds can be accurately or completely classifi…

Examples of Account Settlements

- Settling your accounts can be confusing, especially since there are several different ways you can do so. Here are some examples of account settlements.

Settlement Accounts vs. Account Settlements

- So, what is the difference between settlement accounts and account settlements? Despite the names being so similar, there is quite a difference between the two. Again, account settlements are when you settle outstanding balances either through payments or offsets. But, settlement accounts are bank accounts used to track the balances of payments between banks. Internation…

Settlement Date Accounting

- When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books onlywhen you fulfill the transaction. With settlement date accounting, enter the transactions into your general ledger when the transa…