Can I sue for damages because my car was totaled?

Can I Sue if My Car Was Totaled by Someone Else? When a car is totaled, you are usually entitled to some sort of payment. In many cases, insurance will cover the damage to your vehicle, but personal injuries may entitle you to file a lawsuit instead of accepting what the insurance company has to offer.

Can I buy my car back after it is totaled?

Many insurers will allow you to "buy back" a vehicle they have totaled out if you wish to repair it and make it roadworthy again. If your insurer allows you to do this, you will have to inform your insurer right away if you want your car back.

Can you fix a totaled car?

You can choose to keep a total loss vehicle instead if you want to repair it or salvage its parts on your own. If you try to repair a totaled car, you may run into issues with cost, insurance, passing inspection, or state laws that prohibit keeping it for use.

How to sell a totaled car?

- Fast, free offers: All you have to do is fill out a quick online form to get a quote. You get the numbers you need without the pressure you don't.

- Fair market value: We'll be honest: totaled cars aren't going to go very far in terms of the cash results. ...

- Efficiency: This is by far what we're praised for most. ...

What value do you get for a totaled car?

If the insurer totals your car, they will pay you the vehicle's actual cash value (ACV). The actual cash value is how much it was worth just before the loss. It includes a reduction in value for depreciation, so the ACV will be less than what you paid for the vehicle, even if it's relatively new.

How do you negotiate a car with total loss settlement?

If you are wondering how to negotiate with an insurance adjuster during an auto total loss claim, there are some steps you can follow.Determine what the vehicle is worth. ... Decide if the initial offer is too low. ... Negotiate with your insurance adjuster. ... Hire an attorney. ... Obtain a written settlement agreement.More items...•

How does insurance company value a totaled car?

A car is considered to be a total loss when the overall cost of damages approaches or exceeds the value of the car. Most insurance companies determine a car to be totaled when the vehicle's cost for repairs plus its salvage value equates to more than the actual cash value of the vehicle.

What does total loss settlement mean?

If your vehicle is declared a total loss, under California law, your insurance company is required to replace the vehicle or pay you the actual cost of a “comparable automobile” less any deductible provided in the policy.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease payments or deny claims for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

How long do car insurance claims take?

The time that it takes an insurance claim to finalise could be anywhere between a week, a month or even a year. It depends on a number of factors, such as the type of claim, the complexity of the situation, how severe the damage is and how many people are involved in the process.

Does totaling a car affect your credit?

How Can a Totaled Car Affect Your Credit Scores? Car accidents, even those that result in a financed car being totaled, won't directly impact your credit scores. Credit scores are based solely on the information in your credit report and don't include things like your driving record or previous insurance claims.

Is my car totaled If the frame is bent?

In short, the severity of the damage to the frame ultimately determines if the vehicle is to be declared a structural total loss. If the damage is so bad that it is uncertain whether a repair can be performed, the vehicle is considered a total loss.

How do insurance adjusters determine the value of a car?

To conduct an appraisal, the adjuster will assess the car's damage and then estimate how much it would cost to repair it. The adjuster is trying to determine how much your car would have been worth before the accident. Once they finish their investigation, the claims adjuster will decide if the car is worth fixing.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What to do when your car is totaled and you still owe money?

If your car was totaled, but you still owe money on it, you'll need to closely examine your insurer's settlement offer. Insurers are obligated to compensate you for the value of the vehicle you lost. They do not have to pay enough to purchase a replacement or to cover the amount of the loan outstanding on your wreck.

How long does an insurance company have to investigate a claim?

In general, the insurer must complete an investigation within 30 days of receiving your claim. If they cannot complete their investigation within 30 days, they will need to explain in writing why they need more time. The insurance company will need to send you a case update every 45 days after this initial letter.

Can you negotiate price of totaled car?

The total loss negotiation process is straightforward. A vehicle is legally considered a total loss if the cost of repairs and supplemental claims equal or exceed 75% of the fair market value – which, again, can typically be negotiated.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What to do when your car is totaled and you still owe money?

If your car was totaled, but you still owe money on it, you'll need to closely examine your insurer's settlement offer. Insurers are obligated to compensate you for the value of the vehicle you lost. They do not have to pay enough to purchase a replacement or to cover the amount of the loan outstanding on your wreck.

When Is A Damaged Car Considered A Total Loss?

Your insurance company may decide your damaged car is a total loss if: 1. It cannot be repaired safely 2. Repairs would cost more than the car is w...

How Does The Claim Adjuster Decide How Much My Car Is Worth?

Your adjuster will make note of your mileage, the condition of the body, interior and tires, and any additional parts or equipment you've added. (R...

Will The Insurance Company Buy Me A New Car?

If your car is very new -- say, less than three months old -- most major insurance companies will replace it with a new car.But beyond that point,...

How Soon Will I Get A Check?

Most companies will issue payment within a few days of finalizing the actual cash value. If you leased the car, payment goes directly to the leasin...

Can I Keep My Car and Repair It myself?

Usually a damaged car is auctioned at a salvage yard and the insurance company keeps the proceeds of this sale. If you want to keep your damaged ca...

Would I Go Through This Experience Again?

You've just had a hands-on lesson in the value of car insurance. If your company didn't measure up, it's time to consider a change.An at-fault acci...

What does it mean when a car is totaled?

An insurance company may declare your car as a total loss if your vehicle has too much damage. They can also say it's totaled if it's too expensive to repair. A totaled car means that the car is not worth fixing.

What Is the Auto Insurance Settlement Process?

The insurer will pay you a settlement based on the actual value of your car now. After you receive your settlement, you can start shopping for a new car. Did you use a loan to purchase your car? Unfortunately, the settlement you receive may not cover the entire amount you borrowed. For instance, a person may take out a $25,000 loan to pay for a hybrid vehicle, but its value has depreciated to $20,000. Your insurance company would reimburse you $20,000 for the actual cash value for your car. You would pay this amount to the lender plus the outstanding $5,000. Having GAP coverage can protect you from having to paying your lender for this loan out-of-pocket. Speak with your lender. Find out whether you can make an agreement about the settlement and the remaining amount you owe. The insurer will make the claim check payable to you and your lender if your car is totaled. Speak with your lender to find out how to release the money. We’ll speak more about GAP coverage in the next section.

How Do Different Areas Define Vehicles as a Total Loss?

The insurance company will also compare your car with similar vehicles within your area to calculate its current market. Each state has established a different legal threshold to define a totaled vehicle. Some locations use the Total Loss Threshold (TLT). Under this formula, the damage only needs to exceed a certain percentage of the vehicle’s value for the insurer to declare it a total loss. States that use the TLT include:

What if I Don’t Agree that My Car Is a Total Loss?

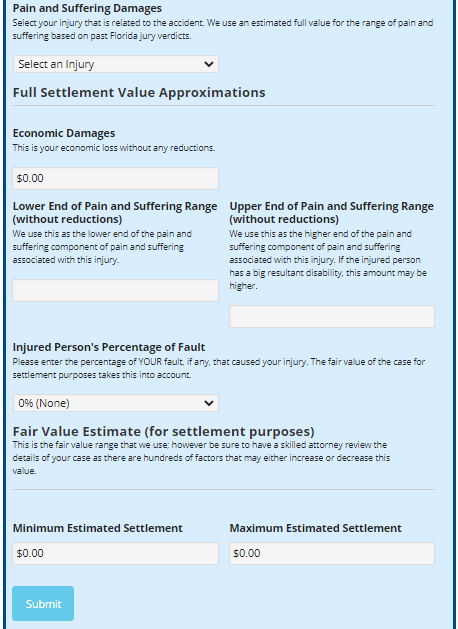

You don’t have to accept the offer from the insurance adjuster if it doesn’t seem fair or doesn’t match the estimates you received. It’s within your power to decline their figure and ask for a settlement. You can negotiate with the insurance company before considering legal action. Most insurers don’t want to bring these matters to court. Before entering negotiations, have the desired settlement and minimum settlement in mind. You can base your highest and lowest estimates upon the research you’ve done. When negotiating, ask the insurance adjuster the reasons they offered this settlement. After listening to them, you can make a counter offer.

Do I Have to Pay a Deductible if My Car Was Totaled?

Yes, you will still have to pay your deductible, even if your car was totaled. A deductible is an amount that policyholders will have to pay out-of-pocket before the insurance company pays any expenses. Most deductibles are a specific dollar amount. Others are listed as percentages on policies. Once you pay off your deductible, your insurance coverage will kick in, and the insurer will pay the rest of your claim up to the limits listed in the policy’s conditions.

Can I Buy My Totaled Car Back?

Some insurance companies will allow you to buy back totaled vehicles if you want to make repairs. You can contact your insurance agent to find out the process to repurchase your vehicle. Unfortunately, you may have to pay for the repairs out of pocket. Once you meet your deductible, you’ll receive the vehicle’s actual cash value. If you still owe money on your loan, you must pay off the balance before the lender transfers the title.

How to determine cash value of car?

There are several guides you can use to determine the actual cash value of your vehicle. These publications include Kelley Blue Book, Edmunds, and the National Association of Automobile Dealers’ NADA Guides. If you don’t think the insurance adjuster has given you a fair appraisal, you can also get an assessment from an auto shop that's unaffiliated with the insurance company. Additionally, you can get a quote in writing from a car dealer to help with your insurance claim when the adjuster works on the estimate.

How to negotiate a loss settlement for a totaled car?

1. Know what you are selling to your car insurance company. If your insurance company deems your vehicle totaled, then according to certain policies, your insurer may need to buy your totaled car from you at a reasonable price.

What does totaled mean for auto insurance?

By totaled, auto insurers generally mean the cost of repairs is greater than the actual cash value of the car. It is in your best interest to provide the adjuster with the sticker details that accompanied your car when you purchased it.

How to determine the value of a car?

With the sticker or list of the vehicle’s features, one option is to visit nadaguides.com. Enter the information of your vehicle to determine the value of your car. Remember, the important amount is the retail value, not the trade-in value. You are not trading in your car; you are selling your car to the insurance company. Print the estimated retail amount and features used to determine the amount, as you will need to show this to the adjuster when you make the counter offer. Many sites offer a guide to how you should evaluate the condition of your vehicle as the current vehicle owner. Use this information wisely.

What to do if you can't come to an agreement on value?

If you still can't come to an agreement on value, you can contact a consumer representative at your state's insurance departments.

Do you have to tell insurance adjuster that a DVD player is a split screen?

For example, you may remember to tell the insurance claims adjuster the vehicle had a DVD player, but did you tell him/her that it was a split-screen DVD player? You may not realize it, but these types of added items may increase the settlement amount. There are also processes to challenge findings if you think the Kelley Blue Book value is higher.

Can you trade in your car?

You are not trading in your car; you are selling your car to the insurance company. Print the estimated retail amount and features used to determine the amount, as you will need to show this to the adjuster when you make the counter offer.

Can you keep a totaled car?

Options for keeping a totaled car are limited. Unfortunately, it could cost more to repair because not all the damage is immediately obvious. When you buy a car insurance policy, you sign a contract that says that you can't make your insurer payout more than your car is worth.

What to do when your car is totaled?

What happens when insurance totals your car? There are options other than just accepting your insurance company's payout.

What can you do to be proactive and prepare in case your car gets totaled?

No one likes to believe that they will ever be in a car crash, let alone have their car totaled, but those who think about it in advance are much more prepared when it does happen.

What does 80% mean on a salvage title?

The “80%” simply means that if the cost to repair a damaged vehicle is 80% of its value or more, then if the vehicle is declared a total loss by the insurance company, that the salvage title returned on the salvage will be a “Certificate of Destruction” in the insurer’s name and not eligible to be rebuilt.

What does the condition of a car tell the insurance company?

The condition of the body, interior and tires, and other additional parts or equipment you've added will help the insurance company to determine the cost of your car.

How old is a car when it is replaced?

If your car is very new -- say, less than three months old -- most major insurance companies will replace it with a new car.

What is the ACV of a car?

This is called the Actual Cash Value (ACV) of your car.

What is salvage vehicle?

Vehicle is “wrecked vehicle” when so disabled that can’t be used for primary function without substantial repair or reconstruction. Insurance company which “totals” vehicle must mark the word “junk” on the title and surrender the title to the state.

What is a Totaled Car?

Insurance companies “total” a car when the cost to repair the damage exceeds the vehicle’s market value. They may also declare it a total loss if it would be unsafe to drive even if you fix it. If the insurer totals your car, they will pay you the vehicle’s actual cash value (ACV). The actual cash value is how much it was worth just before the loss. It includes a reduction in value for depreciation, so the ACV will be less than what you paid for the vehicle, even if it’s relatively new.

When is a Car Considered Totaled?

In many cases, the insurance company will total a car even if the repair costs are less than the vehicle’s actual cash value — sometimes a lot less. That’s because it can be difficult to determine the full extent of the damage before repairs begin.

How Does the Insurance Company Determine a Car is a Total Loss?

To determine whether a car is a total loss, the insurance company must calculate the vehicle’s actual cash value immediately before the loss occurred and estimate the amount of damage. Most insurers work with a third-party vendor that aggregates vehicle data to determine the ACV. The insurance company will then send an adjuster to inspect the damage and estimate the repair costs.

What to do if you don't think your car insurance is fair?

So, you’ll need to do some research. You can check sources like Kelley Blue Book and gather information about what similar cars are selling for in your area. Present the information to the adjuster and see if you can come to an agreement.

How to negotiate a car insurance claim?

Negotiate the claim with the insurer. If you think the insurance company’s assessment of your car’s ACV is too low , you can negotiate the payout. But you’ll need to show why your car is worth more than what the insurer is offering.

What happens if you total a car?

If this happens, the carrier will reimburse you for the actual cash value of the vehicle.

How to assess damage to a car?

Assess the damage. The insurance company will send an adjuster to assess your vehicle’s damage. The adjuster will conduct a visual inspection to estimate the cost of repairs.

Who is responsible for a car accident?

Technically, the at-fault driver is responsible for informing their auto insurance provider of the accident, but some are reluctant to do so as they don’t want their rates to go up. You can always contact the insurance company after the accident to make sure they have reported the situation. When reporting an accident, it’s best to state the facts and avoid bringing your opinion into it. Supply any information you may have gathered, such as photographs, a copy of the police report, and witness statements.

What is the determination of fault?

Determining Fault. While the police may make a determination as to who is at fault for citation purposes, the insurance companies will work together to make their own determination as well. In some cases, this determination will not match who law enforcement determines to be at fault. The insurance determination is what matters when it comes ...

Will My Premiums Go Up if I Am Not At Fault?

In most cases, your insurance premiums shouldn’t increase after an accident in which you were not found to be at fault. However, if you have to file a claim with your insurance company because the other involved driver left the scene or wouldn’t provide you with their information, you may find that the carrier raises your rate. Interested in shopping insurance rates? Give us a call today.-

What to do after a collision?

After a collision, it’s always best to call the police and exchange information with the other driver (s) involved. The police can arrive on the scene and complete a report that outlines all the details while they’re fresh in everyone’s minds, as well as interview any witnesses to get more information.

Should insurance take care of totaled car?

In theory, the other driver’s insurance company should step up and take care of the costs associated with your totaled vehicle, any necessary medical care for injuries sustained, and the rental car you needed to get around during the determination and review period. However, this isn’t always the case. Some insurance companies are more likely to side with their insured individuals, particularly if the story they tell differs from what actually occurred.

Is a third party auto claim a first party claim?

This process is called filing a third-party auto claim while filing a claim with your own insurance company is a first-party claim. However, it’s important to check the laws in your state. Some states are considered no-fault states and these states require drivers to file first-party claims with their own insurance companies first.

Can you replace a totaled car?

The settlement offered may not be enough to replace your car or purchase a similar vehicle, so make sure you understand what the company is offering to you before you accept.

How to Negotiate a Total Loss Car Insurance Settlement

It is possible to negotiate your totaled car insurance settlement if you think that your insurer’s offer is too low. If this is the case, you should send a counteroffer that includes your justification for why your car was worth more prior to being totaled.

How to Get a Totaled Car Settlement

Use the filters below to be matched with the right companies in your area.

Who is the best company to work with when dealing with totaled vehicles?

Based on consumer surveys and ratings from reputable sources the top companies to work with when dealing with claims and/or totaled vehicles are USAA, Travelers, Auto-Owners, and Amica.

What is the TLT in insurance?

Some use what is called the Total Loss Threshold or TLT where the damage needs to exceed a certain percentage of the vehicle’s value.

How do Insurers Determine the Fair Market Value of a Vehicle?

The definition of fair market value is when a buyer or seller can agree on a price.

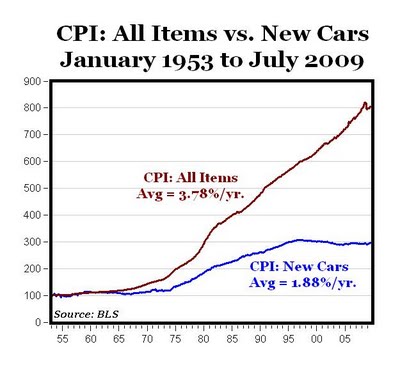

How much does a car depreciate in the first year?

Note: The average vehicle can depreciate from 17% to 30% in the first year according to NADA. Some depreciate up to 38%. When you are attempting to negotiate with an insurer after a total loss claim you are likely to find out your vehicle is not worth as what you expect.

What does an insurer look at when repairing a vehicle?

Many insurers are going to look at the cost of the repairs, the salvage value of the vehicle, and the cost to the insurer while the vehicle is being repaired.

Why won't my insurance give me more money for my car?

Your insurer is not going to give you more money for your car simply because you think it is worth more than their estimate. The bad news is, if you want more money for your car, you’re going to have to negotiate for it.

How to find out what your car is worth?

Instead, consider using any and all of these tactics: 1 Do your own research. 2 Contact local dealerships. 3 Keep detailed records and take into account any extra options and features your car had. 4 Compare your research with that of the insurer. 5 Be courteous. 6 You are attempting to get the fair market value of the vehicle – not what you think it is worth. What the market or unbiased buyer or seller would agree on a price.

What happens when a car is totaled?

When your car is totaled you can maximize the amount of money you get by getting your insurance payout, and then selling your wrecked car.

How much does insurance pay for a totaled car?

If your car is totaled how much does insurance pay? They pay the difference between your vehicle’s pre-accident appraised value and your deductible.Your insurance covers the difference, so you can hopefully get a good value from their insurance payout for your totaled car. Even after the insurance claim, the totaled car may still have value. However, depending on what additional insurance benefits you opted in for such a collision coverage or GAP insurance, there may be more to it. It also applies to cars with mechanical problems, such as a blown engine, or a junk vehicle - which would mean that repair costs exceed the current market value of the used vehicle.

How Much Will I Get For My Totaled Car?

Did the airbag deploy? Is there damage to more than one side of your car? After your accident, is your car unable to drive? If one or more of these answers is ‘yes’, then it’s probably safe to say your car is totaled.

What is The Value of A Totaled Car?

There’s no clear-cut formula you can use to determine your totaled car value. Because every vehicle’s condition is different, you won’t get a concrete number until you’ve hashed it out with your adjuster. And even then, it’s often up for discussion at least a little. You can, however, get insight into how that number is achieved.

How to determine the value of a car?

What is The Value of A Totaled Car? 1 Actual Cash Value is determined. That’s the resale price for your vehicle if it hadn’t been totaled. The insurance company will look at recent listings and sales for similar vehicles in your area. 2 Pre-accident condition is considered. Your car’s mileage, options and trim level, and any pre-accident damage is weighed into the equation. 3 Your deductible is… well, deducted. The insurance deductible you chose for your insurance policy is held back from the payout amount for your claim.

What to do after a car is totaled?

What Can I Do After My Car’s Been Totaled? If your car has been totaled, we can help you get the most from it. In many cases, you can settle your total loss claim, then buy back your totaled car at salvage value. This way you can profit from selling a totaled car, and get your insurance payout at the same time.

How much of the fair value of a car is a total loss?

Work out 20 to 40 percent of the fair condition value, depending on how bad your total loss car’s condition is. It’s probably closer to the 20 percent mark.