A Settlement Option is an agreement between an insurance company and an individual policyholder Insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier or underwriter. A person or entit…Insurance

What does settlement option mean in life insurance?

Definition. Settlement Options — in life insurance, how proceeds are paid to the designated beneficiaries.

What are the different settlement options?

The most common settlement option is a lump sum payment. However, this is not the only settlement option that is available to policyholders or beneficiaries. Settlement amounts vary from policy to policy. Other settlement options include the interest option, the fixed period option, the fixed amount option, and the life income option.

What is a fixed amount settlement option?

Under the fixed amount settlement option, the policy proceeds are paid out in fixed amounts until both principal and interest have been fully paid out to the beneficiary. Note that, with this option, the beneficiary can increase or decrease the payment amount (or change settlement options entirely) at any time.

What is an interest only settlement option in a will?

A far less common settlement option is an interest only payment the insurance company will make to the beneficiary. Under this option, the beneficiary will receive a payment of the interest earned on the death benefit sum; the death benefit will remain at the insurance company.

What is the purpose of a settlement options?

The primary objective of settlement option is to generate regular streams of income for the insured. Description: Under settlement option, the insured receives a regular flow of income from the insurer post the maturity of the policy.

What are the settlement options?

The following are the most common options available:- Lump Sum. The beneficiary takes the full amount of the death benefit as a single settlement. ... - Interest Only. ... - Fixed Period. ... - Life Annuity. ... - Life Annuity with Period Certain.

What are settlement options for life insurance policies?

Common Life Insurance Settlement OptionsLump-Sum Payment. A lump-sum payment is perhaps the easiest to understand. ... Interest Only. ... Interest Accumulation. ... Fixed Period. ... Lifetime Income. ... Lifetime Income With Period Certain.

What are settlement options for life insurance except?

All of the following are life insurance settlement options, EXCEPT: There are four settlement options: interest only, fixed-period installments (period certain), fixed-amount installments and life income. An automatic premium loan is a policy loan provision.

Are settlement options taxable?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

What is a fixed settlement option?

Definition of fixed-amount settlement option choice of beneficiary in which the death benefit of a life insurance policy is retained by the company to be paid as a series of installments of fixed dollar amounts per installment until the death benefit and interest are exhausted.

What are the five settlement options for the payment of the proceeds of a life insurance policy to its beneficiary?

By the end, you'll have working knowledge of lump-sum payments, interest income payments, interest accumulation, fixed period and fixed amount payout, and the life-only settlement, also known as the life annuity.

Which of the following settlement options does not include a life contingency?

Settlement options with a life contingency base payments on which of the following? The fixed amount option does not include a life contingency.

How are life insurance beneficiaries paid out?

Life insurance payouts are sent to the beneficiaries listed on your policy when you pass away. But your loved ones don't have to receive the money all at once. They can choose to get the proceeds through a series of payments or put the funds in an interest-earning account.

Which life insurance settlement option is considered the default option?

The lump sum settlement option is by far the most common settlement option, and it's usually the default settlement option. Under this option, the life insurer pays the beneficiary the lump sum total death benefit of the policy.

What is a single life settlement option?

A single-life payout is an annuity or pension option that means that payments will stop when the annuitant dies. In a joint-life payout, payments continue after death to the annuitant's spouse. Single-life payouts are generally larger on a per month basis since the payments stop upon the death of the annuitant.

Which settlement option provides a single beneficiary?

Which settlement option provides a single beneficiary with income for the rest of his/her life? Correct! The Single Life Option provides a single beneficiary with income for the rest of his/her life.

What are annuity settlement options?

Settlement options are also available to the beneficiary after the annuitant's death. Rather than taking a lump sum distribution and incurring potentially severe tax consequences, the beneficiary may elect a settlement option, become the annuitant, and spread the payments and taxation over time.

What is the settlement date for options?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date3. For foreign exchange spot transactions, U.S. equities, and municipal bonds, the settlement date occurs two days after the trade date, commonly referred to as "T+2"4.

What is a joint and survivor settlement option?

A joint and survivor annuity is an annuity contract that guarantees payments so long as the contract owner or a secondary annuitant lives. Payments are slightly lower, but they last longer. Provisions can be added for making payments to a third party should both annuitants die before payments exceed the principal.

What is the purpose of settlement options quizlet?

What is the purpose of a fixed-period settlement option? To provide a guaranteed income for a certain amount of time.

What is the Purpose of the Settlement Option?

The usual purpose of a settlement option is to give the policy owner some control over how the death benefit of his/her policy gets distributed to his/her beneficiary (ies). In many cases, the settlement option may become a spendthrift-like mechanism that limits the amount of money that a beneficiary has at any one time, but it's a rather weak tool at accomplishing this.

What is settlement option in life insurance?

The settlement option on a life insurance policy instructs the life insurance company how to pay the death benefit at policy claim time. Traditionally, the policy owner chooses the settlement option, but the beneficiary has the option to change it at claim time. In some unique situations, the settlement option selected by ...

What happens to the interest earned on a lump sum settlement?

This means anytime a settlement option results in interest payments to a beneficiary, the interest earned will result in reportable income paid by the insurance company to the beneficiary. For a lump sum settlement option, the most common way a beneficiary might earn interest on the death benefit is a processing delay.

What is lump sum settlement?

The lump sum settlement option is by far the most common settlement option, and it's usually the default settlement option. Under this option, the life insurer pays the beneficiary the lump sum total death benefit of the policy. The beneficiary of the life insurance policy will receive the entire death benefit payment as a single payment ...

How long does it take for a life insurance company to pay out a death benefit?

At death of the insured, the life insurance company will begin making payments to the beneficiary from the death benefit, and will stretch the payment out over 10 years. Because life insurers must pay interest on death benefit funds that it does not pay to a beneficiary within 30 days of the insured's death, this settlement option will result in ...

How long does a death benefit settlement last?

Again, because the insurer pays interest on any death benefit sum held longer than 30 days , this settlement option will result in interest earned on the death benefit sum that remains at the insurance company. A far less common settlement option is an interest only payment the insurance company will make to the beneficiary.

Does the death benefit stay with the insurance company?

Under this option, the beneficiary will receive a payment of the interest earned on the death benefit sum; the death benefit will remain at the insurance company. Usually, the insurer will not hold the entire death benefit indefinitely, but will instead make interest only payments to the beneficiary for a certain period ...

How many settlement options are there for life insurance?

This is one of the more confusing life insurance settlement options because there are four types of options to choose from. Along with the straight life income option explained above, there are three other options.

What is settlement in life insurance?

A settlement is the way in which your life insurance policy proceeds are paid out. There are many life insurance settlement options that can be confusing at first; your policy may pay out a lump-sum cash payment, life income, a fixed amount, or interest paid periodically. As a policyholder, you can usually choose the settlement method you prefer ...

What is a specific life option?

The specific life option allows the beneficiary to give the insurance company a payout schedule to follow. If the beneficiary dies before the period is over, a secondary beneficiary will receive the rest of the payments.

What is life income option?

The life income option means the beneficiary will receive payments for his or her entire lifetime. If the beneficiary chooses this settlement option, the insurance company will decide how much income the beneficiary will receive each year based on age and gender although the company may purchase an annuity instead.

What is lump sum life insurance?

The lump sum option is by far the most common of all life insurance settlement options and the most simple to understand. With a lump sum payment, the beneficiary receives the full death benefit all at once and income tax-free. The beneficiary can choose what he or she wants to do with the payout, including investing the money. If the insured had a loan against the cash value of the policy, the amount owed will be subtracted from the death benefit.

When do insurance payments stop?

Payouts stop when the beneficiary dies. If the beneficiary dies sooner than expected, the insurance company can keep the unpaid amount in most cases. This option tends to work best for people who want guaranteed payments for life but do not need a large sum of money at once.

Can you choose a lump sum payout?

As a policyholder, you can usually choose the settlement method you prefer although your beneficiary may also get to choose. Most beneficiaries choose a lump sum payout but it’s a good idea to explore other options. Many life insurance companies offer a guaranteed interest rate on all settlement options with the exception of a lump sum.

What is fixed amount settlement?

Using the fixed amount settlement option, the death benefit proceeds will be given out in a fixed amount over time until both the principal and the interest have been totally paid out to the beneficiary. While using this specific option, the recipient (beneficiary) has the option to either increase or decrease the payment amount – and if they prefer, they could even change to a completely different settlement option entirely.

What is advance settlement planning?

Advance Settlement Planning. Obtaining the settlement from the life insurance policy is only about half of the battle. It is essential that you’re buying the best type of life insurance for your family, so when the time arrives to get the payout from the insurance company, your family has the funds that they will need.

What is fixed period option?

The fixed period option will pay out both an amount of principal plus interest to the beneficiary during a stated time frame. If the primary beneficiary should die before the whole amount of the proceeds have been paid, the balance of the funds will be paid to the contingent beneficiary that was identified in the insurance policy.

How to contact Life Insurance Settlement?

Click Now for Your Instant Quote! For more information on life insurance settlement options, contact the insurance professionals at LifeInsure.Com at (866) 691-0100 during normal business hours, or contact us through our website for a free and confidential quote.

What is interest income option?

Interest Income Option. Using the interest income option, the life insurance company holds the funds and will pay a specified amount of interest on the funds. The interest can be disbursed on a monthly, quarterly, semi-annual, or annual schedule. When selecting this option, the beneficiary will have the capability to get a portion or all ...

What is settlement option?

Definition: Under a settlement option, the maturity amount entitled to a life insurance policyholder is paid in structured periodic installments (up to a certain stipulated period of time post maturity) instead of a 'lump-sum' payout.

What is the primary objective of settlement option?

The primary objective of settlement option is to generate regular streams of income for the insured. Description: Under settlement option, the insured receives a regular flow of income from the insurer post the maturity of the policy. An annuity or a pension is type of settlement option where the insured gets regular stream ...

What is an annuity settlement?

An annuity or a pension is type of settlement option where the insured gets regular stream of income after the completion of the maturity period when the insured reaches the vesting age. PREV DEFINITION. Risk Assessment.

What is surrender value in insurance?

Surrender Value is the amount the policyholder will get from the life insurance company if he decides to exit the policy before maturity.

What is settlement option?

Settlement options are just a beneficiary's options for how to receive their payout from a life insurance company.

What is important to consider when choosing a settlement option?

An important factor to consider when choosing a settlement option is how the payments you receive will be treated for tax purposes.

What is a second life settlement?

Under this second life settlement option, the life insurance company holds the policy proceeds in an interest-bearing account and makes interest payments to the beneficiary each month.

What is the risk of lump sum payment?

The risk of the lump sum payment option is that the beneficiary spends the money too quickly.

What is the second type of payout?

Surrendering A Policy: The second type of payout occurs when a whole life insurance policy owner no longer needs their policy and chooses to “surrender” (sell) it back to their life insurance company. The policy owner then receives a cash payment equal to their cash value minus surrender fees.

What is an annuity payment?

Payments are structured as an annuity that pays out over the lifetimes of both individuals. Any amount remaining after the second spouse dies goes to a designated third beneficiary, usually a child of the couple.

What is the third settlement option for life insurance?

The third of these life insurance settlement options is to leave all of your policy proceeds with the insurer, including interest earned.

What is interest only settlement?

2. Interest income (also known as interest only) With an interest-only settlement, the insurance company holds the principal of the death benefit and pays any earnings on that amount to the beneficiary. You can think of this settlement format as a savings account you fund for your loved one.

What is a fixed period life settlement?

The fixed period life settlement option distributes the death benefit plus any earned interest over a specific period of time. That monthly check functions as tax-free income and can help your beneficiary cover living expenses. This format is particularly appropriate when you want to ensure your beneficiary can keep making mortgage payments. Say he or she has 10 years left on a mortgage with $1,5000 monthly payments. A monthly settlement payment of $1,500 plus interest that lasts for 10 years would help your beneficiary reach the point of owning that home free and clear.

What is the death benefit of a life insurance policy?

The policy’s death benefit, paid out to your named beneficiary after you pass, makes that possible. That payout is called the “settlement” of your policy, and it can take different forms. Your beneficiary might receive the death benefit in a single lump-sum, for example, or as a lifetime stream of payments.

What is lump sum payment?

1. Lump-sum payment. Lump-sum payment is the simplest and most common insurance type of life insurance settlement. Once the insurance company receives and validates the life insurance claim, your beneficiary will be paid the death benefit in a single, tax-free payment. As with all life insurance settlements, there are no restrictions on how ...

How to cash out life insurance?

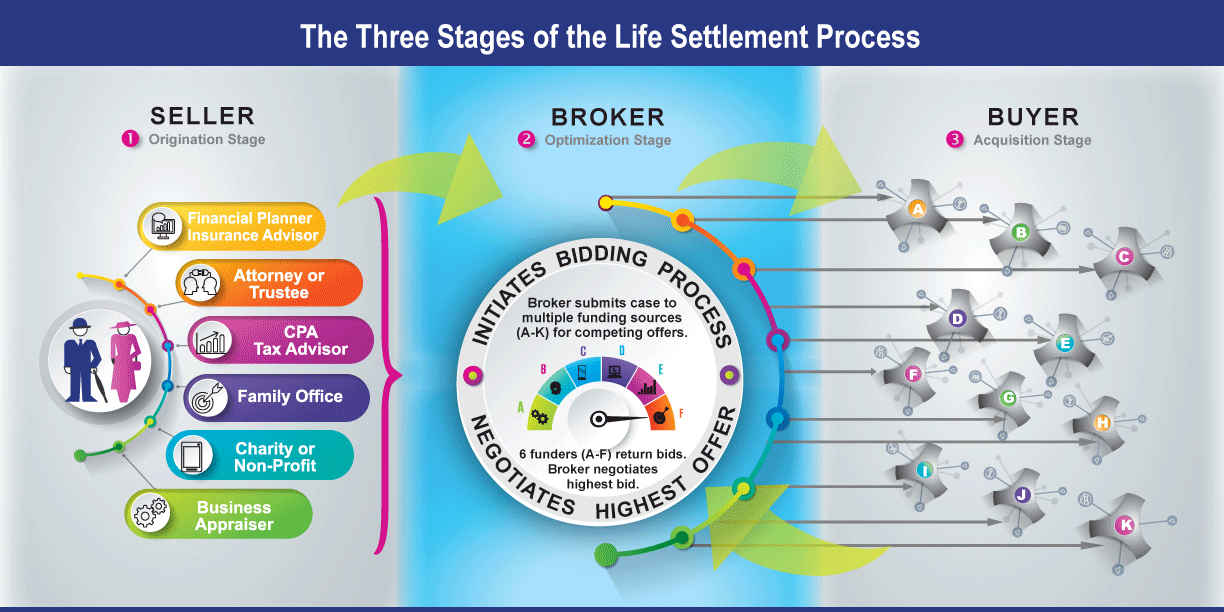

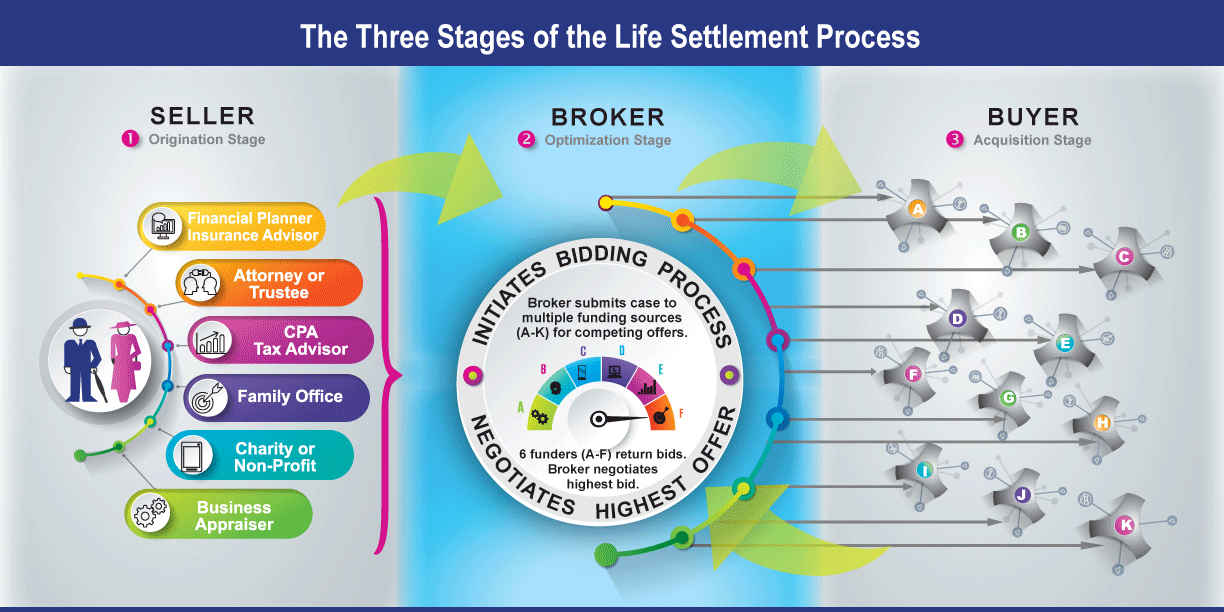

To cash out your life insurance while you’re living, consider a life settlement . If none of these options sound right for your situation, you might prefer to liquidate your life insurance while you are living. You can do this through a life settlement, which is the sale of your life insurance to a third-party for cash.

How are life settlements paid?

The proceeds from a life settlement are paid to you directly in one lump-sum payment, and there are no restrictions on how you use the funds. You could set up an investment account with named beneficiaries, for example. You could also pay off debt, earmark the money for your future healthcare expenses, or buy an RV.

Can you change your life insurance policy later?

Normally, you as the policyholder would choose the structure of the life insurance settlement, but your policy may allow your beneficiary to change it later. Life insurance settlement options are notoriously confusing, particularly when you try to compare them. Evaluating a lump-sum payment relative to an annuity, for example, ...

What are the two types of options settlement?

First of all, there are two types of Options settlement – American style and European style. And there are two baskets of securities when it comes to settlement procedures – 1) Equities and ETFs and 2) Major Indices like the SPX, NDX and the RUT. The American style applies to all equities and ETFs, and the European style applies to cash settled ...

What happens if you buy an option and it is ITM?

And if you’re an Option buyer and your Option is ITM, then you will be automatically exercised, unless you have informed your broker specifically that you don’t intend to exercise. This applies even if the Option is ITM by 1 cent. This type of settlement is done by “exchange of securities”.

When can you exercise American style options?

American style Options can be exercised at any time prior to the day of expiry of the Option. The American style applies to all equities and ETFs (Basket 1), including ETFs based on indices – like the SPY or QQQ. They trade until the close of every third Friday of the month.

Is the SPX a European option?

In the US markets, only Options on the major indices like the SPX, NDX and the RUT are European style. And these Options are also “cash-settled” – meaning the settlement process only involves transacting in cash between the buyers and sellers. There are no underlying securities that exchange hands. In fact, these indices are not tradable securities.

Options Expiration

Physical Settlement

- Physical settlement of options contracts is the most common form of settlement and involves the physical or actual delivery of the underlying security at settlement. Physical settlement of a long equity call option, for example, would be the purchase of 100 shares of the underlying security at the contract’s strike price. Physical settlement of a l...

Cash Settlement

- Cash settlement occurs when cash exchanges hands at settlement instead of an underlying security or physical commodity. Cash settlement is primarily used with index options because an index is not deliverable. When the options contract holder exercises an index option (buyer), the difference between the options contract strike price and the underlying index price is paid to the …

Settlement timelines

- Settlement timelines vary based on the type of options contract. For example, equity options are P.M. settled while VIX index options and some SPX index options are A.M. settled. Buyers of options contracts may exercise their option any time prior to the expiration time on the expiration date for American-style contracts or on the expiration date for European-style contracts. Brokera…

The Four Most Common Settlement Options

What Is The Purpose of The Settlement Option?

- The usual purpose of a settlement option is to give the policy owner some control over how the death benefit of his/her policy gets distributed to his/her beneficiary(ies). In many cases, the settlement option may become a spendthrift-like mechanism that limits the amount of money that a beneficiary has at any one time, but it's a rather weak tool ...

Tax Consequences

- In general, beneficiaries receive the death benefit of a life insurance policy income tax free. Interest paid by an insurance company on a death benefit, however, is taxable as ordinary income to the beneficiary. So while the entire death benefit amount remains tax free, any interest earned on it will be taxable. This means anytime a settlement option results in interest payments to a b…

How Using The Option Works

- The policy owner can choose a life insurance settlement option at policy issue or at anytime throughout the life of the policy while the insured is alive. Usually the policy owner has the option to change the selected option whenever he/she sees fit. If the policy owner makes no specific settlement option election, the lump sum option is usually the default. Upon the death of the ins…

Strengths and Weaknesses of Settlement Options

- Settlement options can meet the needs of common financial worries a beneficiary or policy owner might have about managing a large payout from a life insurance policy. But, the methods settlement options use to limit the mount of money a beneficiary will receive at one time are largely voluntary on the behalf of the beneficiary. This means that if the policy owner has seriou…