An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.

Full Answer

What is an'account settlement'?

Account Settlement. What is an 'Account Settlement'. An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero.

What is the process of account settlement?

BREAKING DOWN 'Account Settlement'. The accounts receivable department of a company is charged with the account settlement process of collecting money owed to the firm for providing goods or services. The ages of receivables are broken down into intervals such as 1-30 days, 31-60 days, etc. Individual accounts will have amounts...

What is an accounts receivable settlement?

Understanding Account Settlements The accounts receivable department of a company is charged with the account settlement process of collecting money owed to the firm for providing goods or services.

What is an invoice settlement parameter?

Settlement is the process of settling an invoice with a payment or credit note. These parameters are located in the Settlement area of the Accounts payable parameters form. For information about these parameters, see Accounts payable parameters (form).

What is settlement of accounts payable?

What Is an Account Settlement? An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.

What is settlement in the payment process?

Payment settlement involves collecting the funds for the amount recorded for an order. For example, when using credit cards, the settlement process specifically involves contacting the payment system and collecting the required amount of funds against the credit card.

What are settlements accounting?

An account settlement, or settlement of accounts, is the action of paying off any outstanding balances to bring an account balance to zero. To settle an account can also mean completing the offset process between two or more parties in an agreement.

How do settlement accounts work?

The settlement bank will typically deposit funds into the merchant's account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

What is the difference between clearing and settlement in payments?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

What is a settlement run?

A Planned Settlement Run is a complete determination of all charges related to all Supply Points which are registered within the central system (CMOS) for each Invoice Period (a full calendar month from the first up to and including the last day of the month).

How Should settlements be recorded in accounting?

You list it as a liability on the balance sheet and a loss contingency on the income statement. It's possible but not probable you'll lose money. You disclose it in the notes on the financial statement, but you don't include the amount in your statements.

What is the journal entry for settlement of account?

The journal entry is debiting accounts payable and credit cash. The transaction will remove the accounts payable of a specific invoice from the supplier and reduce cash payment.

What is the difference between settlement and balance?

Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account. The account will be reported to the credit bureaus as "settled" or "account paid in full for less than the full balance."

What triggers settlement accounting?

Accounting for a settlement requires accelerated recognition in expense of a portion of deferred gains and losses, and a common practice has been to measure a settlement either at fiscal year-end or at the date when the amount of lump sums paid plus annuities purchased during the year exceeds a certain threshold.

What does settlement mean in banking?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What does it mean to settle a transaction?

Transaction settlement is the process of moving funds from the cardholder's account to the merchant's account following a credit or debit card purchase. The issuer will route funds to the acquirer via the card network.

What is settlement in credit card processing?

As stated above, a credit card settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. The remaining amount can be repaid in one single payment or as a series of payments, as determined through the specific agreement.

What is settlement on card machine?

'Settlement' is when authorised transactions are sent to the processor for payment to you (the merchant). This typically takes 3-5 working days. By comparison, 'Same Day Settlement' means you will receive your funds in just a few hours, hence 'Same Day'.

Examples of Settlement Run in a sentence

In such circumstances any Dispute Settlement Run may need to occur after implementation of the remediation plan.

More Definitions of Settlement Run

Settlement Run means, in respect of transactions occurring on the relevant Settlement Day for which payments are to be settled pursuant to this Schedule, the data which the Settlement System Administrator is required to deliver from time to time to the Pool Funds Administrator pursuant to Section 17 in respect of such transactions; and

Related to Settlement Run

Settlement Cycle means in respect of an Index, the period of Clearing System Business Days following a trade in the securities underlying the Index on the relevant Exchange in which settlement will customarily occur according to the rules of such Exchange (or, in respect of a Multiple Exchange Index, the longest of such period).

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

What is the account receivable department?

The accounts receivable department of a company is charged with the account settlement process of collecting money owed to the firm for providing goods or services. The ages of the receivables are broken down into intervals such as 1–30 days, 31–60 days, etc. Individual accounts will have amounts and days outstanding on record, and when the invoices are paid, the accounts are settled in the company's books.

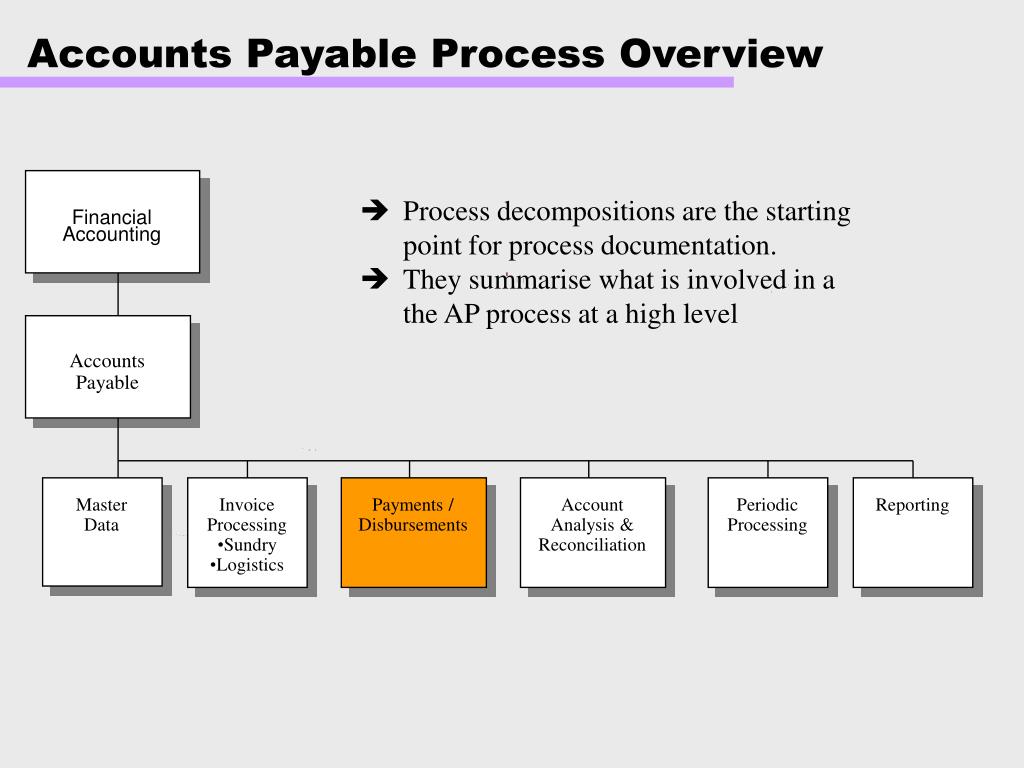

What is the process of paying an account payable?

Accounts payable process usually starts with the request of the goods to be purchased to the purchasing department or the responsible personnel until the payment is made to the supplier of goods or services.

What is the first step in the account payable process?

The first step of accounts payable process usually starts with requesting the goods or services to be purchased. In this step, the important procedure is the authorization that is usually required for any purchase request. The purchase request may come from the warehouse staff who control the stock or the personnel that need goods ...

What is the record of accounts payable?

Likewise, the accounts payable process here is where the accountant will record accounts payable as liability using the purchase order, receiving report and supplier’s invoice.

What happens when a company receives goods?

Receive Goods or Services. The accounts payable process after sending the purchase order to the supplier will continue when the company receives goods or services from the supplier. In this case, when the company receives goods, the person receiving goods will match the purchase order with the actual quantity of goods received ...

How many suppliers are there in the accounts payable process?

In this second step of the accounts payable process, after receiving the approved purchased request, the personnel responsible for purchasing usually start seeking quotations from different suppliers (usually 3 suppliers). Once the quotations obtained, there is usually a meeting to decide which supplier to choose for purchasing based on the price and quality of goods or services.

What documents do accountants need to check for accounts payable?

In this step of the accounts payable process, the accountant needs to check official receipt or receipt voucher as well as bank transfer slip or copied cheque, if payment is made by bank transfer or cheque, as supporting documents.

What documents should be included in a payment before making payment?

Before making payment, the accountant should make should that all three supporting documents including purchase order, receiving report and supplier’s invoic e, are available for verification.

Account Settlements and Clearing Accounts

- Settling an account often occurs with clearing accounts. What is a clearing account? A clearing account is either a: 1. Bank account used to hold funds until payments can move to another account (e.g., payroll accounts to employee bank accounts), OR 2. Temporary account used to r…

Examples of Account Settlements

- Settling your accounts can be confusing, especially since there are several different ways you can do so. Here are some examples of account settlements.

Settlement Accounts vs. Account Settlements

- So, what is the difference between settlement accounts and account settlements? Despite the names being so similar, there is quite a difference between the two. Again, account settlements are when you settle outstanding balances either through payments or offsets. But, settlement accounts are bank accounts used to track the balances of payments between banks. Internation…

Settlement Date Accounting

- When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books onlywhen you fulfill the transaction. With settlement date accounting, enter the transactions into your general ledger when the transa…