What is the purpose of a settlement sheet?

Settlement Sheet (Use of Proceeds Certification) The purpose of this form is to document and verify that loan proceeds have been disbursed in accordance with the Authorization and to document that the Borrower’s contribution has been injected into the business prior to the Lender disbursing any loan proceeds.

What is a settlement statement?

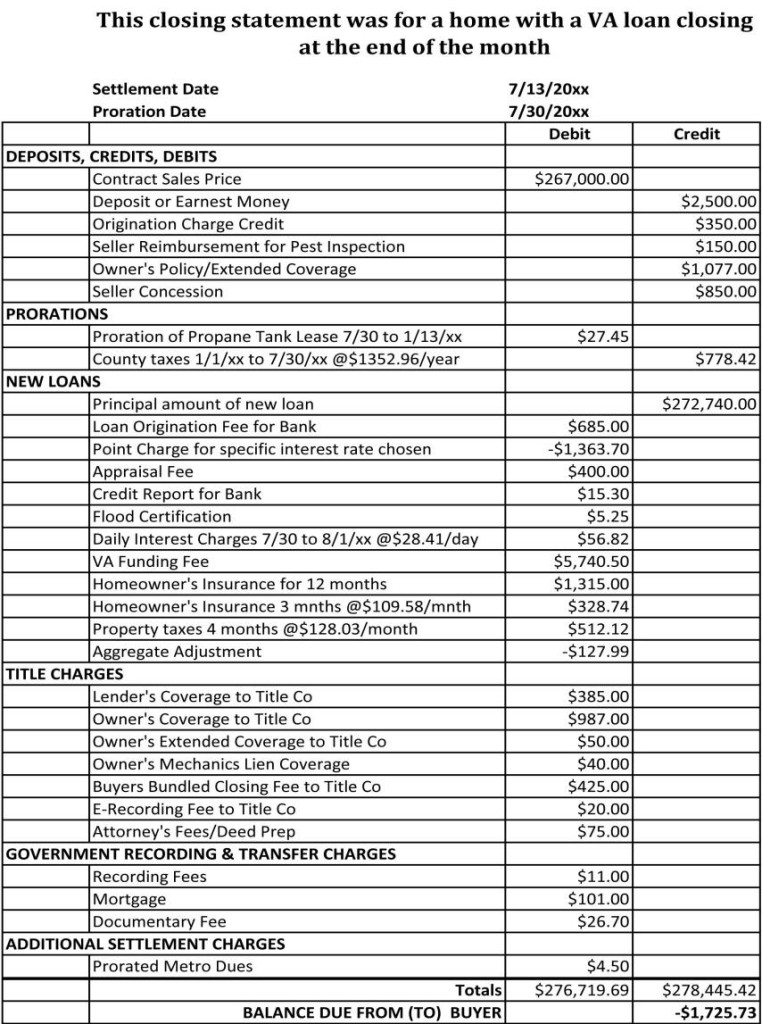

Updated Mar 23, 2018. A settlement statement is a document that summarizes all of the fees and charges that a borrower and lender face during the settlement process of a loan transaction. Different types of loans have varying requirements for settlement statement documentation. Settlement statements can also be referred to as closing statements.

What types of transactions are typically consummated with a settlement statement?

Business transactions: Large business transactions, such as mergers and acquisitions, are usually consummated with some type of closing or settlement statement.

How do I get a settlement statement for a commercial loan?

Commercial and personal loan borrowers will usually work with a loan officer who presents them with the closing, settlement statement. Some online lending and credit card agreements may provide different iterations of settlement statements that a borrower receives electronically.

What is a settlement statement in a business?

A settlement statement is a document that summarizes the terms and conditions of a settlement agreement between parties. Commonly used for loan agreements, a settlement statement details the terms and conditions of the loan and all costs owed by or credits due to the buyer or seller.

What is the purpose of a settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

How do you write a settlement statement?

A settlement agreement should be in writing....Those requirements include:An offer. This is what one party proposes to do, pay, etc.Acceptance. ... Valid consideration. ... Mutual assent. ... A legal purpose.A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

What is the most commonly used form for settlement statements?

HUD-1 formA HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What form contains a settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What is final settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction.

What is a settlement letter?

A settlement letter is a letter that provides a quote for the amount you need to pay in order to settle your vehicle finance account in full.

Does a settlement agreement need to be in writing?

A Settlement Agreement can be proposed by either an employer or employee; however, it is usually the employer who makes the first approach. To be legally valid, a Settlement Agreement must: be in writing.

What is a settlement statement vs closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Is settlement the same as closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

What is a settlement statement vs closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

What is a settlement statement quizlet?

Uniform Settlement Statement. Under RESPA, a lender must use HUD's Form 1 Uniform Settlement Statement to disclose settlement costs to the buyer. This form covers all costs that the buyer will have to pay at closing, whether to the lender or to other parties.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

What Is a Settlement Statement?

Settlement statement defines the document which discloses the summary writing of the transaction between the service provider and the client.

What to consider when writing a settlement statement?

Either way, one needs to consider many things when writing a settlement statement. Here are some of those things: Know your purpose in writing the settlement statement. You should have a goal in mind as to why you are writing a settlement statement. If you don’t have one, don’t write it.

Why do people use financial statements?

People involved in business also make use of statements in conducting their business operations. Financial statements express a company’s financial status, operations, and plans over a certain time period. This goes to show that statements are reliable even in the world of business.

Why do both parties need to check the contents of a document?

Both parties need to check the contents of the document thoroughly in order to avoid future conflicts and lawsuits. This will serve as one of the final agreements both parties will undergo upon the completion of their transaction. The process, however, might vary from one service provider to another, so the client also need to review the process properly.

How is a Settlement Statement Used?

When closing on a mortgage loan package, it is mandatory for the borrower to review and sign a settlement statement. With mortgage loan products, you require to have a settlement statement that is comprehensive. However, there are other types of loans whose statement settlement documentation is not extensive. A settlement statement consists of things such as:

Who prepares the settlement statement for closing?

In most cases, it is the third party in the transaction that prepares the settlement statement for closing. The third-party can be the officers that deal with this kind of documents and usually have a title. It could also be an escrow company presiding over the closing. The cost of preparing the document varies depending on the state. Note that states have different customary practices, and this includes fees charged for settlement services. In the state of California, both the seller and the buyer usually sign the document at closing.

How many pages are in a closing disclosure?

Closing Disclosure - During the offering of the standard mortgage loan, there is the inclusion of a closing disclosure. The form consists of five pages, and it contains the costs, monthly payments as well as closing costs of the borrower. According to the regulations, a lender has to give a mortgage borrower a closing disclosure three days before the loan closing. The reason is that there are items in a closing disclosure form that may require three days to review. Some of these changes may include:

What are the charges on a loan settlement statement?

The second section has all the charges imposed on the buyers loan and the fee paid by the buyer before the loan closing. Note that any fee paid before or outside closing, are have the initials POC. Some of the charges in this section include the title policy, document preparation, title research, and attorneys fees. The third section highlights research, transfer, survey, and inspection fees.

How long does it take to get a settlement statement?

Typically, the borrower will receive a settlements statement copy three business days after the borrower applies for a mortgage loan. Note that the form has three pages containing the information which includes:

When to use HUD-1 settlement statement?

Significance - According to RESPA, it is mandatory to use the HUD-1 settlement statement when closing real estate deals. It is on this page that all the mortgage loan terms are stated. The page consists of the following:

Do you need a settlement statement for a mortgage?

With mortgage loan products, you require to have a settlement statement that is comprehensive. However, there are other types of loans whose statement settlement documentation is not extensive. A settlement statement consists of things such as:

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

What is offset in insurance?

Amounts receivable and payable to reinsurers are offset for account settlement purposes for contracts where the right of offset exists, with net insurance receivables included in other assets and net insurance payables included in other liabilities. 1.