The Settlement Statement is also called the Seller’s Closing Statement.

- Property sale price

- Personal property

- Earnest money

- Loan amount

- Existing loan amount

- Seller credit

- Excess deposit

What Settlement Statement items are tax deductible?

What on the HUD-1 Statement Is Deductible on Federal Taxes?

- Prepaid Property Taxes. The HUD-1 settlement statement for taxes itemizes closing costs, including prepaid items such as real property taxes and mortgage interest.

- Mortgage Loan Points. When taking a look at a HUD statement example, you'll find mortgage loan discount points listed. ...

- Prepaid Mortgage Interest. ...

- Non-Deductible Settlement Charges. ...

What is Mortgage Settlement Statement?

“A settlement statement indicates to the borrower how much money they need to bring to closing to buy or refinance the property, and it shows the seller how much their proceeds will be from the transaction,” explains Jana Paterson, an attorney with Atlanta real estate law firm Cook & James.

What is HUD 1 settlement statement?

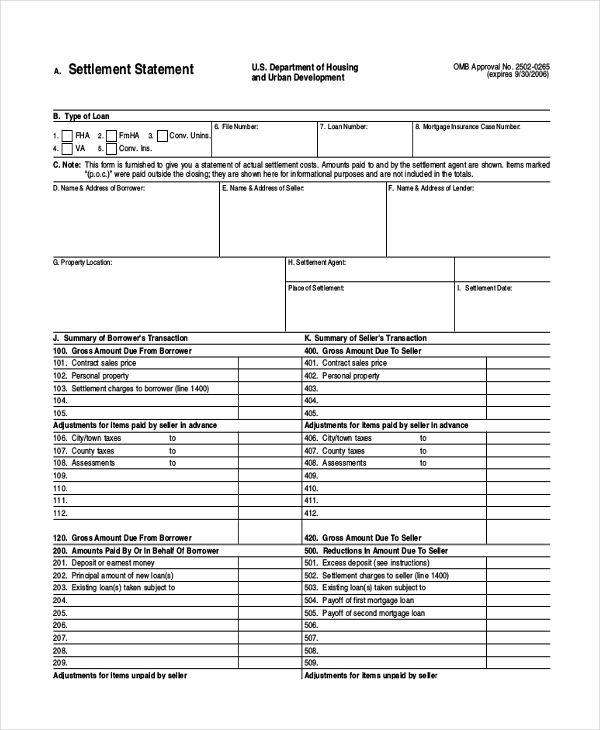

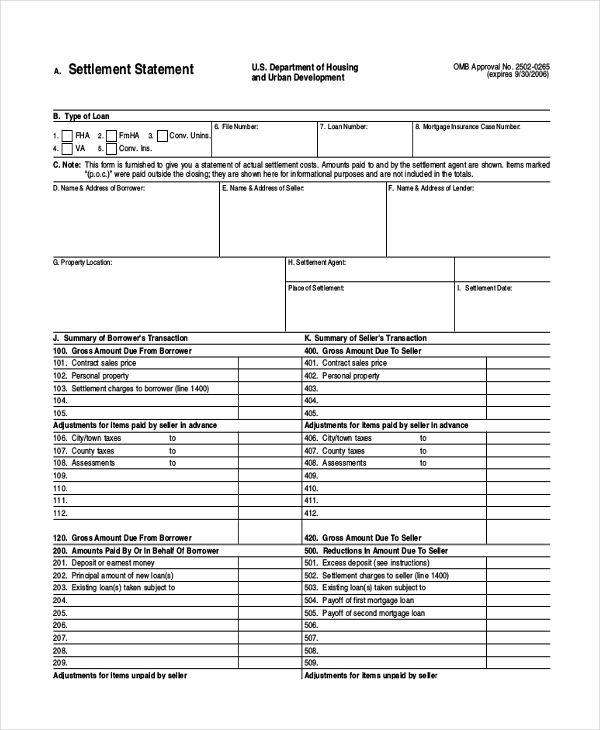

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is final settlement statement?

The final settlement statement will include the total settlement amount and a detailed breakdown showing how your proceeds will be disbursed. The settlement statement should account for every dollar received and every dollar disbursed in your settlement. View our Final Settlement Statement Example. In this article, we will break down each section of a typical final settlement statement.

What is the purpose of a settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Is a settlement statement the same thing as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is the most commonly used form for settlement statements?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is a closing statement in a settlement?

A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

Is a closing disclosure the same as a closing statement?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

Who provides the HUD Settlement Statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

How do you read a settlement statement?

0:277:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What does closing statement look like?

A mortgage closing statement lists all of the costs and fees associated with the loan, as well as the total amount and payment schedule. A closing statement or credit agreement is provided with any type of loan, often with the application itself.

What is a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

Is closing disclosure same as HUD statement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

What is a Settlement Statement?

The Settlement Statement or closing statement is a document that outlines what the buyer has to pay to the vendor on settlement day. It includes all payments and receipts that are related to the settlement. This may include stamp duty, the First Home Owner Grant and the Statement of Adjustments. It also includes the total purchase price less any deposit paid. The Settlement Statement is usually put together by your conveyancer or property lawyer when they are getting ready to settle the property purchase.

Why are settlement statements included in the Statement of Adjustments?

Settlement Statements are usually incorporated into the Statement of Adjustments because the income and expenses related to the property also need to be settled between the parties. These expenses may include things like municipal rates, land tax and other periodic expenses related to the property.

What is a settlement?

Real estate settlement happens when the land is transferred over to the buyer. Settlement day usually marks the end of the transaction. Aside from handing over keys, there are several things that happen on settlement day. A settlement day checklist includes:

What is included in a statement of adjustment?

Some of the most common include: Municipal Rates: The seller is liable to pay for the rates up to settlement day.

How is a statement of adjustments calculated?

The Statement of Adjustments will be calculated assuming that all of the expenses have been paid. If they haven’t then they will be paid out of the total money that is to be paid to the seller. This means that the seller will effectively pay them up to settlement date. Sometimes this involves having a bank cheque for settlement drawn up so that these expenses can be paid.

Why do you need to adjust settlement dates?

Because settlements rarely occur at the end of the year or month, adjustments need to be done to make sure both the buyer and the seller only pay (and receive) their fair share. If for some reason the settlement date is delayed, then the adjustments will need to be recalculated.

What does settlement adjuster include?

The income may include things like rent if the property has tenants. Generally, the settlement adjuster will include income or expenses that are paid periodically. That means they are paid or received weekly, monthly or annually. The seller must pay these expenses and can receive the income up to and including on the settlement day.

How is a Settlement Statement Used?

When closing on a mortgage loan package, it is mandatory for the borrower to review and sign a settlement statement. With mortgage loan products, you require to have a settlement statement that is comprehensive. However, there are other types of loans whose statement settlement documentation is not extensive. A settlement statement consists of things such as:

What are the charges on a loan settlement statement?

The second section has all the charges imposed on the buyers loan and the fee paid by the buyer before the loan closing. Note that any fee paid before or outside closing, are have the initials POC. Some of the charges in this section include the title policy, document preparation, title research, and attorneys fees. The third section highlights research, transfer, survey, and inspection fees.

How many pages are in a closing disclosure?

Closing Disclosure - During the offering of the standard mortgage loan, there is the inclusion of a closing disclosure. The form consists of five pages, and it contains the costs, monthly payments as well as closing costs of the borrower. According to the regulations, a lender has to give a mortgage borrower a closing disclosure three days before the loan closing. The reason is that there are items in a closing disclosure form that may require three days to review. Some of these changes may include:

How long does it take to get a settlement statement?

Typically, the borrower will receive a settlements statement copy three business days after the borrower applies for a mortgage loan. Note that the form has three pages containing the information which includes:

When to use HUD-1 settlement statement?

Significance - According to RESPA, it is mandatory to use the HUD-1 settlement statement when closing real estate deals. It is on this page that all the mortgage loan terms are stated. The page consists of the following:

Who prepares the settlement statement for closing?

In most cases, it is the third party in the transaction that prepares the settlement statement for closing. The third-party can be the officers that deal with this kind of documents and usually have a title. It could also be an escrow company presiding over the closing. The cost of preparing the document varies depending on the state. Note that states have different customary practices, and this includes fees charged for settlement services. In the state of California, both the seller and the buyer usually sign the document at closing.

Do you need a settlement statement for a mortgage?

With mortgage loan products, you require to have a settlement statement that is comprehensive. However, there are other types of loans whose statement settlement documentation is not extensive. A settlement statement consists of things such as:

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is a settlement statement?

Settlement Statements – This is the version supplied solely to the buyer and contains only information pertinent to the buyers side of the transaction.

Where Can I Download a Sample ALTA Settlement Statement?

You can download a sample ALTA statement by clicking the text link below.

What is an ALTA Statement?

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is the difference between seller disclosure and closing disclosure?

The difference between a seller disclosure and closing disclosure is simple – the seller will receive a seller’s disclosure, which provides a breakdown of costs and fees that factor into the cash they will receive at the transaction’s end. Due to TRID regulations, agents will have nothing to do with the closing disclosure.

What is closing disclosure?

The closing disclosure is provided to the buyer and pertains a list of fees and costs and how they work into the buyer’s total expense. It is important to note that only the lender can provide the Closing Disclosure to the buyer 3 days prior to closing? And only the buyer should be able to see it unless they allow the release of it by signing a release disclosure. You should also know that the lender is obligated under the TRID regulations, and the lender can be penalized for failing to disclose 3 days after they’re loan application is approved and again 3 days prior to closing.

Why is a standard form required for title insurance?

Having a standard form for nearly all title insurance policy transactions maintains that all exchanges of land are done smoothly and efficiently.

Can you have a buyer's statement and seller's statement in ALTA?

But please note that it is possible to have a combined ALTA Buyer’s or Seller’s statement.