Is a debt settlement worth it?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you’re able to offer a lump sum of money to settle your debt. If you’re carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you. There are numerous debt settlement and credit card companies that promise to help you settle your debt for half or even a small fraction of the total balance you owe, but is debt settlement really a good idea?

What is the value of a concussion settlement?

A CONCUSSION SETTLEMENT AMOUNT DEPENDS ON THE FACTS OF THE CASE. A concussion settlement amount can vary widely from several thousand dollars to hundreds of thousands of dollars, depending on the unique facts of the case. There is no one universal answer to this question.

Who is the largest buyer of structured settlement payments?

The truth is there is no one person or company that buys the majority of annuities, structured settlement payments, and lottery winnings. It is a very diverse field of investors, insurance companies, banks, and investment houses that purchase these type of reliable periodic payment streams.

How much is my car accident settlement worth?

The payouts after car accidents range from a few hundred dollars for minor vehicle repairs to millions after severe injuries and fatalities. According to the Insurance Information Institute (III), the typical car accident settlement amount for bodily injury was $15,785 and the average compensation for property damage was $3,841 in 2018.

What is settlement accounting?

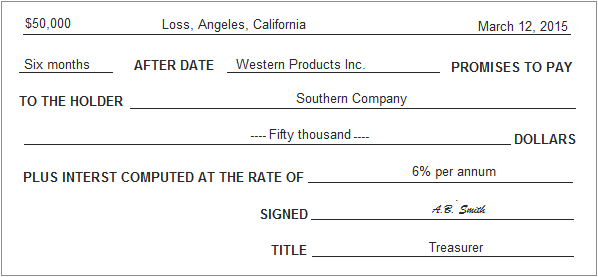

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is recorded on the "books" at the point in time when the given transaction has been fulfilled.

What does the settlement amount mean?

Settled Amount means the amount for which the Claim is Settled (including interest and costs).

What is the difference between settlement and balance?

Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account. The account will be reported to the credit bureaus as "settled" or "account paid in full for less than the full balance."

What are settlement assets on a balance sheet?

Settlement Asset means any cash, receivable or other property, including a Settlement Receivable, due or conveyed to a Person in consideration for a Settlement made or arranged, or to be made or arranged, by such Person or an Affiliate of such Person.

How is a settlement amount calculated?

Settlement amounts are typically calculated by considering various economic damages such as medical expenses, lost wages, and out of pocket expenses from the injury. However non-economic factors should also play a significant role. Non-economic factors might include pain and suffering and loss of quality of life.

What is an example of settlement?

An example of a settlement is when divorcing parties agree on how to split up their assets. An example of a settlement is when you buy a house and you and the sellers sign all the documents to officially transfer the property. An example of settlement is when the colonists came to America.

What is current settlement value?

The Settlement Value is the amount paid to the holder of the in the money Contract on Settlement Date. The Settlement Value is the amount paid to the holder of the in the money Contract on the Settlement Date.

What does settlement mean in finance?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What is the journal entry for settlement of account?

The journal entry is debiting accounts payable and credit cash. The transaction will remove the accounts payable of a specific invoice from the supplier and reduce cash payment.

Is a settlement considered an asset?

A settlement check is considered an asset, not income.

How do settlement accounts work?

The settlement bank will typically deposit funds into the merchant's account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

What is the official settlement balance?

What Is an Official Settlement Account? An official settlement account is a special type of account used in international balance of payments (BoP) accounting to keep track of central banks' reserve asset transactions with one other.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What is loan settlement amount?

Loan settlement is the process of negotiating with your lender to pay off your loan for a lesser amount than what you originally borrowed. This can be done for various reasons, such as financial hardship or wanting to get out of debt quicker.

What is settlement amount in credit card?

As stated above, a credit card settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. The remaining amount can be repaid in one single payment or as a series of payments, as determined through the specific agreement.

What's the difference between settlement and paid in full?

Paying in full means paying the total amount of your debt. Settling in full means coming to an agreement with your creditor or collection agency on an updated payment plan. While this may seem simple, there are nuances to how lenders look at the two on your credit report.

What is Settlement Date Accounting?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is recorded on the "books" at the point in time when the given transaction has been fulfilled.

When is a settlement date recorded?

Under settlement date accounting, a transaction is recorded in the general ledger when it is "fulfilled" or "settled."

Why is it important to remain consistent with the general ledger?

However, a company needs to remain consistent with its chosen method in order to preserve the integrity of information recorded in its general ledger, which is used to create the company's financial statements .

Can you see the impact of planned transactions that have not yet been finalized?

However, it does not allow financial statement users to see the impact of planned transactions that have not yet been finalized.

Is settlement date accounting conservative?

It is a conservative accounting method, which means that it errs on the side of caution when recording journal entries in the general ledger.

What is an account settlement?

An account settlement, or settlement of accounts, is the action of paying off any outstanding balances to bring an account balance to zero.

What is settlement date accounting?

With settlement date accounting, enter the transactions into your general ledger when the transaction happens. This method ensures that everything on your general ledger has actually happened with the exact amount recorded. You settle the account at the time you record the transaction.

What happens to the clearing account balance after employees deposit their checks?

After the employees deposit their checks and you remit the taxes, the clearing account balance is zero. So, you settled the account.

What is an example of an outstanding balance?

For example, you have one outstanding balance in an account. Customer A owes the entirety of the balance because of Invoice A. When Customer A pays the invoice, the account is now settled.

Why do you settle your accounts?

When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books only when you fulfill the transaction.

Is a settlement an account payable?

If you record payments you owe to a lender or other business until you pay off the fund s you owe, the account you settle is an account payable ( i.e., a liability account).

Do the values of the two accounts settle the account?

Even though the values of the two are not equal, the exchange of value in the agreement settled the account.

What is Settlement in Cost Accounting?

Maybe most people still don’t know what settlement is. Besides being rarely used in the payment system for buying and selling activities in general. Settlement is essentially a payment system for incoming transactions in the form of demand deposits for the purchase of goods or services. However, in journal entries, income can be converted.

Recording of Settlement in the Cost Accounting Journal

Settlement is recorded in cost accounting after the company receives payment or cash and the product or service is delivered and received by the consumer. Cash receipts can affect not only the sales process but also the cost of goods sold and finished product inventory in cost accounting.

Conclusion

That is a complete discussion of settlements related to cost accounting. However, businesses must require accurate and neat recording of expenses according to the above journal. Why is that? Because with cost accounting you can use it as a controller and also the right cost planning.

David Geloran Follow

Pension plans tend to have large, long-term liabilities, and their impact on financial statements attracts attention. However, pension accounting is complicated, and the footnotes are painfully long and difficult to understand.

David Geloran

I find it very helpful to try to put to paper what I have learned about a topic, to help me solidify my understanding and be able to present that material in a more articulate manner. I am not an accountant – so if I have misstated anything, please reach out to me to discuss.

What is ASC 815-20-25-137?

ASC 815-20-25-137 (d) requires the swap’s fair value at inception of the hedging relationship to be at or near zero. Therefore, if a private company enters into an interest rate swap with terms that do not reflect the prevailing market rates and pays or receives a significant premium, or designates an existing interest rate swap with a significant fair value at the inception of the hedging relationship, the simplified hedge accounting approach should not be applied.

What happens when a company discontinues a simplified hedge accounting approach?

On the date the simplified hedge accounting approach is discontinued, a private company must calculate the fair value of the swap (not the settlement value) and record the difference between settlement value and fair value in other comprehensive income. Subsequent changes in the fair value of the swap will be reported in earnings unless the private company meets the requirements for cash flow hedge accounting using a method other than the simplified hedge accounting approach; in that case, the private company may designate a new hedging relationship prospectively.

What is ASC 815?

ASC 815 requires contemporaneous documentation of hedging relationships to be prepared at hedge inception . The simplified hedge accounting approach relaxes the requirements for contemporaneous documentation. Under the simplified approach, hedge accounting documentation must be completed by the date on which the first annual financial statements are available to be issued after hedge inception. For example, if a calendar year-end private company enters into an interest rate swap on January 1, 20X1, and has until March 31, 20X2 to issue the annual financial statements, it would have until the financial statements are available to be issued (i.e., on or before March 31, 20X2) to complete the required hedge documentation.

What is simplified hedge accounting?

The simplified hedge accounting approach makes qualifying for hedge accounting simpler and measurement of the swap less complex. Under the simplified approach, private companies are allowed to assume perfect effectiveness for qualifying receive-variable, pay-fixed interest rate swaps designated in a cash flow hedging relationship provided certain criteria are met. In addition, the simplified hedge accounting approach relaxes the requirements for contemporaneous documentation.

What should a private company weigh before adopting the simplified hedge accounting approach?

Before adopting the simplified hedge accounting approach, an eligible private company should weigh both the impact of applying the approach on its key financial metrics, and the potential cost of unwinding the accounting and reapplying the general hedge accounting requirements if its reporting requirements change because it no longer meets the definition of a private company.

Does ASC 815 require a swap by swap basis?

ASC 815 generally requires reporting entities to use the same method to assess hedge effectiveness for all similar hedges; however, the decision to apply the shortcut method can be elected on a swap-by-swap basis. By analogy, we believe that private companies can elect to apply the simplified hedge accounting approach on a swap-by-swap basis.

Can a private company change the interest rate on a swap?

If the private company subsequently elects to change the interest rate or reset period such that the rate on the swap no longer matches the borrowing, the relationship will no longer qualify for the simplified hedge accounting approach. The private company would have to dedesignate the hedging relationship and discontinue hedge accounting under the simplified approach. However, it would be able to attempt to designate a new hedging relationship. See DH 11.2.6 for information on discontinuance of the simplified hedge accounting approach.

What Is An Account Settlement?

Account Settlements and Clearing Accounts

- Settling an account often occurs with clearing accounts. What is a clearing account? A clearing account is either a: 1. Bank account used to hold funds until payments can move to another account (e.g., payroll accounts to employee bank accounts), OR 2. Temporary account used to record transactions in the general ledger until the funds can be accurately or completely classifie…

Examples of Account Settlements

- Settling your accounts can be confusing, especially since there are several different ways you can do so. Here are some examples of account settlements.

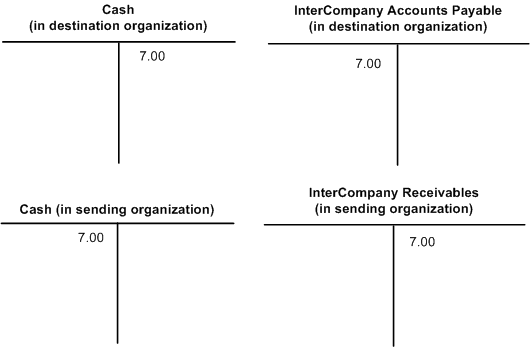

Settlement Accounts vs. Account Settlements

- So, what is the difference between settlement accounts and account settlements? Despite the names being so similar, there is quite a difference between the two. Again, account settlements are when you settle outstanding balances either through payments or offsets. But, settlement accounts are bank accounts used to track the balances of payments between banks. Internation…

Settlement Date Accounting

- When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books onlywhen you fulfill the transaction. With settlement date accounting, enter the transactions into your general ledger when the transa…