Structured settlement

A structured settlement is a financial or insurance arrangement whereby a claimant agrees to resolve a personal injury tort claim by receiving periodic payments on an agreed schedule rather than as a lump sum. Structured settlements were first utilized in Canada after a settlement for children affected by Thalidomide.

How do settlements work in a minor’s case?

When a minor is affected by medical malpractice, courts often award settlements to resolve the defendant’s claim. When a party is deemed at fault in the death of a parent, a wrongful death case may result in a structured settlement.

What are structured settlements?

Structured settlements are a stream of tax-free payments issued to an injured victim. The settlement payments are intended to pay for damages or injuries, providing financial security over time. Structured settlement payments are guaranteed by the insurance company that issued the annuity.

Are structured settlement annuities a good option for minors?

Today, structured settlement annuities make up the overwhelming majority of lawsuit awards when the financial security of minors are at stake, due to the many advantages of accepting an award in this way. The settlement income comes tax-free, even when the annuity earns interest. The settlement does not require maintenance fees.

What is a structured settlement in a wrongful death case?

When a minor is affected by medical malpractice, courts often award settlements to resolve the defendant’s claim. When a party is deemed at fault in the death of a parent, a wrongful death case may result in a structured settlement. Interested in selling your structured settlement payments?

What is the purpose of a structured settlement?

A structured settlement is a regular stream of tax-free payments granted to the plaintiff in a civil lawsuit. Structured settlements are meant to provide long-term financial security to the injured party. If the amount of money is small enough, the wronged party may have the option to receive a lump sum settlement.

Who gets a structured settlement?

Allowed by the US Congress since 1982, a structured settlement is: A completely voluntary agreement between the injured victim and the defendant. Under a structured settlement, an injured victim doesn't receive compensation for his or her injuries in one lump sum.

Are structured settlements a good idea?

The best reason to support structured settlements is to have payouts of income to last throughout the beneficiary's lifetime. With guaranteed payments, there is less chance of losing principal to poor investments, spendthrift habits or the undue influence of family and friends.

Can I gain access to my child's settlement money Missouri?

Any settlement proceeds paid into a special account as described in the Act can only be accessed when ordered by a court, when the minor turns eighteen (18) years old, at the direction of a duly appointed conservator or the custodian for the uniform transfer to minors account for the sole benefit of the minor, or upon ...

What is better a lump sum or structured settlement?

Structured settlements can save you on taxes versus a lump sum, and for many people work as a form of income or annuity every year. Structured settlements can work in many instances. But they may be less than advantageous in others.

Do Structured Settlements count as income?

Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time.

Can you cash out a structured settlement?

If you have a structured settlement in which you receive your personal injury lawsuit award or settlement over time, you might be able to "cash-out" the settlement. To do this, you sell some or all of your future payments in exchange for getting cash now.

What is an example of a structured settlement?

Examples of cases that may result in structured settlements include personal injury, workers' compensation, medical malpractice and wrongful death.

Are Structured Settlements safe?

MYTH #2: Structured settlement returns are dependent on market conditions. Structured settlements are one of the safest, most stable investments on the market. The rate of return is locked in when the annuity is purchased, providing the claimant with a reliable investment, regardless of how the market fares.

How do I get my settlement when I turn 18?

With the Judge's Court Order in hand, when you turn 18 you can take it to the bank in which the money has been deposited. Providing the court order to a person who is in a position to release the funds should enable the funds to be released to you immediately.

Can you claim for a child in a car accident?

Children that have been injured in a car accident, whether they were a passenger in a car, or a pedestrian, have as much right as an adult to claim personal injury compensation for the injuries they have sustained. However, the claims process is a little bit different when the claimant is under 18.

Will Virginia give you Minors personal injury settlement?

When a minor's personal injury case is settled, Virginia law requires that the court approve the terms of the settlement agreement to ensure that the agreement is in the best interests of the child.

Who owns the annuity in a structured settlement?

A settlement agreement establishing the structured settlement will typically expressly state that the assignment company has all rights of ownership of the annuity. The structured settlement payee only owns the right to receive payments. The payee does not own the structured settlement annuity.

What percentage do structured settlement companies take?

“Some structured settlement companies charge 25 percent to 50 percent of the payment amount to be received,” said Sullivan. “That means getting the rest of $500,000 remaining in an annuity might result in a loss of $125,000 to $250,000.”

Can you lose a structured settlement?

Structured settlements are guaranteed On the other hand, if you decide to invest your settlement money on your own, the return on your investment might not do so well. It is not guaranteed at all. In fact, it may go south quickly, resulting in you losing all your money before you know it.

How can I get money from my structured settlement?

Put simply, a structured settlement is not a loan or a bank account, and the only way to receive money from your settlement is to stick to your payment schedule or sell part or all of your payments to a reputable company for a lump sum of cash.

Ensuring Money For A Child’S Future

When courts decide or plaintiffs and defendants settle large cases that involve children, the financial result takes into account the child’s long-...

How Minors Benefit from Structured Settlements

Today, structured settlement annuities make up the overwhelming majority of lawsuit awards when the financial security of minors are at stake, due...

Designing Structured Settlements For Minors

Designing structured settlements for minors is a critical part of the settlement process. Federal and state laws assign courts the responsibility o...

Structured Settlements Versus 529 Plans

As an alternative to structured settlements, some families may consider putting their financial award into a 529 plan for their minor. Developed in...

How Do Minors Receive Structured Settlements?

Settlements may be issued because of personal injury or, in wrongful death cases, because a parent’s or guardian’s is life was cut short, leaving the child without the financial security the deceased would have provided.

Why do you need a structured settlement for a minor?

Choosing a structured settlement for a minor may also speed up court approval because this arrangement is designed to protect minors’ interests.

How are settlements structured?

Step-by-Step: How Structured Settlements Are Created 1 The defendant resolves a claim by offering a settlement. 2 Both parties agree to the terms of the settlement. 3 The payment schedule is established. 4 The allocation of the funds — blocked account or trust — is determined. 5 The proper parties — usually the minor, a parent and their attorney — appear before a judge for approval. 6 A judge may appoint a guardian ad litem to review the settlement to ensure it is in the minor’s best interest.

Why were structured settlements granted?

Structured settlements were first granted on behalf of minors after children were born with severe birth defects from exposure to the drug Thalidomide in the womb.

How are settlements paid for minors?

Structured settlements for minors are usually paid through an annuity issued by a life insurance company.

What is a special needs trust?

A special needs trust offers a key benefit: These trusts are not counted in determining eligibility for public government programs. Public assistance programs such as Social Security Income and Medicaid are essential for many families who may be unable to afford long-term care for a disabled minor.

How does a defendant resolve a claim?

The defendant resolves a claim by offering a settlement.

Types of Structured Settlement Cases

Structured settlements for minors most often arise from cases of birth injury, medical malpractice, and wrongful death claims.

Benefits of Structured Settlements

A young child cannot manage a large sum of money, and receiving a lump sum payment may be prove tempting to a guardian put in place to care for the child. Maintaining a scheduled series of payments makes it more likely that the child’s basic needs (shelter, clothing, food, and medical care) will be met throughout their childhood and teenage years.

Trusts and Other Options

Trusts and guardianship accounts include specialized structures for special situations.

Court Protection for Minors

Settlements are considered legal property of the minor but are awarded under specific provisions dictated by the court. Once structured settlement details are finalized, no one can modify either scheduled payments or their amounts. A court-appointed guardian ad litem will review the settlement to guarantee the minor’s best interest is represented.

About the Author: Zachary C. Cole, Esq

Throughout my career, I have taken over 30 cases to jury trial and negotiated exceptional outcomes to countless others. I focus my practice areas on personal injury, wrongful death, medical malpractice, and criminal defense.

How long does a structured settlement last?

A structured settlement guarantees specific dollar amounts that can be spread over key years in your child’s or minor ward’s life for a finite period of time or even for entire life of your child, if desired.

Why are structured settlements important?

Structured settlements help to secure a brighter future for minors who have suffered a serious personal physical injury, or the wrongful death of a parent. Court approval is required when there are settlements for, or on behalf of minors and children must be court approved.

What is the role of a judge in a settlement?

The judge’s role, in most jurisdictions, is to assist in the determination of the settlement’s fairness and to assure that funds are safeguarded until your child or minor ward is an adult. If cash is paid in a lump sum, most judges require that the funds be placed in a "protected" or "blocked" account until the age of majority (age varies by state law). The money is taxed yearly on interest in excess of a modest exempt amount. The rate of return on the protected or blocked accounts is usually quite low, typically equivalent to a savings account. With such protected or blocked accounts, your child or minor ward assumes complete control of the money, in a lump sum distribution, at the age of majority.

Is it necessary to have oversight of a child's lawsuit?

While the Court of jurisdiction may vary by the type of legal case, court oversight is necessary regardless of whether your child’s lawsuit involves medical malpractice, personal injury, or the wrongful death of a parent or sibling in an auto accident, construction accident, aviation accident or due to a defective product.

Should parents and guardians be concerned about settlement proceeds?

Many parents and guardians are, and should be (and a young adult child should be) concerned with the potential for wasteful dissipation of settlement proceeds. The responsibility of managing all of the settlement money is immense at an age when the child or minor may not be financially savvy or mature.

What is structured settlement?

Structured settlements are financial investments awarded as restitution in personal injury or wrongful death lawsuits. They can be presented as a one-time lump sum, but structured settlements are usually disbursed through periodic payments due to their large amounts. These large settlements can secure a higher quality of life for their owners.

Why are personal injury settlements structured?

For that reason, personal injury settlements are typically set up as a structured settlement to prevent premature access and frivolous spending. The legal system is protective of a minor’s financial security and requires court approval prior to awarding a settlement. Courts are responsible for dictating:

How long do settlements stay in a protected account?

If provided in a large lump sum, settlements are placed in a protected account until minors reach 18 years old and can assume full control over the account. This ensures:

How old do you have to be to get a settlement?

When awarded to minors, these payments are heavily protected until they reach the age of majority, typically 18 years old. Until that time, settlement funds can only be accessed to finance specific needs. This includes medical expenses if the structured settlement was tied to a personal injury lawsuit.

What age can you settle a settlement?

However, until they reach the age of 18 to legally manage their settlement money, there are rules in place to protect minors’ financial security.

Can minors sell settlements?

Once they reach the legal age, minors can assume full control of their settlement contract and can sell payments as they see fit. You can choose to sell all or a portion of your payments, but it is important to understand that you will not receive the full initial value.

Can minors spend settlement money all at once?

Money is protected from improper use or individuals seeking personal gain. Minors cannot spend the settlement money all at once. The settlement has long-term use.

What are the pros and cons of a structured settlement?

The pros of a Structured Settlement for a minor or incompetent involve avoiding exploitation of these settlement funds by individuals who are close to the claimant. Incompetents and minors may use a Structured Settlement as a vehicle to pay for ongoing medical needs resulting from their accidents.

How long can a minor settle in Nevada?

The court must approve a minor child’s settlement and will enter an order that the child’s settlement must be placed in a FDIC insured bank account in the state of Nevada, until the minor child reaches the age of 18 years. These funds can only be removed from the block account by court order. The court will only order the release of these funds before the child turns 18 years of age, only for reasons involving the special educational or medical needs of the minor child.

How Minors Benefit from Structured Settlements

Today, when the financial security of children is at risk, structured annuities represent the vast majority of court orders because of the many advantages of accepting such orders.

How Do Minors Receive Structured Settlements?

The settlement may be due to personal injury, or in the case of negligent death, because the life of the parent or guardian has been shortened, so that the child cannot obtain the financial security that the deceased should have provided. The structured settlement of minors is usually paid through annuities issued by life insurance companies.

Designing Structured Settlements for Minors

Designing structured settlements for minors is a key part of the settlement process. Federal and state laws designate courts to determine the fairness of monetary settlements and the use of reward funds. The court strives to ensure:

Structured Settlements Versus 529 Plans

A 529 plan is an educational savings account, similar to a 401 (k) retirement plan. 529s invest a person’s contributions into a state-approved mutual fund that meets the time horizon and investment objective of the child’s situation.

How Do Structured Settlements Work?

Legal settlements can be paid out in a one-time lump sum or through a structured settlement where periodic payments are made through a financial product known as an annuity. The key differences between these settlement options are in the areas of long-term financial security and taxes.

How are legal settlements paid?

Legal settlements can be paid out in a one-time lump sum or through a structured settlement where periodic payments are made through a financial product known as an annuity. The key differences between these settlement options are in the areas of long-term financial security and taxes. When a plaintiff receives a settlement through ...

What happens when a plaintiff receives a lump sum settlement?

When a plaintiff receives a settlement through a one-time lump sum, they might spend it too quickly, robbing them of the long-term financial security that future payments could provide. Moreover, any interest and dividends earned if the lump-sum were to be invested would be subject to taxes.

Why is structured settlement more than lump sum?

A structured settlement often yields, in total, more than a lump-sum payout would because of the interest your annuity may earn over time.

What are the pros and cons of structured settlement?

Structured Settlement Pros and Cons 1 Payments are tax-free. 2 In the event of the recipient’s death, the beneficiary can continue to receive tax-free payments. 3 Payments can be scheduled for almost any length of time and can begin immediately or be deferred for as many years as requested. They can include future lump-sum payouts or benefit increases. 4 Spreading out payments over time can reduce the temptation to make large, extravagant purchases and guarantees future income. This is especially helpful if the recipient has a medical condition that will require long-term care. 5 Unlike stocks, bonds and mutual funds, structured settlements do not fluctuate with market changes. Payments are guaranteed by the insurance company that issued the annuity. 6 A structured settlement often yields, in total, more than a lump-sum payout would because of the interest your annuity may earn over time.

What is the role of a judge in an annuity sale?

The role of the judge is to decide if the sale is in the best interest of the annuity owner. Other rules may apply depending on the details of your annuity contract and the laws of the state where you live. The Structured Settlement Protection Act of 2002 provides federal guidelines on such transactions.

What was the purpose of the National Structured Settlements Trade Association?

By 1985, the National Structured Settlements Trade Association formed to preserve and promote structured settlements to injury claimants through education and advocacy.

Periodic Payment Settlement Act of 1982

In 1982, the federal government enacted the Periodic Payment Settlement Act of 1982 to protect those who receive awards or settlements from personal injury claims and wrongful death lawsuits.

What is a Structured Settlement Annuity?

Often, the defendant in a wrongful death or personal injury case will purchase an annuity for payouts on verdicts or settlements.

How do structured settlements work?

Legal settlements can be paid in one-off lump sums or structured settlements where periodic payments are done through structured settlement annuities. The key differences between these two are taxation and long-term financial security.

Structured Settlements for Minors

When a minor-aged child is seriously injured by a product, device, accident, or medication, they may also be awarded a verdict or settlement. Unlike adults though, a minor is not able to make financial decisions or have control of a structured settlement.

Should You Opt for a Structured Settlement or a Lump Sum?

Many things should be considered before deciding whether to take a lump-sum payment or a structured settlement including the size of the settlement, your financial management acumen, and your understanding of taxes.

Understanding The Annuity Contract, Lump Sum Settlement, and Taxes

There are pros and cons, advantages and disadvantages with both lump-sum payouts and structured settlement payment plans. Before deciding how to receive your settlement or award money, speak with your attorney.

Benefits of Structured Settlement Payments

In recap, some of the benefits of structured settlement annuities including receiving tax-free income as compensation for personal injury and wrongful death cases are federal and state tax-free according to Section 104 (a) of the Internal Revenue Code.

Types of Structured Settlement Cases

Benefits of Structured Settlements

- A young child cannot manage a large sum of money, and receiving a lump sum payment may be prove tempting to a guardian put in place to care for the child. Maintaining a scheduled series of payments makes it more likely that the child’s basic needs (shelter, clothing, food, and medical care) will be met throughout their childhood and teenage years. Structured settlements: 1. Are n…

Trusts and Other Options

- Trusts and guardianship accounts include specialized structures for special situations. For instance, a special needs trust (SNT) is typically considered if the child’s impairment will impact their ability to work after reaching the age of majority, typically 18 years old. The key benefit of an SNT is that the trusts are not considered when determining eligibility for public government prog…

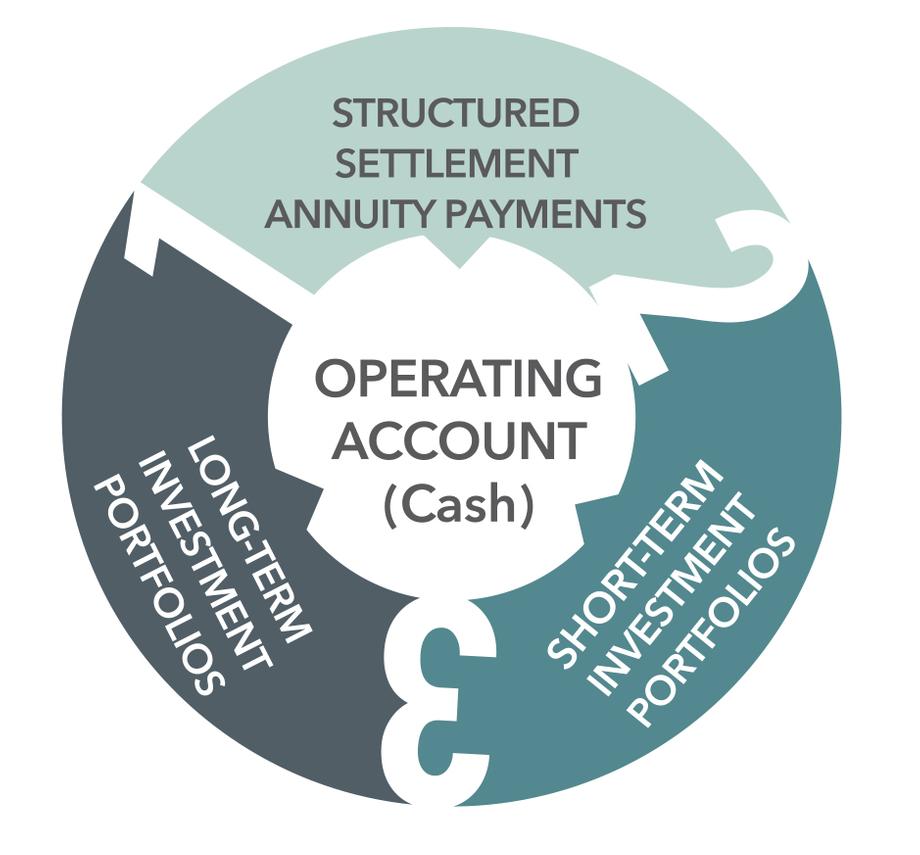

Funding Structured Settlements

- There are several structures these settlements can utilize, and funding is a critical aspect of their design. In some cases, a portion of the money is placed in a blocked bank account only accessible by the minor child’s parent or guardian. This money is intended to pay current medical bills and other essential expenses caused by the accident. The funds may also be utilized to est…

Court Protection For Minors

- Settlements are considered legal property of the minor but are awarded under specific provisions dictated by the court. Once structured settlement details are finalized, no one can modify either scheduled payments or their amounts. A court-appointed guardian ad litem will review the settlement to guarantee the minor’s best interest is represented. Probinsky & Cole provide perso…