Settlement of Transactions: Swift, Chips, Chaps, Fed wire Transaction settlement is the process of moving funds from the cardholder’s account to the merchant’s account following a credit or debit card purchase. The issuer will route funds to the acquirer via the card network.

Is swift a payment system or settlement system?

SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems. SWIFT’s customers include banks, market infrastructures, broker-dealers, corporates, custodians, and investment managers. SWIFT is subject to oversight by the central banks of the Group of Ten countries.

What is the purpose of Swift?

SWIFT provides a telecommunication platform for the exchange of standardized financial messages between financial institutions and corporations. SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems.

How can I pay my employees using swift payments?

One excellent option is to make payments through the Society for Worldwide Interbank Financial Telecommunications (SWIFT). SWIFT transactions are safe, fast, and reliable. They help you streamline and expedite payroll, pay your employees on time, and stay compliant with the law.

How secure are swift payments?

SWIFT payments are highly secure — this feature is one of the primary benefits of the SWIFT system. Let’s take a look at how SWIFT ensures safe and secure international payments. SWIFT maintains robust security protocols through its Customer Security Controls Framework (CSCF).

How does settlement work in SWIFT?

For international wire transfers, the Society for World Interbank Transactions (SWIFT) delivers payment instructions which a clearing or settlement system then settles. Together, CHIPS and Fedwire handle the approving and settling of wire transfers in US dollars.

What is the meaning of SWIFT payment?

the Society for Worldwide Interbank Financial TelecommunicationWhat is SWIFT? SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a secure global messaging network that banks use to make cross-border payments. The network facilitates financial institutions to wire money to each other, helping ensure that global trade carries on smoothly.

How do I receive swift payments?

Here's how it works: when a person transfers money individually, they will go to their bank with the recipient's banking SWIFT code and an international account number (more on that later). The local bank will then send a SWIFT message to the recipient's bank to accept the transfer.

What is SWIFT stands for?

the Society for Worldwide Interbank Financial TelecommunicationsSWIFT is an acronym for the Society for Worldwide Interbank Financial Telecommunications and may also be referred to as a CIC code. U.S. Bank's swift code is USBKUS44IMT.

Who owns the SWIFT payment system?

SWIFT is a cooperative company under Belgian law and is owned and controlled by its shareholders (financial institutions) representing approximately 2,400 Shareholders from across the world.

How much time does it take for SWIFT transfer?

You need to fill the beneficiary's details, such as bank account number, postal address of the bank and its SWIFT code, in a form. Once this is done, the amount will be debited from your account and credited to the foreign bank account in 48-72 hours.

How do I trace a SWIFT transfer?

If your transfer isn't delivered within the window you were promised, you can request a trace on your transaction using the bank's SWIFT code. A SWIFT code is an ID that banks use when sending wire transfers. With this number, your bank can determine whether the deposit is on hold or in progress.

How do I verify a SWIFT transfer?

You can confirm your payments by sending an interbank payment message (MT 199) to a dedicated gpi Tracker BIC through your existing SWIFT interface. This message then triggers an update to the Tracker and provides payment confirmation to the ordering bank.

Is SWIFT transfer safe?

Although the SWIFT network is considered a safe messaging system, there are numerous vulnerabilities in the process of traditional wire transfers. First of all, given the sheer amount of data you're supposed to provide about the recipient, it's no wonder that you (or an employee of any bank involved) can make mistakes.

How many banks use SWIFT?

Now, more than 11,000 financial institutions across more than 200 countries and territories use SWIFT.

What is the minimum limit in Real time Gross Settlement Transfer?

₹ 2,00,000/-Ans. The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is ₹ 2,00,000/- with no upper or maximum ceiling.

How do I cancel a SWIFT payment?

0:471:08SWIFT gpi - Stop & recall payment - YouTubeYouTubeStart of suggested clipEnd of suggested clipService when corporations send you a stop payment request you can immediately stop the payment viaMoreService when corporations send you a stop payment request you can immediately stop the payment via the swift. Network thanks to the unique tracking code you can notify every single bank in the chain.

How do I do a SWIFT transfer?

To make a SWIFT transfer overseas, you need to enter your recipient's information (their name, address, their bank's name, and address, the recipient's bank account number, and their bank's SWIFT/BIC code), the amount you want to send, and confirm your payment.

What is SWIFT used for banking?

Simply put, SWIFT is a global payments system, which is used by more than 11,000 financial institutions and companies around the world, across over 200 countries. Think of SWIFT as Gmail for banks. Or like SMS, but for money transfers. In short, SWIFT is a messaging system for money transfers.

Does China use SWIFT?

China, despite having concern about its reliance on Western financial infrastructure, continues to use SWIFT when messaging payment instructions across borders, even to its own foreign bank branches and subsidiaries.

Do all banks have a SWIFT code?

Many U.S. credit unions and small banks do not connect to the SWIFT network and do not have a SWIFT code. Instead, some of these institutions send and receive international transactions, or wire transfers, using other U.S. banks that serve as intermediaries to wire the money or other wire transfer services.

What is SWIFT in banking?

SWIFT is a vast messaging network used by banks and other financial institutions to quickly, accurately, and securely send and receive information, such as money transfer instructions.

How Does SWIFT Make Money?

16 Members are categorized into classes based on share ownership. 17 All members pay a one-time joining fee plus annual support charges which vary by member classes.

Why Is SWIFT Dominant?

According to the London School of Economics, "support for a shared network...began to achieve institutional form...in the late 1960s, when the Société Financière Européenne (SFE, a consortium of six major banks based in Luxembourg and Paris, initiated a ‘message-switching project.'" 8

Why did Swift start?

In the beginning, SWIFT founders designed the network to facilitate communication about Treasury and correspondent transactions only . The robustness of the message format design allowed huge scalability through which SWIFT gradually expanded to provide services to the following:

How many transactions did SWIFT send in 2020?

More than 11,000 SWIFT member institutions sent over 35 million transactions per day through the network in 2020. The organization recorded an average of 42.5 million messages per day on a year-to-date (YTD) basis in March 2021. Traffic grew by 9.8% compared to the same period of the previous year. 1.

What is Swift used for?

While SWIFT primarily started for simple payment instructions, it now sends messages for a wide variety of actions, including security transactions, treasury transactions, trade transactions, and system transactions. Nearly 50% of SWIFT traffic is still for payment-based messages, 47% is for security transactions, ...

What is SWIFT network?

SWIFT is a messaging network that financial institutions use to securely transmit information and instructions through a standardized system of codes.

What is Swift Payment?

SWIFT Payment is the acronym of the Society for Worldwide Interbank Financial Telecommunication, an organization based in Brussels that has been around since the early 1970s . What are SWIFT payments and how do they work?

How does the higher the fees deducted from the payment affect the Swift message?

As you can appreciate, the more intermediary banks engaged in the transaction, the higher the fees deducted from the paid amount, the longer the payment will take to be credited to your account, and finally the higher the risk to have the SWIFT message lost.

What is the SWIFT network?

SWIFT was created to help banks communicate faster and more securely among themselves in relation to the processing of international payments.

What is Swift GPI?

SWIFT GPI aims to improve the transparency and traceability of cross-border payments. In other words, this means that if your bank is a member of the SWIFT network, they may check where a payment is at any given time of the day.

What is Swift communication?

Basically what SWIFT does is channel the message enclosing payment instructions from the issuing bank, i.e. the bank of the payor, all the way to the remitting bank, i.e. the bank of the beneficiary.

How many countries are part of SWIFT?

More than 10,000 financial institutions in more than 200 countries are members of the SWIFT network, making it the largest international payment network worldwide.

What are the sources of income for Swift?

Other sources of income for SWIFT are coming from additional services such as business intelligence, reference data, and compliance services.

SSI Retail

Our SSI Retail directory provides everything you need to address your SSI needs for retail payments – helping you improve straight-through processing rates, enhance customer satisfaction and reduce correspondent fees.

SSI Wholesale

Meeting your SSI needs for wholesale payments, our SSI Wholesale directory helps you ensure a fast cross-border payments process, reduce settlement risk and avoid possible loss of interest.

SSI Plus

Suitable for financial institutions or global corporates, SSI Plus addresses your SSI needs for both retail and wholesale payments.

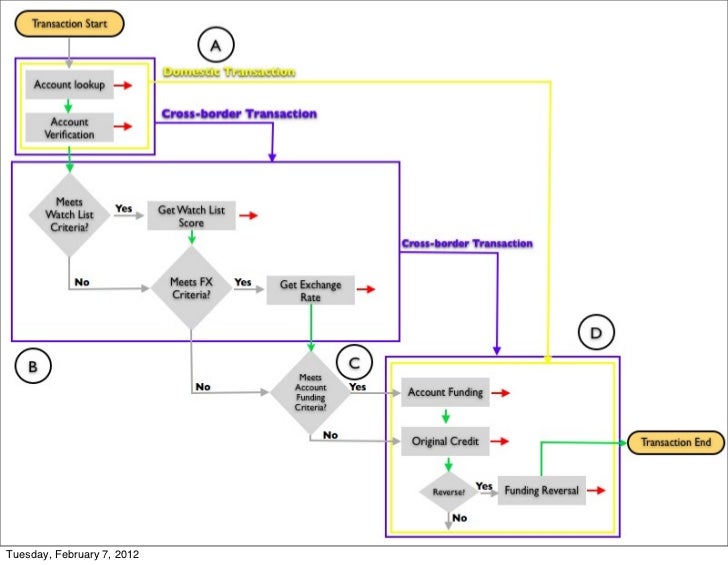

How does the payments process work?

When a domestic payment is made, the initiating institution sends a message to the receiving institution, after which the transfer is settled electronically. As such, domestic payments can often be settled instantly or within 24 hours.

Why can payments sometimes take longer to process?

Delays can arise at a number of different points in the cross-border payments process, with common causes of friction including:

Straight-through processing

Straight-through processing (STP) is the term used to describe an automated payments process that can take place without the need for manual intervention. This eliminates the operational burden that can arise when banks need to repair payments, manually add data or adopt workarounds.

Remittance information

Another component of the payments process is the remittance information that accompanies a payment. Accurate remittance data is important because it enables the payment beneficiary to reconcile the payment with outstanding invoices, resulting in a more efficient reconciliation process.

Visibility over fees

Payments may also be subject to various types of transaction fees, including FX conversion costs and payment processing fees. However, where cross-border payments are concerned there is often a lack of transparency over the fees and deductions charged for different payments.

How is SWIFT helping?

Alongside our instant and frictionless payments strategy, a number of SWIFT initiatives are helping to streamline the payments process. SWIFT gpi enables banks to pass on remittance information with no loss of data, making it easy for end users to reconcile incoming payments with outstanding invoices.

What is SWIFT a member of?

The Society for Worldwide Interbank Financial Telecommunication, Societe Cooperative a Responsabilite Limitee (limited co-operative society) (“SWIFT”) is a member-owned co-operative. SWIFT provides a telecommunication platform for the exchange of standardized financial messages between financial institutions and corporations. SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems. SWIFT’s customers include banks, market infrastructures, broker-dealers, corporates, custodians, and investment managers. SWIFT is subject to oversight by the central banks of the Group of Ten countries.

What is SIA in banking?

The Italian Interbank Company for Automation (SIA), established in 1977 by CIPA (Convenzione Interbancaria per i Problemi dell’Automazione), has the objective of providing operational support for the Italian banking system’s automation projects. It manages the national interbank network (RNI) and is responsible for the development and operation of an integrated system of services and procedures which constitute the technological platform supporting the payment system and the financial market. Recently, a project to integrate the RNI in SWIFT was launched given the convergence of network systems towards internet protocols. At the beginning of 2000 the Bank of Italy completed the disposal of its stake in the SIA, which in 1999 had merged with CED-Borsa (a software company which manages stock exchange trading systems), thereby integrating the management of IT systems in market and settlement systems.

Is Swift a payment system?

SWIFT is neither a payment system nor a settlement system though the SWIFT messaging standard is used in many payment and settlement systems. SWIFT’s customers include banks, market infrastructures, broker-dealers, corporates, custodians, and investment managers. SWIFT is subject to oversight by the central banks of the Group of Ten countries.