What are tobacco bonds and how do they work?

In the ten years following the settlement, many state and local governments have opted to sell so-called Tobacco Bonds. They are a form of securitization. In many cases the bonds permit state and local governments to transfer the risk of declines in future master settlement agreement payments to bondholders.

What is the tobacco Master Settlement Agreement?

The Tobacco Master Settlement Agreement ( MSA) was entered on November 23, 1998, originally between the four largest United States tobacco companies ( Philip Morris Inc., R. J. Reynolds, Brown & Williamson and Lorillard – the "original participating manufacturers", referred to as the "Majors") and the attorneys general of 46 states.

How are tobacco companies obligated to pay the settling states?

Under the MSA, tobacco manufacturers are obligated to make annual payments to the Settling States in perpetuity, so long as cigarettes are sold in the United States by companies that have settled with the States. The NAAG Center for Tobacco and Public Health makes certain such payments are made.

How much tobacco bond money is still outstanding?

Because of the steep payments promised to some bondholders, that could take years or decades in which taxpayers lose out on the tobacco money. In all, states, counties, cities, and territories sold some $36 billion in tobacco bonds that are still outstanding. Most had routine repayment terms.

What is tobacco settlement?

Under the Master Settlement Agreement, seven tobacco companies agreed to change the way they market tobacco products and to pay the states an estimated $206 billion.

When was the tobacco settlement?

November 1998The tobacco Master Settlement Agreement (MSA) is an accord reached in November 1998 between the state Attorneys General of 46 states, five U.S. territories, the District of Columbia and the four largest cigarette manufacturers in the United States.

When was the Tobacco Master Settlement Agreement?

1998In 1998, 52 state and territory attorneys general signed the Master Settlement Agreement (MSA) with the four largest tobacco companies in the U.S. to settle dozens of state lawsuits brought to recover billions of dollars in health care costs associated with treating smoking-related illnesses.

What effect did the settlement have on tobacco sold in the US?

Revenues from domestic sales of tobacco products increased after the MSA was reached, and profits from this source increased as well. Although overall domestic consumption of cigarettes decreased,22 the cigarette price increases more than offset such declines.

Can I sue tobacco companies for COPD?

Yes, you can still sue tobacco companies in certain cases. You may be able to bring an action as an individual or, in some cases, as a representative of a class in a class action.

What happened with the tobacco court case?

The High Court of Australia ruling By a majority of six to one, the High Court rejected the tobacco companies' arguments that there had been an acquisition of property under the Australian Constitution.

Why was the tobacco Master Settlement Agreement made?

to create and fund the National Public Education Foundation, dedicated to reducing youth smoking and preventing diseases associated with smoking. to make annual payments to the settling states in perpetuity.

What is MSA reporting for tobacco?

MSA Multicat Mandatory Data Multicat reports are weekly reports filed electronically by tobacco, candy, drinks, and grocery distributors to report sales and inventory floor counts to brand manufacturers as part of participating in their trade programs.

What did the Master Settlement Agreement accomplish?

It settled the state lawsuits that sought billions of dollars in costs associated with treating smoking-related illnesses. The Attorneys General of the 46 states, the District of Columbia and five U.S. territories signed the MSA with the four largest U.S. tobacco companies in 1998.

How have the tobacco companies responded to the tobacco settlement?

Tobacco manufacturers responded in full force, fighting each lawsuit and refusing to settle out of court.

Does the government get money from cigarettes?

State and local governments collected $19 billion in revenue from tobacco taxes in 2019, which was 0.6 percent of state and local general revenue.

What was the result of the 1998 settlement between the tobacco industry and US states?

Forty-six states and the four largest tobacco companies reached a landmark settlement that brought sweeping changes to cigarette manufacturers' practices—and to rates of smoking. Since the settlement, cigarette smoking rates in the United States have been cut nearly in half.

Who won the tobacco lawsuit?

In 2006, the American Cancer Society and other plaintiffs won a major court case against Big Tobacco. Judge Gladys Kessler found tobacco companies guilty of lying to the American public about the deadly effects of cigarettes and secondhand smoke.

What was the result of the 1998 settlement between the tobacco industry and US states?

In the largest civil litigation settlement in U.S. history, the states and territories scored a victory that resulted in the tobacco companies paying the states and territories billions of dollars in yearly installments.

Why was the tobacco Master Settlement Agreement made?

to create and fund the National Public Education Foundation, dedicated to reducing youth smoking and preventing diseases associated with smoking. to make annual payments to the settling states in perpetuity.

When did tobacco companies start getting sued?

The tobacco industry has been under intense legal pressure since 1994, when states began to file multibillion dollar claims against the tobacco industry, to recoup the cost of caring for people with smoking related disease through Medicaid (the federal state health insurance programme), which pays for the health care ...

What is the tobacco master settlement agreement?

They share a revenue stream from the Tobacco Master Settlement Agreement, a 1998 national settlement in which Philip Morris, Lorillard and Reynolds American agreed to make annual payments to states in perpetuity to resolve liabilities for health-care costs related to smoking.

How long does a tobacco bond last?

The typical tobacco bond lasts 30 years or less and pays interest every year. By 2014, tobacco bonds made up $94 billion of the $3.7 trillion municipal bond market.

What is the tobacco master settlement agreement?

The Tobacco Master Settlement Agreement ( MSA) was entered in November 1998, originally between the four largest United States tobacco companies ( Philip Morris Inc., R. J. Reynolds, Brown & Williamson and Lorillard – the "original participating manufacturers", referred to as the "Majors") and the attorneys general of 46 states. The states settled their Medicaid lawsuits against the tobacco industry for recovery of their tobacco-related health-care costs. In exchange, the companies agreed to curtail or cease certain tobacco marketing practices, as well as to pay, in perpetuity, various annual payments to the states to compensate them for some of the medical costs of caring for persons with smoking-related illnesses. The money also funds a new anti-smoking advocacy group, called the Truth Initiative, that is responsible for such campaigns as Truth and maintains a public archive of documents resulting from the cases.

Who was the first to sue the tobacco industry?

The first was declared in May 1994 by Mississippi Attorney General Mike Moore . The general theory of these lawsuits was that the cigarettes produced by the tobacco industry contributed to health problems among the population, which in turn resulted in significant costs to the states' public health systems.

How long does it take for a SPM to join the Master Settlement Agreement?

As an incentive to join the Master Settlement Agreement, the agreement provides that, if an SPM joined within ninety days following the Master Settlement Agreement's "Execution Date," that SPM is exempt ("exempt SPM") from making annual payments to the settling states unless the SPM increases its share of the national cigarette market beyond its 1998 market share, or beyond 125% of that SPM's 1997 market share. If the exempt SPM's market share in a given year increases beyond those relevant historic limits, the MSA requires that the exempt SPM make annual payments to the settling states, similar to those made by the OPMs, but based only upon the SPM's sales representing the exempt SPM's market share increase.

What was the 1997 National Settlement Proposal?

This proposed congressional remedy (1997 National Settlement Proposal (NSP), a.k.a. the "June 20, 1997 Proposal") for the cigarette tobacco problem resembled the eventual Multistate Settlement Agreement (MSA), but with important differences. For example, although the congressional proposal would have earmarked one-third of all funds to combat teenage smoking, no such restrictions appear in the MSA. In addition, the congressional proposal would have mandated Food and Drug Administration oversight and imposed federal advertising restrictions. It also would have granted immunity from state prosecutions; eliminated punitive damages in individual tort suits; and prohibited the use of class actions, or other joinder or aggregation devices without the defendant's consent, assuring that only individual actions could be brought. The congressional proposal called for payments to the states of $368.5 billion over 25 years. By contrast, assuming that the Majors would maintain their market share, the MSA provides baseline payments of about $200 billion over 25 years. This baseline payment is subject to

How many plaintiffs have ever prevailed in the tobacco case?

Only two plaintiffs ever prevailed, and both of those decisions were reversed on appeal. As scientific evidence mounted in the 1980s, tobacco companies claimed contributory negligence as they asserted adverse health effects were previously unknown or lacked substantial credibility.

How many lawsuits were filed against tobacco companies?

By the mid-1950s, individuals in the United States began to sue the companies responsible for manufacturing and marketing cigarettes for damages related to the effects of smoking. In the forty years through 1994, over 800 private claims were brought against tobacco companies in state courts across the country. The individuals asserted claims for negligent manufacture, negligent advertising, fraud, and violation of various state consumer protection statutes. The tobacco companies were successful against these lawsuits. Only two plaintiffs ever prevailed, and both of those decisions were reversed on appeal. As scientific evidence mounted in the 1980s, tobacco companies claimed contributory negligence as they asserted adverse health effects were previously unknown or lacked substantial credibility.

When was the Master Settlement Agreement signed?

Adoption of the "Master Settlement Agreement". In November 1998 , the Attorneys General of the remaining 46 states, as well as of the District of Columbia, Puerto Rico, and the Virgin Islands, entered into the Master Settlement Agreement with the four largest manufacturers of cigarettes in the United States.

How much money did states sell in tobacco bonds?

In all, states, counties, cities, and territories sold some $36 billion in tobacco bonds that are still outstanding. Most had routine repayment terms. But to get extra cash up front, some sold capital appreciation bonds, or CABs which came with steeper repayments terms.

What was the settlement with Big Tobacco?

A landmark 1998 settlement with Big Tobacco awarded states billions of dollars a year to offset the health-care costs of smoking. What seemed like a boon become a debt trap for many state and local governments when they used it to promise investors billions in the future in exchange for cash advances.

How long do bonds last?

Investors buy the bonds, providing states with cash. States repay the bondholders using the tobacco money. The typical bond lasts 30 years or less and pays interest every year.

Can investors be repaid for tobacco?

If tobacco payments fall short, investors have no right – ‘no recourse’ – to be repaid with taxpayer money. But they retain rights to future tobacco payments. Because of the steep payments promised to some bondholders, that could take years or decades in which taxpayers lose out on the tobacco money.

How many states issue tobacco settlement bonds?

Municipal tobacco settlement bonds are one of the largest, most liquid and highest yielding sectors within the municipal high yield bond market. Issued by 17 states, the District of Columbia, three territories and a handful of counties, senior lien tobacco bonds total about $32 billion in par amount outstanding, ...

What is municipal tobacco bond?

Municipal tobacco bonds issued against the proceeds of the landmark settlement are one of the largest, most liquid and highest yielding segments of the municipal bond market.

What are the risks of investing in bonds?

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

What are the effects of reductions in bond counterparty capacity?

Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax.

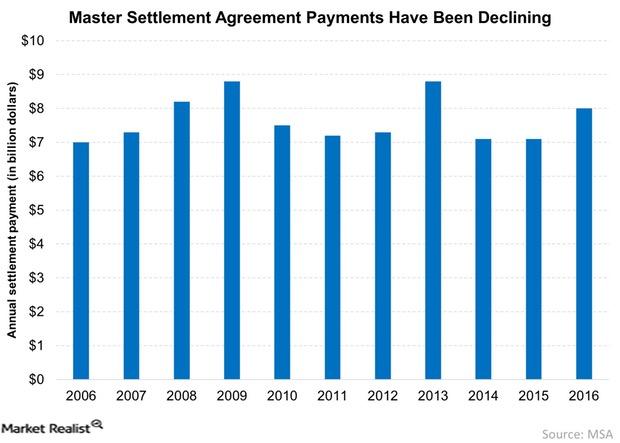

What is the most important factor affecting the stream of settlement payments under the MSA?

The most important factor affecting the stream of settlement payments under the MSA is U.S. cigarette consumption. A quick look back in history: Cigarette production began in the U.S. in the early 20th century. In 1964, the U.S. Surgeon General released a report titled “Smoking and Health” that warned of smoking’s adverse health effects. In 1981, the number of cigarettes smoked annually in the U.S. peaked at 640 billion. This number has since fallen to 263 billion for 2014 as usage bans, cigarette taxes and other restrictions have been enacted.

Can municipal bonds be used as investment?

Yes; however, municipal tobacco bonds can still be an attractive investment. This is because they behave differently from a typical corporate bond in a default scenario. For a typical corporate, assets are sold or debtor liabilities are reorganized, leaving the original creditor with a recovery claim. For a tobacco bond, if the tobacco trust does not have enough cash to pay interest and principal due, bonds remain outstanding (no acceleration) and payments continue to be made from whatever tobacco settlement revenues are available. As a reminder, the settlement payments go on in perpetuity until the bonds are paid off or people stop smoking altogether.

What is the prohibition on tobacco companies?

Prohibiting tobacco companies from taking any action to target youth in the advertising, promotion or marketing of tobacco products.

How many tobacco companies have settled under the MSA?

Eventually, more than 45 tobacco companies settled with the Settling States under the MSA. Although Florida, Minnesota, Mississippi, and Texas are not signatories to the MSA, they have their own individual tobacco settlements, which occurred prior to the MSA.

What is the NAAG Center for Tobacco and Public Health?

The NAAG Center for Tobacco and Public Health works with the Settling States of the MSA to preserve and enforce the MSA’s monetary and public-health mandates, including: Representing, advising, and supporting the Settling States in MSA-related legal matters , including litigation and arbitrations.

What law gave the FDA the power to regulate tobacco products?

In 2009, the Family Smoking Prevention and Tobacco Control Act gave the FDA the power to regulate tobacco products. State attorneys general have been active participants in helping the FDA shape its regulatory authority.

How does the MSA affect smoking?

The MSA continues to have a profound effect on smoking in America, particularly among youth. Between 1998 and 2019 , U.S. cigarette consumption dropped by more than 50%. During that same time period, regular smoking by high schoolers dropped from its near peak of 36.4% in 1997 to a low 6.0% in 2019. As advocates for the public interest, state attorneys general are actively and successfully continuing to enforce the provisions of the MSA to reduce tobacco use and protect consumers.

What is the purpose of entering into agreements with major retail chains?

Entering into agreements with major retail chains to ensure that retailers comply with state laws setting the minimum age at which tobacco products may be purchased and limiting the quantity and content of tobacco advertising at retail locations.

What is the Truth Initiative?

Establishing and funding the Truth Initiative, an organization “dedicated to achieving a culture where all youth and young adults reject tobacco.”.

What is tobacco bonds?

The state issues bonds backed up by the promise of future payments. The term “tobacco bonds” is a reference to this irresponsible practice. The buyers of bonds (the most prominent of which are powerful financial institutions) make a handsome long-term profit. State governments and their taxpayers get a raw deal.

What is the Tobacco Master Settlement Agreement?

The Tobacco Master Settlement Agreement simultaneously represents one of the most egregious examples of a government shakedown of private industry and offers a case study of the problems that stem from big government and big business scratching each other’s backs. It has turned the largest tobacco companies into an indispensable cash cow for politicians and bureaucrats, enabled irresponsible state spending, and, amazingly, has resulted in less money for public health and tobacco control while propping up a declining industry. As is the case with discriminatory tobacco taxes, the incentives of the MSA are perverse: the more people smoke, the more money the government gets to spend on whatever it wants. The biggest losers are those with tobacco-related diseases and smokers trying to quit.

What was the master settlement agreement between the tobacco companies and the states?

In November 1998, forty-six US states, along with the District of Columbia and five US territories, and the major tobacco companies entered into a contract of an extraordinary nature. (The other four states, Florida, Minnesota, Mississippi, and Texas, had entered similar agreements on their own beginning the year before.) The agreement, known as the Master Settlement Agreement (MSA), represented the culmination of a decades-long argument between the tobacco companies and state governments. After the dangers of smoking became known, the tobacco industry had engaged in extensive efforts to somehow stay in business, deflect and defeat lawsuits, and minimize negative attention. Public healthcare systems—and most of the healthcare in this country is taxpayer-funded or subsidized—had seen an influx of patients with smoking-related diseases, and state governments began filing lawsuits against the tobacco companies, claiming they wanted money to help cover smoking-related healthcare costs. The tobacco companies had lots of money but were nervous about the states’ potential to sue them out of business. So, they decided to talk. The result was the MSA.

How does the amount paid by tobacco companies affect the number of cigarettes sold?

The amount paid by the tobacco companies would directly correlate to the number of cigarettes sold—the more cigarettes sold, the more money the states would get. In exchange for their money, the tobacco companies would not be sued by state and local governments seeking recovery of costs associated with tobacco use.

How much money did tobacco companies pay to the states?

Nearly twenty years later, the tobacco companies have paid a staggering $119.5 billion to the states and territories participating in the MSA and another $25.4 billion to the four states with their own agreements. What have the states done with this huge amount of money?

How do politicians take advantage of the tobacco industry?

Besides politicians’ quintessential habit of spending money on things it was not meant for, there is a more insidious way that they have taken advantage of the never-ending stream of money from the tobacco companies. This is called securitization, and it occurs when a cash-strapped state borrows against promised future MSA payments so that it can get the money immediately. The state issues bonds backed up by the promise of future payments. The term “tobacco bonds” is a reference to this irresponsible practice. The buyers of bonds (the most prominent of which are powerful financial institutions) make a handsome long-term profit. State governments and their taxpayers get a raw deal. As the Campaign for Tobacco-Free Kids warned as early as 2002, states that securitize their tobacco funds get much smaller total payments, “usually for about 40 cents on the dollar or less,” than they would if they let the future revenue come in as planned. Borrowing against future payments in exchange for less money today leads to fewer resources for public health and more money for Wall Street. Yet politicians openly turn to the MSA revenue to cover for their irresponsible spending. For example, in November 2017, as Pennsylvania tried to balance its budget shortfall that had been caused by a refusal to eliminate wasteful spending, securitizing tobacco settlement revenue was the preferred course of all parties. Unfortunately, even some otherwise fiscally responsible politicians like to securitize tobacco revenue, as they consider it a better option than raising taxes.

What is the amount of money deposited into the Tobacco Settlement Bond Proceeds Account?

Moneys All earnings on Fund investments shall be deposited into the Tobacco Settlement Bond Proceeds Account and the Tobacco Settlement Residual Account as provided by the terms of the Railsplitter Tobacco Settlement Authority Act, provided that an annual amount not less than $2,500,000, subject to appropriation, shall be deposited into the Tobacco Settlement Residual Account for use by the Attorney General for enforcement of the Master Settlement Agreement.

What is settlement bond?

Settlement Bond means a bond issued to ASTC at the request of a Participant in accordance with Rule 4.9.1.

What happens if a company loses a settlement bond?

In the event of a loss of securities covered under this Settlement Bond, the COMPANY may, at its sole discretion, purchase replacement securities, tender the value of the securities in money, or issue its indemnity to effect replacement securities.

Where are the net proceeds of tobacco bonds deposited?

The net proceeds of bonds shall be deposited by the State in the Tobacco Settlement Bond Proceed s Account, and shall be used by the State (either directly or by reimbursement) for the payment of outstanding obligations of the General Revenue Fund or to supplement the Tobacco Settlement Residual Account to pay for appropriated obligations of the Tobacco Settlement Recovery Fund for State fiscal year 2011 through 2013.

Is the new UAL ORD settlement bond acceptable?

Pursuant to the Chicago Municipal Bond Settlement Order and the Chicago Municipal Bond Settlement Agreement, the New UAL ORD Settlement Bond documents shall be reasonably acceptable to Stark Investment LP.

Overview

In finance, a tobacco bond is a type of US bond issued by a state to obtain immediate cash backed up with a won lawsuit against a tobacco company. The typical tobacco bond lasts 30 years or less and pays interest every year.

By 2014, tobacco bonds made up $94 billion of the $3.7 trillion municipal bond market. They share a revenue stream from the Tobacco Master Settlement Agreement, a 1998 national settlement i…

History of adoption

Summary of terms

Contraband statutes

Criticism

The Tobacco Master Settlement Agreement (MSA) was entered on November 23, 1998, originally between the four largest United States tobacco companies (Philip Morris Inc., R. J. Reynolds, Brown & Williamson and Lorillard – the "original participating manufacturers", referred to as the "Majors") and the attorneys general of 46 states. The states settled their Medicaid lawsuits against the tobacco industry for recovery of their tobacco-related health-care costs. In exchange, the compa…

Securitization

In September 1950, an article was published in the British Medical Journal linking smoking to lung cancer and heart disease. In 1954 the British Doctors Study confirmed the suggestion, based on which the government issued advice that smoking and lung cancer rates were related. In 1964 the United States Surgeon General's Report on Smoking and Health likewise began suggesting the relati…

Individual state settlements

The Original Participating Manufacturers (OPMs) agreed to several broad categories of conditions:

• to restrict their advertising, sponsorship, lobbying, and litigation activities, particularly as those activities were seen as targeting youth;

• to disband three specific "Tobacco-Related Organizations," and to restrict their creation and participation in trade associations;

See also

By the middle of 2000, domestic NPMs and importers had begun to obtain greater market share. The NAAG noted that reductions in settlement payments which result from an overall reduction in cigarette consumption benefit the states because health care costs imposed by each cigarette exceed the settlement payments. On the other hand, when reductions in settlement payments occur because NPM sales displace PM sales, the states receive no benefits if the NPMs do not …