What is an aggregate adjustment and why does it matter?

Because of this, your lender may need to make an aggregate adjustment, which is a calculation your lender will use to make sure the correct amount of money is collected in your escrow account at the time of closing.

What is an aggregate adjustment in escrow?

The escrow account is then used to make these payments when they are due. The term “aggregate adjustment” refers to a calculation the lender uses to make sure the correct amount of money is collected in the escrow account. The federal government prohibits lenders from withholding more money...

How do I calculate the aggregate adjustment for expenses?

Take the number from the month with the largest negative balance, and turn it into a positive number. That will be the amount of the aggregate adjustment. You'll therefore pay into escrow two months' of expenses plus the aggregate adjustment amount.

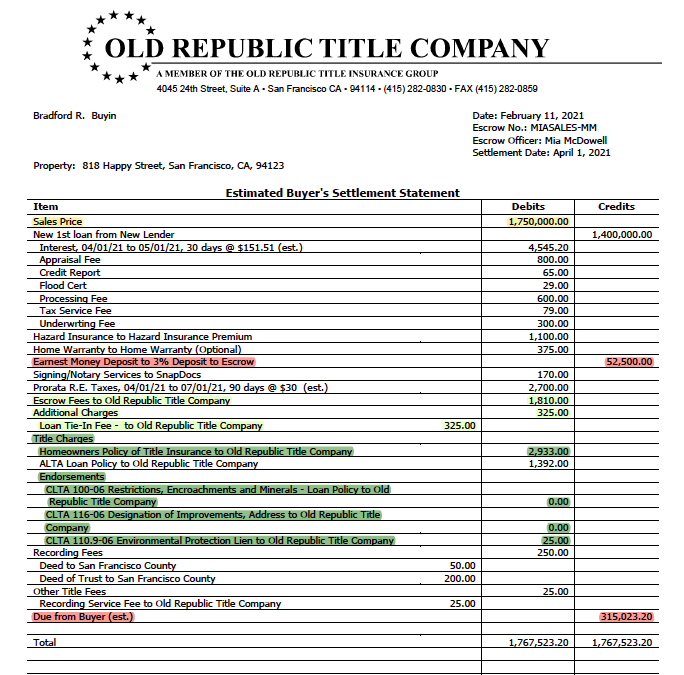

What is a settlement statement?

What is a settlement statement? A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What does aggregate adjustment mean?

Aggregate adjustment is the calculation a mortgage lender uses to prevent collecting more money for a borrower's escrow account than is allowed under the Real Estate Settlement Procedures Act (RESPA).

How is the aggregate adjustment calculated?

The simplest way to calculate the aggregate adjustment is to make a short summary of the year's payments and expenses. With one line for every month, enter the amount due for property tax, insurance, or other regular expenses for that month. Then add up the total expenses and divide by 12.

Why is there an aggregate adjustment?

Between the day you apply for a mortgage and the day you close, a lot can change in this estimate. Because of this, your lender may need to make an aggregate adjustment, which is a calculation your lender will use to make sure the correct amount of money is collected in your escrow account at the time of closing.

What does a negative aggregate adjustment mean?

About Aggregate Escrow Adjustment The aggregate escrow adjustment is usually a negative amount or zero. If the aggregate adjustment is negative, then the lender must credit the amount of the adjustment to the borrower, which reduces the amount the borrower must deposit into his escrow account at closing.

How is aggregate adjustment related to closing disclosure?

This is where the Aggregate Adjustment comes in. It's usually a credit back to the homeowner due to a requirement that the lender cannot collect more than 1/6th of the total annual payments as a cushion. If the lender's calculation results in too much being collected, then a credit back to you must be made.

How do you calculate adjustments?

0:212:36Adjustment Factor - YouTubeYouTubeStart of suggested clipEnd of suggested clipButton the adjustment factor is calculated by dividing the students average score by the teamMoreButton the adjustment factor is calculated by dividing the students average score by the team average score - adjustment factors are calculated.

How much money should be in an escrow account?

To ensure there's enough cash in escrow, most lenders require a minimum of 2 months' worth of extra payments to be held in your account. Your lender or servicer will analyze your escrow account annually to make sure they're not collecting too much or too little.

What is adjustments and other credits on loan disclosure?

Adjustments and Other Credits is the total amount of all items in the Loan Costs and Other Costs tables that are paid by persons other than the loan originator, creditor, consumer, or seller, together with any other amounts that are required to be paid by the consumer at closing pursuant to the contract of sale (if any ...

What are adjustments for items unpaid by seller?

Adjustments for Items Unpaid by Seller Adjustments for Items Unpaid by Seller are amounts due to the consumer to be paid by the seller and are disclosed in two places. the item.

What is aggregate escrow analysis?

Aggregate (or) composite analysis, hereafter called aggregate analysis, means an accounting method a servicer uses in conducting an escrow account analysis by computing the sufficiency of escrow account funds by analyzing the account as a whole.

What is aggregate monthly debt from POS?

Aggregate Monthly Payment means, with respect to any Monthly Calculation Period, a payment representing a fee for outstanding Repo-style Transactions and interest on outstanding Funding Loans in an amount equal to the sum, for each calendar day in such Monthly Calculation Period, of the product of (i) the outstanding ...

What is an annual escrow analysis used for?

Annual analysis It includes a review of activity in your escrow account during the past 12 months, with projections for the next 12 months. This helps us determine the amount you need to pay into your escrow account each month, so we can pay your taxes and/or insurance expenses on your behalf for the next 12 months.

How aggregate percentage is calculated?

Aggregate percentage is calculated in such a way that the total number scored by candidate in a particular subject divided by full marks of the mentioned subject and then whole result is multiplied by 100.

How is MBBS aggregate calculated?

Steps to Calculate Aggregate for MDCATMarks obtained in HSSC /Equivalent x 1100 x 0.50 = 50% of HSSC/Equivalent. ... Marks obtained in Entrance Test / SAT II / MCAT x 1100 x 0.50 = 50% of Admission Test.Aggregate Marks x 100 = Aggregate Percentage. ... 980 x 1100 x 0.50 = 490. ... 970 x 1100 x 0.50 = 485.

How do you calculate aggregate percentage for 3 years?

Calculate 25% of your 1st year marks, 50% of your 2nd year marks, 75% of your third year marks. Add all these marks and divide them by 5000. Multiply it with 100 and you will get your aggregate percentage.

Is aggregate and percentage same?

Marks percentage is per cent of marks you scored from total marks whereas the aggregate percentage is per cent of marks you scored in a particular number of the subjects.

What is an Aggregate Adjustment?

After applying for a mortgage, your lender must provide a Loan Estimate within three days of receiving your application. This will give you all of the most pertinent information about your loan.

What happens if you have a surplus in your escrow account?

In the Event of a Surplus. If taxes in your area happen to go down or your payments are overestimated, you will have too much money in your escrow account at the end of the year. Your lender will then pay the appropriate amount to the municipality, and the remaining amount goes to you.

What is escrow analysis?

Because escrow is collected in advance, your lender might not have enough funds in your account to cover any increase in taxes or insurance, otherwise known as a “shortage.”. In this case, you will owe the difference.

What is aggregate adjustment?

What is the Aggregate Adjustment? Section 10 of the Real Estate Settlement Procedures Act sets limits on the amount of borrower money that a lender may hold in escrow. An escrow account may include taxes, homeowner’s insurance, flood insurance, private mortgage insurance and other charges related to the property.

How much of the total disbursement can a lender hold?

Because of Section 10 the lender can now only hold 1/12 of the total amount of disbursements payable during the year. The lender may also hold a cushion of 1/6 of the total disbursement for the year.

What is mortgage aggregate adjustment?

The mortgage aggregate adjustment determines the initial deposit that must be placed in the escrow account at closing. The formula is used to calculate the amount that allows a two-month cushion, which is a maximum sum of money in addition to the amount needed to cover escrow items in the borrower’s account at all times. It provides the lender with enough funds to pay for such items as property taxes and insurance. However, the escrow amount should not exceed what is legally allowed by Section 10 of the Real Estate Settlement Procedures Act.

How to determine escrow deposit amount?

To determine the initial escrow deposit amount, the lender starts with calculating the lowest projected balance for the account after the expected monthly escrow payments are paid for the year, which is the aggregate accounting adjustment. After the lowest negative balance is determined, the lender would add the cushion, which is calculated to be two monthly payments or less, depending on state laws.

What is section 1000 on HUD?

On the HUD-1 Settlement Statement, section 1000 is the “Reserves Deposited with Lender.” If the lender establishes an escrow account, this section will include the initial deposit for the escrow account and the items that will be paid out of the escrow account. Once the initial deposit amount is determined, the lender will include the aggregate adjustment on the last line in this section. This amount will be a credit to the borrower, and is either zero or a negative number.

What is aggregate adjustment?

The aggregate adjustment can increase the amount you'll owe at mortgage closing. In an ideal world, all of the expenses related to your home would match up with the monthly schedule on which you pay your mortgage. In that case, all you'd need to do is to add up your monthly expenses and multiply by two.

Do you need an aggregate adjustment for escrow?

That would determine the escrow amount, and you wouldn't need an aggregate adjustment. However, if one of your expenses requires making an annual payment up front, then the escrow would have a negative balance that would only be recovered over time.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

What Is an Aggregate Adjustment?

Your homeowner’s insurance or real estate taxes may be more expensive than the lender thought or you may need to buy flood insurance. When you close, your lender will determine your aggregate adjustment calculation to make sure you're not contributing too much to your escrow account. After that, your lender will calculate a follow-up aggregate adjustment to your escrow account at least once a year.

How often do you have to adjust your escrow account after closing?

After that, your lender will calculate a follow-up aggregate adjustment to your escrow account at least once a year.

What Is An Aggregate Adjustment?

Making Payments from Year-To-Year

- Each year, your bank receives updated information on your property taxes and insurance payments. They will then perform what’s often referred to as an escrow analysis. Because escrow is collected in advance, your lender might not have enough funds in your account to cover any increasein taxes or insurance, otherwise known as a “shortage.” In this case, you will owe the dif…

in The Event of A Surplus

- If taxes in your area happen to go down or your payments are overestimated, you will have too much money in your escrow account at the end of the year. Your lender will then pay the appropriate amount to the municipality,and the remaining amount goes to you. Your lender will either send you a check for the surplus amount or give you the option to leave the money in you…