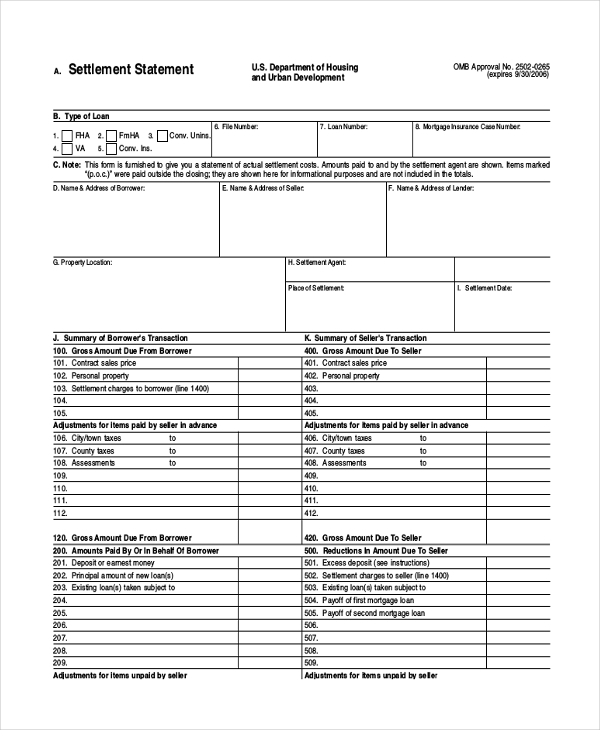

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is an affidavit of title and Alta statement?

c. American Land Title Association (ALTA) Statement. Not unlike the Affidavit of Title, the ALTA statement contains representations regarding the status of the property’s title (e.g., the lack of easements and other encumbrances, the lack of any other claims to possession or lien on the property).

What is an Alta/Closing Disclosure/HUD-1 statement?

ALTA Settlement Statements are used in conjunction with the HUD-1 settlement statement. Under the new CFPB regulations, most real estate transactions require the use of the new Closing Disclosure Form. However, the HUD-1 settlement statement is still used in certain cases such as: Home equity revolving lines of credit.

What in my settlement statement is deductible?

The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

Is an Alta the same as a closing statement?

Unlike the Closing Disclosure that is meant to show the closing costs exclusively to the borrower (buyer), the ALTA statement is like a receipt given to agents and brokers on both sides of the transaction.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What does Alta mean in mortgage?

American Land Title AssociationThe American Land Title Association (ALTA) helps manage the title insurance industry. A property title traces the history of ownership of the property.

Is an Alta the same as a HUD-1?

The Alta Settlement Statement has both the buyer and seller information on it with all credits and charges listed, more like the HUD-1 form.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is the difference between closing and settlement?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What is the meaning of Alta?

Alta definition A female given name possibly from Latin alta (“high”), fairly common in nineteenth century U.S.A. pronoun.

What is Alta account?

Alta account means the bank account opened by, held by and operated by Alta at local Bank for purposes of receiving cash deposits and transferring same to the designated account of the Alta client in question; Sample 1.

What is a mortgage Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Are HUD-1 Settlement Statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

What is the HUD statement called now?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What replaced the HUD-1 Settlement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

Which two items will appear on a closing disclosure?

Credits and debits appear on the closing statement.

What is the difference between a HUD-1 and a closing disclosure?

The HUD-1 form, listing all closing costs, is given to all parties involved in reverse mortgage and mortgage refinance transactions. Since late 2015, a different form, the Closing Disclosure, is prepared for the parties involved in all other real estate transactions.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

What is an ALTA Statement?

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

Where Can I Download a Sample ALTA Settlement Statement?

You can download a sample ALTA statement by clicking the text link below.

What is the difference between seller disclosure and closing disclosure?

The difference between a seller disclosure and closing disclosure is simple – the seller will receive a seller’s disclosure, which provides a breakdown of costs and fees that factor into the cash they will receive at the transaction’s end. Due to TRID regulations, agents will have nothing to do with the closing disclosure.

What is closing disclosure?

The closing disclosure is provided to the buyer and pertains a list of fees and costs and how they work into the buyer’s total expense. It is important to note that only the lender can provide the Closing Disclosure to the buyer 3 days prior to closing? And only the buyer should be able to see it unless they allow the release of it by signing a release disclosure. You should also know that the lender is obligated under the TRID regulations, and the lender can be penalized for failing to disclose 3 days after they’re loan application is approved and again 3 days prior to closing.

What is a settlement statement?

Settlement Statements – This is the version supplied solely to the buyer and contains only information pertinent to the buyers side of the transaction.

What is a HUD-1?

A Hud-1 used to be the primary statement associated with real estate and is used to document all cash transactions and how they affect both parties. It is now outdated. The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer.

Why is a standard form required for title insurance?

Having a standard form for nearly all title insurance policy transactions maintains that all exchanges of land are done smoothly and efficiently.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What are points in a mortgage?

Points. Mortgage points are given to the lender for which they reduce the interest rate for the buyers. This amount is paid upfront during closing.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

What does escrow charge?

The escrow or title company charges buyers for settlement charges and escrow costs. These costs are debited from the buyer’s side.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is appraisal fee?

Appraisal Fee to. Paid to the lender or an appraisal company to determine the current value of the property.

What is the disbursement date?

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases. Other Dates: Dates given for recording or anything that relates to transferring the title of the property.

How many versions of ALTA Settlement Statement are there?

There are four versions of the ALTA Settlement Statement available:

How to contact ALTA?

Contact ALTA at 202-296-3671 or [email protected].

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.