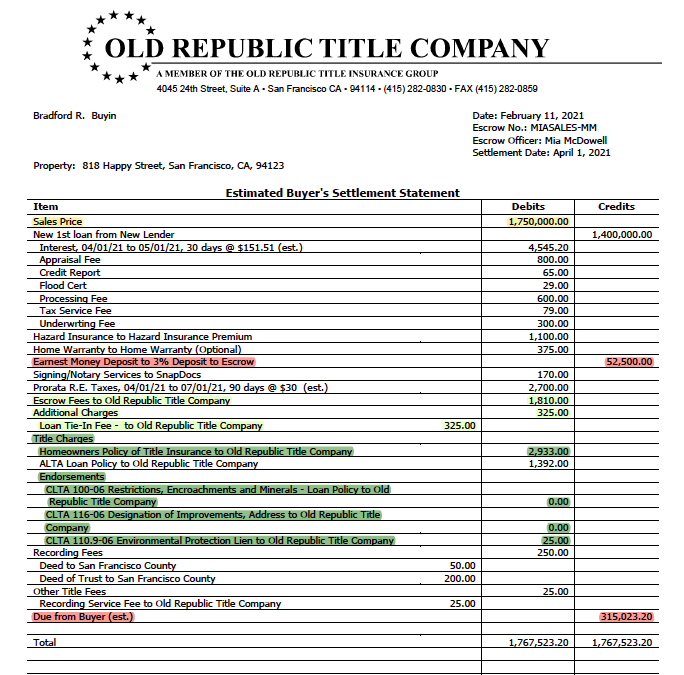

What in my settlement statement is deductible?

The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

Can escrow cash a check before closing of escrow?

Escrow companies will accept a cashier’s check or wire, or a personal check for the earnest money deposit. It is important to discuss your planned “source of funds” with your lender early in the process, because any funds used to close escrow need to be verified before closing.

Can seller stop escrow?

The seller can either agree to give you more time to sell your house, or decline and cancel escrow. A more common contingent scenario that causes sellers to back out is when the deal depends on the seller finding a new place to purchase.

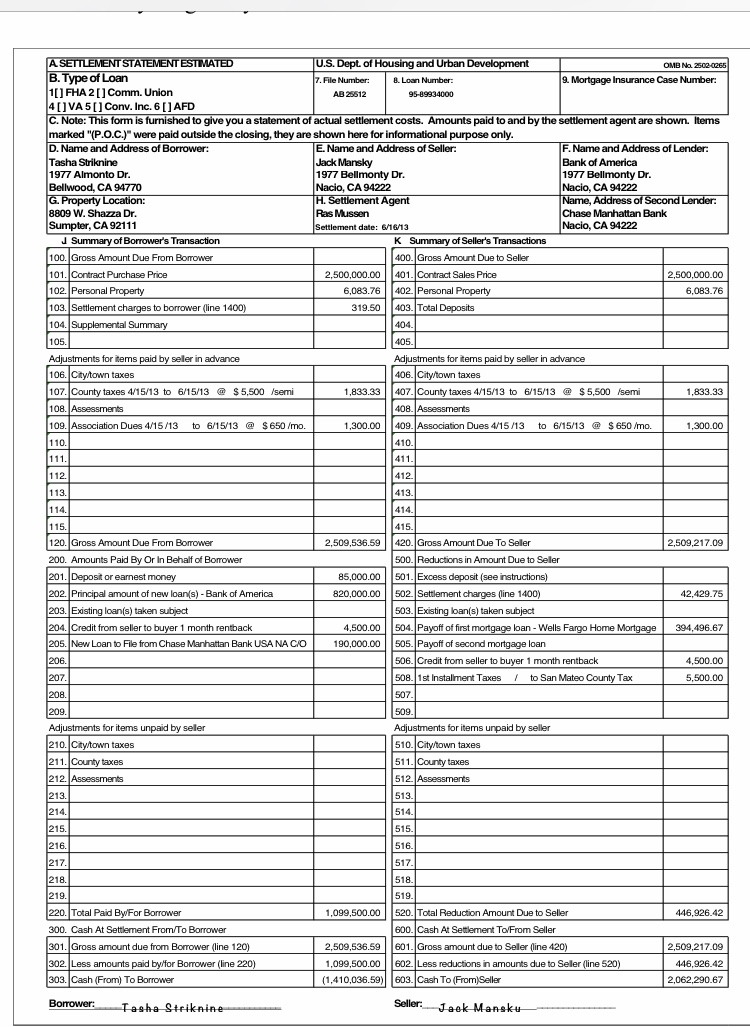

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is a settlement statement for home purchase?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is a final escrow statement?

YOUR CLOSING STATEMENT IS "IMPORTANT": When your escrow has closed you will receive a closing statement which is a summary of the costs and financial settlement of your real estate transaction. This closing statement will be important for future tax needs and other possible considerations.

What is the escrow settlement procedure?

An escrow is an arrangement in which a disinterested third party, called an escrow holder or settlement agent, holds legal documents and funds on behalf of a buyer and seller, and distributes them according to the buyer's and seller's instructions.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Is a closing statement the same as a closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

What happens at settlement for the seller?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

How do I check my escrow balance?

You can:Access your mortgage account online. Sign on to your mortgage account to check your escrow account balance and see when tax and insurance payments are made from that account. ... Check your escrow review statement. We review your escrow account at least once a year and send you a statement each time.

Should you pay escrow shortage in full?

Should I pay my escrow shortage in full? Whether you pay your escrow shortage in full or in monthly payments doesn't ultimately affect your escrow shortage balance for better or worse. As long as you make the minimum payment that your lender requires, you'll be in the clear.

Should I pay off my escrow balance?

Both the principal and your escrow account are important. It's a good idea to pay money into your escrow account each month, but if you want to pay down your mortgage, you will need to pay extra money on your principal. The more you pay on the principal, the faster your loan will be paid off.

What should I do with my escrow refund check?

What Should I Do? Sorry, but this is the only right answer: You should immediately deposit your insurance refund check into your escrow account. Your mortgage servicer uses your escrow account to hold money in reserve for your homeowners insurance and property taxes.

What should you not do during escrow?

What Should I Not do During Escrow?Do not make large purchases which could be viewed as debt.Do not apply to or open any new lines of credit.Do not make finance related changes, like a new job or bank.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Who prepares the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

What is settlement in real estate?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What information does an escrow statement contain?

Typically, statements have a few sections and contain some crucial information.

What is included in escrow?

When you have an escrow account, your monthly mortgage bill includes your principal and loan interest, plus your property taxes and your insurance — hazard insurance, and flood insurance if you’re in a flood zone as well. That means your monthly payments could change, even with a fixed-rate mortgage, if your other expenses fluctuate.

What happens to escrow payments when property taxes go up?

If your taxes go up or your property is assessed for a higher value than anticipated, your escrow account may not be able to cover the full charges, so you may owe a larger lump sum at the end of the year.

What is an escrow account?

This account is used to pay property-related expenses like taxes and insurance, which are wrapped into your monthly mortgage payment. As the end of the year approaches, you’ll probably be receiving an annual statement about this account ...

Is escrow money up to the bank?

The amount covered by your escrow account isn’t up to the bank though, Johnson-King said. It really determined by what the insurance market is doing and the politicians who control your property taxes. “On the other hand, if you’ve paid in more than you owe, you should be able to get money back,” she added.

Is an escrow account good for a home?

For most homeowners, an escrow account is usually a good idea. “It’s going to relieve a lot of stress for you. Not everyone is good at budgeting their money. Most lenders will set up an escrow account for you if you request it,” Johnson-King said.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

What is a mortgage payoff?

Mortgage Payoff. The payoff amount is sent to the existing mortgage company and includes additional interest a few days beyond closing. Title Insurance (Owner’s Policy) Typically paid for by the seller, however the contract gives the option for either buyer or seller to pay.